Locator: 49905MEASLES.

Locator: 49905ANTIVAXXERS.

Tuesday, February 3, 2026

WMT Hit 52-Week High -- February 3, 2026

Locator: 49904MARKET.

Apple: M5 Pro and M5 Max MacBook Pro launch imminent. Link here.

Market today, February 3, 2026, at the close:

- WMT: closed at $127.71; up 3% today; hits a 52-week high; reminder: trades on the NASDAQ as a "tech" stock; P/E = 45.

- BRK-B: up $6.45 today; trading at $493.75;

- SCCO: up $22.64; up 12%; trading at $215, just shy of its all-time high;

- PLTR: the ring to the rule them all -- up $10 today; up 7%; trading at $158; 52-week high, $207.

- CAT: up 2%; up $12; trading at $703; hit a 52-week high of $710 before dropping back to $703 at the close.

It appears that traders are dividing tech stocks into two major groups

- those chasing cash;

- those not chasing cash.

Today: Dow -- 281 stocks hit 52-week highs at some point during the day -- link here -- including:

- BUD

- BWXT

- CAT

- EPD

- XOM

- MRK

**********************************

Disclaimer

Briefly

Briefly:

I am inappropriately exuberant about the Bakken and I am often well out front of my headlights. I am often appropriately accused of hyperbole when it comes to the Bakken. I am inappropriately exuberant about the US economy and the US market. I am also inappropriately exuberant about all things Apple. See disclaimer. This is not an investment site. Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here. All my posts are done quickly: there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything. If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them. Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market. I am also inappropriately exuberant about all things Apple. And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia. Nvidia is a metonym for AI and/or the sixth industrial revolution. I am also inappropriately exuberant about all things Broadcom. Longer version here.

Trump Vs Harvard -- The Stakes Have Just Been Raised -- Does This Man Ever Sleep? February 3, 2026

Locator: 49902LAW.

Axios: link here.

$10 billion or criminal investigation. Time for Harvard to get serious. Harvard will try to run out the clock. Trump has three more years as president.

One way or another. Link here.

************************

Twenty-One Republicans Voted Against Trump,

Voted With Schumer

Reps. Andy Biggs, R-AZ, Lauren Boebert, R-CO, Josh Brecheen, R-OK, Tim Burchett, R-TN, Eric Burlison, R-MO, Kat Cammack, R-FL., Eli Crane, R-AZ, Byron Donalds, R-FL, Randy Fine, R-FL, Brandon Gill, R-TX, Anna Paulina Luna, R-FL, Thomas Massie, R-KY, Cory Mills, R-FL, Andy Ogles, R-TN, Scott Perry, R-PA, Chip Roy, R-TX, David Schweikert, R-AZ, Keith Self, R-TX, Victoria Spartz, R-IN, Greg Steube, R-FL, and William Timmons, R-SC.

Republicans not supporting Trump -- it gets tedious.

****************************

Southern California Vacation For Family Of Four

Two Adults; Two Children Under Age Of 12

$7,200. And worth every penny.

$300 x 24 months = $7,200.

$600 x 12 months = $7,200.

Air transportation, return.

Car rental.

Seaside accommodations, five days, five nights.

Two days at Legoland.

One day at San Diego Zoo.

Two days at the beach.

******************************

The Book Page

The News: A User's Manual, Alain de Botton, c. 2014.

Author: also, How Proust Can Change Your Life.

************************

Movie Night

A Fish Called Wanda.

Five States Considering Eliminating Property Tax -- February 3, 2026

Locator: 49901TAXES.

Five states are considering elimination of the property tax.

Link here: https://www.foxbusiness.com/politics/states-considering-eliminating-property-taxes-homeowners.

North Dakota leads the list. Followed by Georgia, Florida, Texas, and Indiana.

Two of those states don't have a state income tax either: Florida and Texas.

Time For A Musical Interlude -- A Thousand Miles From Nowhere -- February 3, 2026

Chasing Capital Or Chasing Access To Fabs -- February 3, 2026

Locator: 49895TECH.

I see it this way:

- personal tech:

- Android

- Apple

- macro

- large data centers

- large language modesl

- space

Macro:

- chasing capital

- Android / Apple chasing chips and chasing "fabs."

