Apparently there's a huge storm hitting Chicago and heading toward the northeast. I'm not following it very closely and ESPN hasn't said a thing about it. But from the Drudge Report:

Sounds like the worse "winter" storm since the Ice Age, and it's not even winter yet.

"1975" doesn't even make the top 10. From The Chicago Tribune:

1975: less than 11 inches. Somewhere between 9.8 inches and 11 inches.

Monday, November 26, 2018

Random Graphs And Why I'm Not Worried About Conventional Oil Exploration And CAPEX -- November 26, 2018

Some day when I'm the mood I might opine why I'm not worried about the IEA trope that not enough money is being spent on conventional oil exploration.

For now, re-posting graphs that have previously been posted on the blog.

For now, re-posting graphs that have previously been posted on the blog.

How Good Are The "New" Bakken Wells? An Old Graphic Is Fairly Staggering -- November 26, 2018

Re-posting from November 21, 2018.

While looking for something else, I ran across this graphic from 2017:

Visually, the graph below is much more impressive than the spreadsheet above.

Note that in the graph below, "91," the current average daily well production is almost off the chart.

A number of observations could be made regarding the graph. The most obvious one: shale operators can respond very quickly to changes in WTI pricing. Note how the operators cut back on initial production during the Saudi Surge.

I wasn't sure if I would ever see this: a reversal in the downward trend of the average amount of oil being produced by North Dakota wells.

After a peak in the early days of the boom, the daily production per well in North Dakota began to fall, hitting an all-time (recent) low of 72 bbls/well/day. I was curious if/when it would level out and if it did level out, at what amount would it plateau?

Well, lookeee here --- after several years of steady decline, the average amount of oil being produced per each North Dakota well increased in the most recent reporting period.

While looking for something else, I ran across this graphic from 2017:

Visually, the graph below is much more impressive than the spreadsheet above.

Note that in the graph below, "91," the current average daily well production is almost off the chart.

A number of observations could be made regarding the graph. The most obvious one: shale operators can respond very quickly to changes in WTI pricing. Note how the operators cut back on initial production during the Saudi Surge.

Labels:

Production,

Production_Well_Average

Eleven New Permits -- November 26, 2018 -- US Oil Output Rising At Its Fastest Pace In 98 Years

For the archives, from Investor's Business Daily, "how fracking turned OPEC into the walking dead."

Eleven new permits:

The river of oil now hitting the market from U.S. fracking has stunned global energy markets. The U.S. has already leapfrogged both Russia and Saudi Arabia as the No. 1 producer. Will U.S. oil lead to OPEC's demise?For the archives, previously posted, but quick reminder. For month of November, 2018:

For the first time since World War II, the U.S. is on the verge of being a net oil exporter — something that, just five years ago, would have been considered impossible.

As Javier Blas of Bloomberg notes, U.S. oil output is rising at its fastest pace in 98 years. Meanwhile, both Russia and the Saudis are also pumping at record levels. The U.S. is tipping the scale. Since 2010 in the West Texas Permian Oil Basin alone, some 114,000 new wells have been drilled, bringing millions of barrels of new oil to the market. Other parts of the U.S. are undergoing the same transformation.

That's bad for OPEC.

"The U.S. energy surge presents OPEC with one of the biggest challenges of its 60-year history," wrote Blas. "If Saudi Arabia and its allies cut production ... higher prices would allow shale to steal market share. But because the Saudis need higher crude prices to make money than U.S. producers, OPEC can't afford to let prices fall." This, of course, has caught the 28-nation Organization of Petroleum Exporting Countries by surprise. Even just a few years ago, the consensus was that fracking and its related technologies would add a decent amount of oil to the market, but nothing like what's happening now.

- Saudi Arabia produce record volume, 11.1 - 11.3 million bopd some days; not yet known if a record will be set for the entire month

- Russia: post-Soviet high, 11.41 million bopd in October, up from 11.36 million bopd in September

- US: similar

President Trump and the US House will shoulder $230 million of the estimated $360 million to complete CIP and the port will cover the remaining $130 million.

*************************************

Back to the Bakken

Active rigs:Back to the Bakken

| $51.63 | 11/26/2018 | 11/26/2017 | 11/26/2016 | 11/26/2015 | 11/26/2014 |

|---|---|---|---|---|---|

| Active Rigs | 62 | 53 | 37 | 65 | 183 |

Eleven new permits:

- Operator: CLR (6); Hess (5 -- one of the Hess permits was from a day earlier)

- Fields: Epping (Williams); Baskin (Mountrail)

- Comments: CLR has permits for a six-well Sodbuster pad in Lot 3, section 6-155-99; Hess has permits for a 5-well EN-Farhart pad in lot 1, section 4-156-93;

- Crescent Point Energ (4): two CPEUSC Holmes and two CPEUSC Ruby permits, all in Williams County

- Petro-Hunt (2): two Noonan Federal permits, both in McKenzie County

- 33940, 3,655, MRO, Axell USA 34-19TFH, Reunion Bay, t10/18; cum --

- 33481, 1,748, Whiting, Wold Federal 42-1-1H, Sand Creek, t9/18; cum 20K after 25 days; the Wold wells in Sand Creek are tracked here;

- 34703, 1,707, Whiting, Stettner 11-24-2H, Robinson Lake, t9/18; cum 6K after 29 days;

- 34702, 592, Whiting, Stettner 11-24TFH, Robinson Lake, t9/18; cum 6K after 29 days;

- starting to see some "recent" permitted wells go to TA status including --

- 30079, TA, Nine Point Energy, Arnegard 150-100-23-14-10TFH

- six Lime Rock Resources wells, four in Dunn County (five Sharon Rainey and one William Sadowsky); two in Billings County (State Gresz wells)

Labels:

Commentary_2018,

PeakOil,

SaudiPerspective

The Market, Energy, And Political Page, T+20 -- Monday, November 26, 2018

Happy? Real happy? Not so happy? I guess it depends on the definition of "surges."

In default? Tick, tick, tick: apparently Venezuela is in default to both China and Russia. Russia strongmen have gone to Venezuela to break some kneecaps.

White elephant? The billion-dollar pipeline Canadians own but can't build. Trudeau seems confused.

**********************************

Chevrolet Volt Short-Circuited

***********************************

Chevrolet Volt Short-Circuited

GM will shut down production of Chevrolet Cruz (small car); the Volt (EV); and, several others. Stories everywhere; one link here. It appears four plants in the US will be closed, and one in Ottawa, Canada. But the number of employees -- it appears 3,300 blue collar workers at the one plant in Canada; and 2,600 employees spread across four factories in the US.

US EV sales are tracked here.

