There was more and more talk this past week that the Saudi Aramco IPO was in deep trouble, some calling it a "real mess." Saudi Arabia is in a fight for its life and the princes are fighting each other. This was just one of several posts on the subject.

Meanwhile, in the US, the oil and gas sector keeps chugging along. US crude oil storage capacity is soaring. I remember when folks used to talk about storage capacity at Cushing becoming a problem; not so much any more.

WTI briefly touched $52/bbl -- probably due to Iraqi-Kurdish conflict -- and then dropped back to $51.

Also, in the US, Haynesville, once thought to be dying, is surging. A new USGS survey reveals that Haynesville has almost half what Qatar has (natural gas)

Best posts all week: the Brits don't understand the US shale revolution; and, the Brits don't understand the US shale revolution.

The impressive Bakken

CLR's Hendrickson well in Elm Tree

EOG to report four huge wells in Clarks Creek

Random update of an MRO re-frack, an Oscar Stohler well

Bakken re-fracks

EOG well producing 3,000 bbls/month jumps to 13,000 bbls/month

The number of Bakken wells producing 30,000 bbls/month continues to increase

Operations:

Number of active rigs dropping in North Dakota; and here

Rachel Wolf wells have been updated

Production data for August, 2017

Pipelines

DAPL donations to North Dakota emergency responders

Judge allows DAPL oil to continue to flow

Bakken economy

Legacy Fund update

CLR makes first sale of Bakken crude oil specifically for overseas destination

Fake news: Williston, ND, was not among the cities named as the "50 Most Livable Cities in the US"

Friday, October 20, 2017

Number Of Active Rigs Dropping -- October 20, 2017

Getting ready for winter? Down to 56 active rigs in North Dakota:

No new oil or gas permits today.

"Don't Cry Joni" is one of my favorite Conway Twitty songs (B-side, released in 1975) but I have to admit this cover may be better than the original.

Don't Cry Joni, Lalchhanchhuaha featuring Zualbawihi

| $51.66→ | 10/20/2017 | 10/20/2016 | 10/20/2015 | 10/20/2014 | 10/20/2013 |

|---|---|---|---|---|---|

| Active Rigs | 54 | 33 | 68 | 191 | 184 |

No new oil or gas permits today.

- EOG (6): five Hawkeye permigs and one Hawkeye permit, all in McKenzie County

- Enerplus (4): two Walley, one Giraffe, one Hyena, and one Cheetah permit renewed, all in Dunn County

- EOG: seven permits, all in Mountrail County

*******************************************

Does It Get Any Better?

"Don't Cry Joni" is one of my favorite Conway Twitty songs (B-side, released in 1975) but I have to admit this cover may be better than the original.

The Energy And Market Page, T+272, Part 2 -- October 20, 2017

Wow, The WSJ used a lot of black ink to produce that image.

*******************************************

48 Years Ago

There was an 18-month-period, from late 1968 through mid-1970 that clearly had some of the best music ever. This was the year of Woodstock. The Beatles were still going strong, but touring less, and would soon stop completely. Led Zeppelin's first two albums, Zeppelin I and Zeppelin II, were released in 1969. The era of "free love" and the uncertainties of the Vietnam War probably contributed to some of this really incredible music.

Not from 1969, but I'm going to post it anyway. One of the comments at YouTube where this was found, "We sang this song in Vietnam at Night; in 1969......we were all but forgotten."

The Energy And Market Page, T+272 -- October 20, 2017

Uh-oh! Tesla may have to increase price of their "mass-market" Model 3. Anyone who has followed the Tesla story knows that the Model 3 would never be a "mass-market" product.

Wow. The Dow 30 up another 110 points in late morning trading. In fact, all three major indices are up (again). More records set. Dow 30 closes up 165 points; S&P 500 up 14 points; Nasdaq up 24 points.

NYSE, new highs,197 227 249, including -- BRK-B; Canadian Pacific Railway; JPM; McDonald's; Steris;

Yes, I've posted this video way too often but for me the video captures the frenetic activity in Washington, DC; and on Wall Street, NYC. And, of course, the reference to "wartime."

Life During Wartime, Talking Heads

Wow. The Dow 30 up another 110 points in late morning trading. In fact, all three major indices are up (again). More records set. Dow 30 closes up 165 points; S&P 500 up 14 points; Nasdaq up 24 points.

