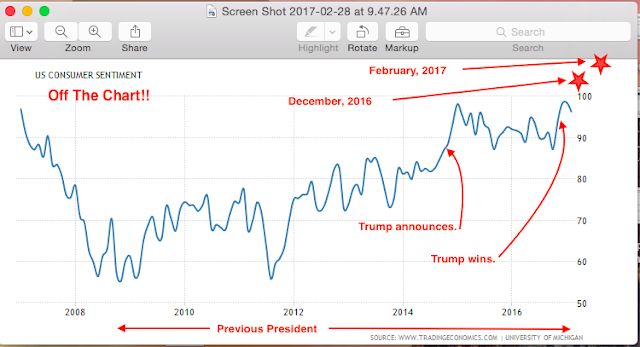

Consumer confidence soars to 15-year high (that would encompass both the Obama administration -- hope and change -- and the Bush administration -- more of the same). One wonders where we would be if Hillary were president.

February's reading of 115 topped the 15-year high of 113.7

set back in December after Donald Trump's election

victory. Best reading since July, 2001.

So, what's the market doing? Flat, crawling back from a negative opening. Yesterday: twelve consecutive days of record-setting closes -- ties record.

Back to the Oscars. My hunch -- the conspiracy theorists are correct on this one.

Worth repeating: As Nobelist Milton Friedman correctly quipped, “A minimum wage law is, in reality, a law that makes it illegal for an employer to hire a person with limited skills.”

**************************

Neanderthal Man: In Search of Lost Genomes

Svante Paabo

c. 2014

DDS: 569.986 PAA

The author: director of the Department of Genetics at the Max Planck Institute for Evolutionary Anthropology in Leipzig, Germany. In 2009,

Time names him one of the 100 Most Influential People in the World. Most likely just behind President Obama.

I never thought about this before:

Each of us carries only one type of mitochondrial DNA (mtDNA), which comprises a mere 0.0005 percent of our genome. Since we carry in each cell thousands of copies of just the one type, it is particularly easy to study, unlike the rest of our DNA -- a mere two copies of which are stored in the cell nucleus: one copy from our mother and one copy from our father.

Neanderthal bones first discovered in a small cave in a quarry in Neander Valley in 1856, a few years before the US civil war and three years before the publication of Darwin's

The Origin of the Species.

Neanderthal disappeared some 30,000 years ago.

Most common type of damage to DNA:

- occurs spontaneously

- whether nuclear DNA or mtDNA

- the loss of a chemical component

- the chemical component that is loss: an amino group

- an amino group on the cytosine nucleotide (C)

- the loss of that amino group on C turns C into uracil (U)

- U is not naturally found in DNA (it is found in RNA)

- enzymes remove the U's from DNA; excreted in urine

- about 10,000 C's per cell morph into U's each day, only to be removed and replaced

- and, this is just one of several types of chemical assaults our genomes suffer.

Polymerase chain reaction (PCR): technique invented by the maverick scientist Kary Mullis in 1983

from a single DNA fragment, it is possible, in principle, to obtain a trillion copies after forty cycles

awarded the Nobel Prize in chemistry in 1993

Early on:

We compared our 379-nucleotide Neanderthal mtDNA sequence to the corresponding mtDNA sequences from 2,051 present-day humans from all around the world. On average, twenty-eight (28) of the positions differed between the Neanderthal and a contemporary person, whereas people alive today carry an average of only seven (7) differences from one another. The Neanderthal mtDNA was four times as different.

Figure 1.3 on page 13: the mtDNA tree of all humans alive today --

- all trace back to one common mtDNA ancestor ("Mitochondrial Eve")

- Neanderthal does not trace back to "Mitochondrial Eve"

Ages:

- Mitochondrial Eve: lived between 100,00 and 200,000 years ago

- the common ancestor linking Mitochondrial Eve and Neanderthal Man lived about 500,000 years ago

Independent lab chosen to confirm:

- Penn State University

- Mark Stoneking

- Stoneking had been a graduate student and then a postdoc with Allan Wilson at Berkeley

- author knew him when the author was a postdoc at Berkeley in the 1980s

- Stoneking: one of the people behind the discovery of Mitochondrial Eve

- Stoneking: one of the architects of the out-of-Africa hypothesis of modern human origins: the idea that modern humans originated in Africa some 100,000 to 200,000 years ago, then spread around the world, replacing all earlier forms of humans, such as Neanderthals in Europe, without admixture

- Anne King also in Mark Stoneking's lab

Background regarding three journals:

- Nature, British

- Science, US

- Cell

Competing with out-of-Africa theory: the multi-regional model

- paleontology-based

- modern humans evolved on several continents, more or less independently, from Homo erectus

Other names mentioned at this time:

- Chris Stringer, Natural History Museum in London; paleontologist; early adapter of the out-of-Africa theory

Milford Wolpoff, University of Michigan, a multi-regionalist paleontologist

********************************

Spring

Beautiful, beautiful day for biking. A thunderstorm is forecast for mid-morning but then the rest of the day should be overcast, humid, and very warm.

I wish Sophia could have been with me this morning. The cows and calves were right up along the fence and she would have loved walking up to them. The cornfield -- plowed under from last year -- was filled with Canadian geese. I saw one blue jay. As a kid, I drew a lot of blue jays and squirrels in art class but I never saw a squirrel or a blue jay in Williston until I was in middle school (we called it "jr high") and I would each lunch at Central? Park. I forget the name of that park. But it was the park near Central Jr High. My lunch usually consisted of a Kraft Velveeta processed cheese-on-processed-white-bread that apparently is now considered bad for one's health. If I was lucky, I might also have an apple. I don't recall what I had to drink; maybe a little thermos with water. I know it wasn't milk; I hated milk. Maybe apple juice. Whatever.

Yesterday, I saw a flock of robins -- so I knew spring was here, and then a few minutes later, a most gorgeous cardinal. It appeared to be a young cardinal so maybe a year old? I don't know. Does a one-year-old cardinal look any different than a 5-year-ld cardinal?

But a great day for spring. And, Sophia and I saw at least a dozen turtles down at the creek at the park.

Last evening, when it was pitch black, about 7:45 p.m. Central Time, I pointed to the bright object almost overhead, to the west-south-west, telling 2 1/2 year-old Sophia that was the evening star. She said one word: "Venus."

I swear on a stack of bibles that's exactly what happened. I pointed to the bright object in the sky, pointed it out telling Sophia it was the "evening star" and said it was "Venus."

I had forgotten that we often look at the stars and I always point out what little I know. It's amazing what young minds remember.