I watched ABC report this story; I don't watch evening news but I made an exception tonight to watch the Mars landing story. After listening to the ABC story I went to the internet story regarding GM. What ABC said was accurate. What ABC left out was huge. 14,000 jobs lost; about 5,900 in North America meaning that the vast majority of employees are overseas (perhaps China?). Of the 5,900 in North America, as noted above, 3,300 in one factory in Ottawa, whereas 2,600 employees spread across four plants in the US. From the ABC I had the distinct impression 14,000 GM employees in the US were being cut just before Christmas. Not even close. This is a huge GM story. It's a huge business story. It's not a huge American job story -- GM may in fact hire 2,600 new employees for their US plants. The Bolt was unveiled in January, 2016. The Volt is a hybrid, first commercial production in 2010. The Volt was showing its age and absolutely not competitive against the Toyota Prius.

Wow, the GM story, as I said earlier: his is a huge GM story. It's a huge business story. It's not a huge American job story.

US EV sales are tracked here.

I watched ABC report this story; I don't watch evening news but I made an exception tonight to watch the Mars landing story. After listening to the ABC story I went to the internet story regarding GM. What ABC said was accurate. What ABC left out was huge. 14,000 jobs lost; about 5,900 in North America meaning that the vast majority of employees are overseas (perhaps China?). Of the 5,900 in North America, as noted above, 3,300 in one factory in Ottawa, whereas 2,600 employees spread across four plants in the US. From the ABC I had the distinct impression 14,000 GM employees in the US were being cut just before Christmas. Not even close. This is a huge GM story. It's a huge business story. It's not a huge American job story -- GM may in fact hire 2,600 new employees for their US plants. The Bolt was unveiled in January, 2016. The Volt is a hybrid, first commercial production in 2010. The Volt was showing its age and absolutely not competitive against the Toyota Prius.

Wow, the GM story, as I said earlier: his is a huge GM story. It's a huge business story. It's not a huge American job story.

***********************************

Two Throwaways For The Archives

In default? Tick, tick, tick: apparently Venezuela is in default to both China and Russia. Russia strongmen have gone to Venezuela to break some kneecaps.

White elephant? The billion-dollar pipeline Canadians own but can't build. Trudeau seems confused.

Labels:

Road_To_Venezuela

Taking A Break -- November 26, 2018

Word for the day: use the word "philopatrous" in a sentence. Best definition is for its noun, "philopatry."

I have to take a break. I am overwhelmed with "stuff" this morning. Scroll down -- it's been an incredible morning of news: natural gas; Bakken wells coming off confidential list; surprise surge in spot electricity price at 1:00 a.m. in New England; the Yellowfin wells; the Wiley wells; etc. Enjoy.

But I have to take a break.

Not sure when I will be back on the net.

Spend some time on this graphic. There are two halves to the graphic. Be sure to look at both halves. The left half shows the change in capacity over time with a turn to renewable energy; the right half shows the change in financial cost over time with a turn to renewable energy.

All of this activity to date will have no effect on total CO2 emissions (FWIW) over the long term; absolutely none. Why? China and India are not included in the graphic (and never will be).

If "we" meet the UN climate recommendations (which is financially impossible), the experts suggest that we will prevent the earth from getting two (2) degrees warmer one hundred years from now.

This is undated. I will provide the link when/if I find it. The graphic was sent to me by a reader who seems to be watching the same movie I'm watching. Algore et al are watching another movie.

By the way, speaking of movies, note all the movies coming out this holiday season with #MeToo white women using high-powered handguns to take revenge. Meanwhile, these same actors tell us that "we" need to do more to control handgun violence in the United States. Whatever. Sorry for the digression.

I'm in my "whale" phase.

The book, The Whale: In Search of the Giants of the Sea, Philip Hoare, c. 2010.

Third or fourth reading; not all of it, but selected parts.

By the way, before I go any further, John D Rockefeller prevented several species of whales from going extinct. Just a bit of interesting trivia.

Trivia: JFK collected scrimshaw; his last Christmas gift from his wife was to be a piece of scrimshaw with the presidential seal commissioned by Jackie; she placed the scrimshaw in his coffin.

I have a tradition of reading Black Beauty to the grandchildren, a chapter at a time, during their early years, ages 3 to 7 perhaps, gradually transitioning from my reading to their reading the book to me. I remember reading the book three or four times, all the way through, out loud, with Arianna. I don't recall how much I read with Olivia.

I'm beginning to think maybe I will read The Whale to Sophia. Unlike Black Beauty which is perfect for reading to children, The Whale is not. I would have to pick and choose certain selections from the book. We'll see.

Last night I brought the book over to her house along with one of those huge National Geographic posters, a 1976 "Whales of the World." She was mesmerized. She had just been out to the Aquarium of the Pacific in Long Beach: the first drawing on the poster she pointed to was a killer whale, saying she saw "Orca." And, yes, indeed, there's a huge mural (or maybe even a sculpture, I forget which) of an orca at the aquarium.

I completely misread The Whale the first time I read it. It's really a biography of Herman Melville and/or a biography of Moby-Dick. I thought it was about whales. It is but in a very, very interesting way.

The dots that connect:

Genesis -- Moby-Dick -- The Whale. Had I not been in my "Genesis" phase, I would not now be back in my "whale" phase. LOL.

This is a top-shelf book.

See also Charles Melville Scammon.

See also The Eye of the Whale.

More on Phillip Hoare's book here.

"Are NoDaks, by nature, philopatrous?"Sorry. Time to move on.

I have to take a break. I am overwhelmed with "stuff" this morning. Scroll down -- it's been an incredible morning of news: natural gas; Bakken wells coming off confidential list; surprise surge in spot electricity price at 1:00 a.m. in New England; the Yellowfin wells; the Wiley wells; etc. Enjoy.

But I have to take a break.

Not sure when I will be back on the net.

*******************************

How Many Drops Of Water Are In The World's Oceans?

Spend some time on this graphic. There are two halves to the graphic. Be sure to look at both halves. The left half shows the change in capacity over time with a turn to renewable energy; the right half shows the change in financial cost over time with a turn to renewable energy.

All of this activity to date will have no effect on total CO2 emissions (FWIW) over the long term; absolutely none. Why? China and India are not included in the graphic (and never will be).

If "we" meet the UN climate recommendations (which is financially impossible), the experts suggest that we will prevent the earth from getting two (2) degrees warmer one hundred years from now.

This is undated. I will provide the link when/if I find it. The graphic was sent to me by a reader who seems to be watching the same movie I'm watching. Algore et al are watching another movie.

By the way, speaking of movies, note all the movies coming out this holiday season with #MeToo white women using high-powered handguns to take revenge. Meanwhile, these same actors tell us that "we" need to do more to control handgun violence in the United States. Whatever. Sorry for the digression.

********************

The Book Page

I'm in my "whale" phase.

The book, The Whale: In Search of the Giants of the Sea, Philip Hoare, c. 2010.

Third or fourth reading; not all of it, but selected parts.

By the way, before I go any further, John D Rockefeller prevented several species of whales from going extinct. Just a bit of interesting trivia.

Trivia: JFK collected scrimshaw; his last Christmas gift from his wife was to be a piece of scrimshaw with the presidential seal commissioned by Jackie; she placed the scrimshaw in his coffin.