NYSE, new highs,

- new lows on the NYSE, 22

- GE: from Reuters: even before the stock's decline on Friday, GE produced a total return - share appreciation plus reinvested dividends - of just 0.64 percent over the last 16 years. A $1,000 investment on the day former CEO Jeff Immelt started his tenure would be worth $1,006.38 today. Immelt stepped down August 1, 2017

- GE: from same link: it would generate only about $7 billion in cash from operations, down from $12 billion to $14 billion it had forecast earlier. It left its dividend unchanged

- GE: $1 billion operating cash flow (talking head on CNBC); dividends: $8 billion/year (CNBC)

- GE: "power" division is the big story; it would be interesting to know what percent renewables make up the "power" division

- GE: it seems this, the GE story, is an open-book test

- TSLA: Dow 30 up over 135 points today; meanwhile TSLA is down over 1%; analyst downgrades Tesla; sets price target at $170 (currently around $350);

************************************

Life During Wartime

Labels:

Tesla

Legacy Fund Update Through September, 2017, With Recent October Deposit

Source here.

The Legacy Fund is tracked here.

These are deposits only; not total assets.

Of the seven years the Legacy Fund has been in existence, the October, 2017, deposit exceeded the monthly average for three of the seven years. Just saying. By the way, the law of big numbers seems to work here For the past couple of years or so, North Dakota crude oil production has averaged about 1 million bopd. Math is easy when the denominator or divisor is "1."

The Legacy Fund is tracked here.

These are deposits only; not total assets.

Of the seven years the Legacy Fund has been in existence, the October, 2017, deposit exceeded the monthly average for three of the seven years. Just saying. By the way, the law of big numbers seems to work here For the past couple of years or so, North Dakota crude oil production has averaged about 1 million bopd. Math is easy when the denominator or divisor is "1."

Labels:

Legacy_Fund

Random Update Of Production Data For CLR Hendrickson Well, #18224 -- October 20, 2017

This post will not be updated. This well is followed at this post.With this kind of jump in production, this well had to have been re-fracked, but FracFocus does not have the data and it's been almost half a year, if not longer:

Initial production data:

- 18224, 1,099, CLR, Hendrickson 1-36H, Elm Tree, t12/109; cum 627K 8/17; API - 33-053-03040; recent production:

| Pool | Date | Days | BBLS Oil | Runs | BBLS Water | MCF Prod | MCF Sold | Vent/Flare |

|---|---|---|---|---|---|---|---|---|

| BAKKEN | 8-2017 | 31 | 18525 | 18942 | 13926 | 28888 | 25086 | 3567 |

| BAKKEN | 7-2017 | 31 | 12330 | 12168 | 13382 | 19280 | 17650 | 1430 |

| BAKKEN | 6-2017 | 30 | 16936 | 16845 | 17495 | 25895 | 24705 | 950 |

| BAKKEN | 5-2017 | 31 | 22186 | 22338 | 22567 | 39103 | 25885 | 12971 |

| BAKKEN | 4-2017 | 20 | 16275 | 15840 | 28381 | 22993 | 16226 | 6611 |

| BAKKEN | 3-2017 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 2-2017 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 1-2017 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 12-2016 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 11-2016 | 2 | 6 | 413 | 165 | 2 | 0 | 0 |

| BAKKEN | 10-2016 | 18 | 2274 | 2044 | 250 | 1971 | 1838 | 42 |

Initial production data:

