Locator: 48989B.

WTI: $64.13.

New wells:

- Monday, September 1, 2025: 2 for the month, 95 for the quarter, 535 for the year,

- 40705, conf, Oasis, Lake Trenton Federal 5302 21-31 4B,

- 37544, conf, Hess, AN-Lone Tree-152-95-1207H-8,

- Sunday, August 31, 2025: 55 for the month, 93 for the quarter, 533 for the year,

- Saturday, August 30, 2025: 55 for the month, 93 for the quarter, 533 for the year,

- Friday, August 29, 2025: 55 for the month, 93 for the quarter, 533 for the year,

California refiners: link here.

Phillips 66 on track to shut down its California refinery as scheduled, or perhaps slightly ahead of schedule. No talk yet of who might buy it. ChatGPT says there are no reports of anyone looking to buy this refinery, and the state of California seems to be caught flat-footed on this development though it was announced years ago; California was very, very aware of this closure; but, failed to come up with a Plan B, except to import refined products.

RBN Energy: US refiners could benefit from struggles refineries are facing abroad.

Refineries in Europe, Latin America, Russia and China are facing a host

of issues that could ultimately benefit U.S. refiners. Europe has high

operating costs and political pressures. Attacks have damaged Russia’s

refineries, and the country continues to get blasted with steeper

sanctions. China’s aging plants are closing and there are no new

large-scale projects on the horizon. Latin America lags in capacity

growth. In today’s RBN blog, we look at how these global issues are

boosting opportunities for U.S. refiners.

First, we’ll offer a refresher of the U.S. refining industry before we address the global arena. As we discussed in Us and Them,

the industry has undergone a number of changes in recent years, and

more turbulence looks likely as global economic and trade patterns shift

and the energy transition moves forward. For some U.S. refineries, this

has led to closures due to weak profits, rising regulatory costs and

declining demand for products, particularly gasoline. But other

refineries have prospered and even invested in expansions. The U.S.

refining industry has evolved into the most competitive in the world,

and the issues and challenges faced by other countries will likely

benefit U.S. refiners.

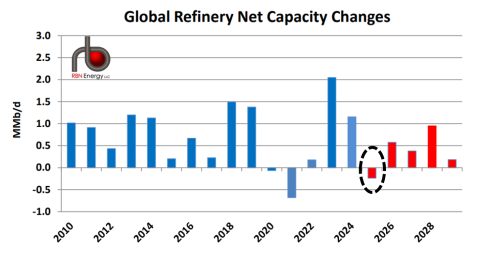

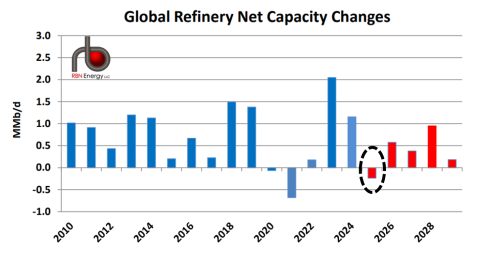

While 2025 will end up with about 1.2 MMb/d of gross capacity

additions worldwide, significant shutdowns will also take place in the

U.S., Europe and China, resulting in a net decrease in capacity of about

240 Mb/d (see dashed black oval in Figure 1 below). As detailed in the

most recent Future of Fuels report

from our Refined Fuels Analytics (RFA) practice, we’ll look at the

challenges facing Russia, Europe, China and Latin America, and spell out

how the political pressures and potential closures could set up U.S.

refiners for growth.

Figure 1. Global Refinery Net Capacity Changes. Source: RFA

We’ll break down each region, starting with Russia.

Russian refineries have faced relentless Ukrainian

drone attacks that have knocked out at least 17% (roughly 1.1 MMb/d) of

Russia’s total refining capacity, sparking fuel shortages and panic

buying in its southern regions. Since June, Ukraine has struck 10 major

refineries, including sites in Volgograd, Saratov, Syzran, Ryazan and

Novokuibyshevsk, with some of these facilities being forced offline for

weeks. Russia responded by banning gasoline exports in July and shifting

crude oil flows toward China and India, despite U.S. pressure to dial

back those sales.