Locator: 45496APPLE.

Anticipation: the new Apple iPad Pro will be released in 2024. It will not be announced in September. I have the latest version of the iPad Pro. It’s quite incredible and shows no “aging.” It is the 3rd generation iPad Pro released in 2018, five years ago.

But, yes, I will get the new 13-inch iPad Pro. Only when you get “hooked into” the Apple biome do you really realize how robust that environment is. Literally, every Apple product is tied into each other. Seamlessly. I don’t have to set up a thing.

When I get home from the library, all my MacBook Air work magically appears on my 27-inch tabletop iMac and my 12.9-inch MacBook Pro exactly where I left off in the library.

The huge screen: not only is it huge, but the crispness and clarity is incredible.

**************************

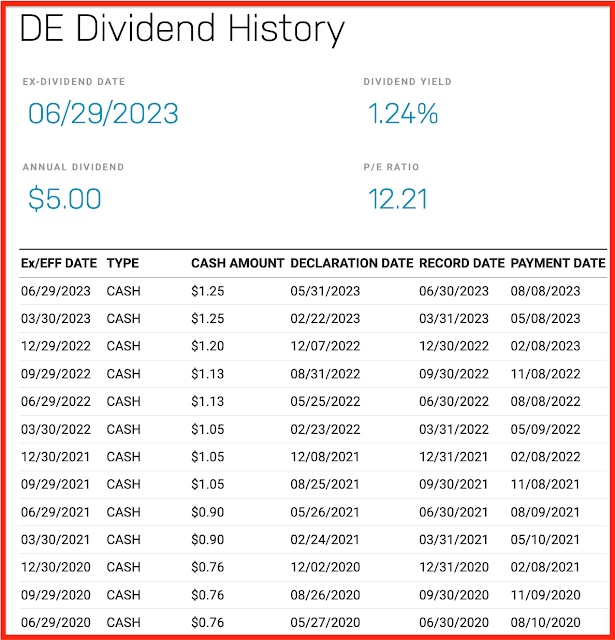

Meanwhile, Dividends

Link here.

ATT: getting favorable press. Analysts suggest dividend is "safe."

Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here.

All my posts are done quickly:

there will be content and typographical errors. If anything on any of

my posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

Again, all my posts are done quickly. There will be typographical and content errors in all my posts. If any of my posts are important to you, go to the source.

**************************

Surprise, Surprise

NVDA.

After being in the red pre-market , it is now up 1%. Up almost $5 / share.

Same with AAPL: up about half a percent. Completely unexpected.

"Oils." Disappointing. Not surprising.

Josh: Sorry. Not sorry.