| BAKKEN | 9-2010 | 22 | 7162 | 7592 | 458 | 7851 | 7851 | 0 |

| BAKKEN | 8-2010 | 31 | 11777 | 11398 | 788 | 11729 | 9779 | 1950 |

| BAKKEN | 7-2010 | 31 | 12185 | 12565 | 908 | 13557 | 11081 | 2476 |

| BAKKEN | 6-2010 | 30 | 13259 | 12947 | 1032 | 13621 | 10013 | 3608 |

| BAKKEN | 5-2010 | 31 | 12810 | 13052 | 846 | 13624 | 13624 | 0 |

| BAKKEN | 4-2010 | 30 | 13650 | 13824 | 893 | 14303 | 14303 | 0 |

| BAKKEN | 3-2010 | 31 | 15595 | 15329 | 1014 | 17498 | 17498 | 0 |

| BAKKEN | 2-2010 | 28 | 16310 | 16399 | 1206 | 18255 | 18055 | 200 |

| BAKKEN | 1-2010 | 31 | 20511 | 20818 | 1518 | 23169 | 21769 | 1400 |

| BAKKEN | 12-2009 | 31 | 26191 | 25750 | 2816 | 29577 | 29577 | 0 |

| BAKKEN | 11-2009 | 11 | 16302 | 15815 | 5110 | 19577 | 8847 | 10730 |

Why The Bakken Continues To Excite Me -- EOG To Report Four Huge Wells -- October 20, 2017

This page will not be updated. These wells are followed elsewhere. EOG permits are followed elsewhere.

EOG will soon report four huge wells in Clarks Creek oil field. It will be interesting to see the frack data (my hunch: well over 10 million lbs/well). Note that each of the four wells below had more than 50,000 bbls/month at least once, two wells had over 60,000 bbls/month; and, one of these wells had almost 70,000 bbls/month.

For newbies: the infrastructure costs (pads, roads to pads, pipelines) to support these wells have pretty much been paid for years ago. These wells were pretty much guaranteed to be huge wells. Three months of 50,000 bbs/month = 150,000 bbls in one quarter. EOG has its own sand mines.

Early production numbers for these wells:

32796, SI/NC, EOG, in July, 2016, target formation was changed from middle Bakken, to Three Forks, first bench; Clarks Creek 73-0719H, SWSE 7-151-94, 45K first month (6/17 -- still conf):

32795, SI/NC, EOG, Clarks Creek 110-0719H, SWSE 7-151-94, 44K first month (6/17 -- still conf):

32794, SI/NC, EOG, Clarks Creek 74-0719H, SWSE 7-151-94, 47K first month (6/17 -- still conf):

33050, SI/NC, EOG, Clarks Creek 75-0719HX, SWSE 7-151-94, 42K first month (6/17 -- still conf):

This made my day.

I'm impressed Father Guido Sarducci agreed to be one of the judges.

Stumbaling, Г.Матвейчук / А.Макеева

EOG will soon report four huge wells in Clarks Creek oil field. It will be interesting to see the frack data (my hunch: well over 10 million lbs/well). Note that each of the four wells below had more than 50,000 bbls/month at least once, two wells had over 60,000 bbls/month; and, one of these wells had almost 70,000 bbls/month.

For newbies: the infrastructure costs (pads, roads to pads, pipelines) to support these wells have pretty much been paid for years ago. These wells were pretty much guaranteed to be huge wells. Three months of 50,000 bbs/month = 150,000 bbls in one quarter. EOG has its own sand mines.

Early production numbers for these wells:

32796, SI/NC, EOG, in July, 2016, target formation was changed from middle Bakken, to Three Forks, first bench; Clarks Creek 73-0719H, SWSE 7-151-94, 45K first month (6/17 -- still conf):

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 8-2017 | 52049 | 93206 |

| 7-2017 | 59709 | 84999 |

| 6-2017 | 45483 | 18118 |

32795, SI/NC, EOG, Clarks Creek 110-0719H, SWSE 7-151-94, 44K first month (6/17 -- still conf):

| ate | Oil Runs | MCF Sold |

|---|---|---|

| 8-2017 | 45724 | 79899 |

| 7-2017 | 50738 | 72096 |

| 6-2017 | 43748 | 1687 |

32794, SI/NC, EOG, Clarks Creek 74-0719H, SWSE 7-151-94, 47K first month (6/17 -- still conf):

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 8-2017 | 51146 | 87778 |

| 7-2017 | 66039 | 94086 |

| 6-2017 | 47392 | 17014 |

33050, SI/NC, EOG, Clarks Creek 75-0719HX, SWSE 7-151-94, 42K first month (6/17 -- still conf):

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 8-2017 | 57069 | 94244 |

| 7-2017 | 60170 | 85764 |

| 6-2017 | 41645 | 15762 |

******************************************************

Stumbaling

This made my day.

I'm impressed Father Guido Sarducci agreed to be one of the judges.

Wells I No Longer Follow -- October 20, 2017

This is simply some housekeeping. Nothing new here. This has all been posted before. The page where this came from was getting too long. These are wells that I was watching for some reason or other; once I saw what I wanted to see, I "closed" them out.

