Friday, October 28, 2022

Laser-Focused On Dividends -- ABBV Increased Its Quarterly Dividend From $1.41 To $1.48 -- October 28, 2022

- AbbVie Inc reported Q3 adjusted EPS of $3.66, up 29.3% Y/Y and beating the consensus of $3.59.

- Overall sales increased 3.3% Y/Y (5.4% on an operational basis) to $14.81 billion, missing the consensus of $14.96 billion.

- The immunology portfolio generated $7.65 billion in sales, +14.6% (+16.4% on an operational basis). Humira sales increased 2.5% to $5.56 billion. Skyrizi sales reached $1.39 billion (+75.4% Y/Y), and Rinvoq jumped 53.5% to $695 million.

- Hematologic oncology portfolio sales were $1.65 billion, down 11.7% (-9.9% on an operational basis). Imbruvica sales decreased 17.4% to $1.34 billion. Venclexta revenues were up 4.5% to $515 million.

- Sales from the neuroscience portfolio reached $1.67 billion, +6.7%. Aesthetics portfolio sales increased 4% (+8.1% on an operational basis) to $1.30 billion, with $637 million in Botox sales for cosmetic uses.

- Dividend: AbbVie increased the quarterly dividend by 5% from $1.41 per share to $1.48 per share.

- Guidance: AbbVie confirms FY22 adjusted EPS guidance and narrows the range from $13.76 - $13.96 to $13.84 - $13.88, compared to the consensus of $13.86.

JNJ is in the process of doing what Abbott/Abbvie did in 2013.

Can't recall if I see Rinvoq ads but I see Skyrizi "everywhere" on Hulu.

Years ago I was told "a billion dollars in sales for a pharmaceutical product" is equivalent to a "ten-bagger" for investors.

Geoff Simon's Quick Connects -- October 28, 2022

Week 43: October 13, 2022 -- October 29, 2022.

Top story:

- Joe Biden is still president.

- Elon Musk buys twitter; deal closed Friday, October 28, 2022.

Top international non-energy story:

- Ukraine war drags on; ninth month.

Top international energy story:

- XOM, Shell, Chevron report record profits

- Saudi's new policy: "Saudi First."

Top national non-energy story:

- AAPL does just fine, surprisingly, and propels market to huge gains.

Top national energy story:

- Diesel shortage.

- Saudi's new policy: "Saudi First."

Focus on fracking: most recent edition.

Top North Dakota non-energy story:

Top North Dakota energy story:

Geoff Simon's top North Dakota energy stories:

Bakken economy:

Commentary:

CLR, Hess, And MRO Each With Four New Permits -- October 28, 2022

*************

Back to the Bakken

From yesterday:

Five new permits, #39346 - #39350, inclusive:

- Operators: Hess (4); Crescent Point Energy)

- Fields: Tioga (Williams); Crescent Point (SWD)

- Comments:

- Hess has permits for four TI-T-Lalim wells in SESW 35-158-95;

- to be sited 374 FSL and between 2265 FWL and 2365 FWL.

From today:

Active rigs: 45.

WTI: $87.90.

Natural gas: $4.684.

Eight new permits, #39351 - #39358, inclusive:

- Operators: CLR (4); MRO (4)

- Fields: Dollar Joe (Williams); Killdeer (Dunn)

- Comments:

- CLR has permits for two Clyde Hauge wells, NWNW 13-155-97,

- to be sited 324 FNL and at 322 FWWL and 412 FWL

- CLR has permits for two Vance wells, NENE 14-155-97, t

- o be sited 305 FNL and at 517 FWL and 562 FWL

- MRO has permits for four wells, a Knox, a Guy Carlson, a Hadley and a Kye, SENW 6-145-94;

- to be sited between 1496 FNL and 1510 FNL and between 1566 FWL and 1685 FWL

NYC Diesel -- $200 / Bbl -- East Coast Diesel -- Only 25 Days Of Supply -- October 28, 2022

My understanding: Russia has lots of heavy oil, lots of heating oil, and lots of diesel. I wonder if SecEnergy Granholm knows that? Problem solved.

Link here. You might want to read the entire thread to know what's going on.

Only Two Things Changed Since Last Night -- October 28, 2022

Don't you just love it? Link here.

