Posting September 16, 2022.

- largest pure-play E&P company in the Delaware Basin

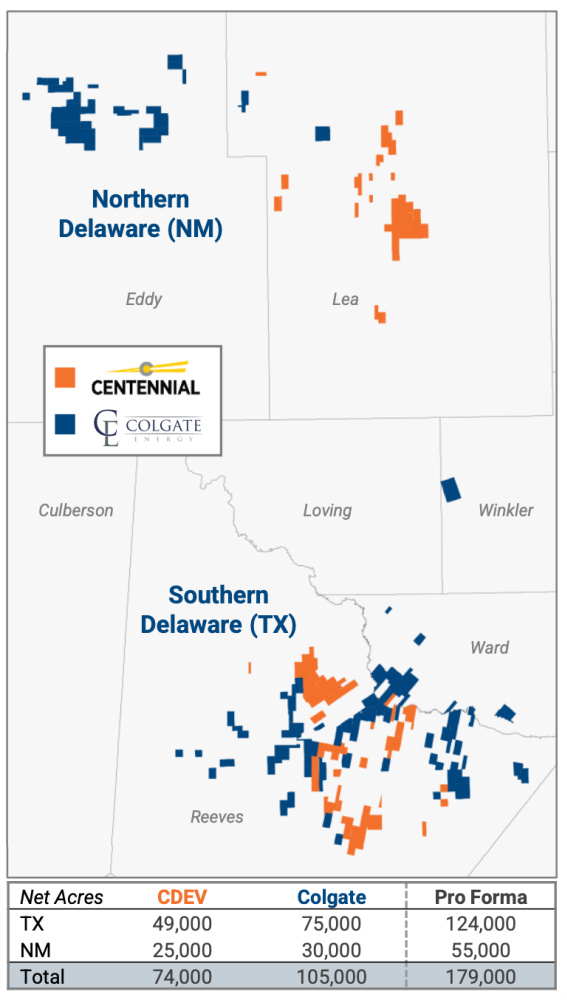

- 180,000 net acres: southeastern NM and west Texas

- the deal

- merger completed September 1, 2022

- merger valued at Colgate at $3.9 billion

- Centennial: 269.3 million shares

- $525 million cash

- assumption fo $1.4 billion Colgate's outstanding debt

- guidance: $1 billion free cash flow in 2023

- operations

- currently: 8 rigs

- will reduce to 7 rigs in November, 2022

- 150,000 boepd, 52% oil, 4Q22

- could reduce rig count further assuming expected operational efficiencies

- ownership

- Permian Resources co-CEOs Hickey and James Walter own approximately 6% of total shares outstanding, representing one of the largest CEO ownership levels in the industry. Furthermore, Permian Resources employees together own over 13% of the company.

- shareholder return: dividends plus share buybacks

- initial dividend 5 cent/share supported below $40/bbl WTI

- should be announced 4Q22

- ticker: PR (NASDAQ); then PR (NYSE)

Ticker:

- PR: link here.

- appears to be chart for CDEV

- market cap: $2.26 billion

- p/e: 8.40

- div yield: n/a

PR: Yahoo!Finance.

- market cap: $4.453 billion

- p/e: 6.15

- EPS: $1.30

- div: n/a

- trading at $8.00

- one-target, estimate: $10

******************************

JP Morgan

SeekingAlpha contributor: JPM -- overweight EOG, Permian Resources; upgrade from neutral; also upgraded Vermillion Energy (VET)

*********************

Alex Kimani

Over at oilprice.com, September 15, 2022

- three strong buys in the oil patch

- for contrarians

- Tamarack Valley Energy, Ltd

- market cap: $1.33 billion

- Calgary, Canada

- will acquire Deltastream Energy in a $1.425 billion deal

- Clearwater play

- Tamarack: will become Clearwater's largest operator

- current share price could drop 50%

- Devon Energy Corp

- market cap: $47 billion

- APA Corp

- market cap: $13 billion

- uptrend following investment in Egypt

- announced significant discovery offshore Suriname

Abbreviated disclaimer: this is not an investment

site. Do not make any investment, financial, job, career, travel, or

relationship decisions based on what you read here or think you may have

read here. Full disclaimer at tabbed link.

All my posts are done quickly:

there will be content and typographical errors. If anything on any of

my posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

From a reader:

Take a look at the DVN ten-year bond.

DVN ten-year bond: 7.950 interest rate

The demand for this five-month-old BAA3 is in so much demand, one must pay $116.048 for a $100 face-value bond.

So if you hold this bond until maturity 04/15/32 this instrument would net yield you 5.746 interest rate.

So if one thinks of all the stuff DVN has bought in last year or so, and the rising interest rates. the folks must think DVN is a pretty strong company to have their bonds sell at sixteen percent over par.