Page 6

Page 1

February 26, 2017: #16630, CLR, a Red River well; pretty good well; off-line for many months starting in 4/2016 -- check back in mid-2017 to see status of well; still off-line as of 9/17; AB

July 30, 2017: follow up on this well in a month or so -- 19004, 1,440, EOG, Squaw Creek, SESE 7-149-94, 640 acres, t11/10; cum 171K 9/17; see this post.

August 24, 2017: 32546, 2,774, Koala Federal 31-25TFH, Poe, t8/17; cum 24K 9/17; (#21303; #20319; #20413). three wells off-line; need to be checked in late 2017; see this post;

August 23, 2017: #16908; #16180; #20233; link here.

September 16, 2017: this well came off-line 7/17; and there are neighboring wells on confidential status suggesting getting ready to frack; Elm Tree is an incredible field; let's see what this well does when it comes back on-line; back on-line as of 8/17 and a huge jump in production:

August 23, 2017: MRO re-frack; did it affect #18842 or #18736? Update, November 11, 2017: #18842 was re-fracked; huge jump in production. Did these newly refracked wells affect #18736? No. Update here, 3/19.

August 15, 2017: #17106; 90,000 bo in one month; http://themilliondollarway.blogspot.com/2017/08/random-update-of-north-dakota-well-with.html. September 14, 2017: huge, huge reporting error for #17106. See this post.

June 30, 2017: #31635; check production profile for typographical error. 8/17: data appears to be accurate.

June 27, 2017: check #19662, #17619, 24553, 24552, 17280 for any halo effect; Parshall Van Hook wells. Maybe some halo effect for #24552.

June 24, 2017: many of the EOG Clarks Creek wells were noted to be off-line as of late 2016, and going into 2017; huge wells; still confidential 8/17)

February 4, 2017: the dual laterals, the dual stacked White Butte Oil (Slawson) wells, Panzer and Meerkat wells. Probably re-check in mid-2017. #21385 taken off line and is on IA status (8/17); wonder what happens next; other wells erratic production; these wells were updated 9/17; #21385 back on line 9/17;

October 28, 2015: follow-up on this well; note strange early production profile; look at all wells in this area in Sand Creek to see if there is operational reason for production profile, #28779. Nothing of note to report 3/17. At least one TFH well revealed a halo effect.

February 20, 2017: check no sooner than May, 2017, to see how long the bump in production lasted for these two wells, #19301, and #19651, two Whiting Koala wells.

March 16, 2017: #20891 recently taken off-line. Back on line, 6/17.

March 28, 2017, the incredibly good Skarston wells are off-line again; no reason why. Check back monthly. Update: about half are back on-line as of 4/17; incredibly good production continues, 6/17.

May 9, 2017: check up on these wells in next month or so. Both in same area where EOG fracked three 3-well pads almost simultaneously: 25238, 17127. Update: no evidence of halo effect. Wow, #17127, a huge well, cum 759K 3/19.

June 7, 2017: #17106; huge jump 4/17; updated here. 3/19.

June 16, 2017: huge jump in production. #18224. Production data for all Hendrickson wells updated 10/18; a great well. Cum 729K 3/19.

February 26, 2017: #16630, CLR, a Red River well; pretty good well; off-line for many months starting in 4/2016 -- check back in mid-2017 to see status of well; still off-line as of 9/17; AB

July 30, 2017: follow up on this well in a month or so -- 19004, 1,440, EOG, Squaw Creek, SESE 7-149-94, 640 acres, t11/10; cum 171K 9/17; see this post.

August 24, 2017: 32546, 2,774, Koala Federal 31-25TFH, Poe, t8/17; cum 24K 9/17; (#21303; #20319; #20413). three wells off-line; need to be checked in late 2017; see this post;

August 23, 2017: #16908; #16180; #20233; link here.