Holy mackerel:

- 148 tickers hit 52-week highs

- I could be wrong, but I think I posted on the blog that I said this was a stock-picker's market;

- if not on the blog, in an e-mail to a reader

- it will continue to be a stock-picker's market

- two, of course, were XOM and CVX

- but no less than six Big Pharma companies (and related)

- CAH, AMGN

- PFE is well off its highs but had a great day today

- not only inflation-proof but do well with inflation

- Campbell Soup Compnan hit a new 52-week high;

- Kellogg and General Mills

- this I know said on the blog: some companies were going to benefit greatly from inflation;

- and that explains CPB, Kellogg, General Mills

- I was agreeing with a Robert Reich tweet

- in fact, take out dot-com-like companies and this has been a great market?

- I have literally no complaints about the market

- I'll bet some mutual funds have one of their years ever

******************************

What Changed Overnight? Two Thinngs

Apple's conference call: stellar.

Oil.

Period. Dot.

***********************

Not Ready For Prime Time

A reader sent me a note on politics, Biden's political future, the next president of the US and some investment comments.

My not-ready-for-prime-time reply:

1. The mid-terms will be most interesting. I am pretty much withholding all prognostications until the mid-terms are over. My hunch: there will be a lot of surprises.2. Pennsylvania has already voted and they have already elected their next senator. That early voting. Oz lost. [My only prognostication .]3. I don't pay attention to anything any politician says -- I used to but about six months ago, Biden's comments were so egregious and yet the mainstream media never seemed concerned, so now, I ignore his comments completely. Occasionally I learn something substantive from the Biden administration on twitter.4. The biggest disappointment is Cramer. Probably the smartest guy in the room in terms of knowing the market and personally knowing / meeting more CEOs than anyone else and yet he is being portrayed as a doofus. I don't know. Much of what he mentioned could not possibly have been predicted -- particularly the policy change on semiconductors and the persistent supply chain shortages. The Fed and Janet Yellen missed the "persistent" in "persistent inflation" but mom-and-pop retail investors did not.5. As for me, as I've mentioned on the blog where I'm focused and it's on investing and dividends. These will be the best two years of investing that we've had in a long time. For me it's a win-win: if the market struggles, it simply continues to be a period of accumulating shares. If the market takes off, I feel quite well-positioned.6. Schwab has non-company-generated graphs to show the history of the market following every period when the Fed began to raise rates. Data since the Fed was established. History suggests 500+ days for the market to get back to its previous highs. Two years of buying beat-down stocks.7. Last note on Apple: once folks actually go through the earnings call, they will be amazed how great that company will continue to be.

Off The Net -- Good Luck To All -- October 28, 2022

********************

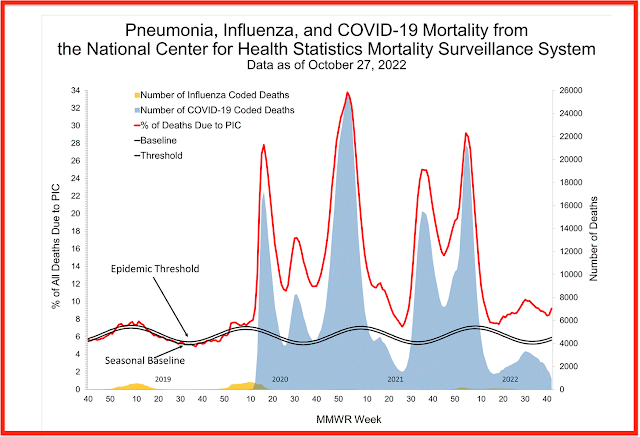

What's Causing All The Deaths?

From the CDC -- which "we" no longer trust.

Note: in a note like this, I will make some typographical and some content errors, which will be corrected as I find them, but I think intelligent folks can sort out (and mentally correct) these errors.

This graph is updated every week by the CDC. The chart starts in week 40 of whatever year the CDC chooses to start because that's when the "flu season" begins.

These are deaths from all "chest colds." It doesn't matter what: viral, bacterial, fungal. All respiratory deaths. "Seasonal flu," Covid, pneumococcal, tuberculosis, whatever.

Let's walk through the graph.

This is the per cent of all US deaths caused by "chest colds."

Or chest infections, if you prefer, short term (acute) or long term (chronic).

Red line: percent of all deaths in the US due to chest infections that week at that point in time.

"Yellow lump" at bottom of graph: "seasonal flu." The number of all deaths due to "seasonal flu." Not percent -- that comes later -- buy the raw number of deaths (see y-axis at the right).

The seasonal baseline for "seasonal flu" was running about 5% and the "epidemic threshold" was just slightly above that. It didn't/doesn't take much for the CDC to declare a seasonal flu epidemic. Maybe that's why folks like me didn't get excited about Covid at first. An example of the CDC crying "wolf" too many times? Every year the CDC said we were on the verge of a seasonal flu epidemic.

So, in 2019, before Covid, the worst "seasonal flu" did was be

responsible for less about 5% of all deaths in the US -- the others being

cancer, heart disease, homicide, vehicular accidents, suicide,

unprovoked attack by a unicorn. About 5%.

Move to late 2019 -- week 50 and into early 2020 -- through week 5.

We still had that "yellow lump" (see above -- nothing changed).

But look at the red line.

The red line: deaths from all causes, trending trending toward 30 percent of all deaths in the US were from "chest colds," or chest infections. Had that been due to smallpox ... well, think about that for a moment.

That's what Dr Fauci, et al, were seeing. In 1920 we had just lived through the same thing, but no one knew the cause. In 2020, we knew the cause and it quickly became politicized. To my chagrin and embarrassment I fell into the politicization.

The blue shaded area is deaths from Covid-19. Some will argue the data was fake in 2020, that's fine. But by 2021, this was no longer fake. If you feel otherwise, quit reading.

So,

the red line: before Covid, about 5% of all deaths in the US were due to chest colds;

by early 2020 -- in just a couple of weeks, upwards of 30% of all deaths in the US were due to chest colds.

Now, there are two more data points / observations I want to make. But I will give you some time to see what you observe with regard to 2022. And one of the observations was noted as early as 2021.

Have fun.

Public Service Announcement -- Telephone Marketing -- October 28, 2022

Telephone marketers: when they call you, they are on a recorded line. Some tell you that; most do not. If they tell you, it is a robot / computer call. If they don't tell you upfront, it's a real person, in most cases.

If you are on the "Do Not Call" list you still get these calls.

At some point, the robot or the person will tell you that a "licensed" agent will call you later with the details. You will be asked if the "licensed" agent can call you back.

If you say "yes," you have now allowed that company forever and ever and amen call you whenever theey want because they have you on a recorded line saying it's okay to call despite being on the "no call list."

Perfectly legal.

My "phone/provider" alerts me to all "SCAM" calls. My phone is on "vibrate" almost 100% of the time, avoiding almost every "SCAM" call.

***********************

From Peter

Biggest Decision Tim Cook Will Have To Make January 27, 2022? To Increase The Dividend From Twenty-Three Cents To Twenty-Four Cents -- October 28, 2022

Tea leaves:

- Tim Cook will grudgingly increase the dividend by a penny, to twenty-four cents;

- in the meantime, he will continue with stock buybacks to offset the penny increase

Twenty-three cents / share x 16.3 billion shares = $3.7 billion.

Twenty-four cents / share x 15.7 billion shares = $3.8 billion.

**************************

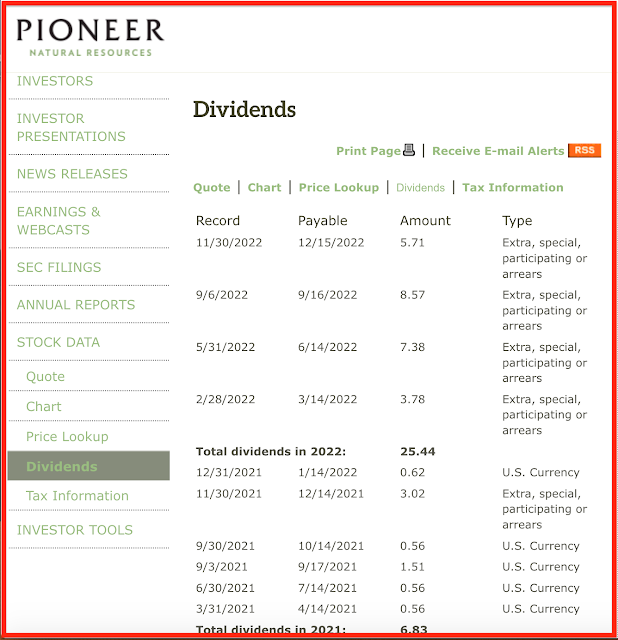

PXD Dividend History

*************************

AAPL

********************

And No Dividend

Back To The Bakken -- October 28, 2022

Wow, wow, wow: go woke, go broke. Third quarterly loss in a row. A year the fund's manager made the conscious decision to pivot to renewable energy because that's what the Norwegian people wanted.

Dow: jumps 250 points. I wonder why? Read on.

Earnings:

- XOM: e$3.88. Record profit for second straight quarter

- earned $18.7 billion; up 6% from second quarter which had been the record

- up 177% from a year ago

- EPS: $4.45 -- soared past the $.379 forecast by Refinitiv

- at Schwab, up $3.06; up 2.84%;

- CVX: e$5.02. Actual: soars. $11.2 billion quarterly profit; second-highest quarterly proft ever; $5.78 EPS vs Wall Street's estimate of $4.86.

- operating profit surged 81%

- refining? Doubled.

- at Schwab, Up $3.82 / share, 2.2%;

- ABBV: e$3.56. Mixed earnings report. Stock slides.

- adjusted, came in at $3.66 against a FactSet f $3.57

- at Schwab, down over 6%;

AAPL:

- at Schwab, holy mackerel! Up $6.27; up 4.33%

- analysts finally took a good luck at those numbers

- I can buy each of the twins a new pair of winter boots

Back to the Bakken

WTI: $87.97.

Natural gas: $5.679.

Active rigs: 44.

Wednesday, November 3, 2022: 2 for the month, 38 for the quarter, 483 for the year.

38870, conf, Kraken, Dragseth 9-4 2H ,

Tuesday, November 2, 2022: 1 for the month, 37 for the quarter, 482 for the year.

None.

Monday, November 1, 2022: 1 for the month, 37 for the quarter, 482 for the year.

38891, conf, CLR, Lime Rock Resources, Hansen B 18-19-2TFH,

Sunday, October 30, 2022: 36 for the month, 36 for the quarter, 481 for the year.

38892, conf, Lime Rock Resources, Hansen B 18-19-3TFH,

38400, conf, CLR, Hess, EN-J Horst-154-93-1112H-4,

Saturday, October 29, 2022: 34 for the month, 34 for the quarter, 479 for the year.

38893, conf, Lime Rock Resources, Hansen B 18-19-4TFHL,

38817, conf, CLR,Bonneville 11-23HSL,

38399, conf, Hess, EN-J Horst-154-93-1112H-3,

None.

RBN Energy: hubs seen as critical part of carbon capture's evolution.

Prior to the adoption of the assembly line, automotive production was slow and expensive, with Ford needing about 12 man hours of labor to do the final assembly for each new car. With Henry Ford’s installation of the first moving assembly line for mass production in December 1913, followed by additional refinements in future years, the average time dropped to about 90 minutes, with manufacturing costs also falling significantly. Those are the types of improvements in cost and efficiency the carbon-capture industry — which to date has been largely limited to smaller, individual projects — is anticipating as hub-style projects gain wider acceptance and begin to take shape. In today’s RBN blog, we look at the two basic concepts for carbon-capture hubs, the key advantages of the hub approach, and the complications inherent in that strategy.

Actually pipelines are kinda important and "everybody" is now against pipelines. This carbon capture stuff is in for a long tough ride.

Twitter Looks "Unchanged" This Morning -- Begs The Question -- Why Did Twitter Need 7,500 Employees? October 28, 2022

Link here. Let me know if you see anything different on twitter from yesterday.

Is twitter down? Link here.

Just some of the news today, all from twitter:

- Pelosi's husband beaten in his home; in hospital.

- META: one of the greatest market cap destructions ever.

- Is AMZN next?

- Permian inflation: runnng at 10 - 15%.

- CVX: to add as many as four rigs to the Permian basin.

- Peter Zeihan on Trump voters in 2020 -- prepared to be annoyed. Be sure to read the entire thread. Says exactly what I've thought all along.

- Trump says Musk said Trump's account would be restored on Halloween. I can't make this stuff up.

- Guns in schools. This should get your attention. I no longer care. Too bad the third graders in Uvalde weren't similarly armed.

- Norway's sovereign wealth fund reports a third quarter loss. Go woke, go broke.

- Jim Cramer chokes up. Should Jim Cramer go?

- Something tells me Saudi Arabia is going to win this round.

So much more but I have to get back to the Bakken.

META: one of the greatest market cap destructions ever.

A lot of small mom-and-pop retail "investors" who knew nothing about the stock market or investing put their life savings into META because they used Facebook all day long, every day, and assumed everyone did. I went every day, once a day, for six weeks to post my NYT Wordle but I quit doing that when I saw how obnoxious the ads had become and most of my contacts were posting where they had lunch that day.

Something tells me Saudi Arabia is going to win this round.