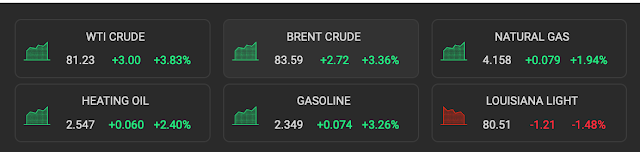

The one data point to watch today: WTI

- just before the market opens, WTI up 2.11%

- WTI up $1.65:

- trading at $79.88

- only 12 cents away from $80 (again)

Speak with forked tongue:

- last month US SecEnergy said government was doing everything it could to moderate gasoline prices;

- today; US moves to restrict oil leasing in Alaska; WSJ;

- should be seen as good news by folks like me: makes the Permian and the Bakken look even better;

- whoo-hoo

- keep it in the ground; we'll eventually drill it, if necessary;

Disclaimer: this is not an

investment site. Do not make any investment, financial, job, career,

travel, or relationship decisions based on what you read here or think

you may have read here.

NE ISO: burning oil not because it has to; it's the only way to keep prices from spiking even more.

- fourteen percent of electricity being generated in NE ISO is now coming from oil.

- another three to five percent is coming from coal.

WTI: could hit $80 this week. BofA analyst still sees $100 oil.

- airline traffic still remains way down; airline traffic huge driver of crude oil demand;

- OPEC failed to meet production goals; data released overnight; spare capacity? What spare capacity?

- note: Josh Young's bullish stand on oil makes me look like an oil bear;

European energy crisis: natural gas prices rise (again) on muted Russian supply; cold weather; link here.

OPEC:

- "uncomfortably thin market buffett" on current trajectory: link here.

- note: Josh Young's bullish stand on oil makes me look like an oil bear; but I repeat myself;

Jay Powell: "testifies" today

- last time he spoke, "transitory" was the new four-syllable word being bandied about;

- today, the four-syllable phrase, "won't be entrenched";

Rivian shares:

- if it drops 30 more cents today, it will be trading below it IPO opening off and well below half it's same day exuberant opening (or thereabouts; this, I"m sure, will be fact-checked); link here;

- fell "a few hundred short" of its approximately 1,000-car delivery goal;

- COO departs; company says this was a planned retirement in the works for five months;

- interestingly, no replacement named despite five months of planning; what am I missing?

Investors: coming in "fours" today -

- four-word phrase: "won't be entrenched"

- four syllable word: "transitory"

- four letter acronym: "FANG"

- four-letter ticker: "MNRL" (see Simply Wall St) --- not including dividends, 74% return over one year;

My biggest investment decision today:

- sell high dividend commodity company going nowhere?

- use those proceeds to buy very-low-dividend-paying company with huge appreciation potential

- decisions, decisions

Inflation? What inflation?

- beer: last night, in anticipation of the SEC Championship game (yes, the SEC Championship game), I went to Target to buy my favorite IPA; had not bought any in quite some time. It's always priced at $9.99 at Target; $8.99 at two other area stores, but Target was closer; that IPA was on sale at Target for $8.99

- non-alcoholic ginger beer from Australia: has not increased prices in over two years; still $5.99 for a four-bottle pack; yes, we drink it straight; not for Moscow mules;

- lamb: grass-fed lamb from Australia has been on-sale for months at local grocer; says "regular" price is $14.99 / lb (I've never paid that much for even the best lamb available);

- on sale for $10.99 / lb

- pricey but we're used to paying $9.99 for salmon so $10.99 for lamb from Australia hardly terrifying

- Russet (or are they "russet") potatoes are practically free (I think 75 cents/pound)

See first comment, a reader asked:

AAPL:

- negotiating for MLB rights for next summer (2022? 2023? I'm not sure what "next" is any more)

- reading the judicial tea leaves: will allow alternate pay schemes on its platform in South Korea (I doubt AAPL has a platform in North Korea)

- AAPL hints at record earnings for current quarter (Oct - Dec, 2021)

- Apple is still bigger than all these companies combined;

ATT:

- I had no interest in accumulating any more, but ATT has had an incredible run the past few months;

- I wonder if folks realize a huge dividend cut is coming;

Loans:

- PNC: circular received yesterday -- personal load "as low as" 7.44% - 9.74% APR, 60-month term with a minimum of $15,000

- Schwab: 1.9%; no minimum; no late fees; no time period;

Jamie Dimon:

- really, really, really upbeat about state of economy

- suggestion: instead of some GOP politician giving SOTU response to Brandon, let Jamie Dimon do it;

- if you really want to see fireworks, let Harold Hamm do the response; LOL

WORDLE, link here:

- many, many strategies

- never-fail strategy:

- first line -- "ADEIU"

- second line -- "AROSE" -- there's actually a better second word but I've forgotten it; should have written it down

- third line: type in word based on "grey" letters only (to extent possible, of course)

- guarantee: will solve every puzzle

- 99% of time I solve the puzzle before having to use fifth (and last) guess

Best three minutes of television last night: last three minutes of the SEC Championship game;

- yes, that's all I watched

- tuned in after watching second episode of "Perry Mason" re-runs with my wife

- Georgia had just returned a 79-year intercept icing the game for Georgia

- I don't know who was crying more:

- for joy: Georgia quarterback;

- for no-joy: Coach Saban

Biggest television choice this a.m. after walking Sophia to bus:

- watching Jim Cramer, 8:00 - 9:00 a.m.

- watching sports-talk television dissect Alabama

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

***********************************

Back to the Bakken

Bismarck: link here -- operator of a pipeline slated to transport carbon dioxide into North Dakota for disposal intends to pick up emissions captured from an ammonia plant planned for Grand Forks.

Active rigs:

$79.40

| 1/11/2022 | 01/11/2021 | 01/11/2020 | 01/11/2019 | 01/11/2018 |

|---|

| Active Rigs | 32 | 11 | 55 | 67 | 54 |

Tuesday, January 11, 2022: 12 for the month, 12 for the quarter, 12 for the year

- 37129, conf, Hess, BL-Frisinger-156-95-2833H-3,

RBN Energy: are "green" and "blue" ammonia the shipping fuels of the future? Part 3. Archived.

The international shipping industry’s push to significantly reduce its

carbon footprint over the next three decades is raising an obvious

question: Is there a zero- or low-carbon bunker fuel that meets all of

the industry’s basic criteria — things like availability, safety, and

relative economy, not to mention sufficient on-board energy to transport

massive, city-block-sized vessels thousands of miles at a clip. There

is no clear answer yet, but there is a lot of talk about ammonia, or

more specifically ammonia produced in a way that either generates no

carbon dioxide (CO2) or that captures and sequesters much of the CO2

that is generated during production. But several major challenges must

be met before “green” and “blue” ammonia can lay claim to even a small

slice of the bunkers market, as we discuss in today’s RBN blog.