Note: An endangered species regulated by the Marine Mammal Protection Act. Importation for commercial purposes has been prohibited since 1973. Interstate sales of registered pre-act teeth with scrimshaw is allowed under a special federal permit. ... Antique scrimshaw (100 years plus) can be sold interstate.This is a great "beach" book. Maybe even for après ski.

I have a tradition of reading Black Beauty to the grandchildren, a chapter at a time, during their early years, ages 3 to 7 perhaps, gradually transitioning from my reading to their reading the book to me. I remember reading the book three or four times, all the way through, out loud, with Arianna. I don't recall how much I read with Olivia.

I'm beginning to think maybe I will read The Whale to Sophia. Unlike Black Beauty which is perfect for reading to children, The Whale is not. I would have to pick and choose certain selections from the book. We'll see.

Last night I brought the book over to her house along with one of those huge National Geographic posters, a 1976 "Whales of the World." She was mesmerized. She had just been out to the Aquarium of the Pacific in Long Beach: the first drawing on the poster she pointed to was a killer whale, saying she saw "Orca." And, yes, indeed, there's a huge mural (or maybe even a sculpture, I forget which) of an orca at the aquarium.

I completely misread The Whale the first time I read it. It's really a biography of Herman Melville and/or a biography of Moby-Dick. I thought it was about whales. It is but in a very, very interesting way.

The dots that connect:

Genesis -- Moby-Dick -- The Whale. Had I not been in my "Genesis" phase, I would not now be back in my "whale" phase. LOL.

This is a top-shelf book.

See also Charles Melville Scammon.

See also The Eye of the Whale.

More on Phillip Hoare's book here.

Labels:

NotesToTheGranddaughters

Natural Gas Fill Rate -- Contribution From A Reader -- November 26, 2018 -- Most Fascintating Story Of 2018?

Other than WTI tanking to $50/bbl, the natural gas story may be the most fascinating / interesting / unexpected story of 2018.

This was sent to me by a reader.

If unable to read the entire note now, come back to it later, but leave with this bottom line:

It's a very, very long note, but incredibly worth the read.

From a reader.

Minimal editing but re-formatted to some extent. Any errors are mine.

Disclaimer: in a long note like this there will be factual and typographical errors. They will be corrected when found. Facts and opinions are commingled on the blog. It is often difficult to separate fact from opinion on the blog.

Disclaimer: this is for educational purposes only. Do not make any financial, investment, travel, job, or relationship decisions based on what you read here or what you think you may have read here.

Now, from the reader:

This is a bit longer than I could squeeze down to blog comment size.

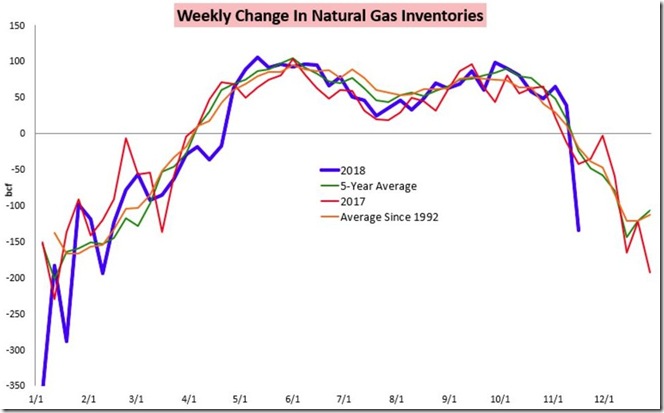

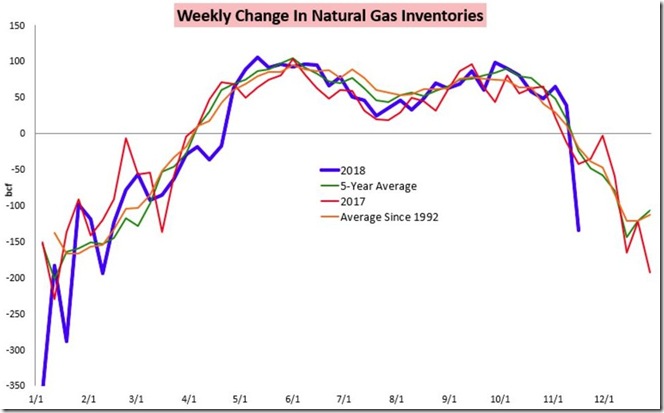

Lasst week's draw was a real outlier....the first graph below tells the story...

The natural gas storage report for the week ending November 16th from the EIA showed that natural gas in storage in the US fell by 134 billion cubic feet to 3,113 billion cubic feet over the week, which left our gas supplies 620 billion cubic feet, or 16.6% below the 3,733 billion cubic feet that were in storage on November 17th of last year, and 710 billion cubic feet, or 18.6% below the five-year average of 3,823 billion cubic feet of natural gas that are typically in storage on the third weekend of November ...

This week’s 134 billion cubic feet withdrawal from US natural gas supplies was quite a bit more than the 92 to 121 billion cubic feet withdrawal that analysts had been expecting, and way more than the average of 25 billion cubic feet of natural gas that have been withdrawn from storage during the second full week of November in recent years, as it was the largest withdrawal this early in the heating season in history; in fact, many years have not seen a natural gas withdrawal that large for the entire month of November....

Natural gas storage facilities in the Midwest saw a 32 billion cubic feet drop in supplies over the week, which increased the region’s gas supply deficit to 12.0% below normal, and natural gas supplies in the East also fell by 32 billion cubic feet as their supply deficit rose to 11.7% below normal for this time of year…

Meanwhile, the South Central region saw a 55 billion cubic feet drop in their supplies, as their natural gas storage deficit jumped to 26.8% below their five-year average for the third weekend of November…at the same time, 8 billion cubic feet were pulled out of natural gas supplies in the Pacific region as their deficit from normal rose to 27.2%, while 7 billion cubic feet were withdrawn from storage in the Mountain region, where their natural gas supply deficit rose to 20.2% below normal for this time of year….

Compared to other mid November low storage readings, this week’s 3,113 billion cubic feet of natural gas in storage was 13.4% lower than the previous 5 year low of 3,594 billion cubic feet that was set on November 14th of 2014, 10.8% below the 10 year low of 3,488 billion cubic feet that was hit on November 14th of 2008, 4.9% below the 3,274 billion cubic feet of natural gas we had in storage on November 18th of 2005, and 1.3% below the 3155 billion cubic feet that were in storage to start the winter on November 14th of 2003…we have to go back 16 years, to November 15th 2002, when 3,096 billion cubic feet of natural gas were in storage, to find a lower quantity of natural gas in storage in mid-November than now….

