Gaslighting: Almost 200 million bbls may never be returned to the SPR. I'm shocked. Shocked.

- the US DOE may not have sufficient budget to refill the petroleum reserve;

- it's such a convoluted story, I won't even attempt to break it down.

- but, that pretty much ends any more releases for political purposes in the near future

- and, we all know, the real SPR is now Saudi Arabia for heavy oil, and the Permian for light oil

- something tells me, we have a new floor for the price of oil -- whoo-hoo!

- it should be an interesting summer.

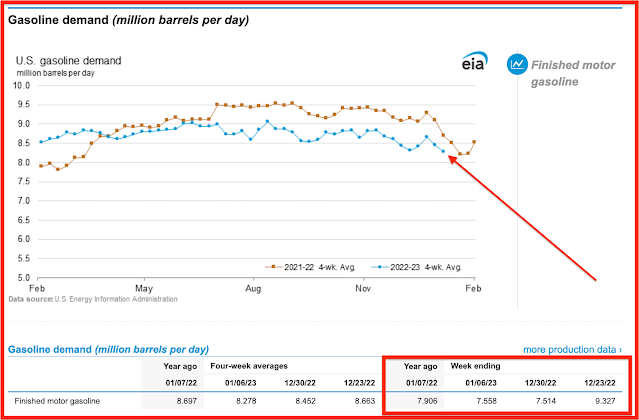

Gasoline demand, link here:

*****************************

Back to the Bakken

Active rigs: link here.

WTI: $77.68.

Natural gas: $3.678.

No new permits.

Nineteen permits renewed:

- XTO (10): four Wood permits in Truax oil field, Williams County; five Hartel permits in Siverston field, McKenzie County; one Carus State permit, Lost Bridge, Dunn County;

- Hess (7):

- Hunt (2): two Patten permits, Parshall oil field, Mountrail County.