A while back -- not that long ago -- we discussed the prices of vaccines in light of the price Pfizer planned to charge for the Covid-19 vaccine. My pet peeve at the time: milleennial mainstreeam media "journalists" failing to put things into perspective.

See these two links for background: here and here.

I've had the two primary Pfizer vaccines, and have had the two boosters, the most recent one recommended only for those at high risk and over the age of 65 (at the time -- I don't know what the recommendations are now). I assume I will be getting a booster every six months. Maybe, maybe not. Depends.

But yesterday, after years of putting it off I got the first of a series of two "shingles" vaccine injections at our local supermarket pharmacy.

Over the past weekend I attended church in Portland where my son-in-law is a pastor (his calling, but not his day job) where two seniors told me the horrors of shingles. Having heard from them in church, I assume it was God talking to me through them.

So, I got my first shingles shot.

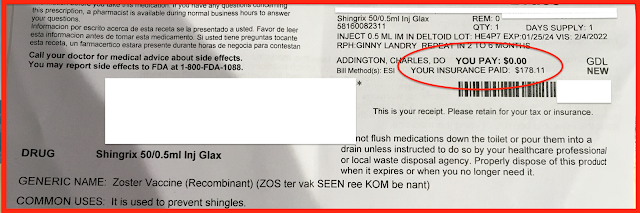

Look at the price:

$178.11 per dose.

Medicare will pay about $50 and the VA will pay the rest.

And this is a two-shot series, almost $400 for the vaccine.

Early on, folks were also surprised that one Covid-19 vaccine did not offer life-long protection. LOL. That's pretty much the norm for all vaccines.

*************************

Disneyland

Speaking of prices.

A few weeks ago -- months ago? -- we also got into the prices Disneyland charges.

Let's put the price of Disneyland (southern California) into perspective, again something no one ever seems to do.

This, from social media today:

Family of four: ski lift tickets for one day, about $1,100.

And, each member will rent $200 worth of ski equipment: $800.

And lunch. And dinner. And overnight accommodations. No one flies all the way to Colorado for one day of skiing. So, a second day for the family, another $2,500 for one day of skiing.

Now, the prices for Disneyland.

From Disney's webpage:

So, for two days, $143 / day or as inexpensive as $83 / day.

And you won't have to buy $200 worth of equipment just to get in.

And, I can guarantee you, one can find less expensive accommodations in southern California than in the mountains of Colorado.

But it gets better. One can actually visit Disneyland for as little as $3.00 / day.

From mousesavers.com: