Locator: 48541CRAMER.

Cramer's first hour: a mix of facts, factoids, opinions from various sources -- often not cited -- while listening to Cramer's first hour on CNBC.

Nobel laureates: Nobel Prize in Chemistry -- half to David Baker and half to Demis Hassabis and John Jumper, all for work with proteins.

- Baker: University of Washington, "computational protein design."

- Hassabis and Jumper: Google DeepMind artificial intelligence lab, "protein structure prediction."

Irony: on the day that the big government / business story -- it's time to break up Google. No good deed goes unpunished.

Weekly EIA petroleum report, link here:

- US oil in storage: 4% below the five-year average despite a build of 5.8 million bbls;

- refiners at an astounding low 86.7%;

- jet fuel supplied: up an astounding 9.2% y/y.

**********************************

Disclaimer

Brief

Reminder

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If anything on any of my

posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia.

********************************

Back to the Bakken

WTI: $73.12.

Thursday, October 10, 2024: 22 for the month; 21 for the quarter, 536 for the year

40273, conf, Empire North Dakota LLC, Nuthatch 29-12 1H,

Wednesday, October 9, 2024: 21 for the month; 21 for the quarter, 535 for the year

None.

RBN Energy: Orla, Texas, Permian's westernmost crude hub, surrounded by lower-quality oil. Archived.

In the far western reaches of the Permian Basin lies Orla, TX — a

town steeped in history and significance. Orla, which can be fittingly

translated into “border” in Spanish, is about 40 miles north of Pecos,

near the New Mexico border in Reeves County.

Founded in 1890 as a

section house for the Pecos Valley Railroad, Orla evolved from a modest

stop along the tracks to a bustling oil supply hub — not your typical

hub with lots of tank farms close together but still a heavy throughput

area — by the 1960s.

Though often considered a ghost town today, with a

population thought to be in the single digits, Orla remains a vital

player in the oil industry. As the origin region for several major

takeaway pipelines in the Permian, this once-thriving community

continues to serve as a crucial link in the region’s vast network of oil

exploration, extraction and transportation, particularly along heavily

traveled U.S. Highway 285. In today’s RBN blog, we look at the role that

Orla plays in crude oil takeaway from the prolific Permian Basin.

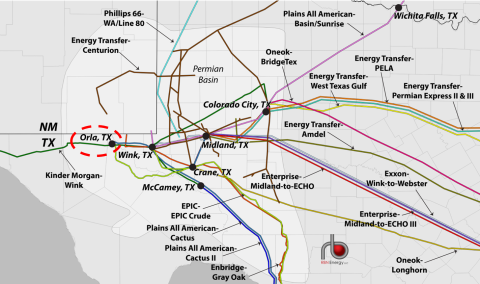

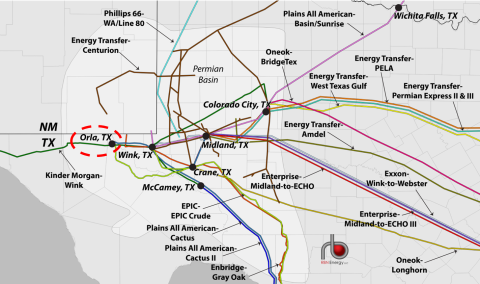

Figure 1. Permian Crude Oil Pipelines. Source: RBN Crude Oil Permian

So how does Orla (dashed red circle in Figure 1 above) fit into the

broader landscape of Permian oil takeaway capacity? Orla, the Permian’s

westernmost crude oil hub, is “where it all begins” — that is, the

boundary for Permian crude production and where a few long-haul

pipelines originate.