- 33247, 2,774, MRO, Mittelstadt 34-12H, Chimney Butte, middle Bakken; t6/17; cum 212K 10/17; API: 33-025-03256; FracFocus, 4/30/17 - 5/21/17; 11.7 million gallons of water; 91% water; 7.8% sand; (#16908 - no bump, #16180 -- re-frac, #20233 - nice bump, not re-fracked);

- 16875, 351, MRO, Trotter 14-23H, Bailey, t2/08; cum 360K 10/18; re-fracked 6/17;

September 16, 2017: this well came off-line 7/17; and there are neighboring wells on confidential status suggesting getting ready to frack; Elm Tree is an incredible field; let's see what this well does when it comes back on-line; back on-line as of 8/17 and a huge jump in production:

- 23108, 767, Slawson Exploration, Wolverine Federal 5-31-30H, Elm Tree, t9/13; cum 465K 10/18;

August 23, 2017: MRO re-frack; did it affect #18842 or #18736? Update, November 11, 2017: #18842 was re-fracked; huge jump in production. Did these newly refracked wells affect #18736? No. Update here, 3/19.

August 15, 2017: #17106; 90,000 bo in one month; http://themilliondollarway.blogspot.com/2017/08/random-update-of-north-dakota-well-with.html. September 14, 2017: huge, huge reporting error for #17106. See this post.

June 30, 2017: #31635; check production profile for typographical error. 8/17: data appears to be accurate.

June 27, 2017: check #19662, #17619, 24553, 24552, 17280 for any halo effect; Parshall Van Hook wells. Maybe some halo effect for #24552.

June 24, 2017: many of the EOG Clarks Creek wells were noted to be off-line as of late 2016, and going into 2017; huge wells; still confidential 8/17)

February 4, 2017: the dual laterals, the dual stacked White Butte Oil (Slawson) wells, Panzer and Meerkat wells. Probably re-check in mid-2017. #21385 taken off line and is on IA status (8/17); wonder what happens next; other wells erratic production; these wells were updated 9/17; #21385 back on line 9/17;

October 28, 2015: follow-up on this well; note strange early production profile; look at all wells in this area in Sand Creek to see if there is operational reason for production profile, #28779. Nothing of note to report 3/17. At least one TFH well revealed a halo effect.

February 20, 2017: check no sooner than May, 2017, to see how long the bump in production lasted for these two wells, #19301, and #19651, two Whiting Koala wells.

March 16, 2017: #20891 recently taken off-line. Back on line, 6/17.

March 28, 2017, the incredibly good Skarston wells are off-line again; no reason why. Check back monthly. Update: about half are back on-line as of 4/17; incredibly good production continues, 6/17.

May 9, 2017: check up on these wells in next month or so. Both in same area where EOG fracked three 3-well pads almost simultaneously: 25238, 17127. Update: no evidence of halo effect. Wow, #17127, a huge well, cum 759K 3/19.

June 7, 2017: #17106; huge jump 4/17; updated here. 3/19.

June 16, 2017: huge jump in production. #18224. Production data for all Hendrickson wells updated 10/18; a great well. Cum 729K 3/19.

LA Times Has Long Article On Tesla Production -- October 20, 2017

Updates

October 22, 2017: from a reader regarding EV battery packs during really, really cold weather --a battery that could provide 1500 kW (around 200 hp) at 30° C would only deliver 325 kW (50hP) at 0° C or a paltry 163 kW (25hp) at - 10° C. This is from a $20,000 power pack. If you live in the Dakotas, and you drive your EV to work, starting it might not be a problem but htat 25 HP motor might take awhile to get you there.

October 22, 2017: catching up on my e-mail. These links were sent to me while I was "on vacation." The stories are from a year ago or so, but something I had not posted earlier, as far as I can recall. Two links:]

- Tesla aside, used electric car resale values are tanking

- resale values for electric cars continue to drop, not for Teslas

Original Post

It appears there are two main issues:

- batteries and the gigafactory

- switch from all-aluminum in models S and X to a mix of aluminum and steel in the Model 3

Tesla's Q3 vehicle delivery report showed only 220 Model 3s being delivered with 260 being produced. Tesla blamed the low count on “production bottlenecks” and stated:

Although the vast majority of manufacturing subsystems at both our car plant and our Nevada Gigafactory are able to operate at high rate, a handful have taken longer to activate than expected.This makes it sound as if there are just isolated problems in the production chain and that most of it is working as planned. An article today from the Wall Street Journal paints a very different picture:

Unknown to analysts, investors and the hundreds of thousands of customers who signed up to buy it, as recently as early September major portions of the Model 3 were still being banged out by hand, away from the automated production line, according to people familiar with the matter.

