Locator: 48697ARCHIVES.

Holy mackerel: from ChatGPT tonight -- the question I asked ChatGPT -- "how many days has President Trump been in office? The answer (LOL). What am I missing?

The correct answer is 127 days (second term). In his second term, President Trump has been in office for 127 days. Let that sink in.

Biggest news tonight: "NATO" agrees to let Ukraine strike as deep into Russia as it wants. Here we go.

Almost as big: if this is true -- President Trump has directed that all US embassies quit scheduling student visa interviews.

I have mixed feelings. Get out the yellow legal pad and line up the pros and cons. I personally think this is the singular act that will convince the doubters Trump means business. You may not want to take Trump literally, but you have to take him seriously. I think that's where journalists and pundits are not serving the American public well. Laughing at Trump, making jokes about Trump is not the right way to go about taking him on mano a mano. He likes making deals, and making deals for Trump is no laughing matter.

Back to student visas. My alma mater won't survive without Asian students. Nor will many other universities. Not in their present form. My hunch: every major university president is calling the Harvard president. His/her days are numbered if, in fact, it's true that the Trump administration has stopped all embassy interviews for student visas. Wow.

ESPN: NBA on TNT -- absolutely excellent. For me, I get ESPS via Hulu. Absolutely worth the subscription price of Hulu.

Beer: I don't think I've had a beer in over a year. Finally I had one tonight -- while watching Knicks play the Indiana Pacers.

"Half-Life" by Manhattan Project Beer Co., Dallas, TX, hazy IPA. Incredibly good. $10.00 for a six-pack. I see "Hop and Sting," made locally here in Grapevine is still $7.99. It was a toss-up whether to get "Hop and Sting" or a Manhattan Project Beer, but, I can't say otherwise, Manhattan Project Beer is absolutely the best.

They must make about a dozen varieties, varying in price from $10 to $20 for a six-pack. I'm wrong. They make 19 craft brews. My go-to: "Half-Life." Amazing. If you were a young college student, why would you have a part-time job at Lowe's when you could have a part-time job at Total Wine, specializing in Manhattan Project Beer with a minor in Bitburger Pils. LOL.

Life is complicated:

I get so much good stuff from so many readers, it's hard to remember how they sent me something when I want to go back and capture it: e-mail; group chat; direct text; a blog link; etc. Life is getting complicated.

Portland:

https://www.facebook.com/reel/3936816733131112This is why I enjoyed 30 years in the service, including 14 of those years overseas -- I met so many interesting folks. This guy is someone who I met so may times overseas.

Working on "sight words":

Wow, never quit reading.

I was blogging and a note happened to fall off the side of my chair, something I had written earlier; this made my night, LOL:

Ermen: supposed that Hatshepsut as Tuthmosis (Thutmose) III's sister (p. 163) -- in fact she was his aunt.

Time for a musical interlude. I may not post anything, but I'm surfing YouTube.

Paradise: I see CNBC has a fluff piece on how "living in paradise differs from visiting paradise."

I know exactly what they mean. I lived in paradise for 20 years or thereabouts -- hitchhiking during my college days; medical school in southern California; thirteen years with the family overseas, mostly Europe; 100 sorties in the F-15D; a summer in a NYC suburb; four years by myself in England; thirteen weeks in Yorkshire, England; a significant "other" at all times; a year reading Hunter S. Thompson; and four years of high school in Williston, North Dakota.

If Tom Cruise had done nothing else, his legacy would have exceeded most with Top Gun.

Keep a journal. The other day, an extended family member asked me the name of the first wife of another extended family member and their son -- it took me a few minutes to find the answer in my journal from 30+ years ago, but I found it.

Some of the most iconic movie scenes in Moreno J's remix of Haddaway's "What Is Love?" Quick, who sang the female "accompaniment"?

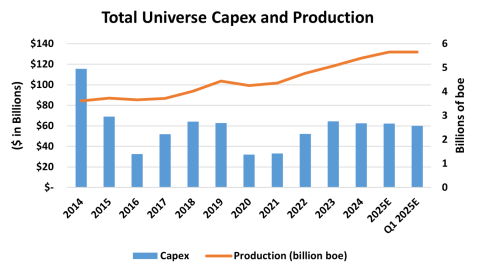

The market: after a most remarkable day, the market is holding, at least for now.

Time to read. Enjoy some music.