For a visualization of what this week’s natural gas withdrawal looks like historically, we have a graphic showing this year’s weekly change in natural gas inventories as compared to last year’s and to the long term averages:

The above graph was copied from a blog post at Bespoke Weather that was published on Wednesday of this week, shortly after the early release of the natural gas storage report…

On this graph, purple shows this year’s weekly additions to natural gas storage in billions of cubic feet above the zero line, and this year’s weekly withdrawals from natural gas storage in billions of cubic feet below the zero line; similarly, weekly additions and withdrawals of natural gas in 2017 are shown in red, the 5 year average weekly change of natural gas in storage is shown in green, and the historical average weekly change of natural gas supplies in EIA data going back to 1992 is shown in orange…

At the far left, you can see the record withdrawal of 359 billion of cubic feet that used 11.5% of all the natural gas we had on hand during the first week in January of this year, and a withdrawal of 288 billion cubic feet during the third week of January that would have also been a record withdrawal if not for the first week; those 2 big withdrawals thus dropped our natural gas supplies to 17.5% below normal to start the year…the cold April further reduced supplies vis a vis normal, as you can see that the averages show we should have been adding to supplies at that time of year….

Through most of the summer, our additions to storage were fairly close the normal range, but by then the stage had already been set for natural gas supplies to be at a 15 year low to start this winter…

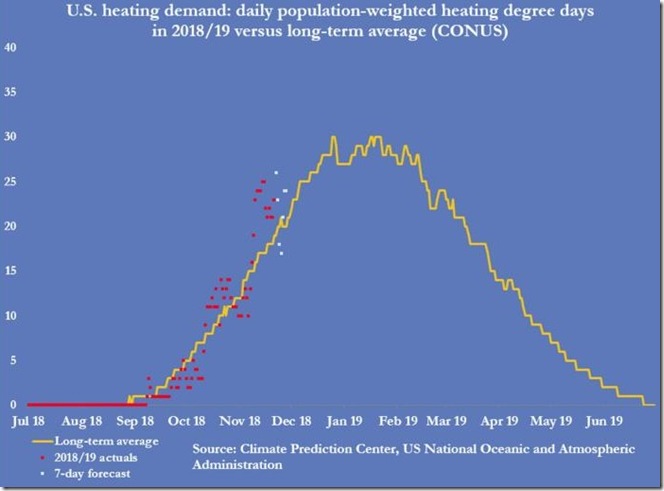

To see what kind of temperature factors caused this week’s large withdrawal, and what kind of temperatures will be influencing next week’s natural gas supply report, we’ll next look at the most recent average temperature summary from the EIA’s natural gas storage dashboard:

The above graphic from the EIA’s natural gas storage dashboard gives us both the average daily temperature from November 9th thru November 22nd in each of the five natural gas regions, as well as a color-coded variance from normal for each of those daily temperature averages, with shades of brown indicating the average temperatures in the region were above normal on a given date, while shades of blue indicate average temperatures that were below normal for the date, as indicated in the legend at the bottom….thus this graphic gives us not only the actual average temperature for each region for each day, but also indicates how much that temperature deviated from the norm…

As you can see, temperatures for every region except for the 3 Pacific states were below normal through the week ending November 16th, with both the Midwest and South Central regions, encompassing the large expanse in the middle of the country, between 15 and 19 degrees below normal on three separate days in the period…

The following week, which will be reported on next week, looks a bit warmer, but not by much, as if you look at the lower line on the graphic you’ll see national average temperature only rose from an average of around 42 degrees during the week ending November 16th to around 44 degrees in the week after that, which means we can expect another large withdrawal this coming week, as consumption of natural gas for heating continues apace…

While average temperatures as shown above give us a general idea of the heating requirements over a given period, their relationship is inexact because they don’t differentiate between broad sparsely populated regions of the country where heating demand might be minimal even if it is cold, and the larger cities where a cold snap would result in a large burn of natural gas for heat…

Moreover, an average temperature for a region like the East above, which includes all the states from Maine to Florida, tells us little about what parts of that region are seeing the heating demand corresponding to the average temperatures….

For a better measure of heating demand, utilities and suppliers of heating fuels use a metric called heating degree days to determine what the daily demand for heating will be, so they can adjust their production or delivery schedules accordingly…those degree days are computed by taking the average daily temperature for a location and subtracting that number from 65 degrees, which is considered to be the temperature when most buildings will start to need heating…

Hence, the colder it gets, the higher the degree day factor becomes, and hence it’s a effective measure of heating demand…

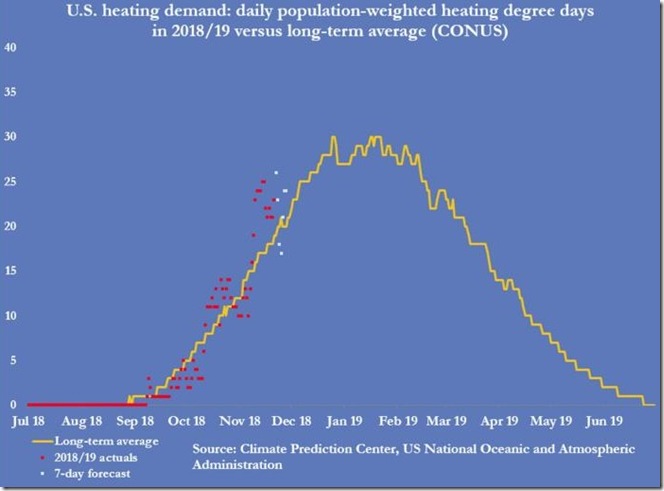

Thus this next graphic, which shows us population weighted heating demand for the entire country, is much more useful in determining the ultimate consumption of natural gas…

The above graph came from a Thursday email titled “Best in Energy” that John Kemp, senior energy analyst and columnist with Reuters, sends out free daily, on request…

In this graphic, the yellow graph shows the average degree days that have been needed per capita each day over the typical US heating season (starting with zero in July), while the red dots indicate the actual population weighted degree days for each day of the 2018-2019 heating season…

In addition, the graph also includes 7 white dots which are a forecast of population weighted degree days that will determine heating requirements for the next 7 days…John did not indicate the exact date for this graph, but since the first white dot shows a large spike, i’m guessing that would probably be for Thanksgiving day, when New York city and most of the Northeast saw their coldest Thanksgiving in 150 years…

Thus the red dots would represent the days prior to November 21st, with all the recent ones clustered roughly between 20 and 25 degree days per capita nationally, indicating heating requirements that would normally be more typical of mid-December…

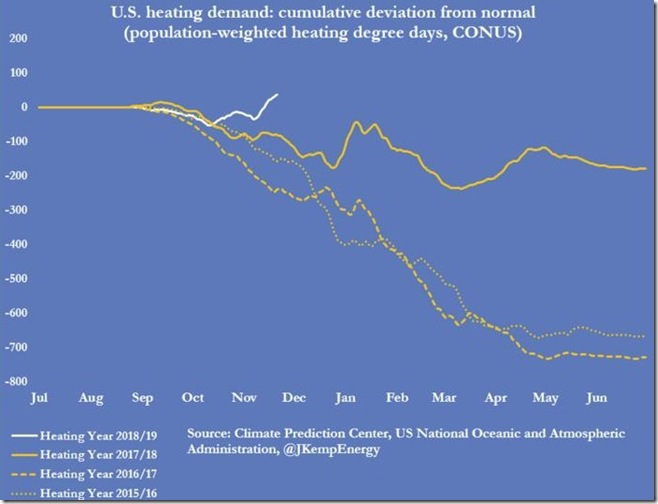

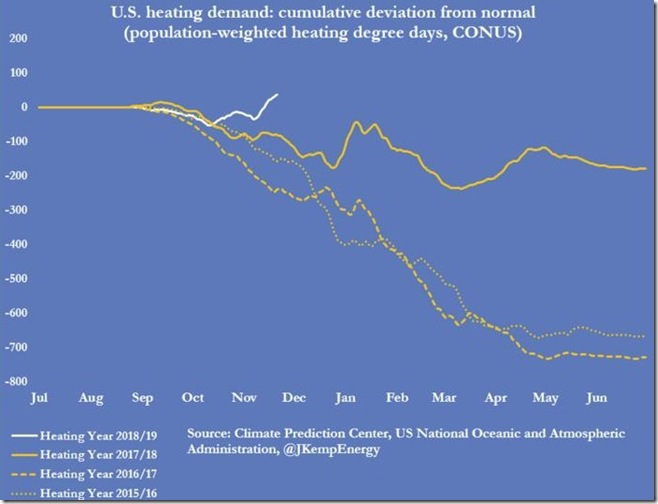

The next graph, also from that John Kemp emailing, shows the cumulative heating degree day deviation from normal, up to and including this reporting week…

In this graph, the divergence of cumulative heating degree days from normal for this year and for each of the previous three heating seasons is shown daily, with the current year shown as a solid white line, with last year’s divergence shown as a solid yellow line, with the divergence from normal for the 2016/2017 heating season shown as a dashed yellow line, and with the divergence from normal of the 2015/2016 heating season shown as a dotted yellow line…

Note that the graphs for all three prior years trend downward, or negative from zero, because all three years experienced warmer than normal temperatures, and hence less degree days than normal…

However, after a warmish October, when this year’s heating requirements were also below normal, the white line for 2018-19 has now moved upwards into positive territory, meaning this year’s cumulative heating requirements are now running above normal…

The broader takeaway from this graph, though, is that the natural gas demand we saw over the past three years is not a good benchmark for what we’ll need this year, because those years were warmer than normal, with the heating needs of both 2015/2016 and 2016/2017 roughly 17% below normal…

As we pointed out four weeks ago, if our natural gas usage this winter is instead similar to that of 2014, our natural gas supplies could fall to below 200 billion cubic feet by the end of the heating season, implying widespread natural gas shortages and much higher prices….

This was sent to me by a reader.

If unable to read the entire note now, come back to it later, but leave with this bottom line:

As we pointed out four weeks ago, if our natural gas usage this winter is instead similar to that of 2014, our natural gas supplies could fall to below 200 billion cubic feet by the end of the heating season, implying widespread natural gas shortages and much higher prices….I have "pasted" the entire note with no editing or re-formatting.

It's a very, very long note, but incredibly worth the read.

From a reader.

Minimal editing but re-formatted to some extent. Any errors are mine.

Disclaimer: in a long note like this there will be factual and typographical errors. They will be corrected when found. Facts and opinions are commingled on the blog. It is often difficult to separate fact from opinion on the blog.

Disclaimer: this is for educational purposes only. Do not make any financial, investment, travel, job, or relationship decisions based on what you read here or what you think you may have read here.

Now, from the reader:

This is a bit longer than I could squeeze down to blog comment size.

Lasst week's draw was a real outlier....the first graph below tells the story...

The natural gas storage report for the week ending November 16th from the EIA showed that natural gas in storage in the US fell by 134 billion cubic feet to 3,113 billion cubic feet over the week, which left our gas supplies 620 billion cubic feet, or 16.6% below the 3,733 billion cubic feet that were in storage on November 17th of last year, and 710 billion cubic feet, or 18.6% below the five-year average of 3,823 billion cubic feet of natural gas that are typically in storage on the third weekend of November ...

This week’s 134 billion cubic feet withdrawal from US natural gas supplies was quite a bit more than the 92 to 121 billion cubic feet withdrawal that analysts had been expecting, and way more than the average of 25 billion cubic feet of natural gas that have been withdrawn from storage during the second full week of November in recent years, as it was the largest withdrawal this early in the heating season in history; in fact, many years have not seen a natural gas withdrawal that large for the entire month of November....

Natural gas storage facilities in the Midwest saw a 32 billion cubic feet drop in supplies over the week, which increased the region’s gas supply deficit to 12.0% below normal, and natural gas supplies in the East also fell by 32 billion cubic feet as their supply deficit rose to 11.7% below normal for this time of year…

Meanwhile, the South Central region saw a 55 billion cubic feet drop in their supplies, as their natural gas storage deficit jumped to 26.8% below their five-year average for the third weekend of November…at the same time, 8 billion cubic feet were pulled out of natural gas supplies in the Pacific region as their deficit from normal rose to 27.2%, while 7 billion cubic feet were withdrawn from storage in the Mountain region, where their natural gas supply deficit rose to 20.2% below normal for this time of year….

Compared to other mid November low storage readings, this week’s 3,113 billion cubic feet of natural gas in storage was 13.4% lower than the previous 5 year low of 3,594 billion cubic feet that was set on November 14th of 2014, 10.8% below the 10 year low of 3,488 billion cubic feet that was hit on November 14th of 2008, 4.9% below the 3,274 billion cubic feet of natural gas we had in storage on November 18th of 2005, and 1.3% below the 3155 billion cubic feet that were in storage to start the winter on November 14th of 2003…we have to go back 16 years, to November 15th 2002, when 3,096 billion cubic feet of natural gas were in storage, to find a lower quantity of natural gas in storage in mid-November than now….

For a visualization of what this week’s natural gas withdrawal looks like historically, we have a graphic showing this year’s weekly change in natural gas inventories as compared to last year’s and to the long term averages:

The above graph was copied from a blog post at Bespoke Weather that was published on Wednesday of this week, shortly after the early release of the natural gas storage report…

On this graph, purple shows this year’s weekly additions to natural gas storage in billions of cubic feet above the zero line, and this year’s weekly withdrawals from natural gas storage in billions of cubic feet below the zero line; similarly, weekly additions and withdrawals of natural gas in 2017 are shown in red, the 5 year average weekly change of natural gas in storage is shown in green, and the historical average weekly change of natural gas supplies in EIA data going back to 1992 is shown in orange…

At the far left, you can see the record withdrawal of 359 billion of cubic feet that used 11.5% of all the natural gas we had on hand during the first week in January of this year, and a withdrawal of 288 billion cubic feet during the third week of January that would have also been a record withdrawal if not for the first week; those 2 big withdrawals thus dropped our natural gas supplies to 17.5% below normal to start the year…the cold April further reduced supplies vis a vis normal, as you can see that the averages show we should have been adding to supplies at that time of year….

Through most of the summer, our additions to storage were fairly close the normal range, but by then the stage had already been set for natural gas supplies to be at a 15 year low to start this winter…

To see what kind of temperature factors caused this week’s large withdrawal, and what kind of temperatures will be influencing next week’s natural gas supply report, we’ll next look at the most recent average temperature summary from the EIA’s natural gas storage dashboard:

The above graphic from the EIA’s natural gas storage dashboard gives us both the average daily temperature from November 9th thru November 22nd in each of the five natural gas regions, as well as a color-coded variance from normal for each of those daily temperature averages, with shades of brown indicating the average temperatures in the region were above normal on a given date, while shades of blue indicate average temperatures that were below normal for the date, as indicated in the legend at the bottom….thus this graphic gives us not only the actual average temperature for each region for each day, but also indicates how much that temperature deviated from the norm…

As you can see, temperatures for every region except for the 3 Pacific states were below normal through the week ending November 16th, with both the Midwest and South Central regions, encompassing the large expanse in the middle of the country, between 15 and 19 degrees below normal on three separate days in the period…

The following week, which will be reported on next week, looks a bit warmer, but not by much, as if you look at the lower line on the graphic you’ll see national average temperature only rose from an average of around 42 degrees during the week ending November 16th to around 44 degrees in the week after that, which means we can expect another large withdrawal this coming week, as consumption of natural gas for heating continues apace…

While average temperatures as shown above give us a general idea of the heating requirements over a given period, their relationship is inexact because they don’t differentiate between broad sparsely populated regions of the country where heating demand might be minimal even if it is cold, and the larger cities where a cold snap would result in a large burn of natural gas for heat…

Moreover, an average temperature for a region like the East above, which includes all the states from Maine to Florida, tells us little about what parts of that region are seeing the heating demand corresponding to the average temperatures….

For a better measure of heating demand, utilities and suppliers of heating fuels use a metric called heating degree days to determine what the daily demand for heating will be, so they can adjust their production or delivery schedules accordingly…those degree days are computed by taking the average daily temperature for a location and subtracting that number from 65 degrees, which is considered to be the temperature when most buildings will start to need heating…

Hence, the colder it gets, the higher the degree day factor becomes, and hence it’s a effective measure of heating demand…

Thus this next graphic, which shows us population weighted heating demand for the entire country, is much more useful in determining the ultimate consumption of natural gas…

The above graph came from a Thursday email titled “Best in Energy” that John Kemp, senior energy analyst and columnist with Reuters, sends out free daily, on request…

In this graphic, the yellow graph shows the average degree days that have been needed per capita each day over the typical US heating season (starting with zero in July), while the red dots indicate the actual population weighted degree days for each day of the 2018-2019 heating season…

In addition, the graph also includes 7 white dots which are a forecast of population weighted degree days that will determine heating requirements for the next 7 days…John did not indicate the exact date for this graph, but since the first white dot shows a large spike, i’m guessing that would probably be for Thanksgiving day, when New York city and most of the Northeast saw their coldest Thanksgiving in 150 years…

Thus the red dots would represent the days prior to November 21st, with all the recent ones clustered roughly between 20 and 25 degree days per capita nationally, indicating heating requirements that would normally be more typical of mid-December…

The next graph, also from that John Kemp emailing, shows the cumulative heating degree day deviation from normal, up to and including this reporting week…

In this graph, the divergence of cumulative heating degree days from normal for this year and for each of the previous three heating seasons is shown daily, with the current year shown as a solid white line, with last year’s divergence shown as a solid yellow line, with the divergence from normal for the 2016/2017 heating season shown as a dashed yellow line, and with the divergence from normal of the 2015/2016 heating season shown as a dotted yellow line…

Note that the graphs for all three prior years trend downward, or negative from zero, because all three years experienced warmer than normal temperatures, and hence less degree days than normal…

However, after a warmish October, when this year’s heating requirements were also below normal, the white line for 2018-19 has now moved upwards into positive territory, meaning this year’s cumulative heating requirements are now running above normal…

The broader takeaway from this graph, though, is that the natural gas demand we saw over the past three years is not a good benchmark for what we’ll need this year, because those years were warmer than normal, with the heating needs of both 2015/2016 and 2016/2017 roughly 17% below normal…

As we pointed out four weeks ago, if our natural gas usage this winter is instead similar to that of 2014, our natural gas supplies could fall to below 200 billion cubic feet by the end of the heating season, implying widespread natural gas shortages and much higher prices….

Labels:

NG_Fill_Rate,

NG_Fill_Rate_2018_2019

A CLR Wiley Well Comes Off Confidential List Today -- November 26, 2018

This page will not be updated.

The Wiley wells are tracked here.

Stim: 4/12/2018; middle Bakken; 60 stages; 8 million lbs

The well:

The Wiley wells are tracked here.

NDIC File No: 33112 API No: 33-053-07837-00-00 CTB No: 219933

Well Type: OG Well Status: A Status Date: 5/25/2018 Wellbore type: Horizontal Location: NENW 25-150-97 Footages: 1265 FNL 1896 FWL Latitude: 47.786286 Longitude: -103.039481 Current Operator: CONTINENTAL RESOURCES, INC. Current Well Name: WILEY 8-25H Elevation(s): 2321 KB 2289 GR 2294 GL Total Depth: 19470 Field: PERSHING Spud Date(s): 2/2/2017 Casing String(s): 9.625" 2089' 7" 11262' Completion Data Pool: BAKKEN Perfs: 11300-19391 Comp: 5/25/2018 Status: GL Date: 10/8/2018 Spacing: 4SEC Cumulative Production Data Pool: BAKKEN Cum Oil: 145963 Cum MCF Gas: 278608 Cum Water: 83892 Production Test Data IP Test Date: 7/1/2018 Pool: BAKKEN IP Oil: 2526 IP MCF: 39301376 IP Water: 47 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Monthly Production Data

|

Stim: 4/12/2018; middle Bakken; 60 stages; 8 million lbs

The well:

- Operator: CLR

- 2560-acre spacing (4 sections)

- TD = 19,470 feet

- 53K well

- already on gas lift

- 146K in less than four months

- these wells cost less to complete than the wells cost during the early days of the boom

- break-even well less than $40/bbl

Labels:

50K_Wells,

Bakken_2.5

Newfield's Yellowfin Wells In Siverston Oil Field

Locator: 10010YELLOWFIN.

Updates

Disclaimer: in a long note like this there will be typographical and factual errors. I have not spell-checked the note yet; will do that later. A reader provided the November 26, 2018, update, but I transcribed it; any errors are mine, not the reader who sent me the great note. Most of this is factual, but there are some opinions in the note, and it is not easy to separate fact from opinion on my blog in many cases.

