The Hess AN-Bohmbach wells have been discussed often. They are tracked here.

I assume I've talked about this one; can't remember.

35093, 10,626, Hess, AN-Bohmbach-153-94-2734H-8, 35 stages, 9.9 million lbs, Antelope-Sanish, t4/19; cum 316K 12/20;

Does anything catch your eye?

Yeah, that IP of 10,626.

Here's a pretty good post at the time. In that post, I said I would be waiting for the NDIC report. I don't recall if I ever followed up on that. Maybe I did. I don't recall. Whatever.

Here's a screenshot of the sundry form from the file report:

It's possible there was a typo on the sundry form.

But if so, there were two typographical errors. Note the natural gas MCF IP: 27,577 MCF which is about 10x the typical natural gas MCF IP.

So, it was real. I guess.

Here's a screenshot of the frack/completion:

****************************************

The Movie Page

The Draft Page, Kevin Costner, 2014.

Critics: mixed reviews.

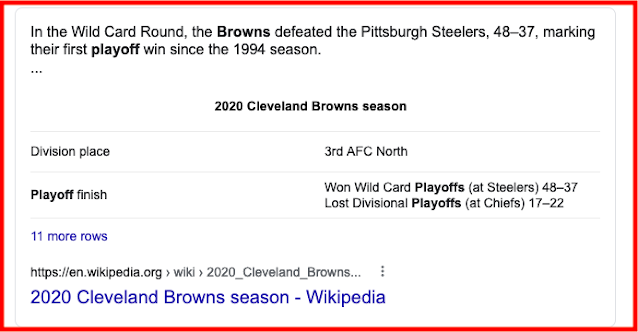

A bit of irony considering the choice of the Cleveland Browns was made for budgetary reasons only. And then seven years later:

My hunch: the movie played better for true football fans than for movie critics.

From wiki, look at how "valuable" the screenplay was:

The screenplay was the number one script on the 2012 Black List survey of unproduced screenplays and WhatCulture listed it as the 10th best script of the 2010s.

It was argued that the script "follows one of the central tenets of screenwriting which is, 'thou shalt make things as hard as possible for your protagonist.'"

However, it was also stated that "[some] of this high-octane drama was lost in the screen translation, which is a shame, since the script is as good as it gets."