While the car’s production began in early July, the advanced assembly line Tesla has boasted of building still wasn’t fully ready as of a few weeks ago, the people said. Tesla’s factory workers had been piecing together parts of the cars in a special area while the company feverishly worked to finish the machinery designed to produce Model 3’s at a rate of thousands a week, the people said.It was obvious back in July when the first “production” Model 3s were delivered to Tesla insiders and employees that these were unlikely to have been produced on a true mass production line. Back then I wrote:

It's reasonable to assume that all the parts and components of the cars are production parts, whether from suppliers or from Tesla's own factories.

What isn't likely is that the cars have gone through the final assembly process as it will be in a few months time. Tesla has committed to a highly automated assembly process, but it's unlikely that this is fully operational. Most likely, there was a very substantial amount of hand assembly that won't be needed once the production line is fully operational.In fact, it now appears that not even all the components of the Model 3 were final production parts. Electrek.co has reported that Tesla has been replacing “prototype” parts with production parts in Model 3s delivered in July. These include the seats, headlight and tail lights, and the all-important battery packs.

The WSJ report indicates that Tesla is still where I thought it was back in July. And the article points out that there is limited value in hand assembly of Model 3 at this point, since it doesn't serve to test out the final assembly process.

Hand assembly of the Model 3 now seems mainly designed to soothe investors by convincing them that Model 3 “production” has started. What I find so distressing about this is that increasingly, Tesla's actions seem to be governed not by technical necessity but by the need to keep investors sold on Tesla.

********************************

Out Of Stock

Out Of Stock

I believe 50,000 were minted. 50,000 or 50,500.

Labels:

Tesla

The Energy And Market Page, T+272 -- October 20, 2017

Saudi Aramco. Talk about stalled IPO continues. Whom do you trust more? Hong Kong analysts or Saudi spokesmen? The Economist has a great story on the IPO and it doesn't look good:

Mega blues: GE cuts 2017 profit forecast; shares tumble. Shares of GE now on sale: falling below $22. The two-year chart looks awful, if placed side-by-side with the overall market during the same period.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, travel, or relationship decisions based on anything you read here or anything you think you may have read here. I wrote this blog myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this blog except for investments in some -- but very, very few -- of the companies mentioned.

Volatility: world's biggest oil traders all over the map when it comes to forecasting oil prices.

OPEC: strongest signals yet it will extend cuts to December 31, 2018.

Schlumberger shares struggling.

Futures: Dow up "almost triple digits."

The proposal to sell shares in Saudi Aramco, the world’s biggest oil company, stunned the financial markets last year. Muhammad bin Salman, now Saudi Arabia’s crown prince, promised that it would be the biggest initial public offering (IPO) of all time, valuing Aramco at $2trn.

It was to be the centrepiece of his plan to transform the Saudi economy, reducing its dependence on oil. It was meant to foster financial transparency and accountability in one of the world’s most hermetic kingdoms. Above all, it would cement the young prince’s image as a bold moderniser soon to inherit the throne.

Alas, youthful impatience appears to have got the better of him. His tendency to micromanage the IPO and vacillate over where Aramco should be listed has caused delay and confusion. Matters came to a head this week when advisers, speaking anonymously, and company executives doing the same, gave conflicting reports, suggesting a mutinous atmosphere.

The kingdom’s advisers say privately that the decision to list in New York or London has been postponed, and that the plan “for now” is to issue shares on Riyadh’s puny Tadawul exchange, with a private placement possibly to Chinese investors. But Khalid al-Falih, the oil minister and Aramco’s chairman, insisted the IPO would go ahead at home and abroad next year as originally planned. Company officials scorn the idea of listing only on the Tadawul, which would be swamped by an Aramco IPO.

The confusion appears to have originated from the royal palace. From the outset, MBS, as the crown prince is known, has insisted that the firm should be valued at no less than $2trn, and that the IPO should happen next year. He had not fully appreciated either the threat of lawsuits related to the terrorist attacks of September 11th 2001 that could result from listing on the New York Stock Exchange, or the complexities of issuing shares on the London Stock Exchange, where institutional investors are angry about efforts to water down listing rules for Aramco. He wrongly assumed that, given the huge fees promised to bankers and advisers, other actors in the world of finance would bend the knee.Moody blues: Hartford is likely to default on its debt by November and, if it doesn’t change course, will run up annual deficits exceeding $60 million through the next 20 years; bondholders may recover as little as 65 percent of their investment.