November 26, 2018: a reader was kind enough to send two long notes regarding the Yellowfin wells. It is hard to give justice to these notes: the reader really shared a lot of information which helps me understand the Bakken better. Some of the information gets deep into the weeds, but will help newbies understand why pad sites are sometimes situated where they are. It also explains the cooperation among surface owners (usually farmers), operators, and government agencies (usually the state) to get this stuff done.

So, let's begin with the great note from the reader.

First: note the location of the Yellowfin wells in the graphic below. The horizontals will run south; the pad site is "outside" the drilling unit. We see this all the time in the Bakken. There are many, many reasons why this happens. In the case the reader wrote:

There is irrigation in the east half of section 6-151-98. The Gariety was drilled west from section 5, then south on the east edge of section 6. The Yellowfins were drilled southwest and then directly south in section 6. Oil pumps and tanks don’t work well on land with center-pivot irrigation systems. The Johnsrud 6-7-2 and 3 are both on higher ground (the latter wells are not seen on the graphic below; they are about a half-mile / mile to the west).

Second: when I first saw the location of the Yellowfin pad, I was unsure which way the horizontals would run. After a bit of superficial sleuthing, I was pretty sure they would run south but didn't mention that in the original post. But note how the Yellowfin pad is directly north of two other pads; it seems like a lot of unnecessary de-conflicting -- but see first comment above. The reader wrote, to repeat, the horizontals will run southwest, bypassing the pads to the south, and then run south into section 6. I should have caught that based on the legal name of the Yellowfin wells.

Third: so this is where we stand, putting the two first two comments together. The Yellowfin wells most likely would have been sited at the same latitude as the Johnsrud wells to the west. So, in fact, if I'm following this correctly, the Yellowfin wells are "Johnsrud" wells. One wonders why they weren't named Johnsrud wells? Now we're really getting into the weeds. LOL.

Fourth: now to the real meat of the reader's note. So, now we will start over with the numbering:

1: the Yellowfin wells are a Newfield test of increased density in the core area of the Bakken. All t three Yellowfin wells are middle Bakken wells; they are located 500 and 660 feet of the existing wells in the same zone. They thread their way between the Johnsrud 6-7-2 (#23906) and the Johnsrud 6-7-3 (#23908); and, the Gariety (#30398), and, the Holm (#25864). This will become apparent when the Yellowfin wells coming off confidential / tight-hole status this week.

2: the first month's production looks promising but it will take some time before the toal impact on all seven (7) wells will be known. Hint: see "Three" coming up next.

3: After the Yellowfin wells were completed, Newfield applied to the NDIC for fourteen (14) wells on the adjacent 1280-acre units to the east and south of these wells. Big hint. By the way, this is why companies like to keep their wells "confidential" as long as possible.

4: now, comparing these Newfield wells to another increased density program -- this one by Whiting. Whiting has developed increased density on their McNamara unit north of New Town. After their first year of production, Whiting shows very strong results for both the new wells and increased estimated ultimate recovery (EUR) for the original wells which were drilled on wider spacing. [We've talked about this before; Filloon has not talked about it but his graphs show it.]

5: the reader added, if 160-acre spacing proves to be economic in some areas of the Bakken it will have a major impact on the percentage of total oil and gas recovery in those units.

5a: if each unit could recover 3% to 5% of total oil in place, eight (8)-same zone wells could give 24% to 40% ultimate recovery! As the reader noted: we've come a long way from one well drilled corner-to-corner in a 640-acre unit in the early days of the Bakken.

6. This increased density could move us to a new level in Bakken development.

7. One final comment on the Dahl 5-8-8HLWR. It appears Newfield had trouble drilling this well and now has decided to drill a "R"eplacement well, grass roots. This is often more economic than spending lots of time and money trying to salvage the original well. The Dahl wells are less than a mile east of the Yellowfin wells. [A big "thank you" to the reader on this: I had noted the "R" when discussing the Dahl wells earlier, but did not know the backstory.]

Original Post

The graphic:

The Newfield Yellowfin wells are in the upper left-hand corner:

- 34800, 815, Newfield, Yellowfin 150-98-6-7-7H, t818; cum 197K 2/20; cum 293K 5/24;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2018 | 24700 | 49495 |

| 8-2018 | 5830 | 1586 |

- 34801, 811, Newfield, Yellowfin 150-98-6-7-8H, t8/18; cum 243K 2/20; cum 334K 5/24;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2018 | 24059 | 48332 |

| 8-2018 | 3346 | 2001 |

- 34802, 869, Newfield, Yellowfin 150-98-6-7-9HLW, t8/18; cum 267K 2/20; cum 437K 5/24;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2018 | 28561 | 58085 |

| 8-2018 | 2534 | 2427 |

The other wells in the graphic.

Two parent wells:

- 18641, AB/IA/A/AB/1,856, Newfield, Newfield, Megamouth 1-8H, t8/10; cum145K 6/19; after being off since late 2016, back on line for 17 days in 1/19, but almost no production; little production through 6/19; remains off line 2/20; very intermittent production; cum 145K 7/21;

- 18741, 407, Grayson Mill / Newfield, Dahl 1-5H, Siverston, t7/10; cum 173K 2/20; for Dahl wells, see this post; huge jump in production after coming back online 5/19; from 700 bbls/month to 4,000 bbls/month; cum 177K 9/21; cum 184K 5/24;

- 25862, IA/1,312, 7, Grayson Mill / Newfield, Holm 150-98-5-8-2H, Siverston, t3/14; cum 224K 2/20; no jump in production; off line as of 12/18 for most of the month; off line most of the month 1/19; cum 260K 9/21; cum 282K 1/24;

- 25863, IA/637, 7, Grayson Mill / Newfield, Holm 150-98-5-8-10H, Siverston, t3/14; cum 148K 2/20; huge jump in production in 9/18; cum 152K9/21; cum 158K 1/24;

- 25864, IA/1,425, 7, Grayson Mill / Newfield, Holm 150-98-5-8-3H, Siverston, t3/14; cum 257K 2/20; huge jump in production in 9/18; cum 270K 9/21; cum 287K 5/24;

- 30397, PNC, Newfield, Gariety 150-98-6-7-10H, Siverston, no production data,

- 30398, AB/1,891, Newfield, Gariety 150-98-6-7-4H, Siverston, t6/15; cum 290K 9/18; recently off-line; coming back on line as of 9/18; but only a few days each month; still off line as of 6/19, though one day in 6/19; off line 9/19; remains off line 2/20;

- 35573, 1,285, 7, Grayson Mill / Newfield, Goliath 150-98-5-8-5H, Siverston, t5/19; cum 160K 2/20; cum 244K 9/21; cum 289K 5/24;

- 35389, 1,427, 7, Grayson Mill / Newfield, Goliath 150-98-5-8-6H, Siverston, t5/19; cum 173K 2/20; cum 250K 9/21; cum 301K 5/24;

- 35574, 658, 7, Grayson Mill / Newfield, Goliath 150-98-5-8-11H, Siverston, t5/19; cum 113K 2/20; cum 173K 9/21; cum 218K 5/24;

- 35391, AB/1,246, Newfield, Dahl 150-98-5-8-7H, Siverston, t4/19; cum 153K 2/20; cum 210K 9/21; off line 5/21; back online for five days, 9/21; cum 210K 4/21;

- 35390, dry, Newfield, Dahl 150-98-5-8-8HLW, Siverston, drilled to depth; fracking failure?