Huge difference.

Apple has "no" direct competition. Sitting in the cat-bird seat.

Apple: link here.

Inflation Watch -- Anti-Fungal -- One Ounce - 1% -- February 3, 2026

Locator: 49893INFLATIONWATCH.

So, what's the average price of an anti-fungal, one ounce, 1%:

At Target, across the street from us:

At "Pop Shelf," across the street from us:

It gets tedious.

Devon Energy With Four New Permits -- February 3, 2026

Locator: 49892B.

WTI: $63.69.

Active rigs: 29.

Four new permits, #42686 - #42689, inclusive:

- Operator: Devon Energy

- Field: Painted Woods (Williams County)

- Comments:

- Devon Energy has permits for four Dayton wells, lot 6, section 6-154-102, to be sited 2248 FSL and 346 / 436 FWL.

Four permits canceled:

- Hunt Oil: an Oakland permit, Mountrail County; and, two Halliday permits, Dunn County.

- Devon Energy: a Barbar permit, McKenzie County;

Twenty-two producers now abandoned:

- Whiting (10)

- Foundation Energy (5);

- Lime Rock Resources (4);

- Oasis (2);

- Missouri River Royalty Corporation (1).

Today: Hell Froze Over -- Literally -- February 3, 2026

Locator: 49891GLOBALWARMING.

Perhaps Algore should give his Nobel prize to President Donald J. Trump. Just saying.

US Shoots Down Iranian Drone Over International Waters -- Finally Some Adulting In The Room -- February 3, 2026

Locator: 49890ADULTING.

Obama: would have let it go; given a speech.

Biden: what's a drone?

Trump: this is really not a good thing. FAFO.

Mark Kelly (D-Ariz): to US Navy seamen -- consult your lawyer -- is an illegal order forthcoming?

Hegspeth: shoot it down.

****************************

Fail

Later, Iranian gunboats failed to board US-flagged oil tanker after US Navy intervenes.

Again:

Obama: would have let it go; given a speech.

Biden: we have oil tankers in the Gulf?

Trump: this is really not a good thing. FAFO.

Mark Kelly (D-Ariz): to US Navy seamen -- consult your lawyer -- is it legal for the US Navy to intervene? For all we know the Iranians were simply bringing chaye.

Hegspeth: call in the US Navy.

ICE Cold -- Minnesota -- February 3, 2026

Locator: 49889GLOBALWARMING.

Tag: Minnesota global warming cold record Tower

*********************************

Legoland -- 2026

Levi in the "short" below. Levi and Judah visiting Legoland this week.

Clearing The Decks -- February 3, 2026

Locator: 49887ARCHIVES.

SCCO: seriously, truthfully, crossing my heart and hope to die, this was the first ticker I checked this morning -- I thought it was all about fiber now -- at least that's what Cramer said.

Dow: all-time high. Who wudda thought?

- Trump closer to deal with Iran?

- the India tariff news?

- earnings?

WOW! This has been a theme on the blog for the past few weeks. Now, this, top story on CNBC online this morning (other then the Disney story). I guess that cash hoard that Apple has is pretty nice. Wow, in a post some weeks ago I addressed this directly.

Gaza: opening the border crossing between Gaza and Egypt was a requirement of President Trump's peace plan for "the territory." Today it's being announced that after two years, the Rafah border crossing is now open. Link here. It's such a big story that even The New York Times was forced to begrudgingly cover it. Rest of liberal media: crickets, but if mentioned, doesn't give any credit to Trump. It get tedious.

Disney: new CEO. CNBC's coverage is excessive.

Palantir: an "n" of one. Greatest quote ever. Link here.

PayPal: an incredible debacle. Link here. For as long as I can remember CNBC beat the drums for this one; now? Crickets. Not mentioned once this week by Cramer, et al.

Melania: driving the Hollywood elite nuts. Link here. Hollywood Reporter, link here. Also not mentioned on CNBC. From the Hollywood Reporter:

GOOG: a decade ago, Google wrote a $900 million check for a 7.5% stake in SpaceX. Today, the SpaceX merger with xAI = a $1.25 trillion market valuation. Absolutely insane.