Mega blues: GE cuts 2017 profit forecast; shares tumble. Shares of GE now on sale: falling below $22. The two-year chart looks awful, if placed side-by-side with the overall market during the same period.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, travel, or relationship decisions based on anything you read here or anything you think you may have read here. I wrote this blog myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this blog except for investments in some -- but very, very few -- of the companies mentioned.

Volatility: world's biggest oil traders all over the map when it comes to forecasting oil prices.

OPEC: strongest signals yet it will extend cuts to December 31, 2018.

Schlumberger shares struggling.

Oilfield services giant Schlumberger Ltd sealed a deal to buy oil and gas assets worth $1 billion from Cenovus Energy on Thursday, raising further concerns about its strategy to own more refining and drilling operations directly.

For Calgary, Alberta-based Cenovus, the sale is the latest in its plan to offload assets as it pays down debt, including loans it took up to fund its $13.3 billion purchase of oil sands and natural gas assets from ConocoPhillips.

Cenovus's shares were up about 2 percent in afternoon trading, while Schlumberger's were down about 1.5 percent, along with other energy stocks due to lower crude oil prices.Schlumberger: sees oil prices rising.

Futures: Dow up "almost triple digits."

RBN Energy Updates Growth In US Crude Oil Storage Capacity -- Huge Story -- October 20, 2017

Active rigs:

RBN Energy: Expanding storage supports booming exports.

| $50.86↓ | 10/20/2017 | 10/20/2016 | 10/20/2015 | 10/20/2014 | 10/20/2013 |

|---|---|---|---|---|---|

| Active Rigs | 56 | 33 | 68 | 191 | 184 |

RBN Energy: Expanding storage supports booming exports.

U.S. crude exports continue to takeoff — increasing during the week ended September 29, to a new record just under 2 MMb/d, according to the Energy Information Administration (EIA), with 1.3 MMb/d in the first week of October followed by 1.8 MMb/d in EIA’s Wednesday report. The crude exodus is primarily occurring from port terminals along the Gulf Coast and is expected to continue as expanding Permian basin shale production is shipped directly to marine docks by pipeline. Recent and planned expansions to crude storage are largely linked to demand for new capacity at marine docks staging cargoes for export. In today’s blog, Morningstar’s Sandy Fielden details the rapid growth of commercial crude storage capacity at Gulf Coast terminals since 2011.

We’ve covered growing terminal and storage capacity on the Gulf Coast extensively since the start of the shale boom. By 2014, pipelines were built out to reach the Gulf Coast from Cushing in the Midwest and the Eagle Ford and Permian basins in Texas, bringing significant new flows to the Houston region.

All the new crude showing up in the Houston region needed new storage capacity to stage its redistribution to local refineries and plants further east in Louisiana. We detailed the growth of Houston storage in a 2015 blog series.

More recently, we covered expanding storage capacity in Texas City and storage at the Louisiana Offshore Oil Port, as well as the potential for crude exports from that port.

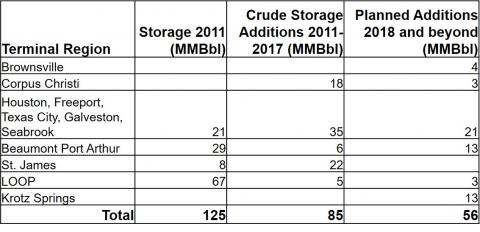

Our estimate of expansions in commercial crude storage capacity along the Gulf Coast by terminal region is summarized in Figure 3 below. We list existing capacity circa 2011, as well as estimated additions between 2011 and 2017 and planned additions next year and beyond. The terminals included are those at Gulf Coast ports or with waterborne access (including the Mississippi River), not inland terminals at pipeline intersections or in producing regions such as the Permian Basin. The data shows crude storage capacity at these terminals increased by 68% from 125 MMBbl in 2011 to 210 MMBbl in 2017 with plans in the works to add another 56 MMBbl or so. Below the table we provide a brief overview and rationale behind new additions in each terminal region.

Source: Company Presentations, Morningstar

Subscribe to:

Comments (Atom)