- 35516, 1,008, 7, Grayson Mill / Newfield, Dahl 150-98-5-8-12H, Siverston, t4/19; cum 176K 2/20; cum 237K 9/21; cum 293K 5/24; still F;

IMO 2020 About One Year Away -- RBN Energy -- Monday, November 26, 2018; $50-Floor Held

ISO New England:

Break-evens:

CBR: Trudeau apparently not in favor of CBR plan. Perhaps the federal government does not have enough money to buy more locomotives? Are you kidding? The greenies would go loco if the federal government were to buy more diesel locos. At least Trudeau notes it's a crisis when WCS is selling for $8/bbl. The Chinese are loving it. Too bad their storage sites are now overflowing. One new data point in the article: Trudeau suggests that the differential is as much as $50.

Wells coming off the confidential list -- (for the Yellowfin wells, see this post -- will be updated later)

Monday, November 26, 2018:

Active rigs:

RBN Energy: how IMO 2020 may impact markets and challenge refiners and shippers.

Break-evens:

CBR: Trudeau apparently not in favor of CBR plan. Perhaps the federal government does not have enough money to buy more locomotives? Are you kidding? The greenies would go loco if the federal government were to buy more diesel locos. At least Trudeau notes it's a crisis when WCS is selling for $8/bbl. The Chinese are loving it. Too bad their storage sites are now overflowing. One new data point in the article: Trudeau suggests that the differential is as much as $50.

Justin Trudeau’s government is unlikely to heed Alberta’s plea for new trains to alleviate the country’s oil crisis, federal officials say.

Buying new locomotives and rail cars isn’t a short-term fix to the glut that has sent prices plunging because it would take at least a year to get the new trains in place, the officials said, asking not to be named because the stance is not public. While two cautioned that no final decision has been made -- with Trudeau visiting the heart of Canada’s oil industry on Thursday -- the officials downplayed the chances of a train purchase.

Alberta asked a month ago for the federal government to buy more locomotives to boost shipping capacity as it struggles with near-record low prices and a supply glut. Premier Rachel Notley made the request after an Oct. 22 meeting in which some oil executives pushed for a forced cut to production.

Trudeau’s energy minister is reviewing the proposal but Notley said Thursday Alberta hasn’t received a reply. Asked if the province would make the purchase on its own, the premier said she’d do “whatever it takes” to increase rail capacity.

Trudeau, who’s speech in downtown Calgary was marked by a pro-pipeline protest that gathered hundreds of people, wouldn’t say what he thinks of the Alberta rail proposal, but agreed the oil situation is serious.

“This is very much a crisis,” Trudeau said. “When you have a price differential that’s up around $42, $50 even, that’s a massive challenge to local industry, to the livelihood of a lot Albertans, and I hear that very clearly.”

******************************

Back to the Bakken

Wells coming off the confidential list -- (for the Yellowfin wells, see this post -- will be updated later)

Monday, November 26, 2018:

- 34801, 811, Newfield, Yellowfin 150-98-6-7-8H, SIverston, a nice well; 24K first full month; t8/18; cum 28K 9/18;

- 34587, 3,024, WPX, Grizzly 25-36HX, Spotted Horn, t9/18; cum 30K in 14 days extrapolates to 64,131 bbls/30 days;

- 34800, 815, Newfield, Yellowfin 150-98-6-7-7H, Siverston, a nice well; 25K first full month; t8/18; cum 31K 9/18;

- 34610, 1,299, Petro-Hunt, Klevmoen 153-95-17C-7-1H, Charlson, t10/18; cum --

- 34586, 3,384, WPX, Grizzly 25-36HF, Spotted Horn; t9/18; cum 14K over 9 days extrapolates to 46,313 bbls / 30 days;

- 34254, 480, Bruin, Sadowsky 14-11-2H, St Anthony, t5/18; cum 26K 9/18;

- 34051, SI/NC, WPX, Howling Wolf 28-33D, Wolf Bay, no production data,

- 33112, 2,526, CLR, Wiley 8-25H, Pershing, t7/18; cum 146K 9/18; see this post;

- 34585, 2,188, WPX, Grizzly 25-36HY, Spotted Horn, t9/18; cum 10K over 8 days extrapolates to 38K over 30 days;

- 33226, 962, CLR, Kennedy 6-31H2, Dimmick Lake, t8/18; cum 39K 9/18

Active rigs:

| $51.10 | 11/26/2018 | 11/26/2017 | 11/26/2016 | 11/26/2015 | 11/26/2014 |

|---|---|---|---|---|---|

| Active Rigs | 62 | 53 | 37 | 65 | 183 |

RBN Energy: how IMO 2020 may impact markets and challenge refiners and shippers.

The planned implementation date for IMO 2020 is still more than a year away, but this much already seems clear: even assuming some degree of non-compliance, a combination of fuel-oil blending, crude-slate shifts, refinery upgrades and ship-mounted “scrubbers” won’t be enough to achieve full, Day 1 compliance with the international mandate to slash the shipping sector’s sulfur emissions. Increased global refinery runs would help, but there are limits to what that could do. So, what’s ahead for global crude oil and bunker-fuel markets — and for refiners in the U.S. and elsewhere — in the coming months? Today, we discuss Baker & O’Brien’s analysis of how sharply rising demand for low-sulfur marine fuel might affect crude flows, crude slates and a whole lot more.

As regular readers of RBN’s blogs know, the International Maritime Organization (IMO), a specialized agency of the United Nations, in recent years has been implementing ever-tightening rules to reduce allowable sulfur-oxide emissions from the engines that power the 50,000-plus tankers, dry bulkers, container ships and other commercial vessels plying international waters. Earlier we explained that in January 2012, the global cap on sulfur content in bunker (marine fuel) was reduced to 3.5% (from the old 4.5%) and that on January 1, 2020 — only 13 months away — it is set to be reduced to a much stiffer 0.5%. There are even tougher standards already in place in the IMO’s Emission Control Areas (ECAs) for sulfur, which include Europe’s Baltic and North seas and areas within 200 nautical miles of the U.S. and Canadian coasts. In July 2010, the ECA sulfur limit in marine fuel was reduced to 1% (from the old 1.5%), and in January 2015, the limit was ratcheted down again to a very stringent 0.1% — a standard that will remain in force within the ECAs when the 0.5% sulfur cap for the rest of the world becomes effective on New Year’s Day in 2020.

Subscribe to:

Comments (Atom)