Trump's tariffs: for as long as I can remember CNBC couldn't say enough bad things about Trump's tariffs; now? Crickets. Not mentioned once this week by Cramer, et al, except in passing.

Pelosi: remember that story about Pelosi selling her Apple stock just before earnings came out? Okay. Some folks follow Pelosi, others follow Trump. It appears Pelosi missed INTC.

Softbank - Intel: link here.

Tuesday, February 3, 2026

Locator: 49886B.

SpaceX + xAI = biggest deal ever in history. That seems to be important. Launching data centers in low earth orbit.

- valuations:

- SpaceX: $859 billion to $1.26 trillion

- xAI: $219 billion to $294 billion

- $1.554 trillion

- is this all about energy to power data centers and cooling these space centers?

India: deal with Trump is biggest story today; so many story lines.

Oracle: ???

****************************

Back to the Bakken

WTI: $62.65.

New wells reporting:

- Wednesday, February 4, 2026: 11 for the month, 64 for the quarter, 64 for the year,

- 42153, conf, Neptune Operating, Gullickson 36-25 4H,

- 41237, conf, Hunt Oil, Clearwater 157-90-14-12H-1,

- 41236, conf, Hunt Oil, Clearwater 157-9-14-11H-3,

- 41234, conf, Hunt Oil, Clearwater 157-90-14-11H-1,

- 41461, conf, CLR, Garfield FIU 2-5HSL,

- Tuesday, February 3, 2026: 6 for the month, 59 for the quarter, 59 for the year,

- 41959, conf, Petro-Hunt, State 162-100-16B-21-2H,

- 41352, conf, Hess, GO-Beck Living TR-156-98-2017H-3,

- 39807, conf, BR, Mazama 1C,

RBN Energy: for Devon and Coterra, a Permian match made in hydrocarbon heaven. Link here. Archived.

The February 2 announcement that Devon Energy and Coterra Energy have agreed to merge didn’t come as a huge surprise — it had been rumored for weeks. The two large oil and gas producers have highly complementary assets in two major basins (the Permian’s Delaware and the Anadarko) and, as they see it, their combination will likely provide $1 billion in synergy-related savings by the end of next year. Finally — and this is important — a Devon/Coterra combination had been urged on by activist investor Kimmeridge Energy Management, with Coterra in particular, for falling short of its potential. In today’s RBN blog, we’ll discuss the deal and its implications.

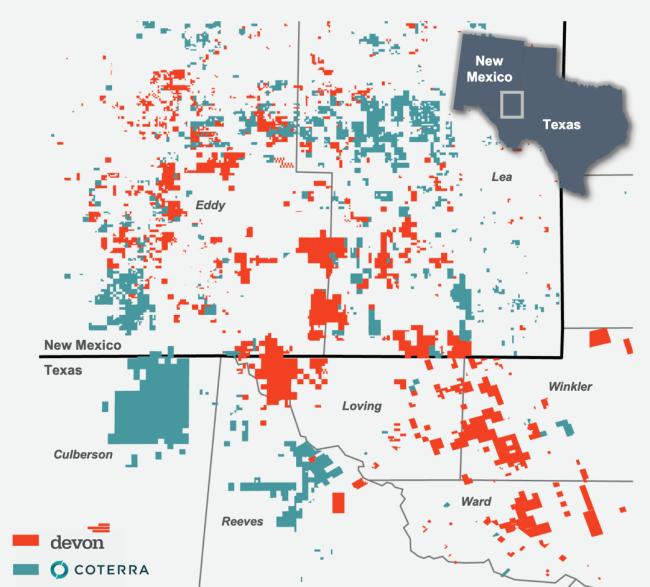

For Devon and Coterra (like ConocoPhillips/Marathon), the Permian — or, more specifically, the Delaware Basin in West Texas and southeastern New Mexico — is key. As shown in Figure 1 above, Devon has about 400,000 net acres (orange-shaded areas) and 496 Mboe/d of production in the play (as of Q3 2025), 45% of it crude oil, while Coterra has 346,000 net acres (teal-shaded areas) and 367 Mboe/d of production (44% oil).

Devon and Coterra are also active in the Anadarko (left-most map in Figure 2 below), where significant portions of their combined 520,000 net acres in Oklahoma are complementary and their pro forma production is expected to average 173 Mboe/d.