Locator: 48462SURINAME.

Updates

August 12, 2025: brief summary following CVX-Hess acquisition:

Following Chevron's acquisition of Hess, the company now holds a 30%

stake in Guyana's prolific Stabroek Block, significantly boosting its

oil production potential.

This deal, finalized after an arbitration win

against Exxon Mobil, positions Chevron as a major player in the region,

alongside ExxonMobil and CNOOC. The acquisition also includes Hess's

Bakken shale assets, adding to Chevron's diversified portfolio. The

increased production and free cash flow from Guyana are expected to

contribute to Chevron's growth, extending its reach into the next decade.

So, this is what we have:

- Trinidad and Tobago: Shell. XOM may be looking to begin exploring there (August, 2025)

- Surinam: Apache and TTE.

- Guyana: XOM, CNOOC, CVX. After CVX acquires Hess, closing in 2025.

- Venezuela: CVX; Trump, after much back-and-forthing, gives green light to CVX which is critical for the Texas gulf coast; the Texas gulf coast needs heavy oil to balance the huge amounts of like oil from the Permian and the Bakken. (Hillary, et al, kept Canada out of that lucrative opportunity by killing the Keystone XL pipeline which will go down in history as one of the most foolhardy things the US ever did -- killing the Keystoe XL.

August 12, 2025:

- Trinidad back in the news, but before we get started, which has the bigger presence, Shell or XOM?

Shell clearly has the substantially larger and operational oil/gas presence in Trinidad today—active production, processing, LNG, and government payments. ExxonMobil, conversely, is making an exploratory return; its impact depends entirely on the outcome of deepwater exploration yet to begin.

- XOM could invest as much as $22 billion, link here.

Original site for tracking Guyana-Trinidad:

here.

Original Post

From earlier:Guyana, Antilles, West Indies.

Reminder:

Link here.

So, this is what we have:

- Trinidad and Tobago: Shell.

- Surinam: Apache and TTE.

- Guyana: XOM.

- Venezuela: CVX.

A reader alerted me to a Charles Kennedy article on Guyana, dated March 6, 2023.

****************************

Most Recent

RBN Energy: today, more recent -- Suriname sets its site on becoming major oil supplier with offshore boost. Archived.

As crude oil production surges off the coast of Guyana, its eastern

neighbor, Suriname, has set off on its own mission to become a global

oil supplier. With some onshore production active for decades, the tiny

South American nation now has its sights set on developing its vast

offshore reserves. While there have been some setbacks, its

international partners are getting their plans back on track. In today’s

RBN blog, we’ll take a deep dive into what’s ahead for Suriname.

We previously highlighted how Guyana has been a rising star (see Break My Stride) in the global crude market, even if it’s only a recent entrant. Guyana now has three crude grades to offer markets (see My Guy)

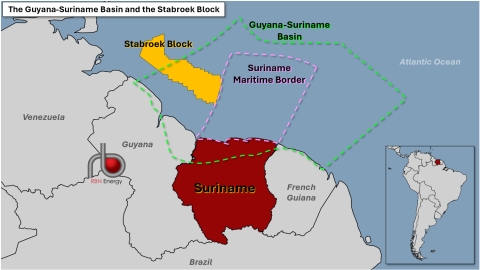

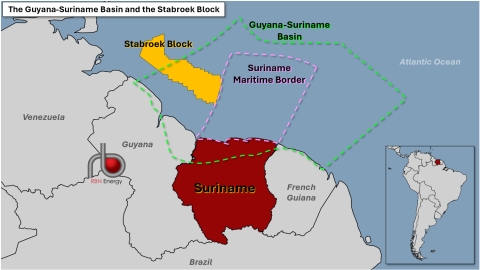

since its first major oil discovery just a decade ago. The offshore

Stabroek block’s only oil-producing area (yellow-shaded area in Figure 1

below) is churning out more than 650 Mb/d of oil from three projects in

the reserve-rich Guyana-Suriname Basin (area within dashed-green line).

Owners of these assets want to roughly double that volume by the end of

2027 with three more projects. It’s worth noting that in 2000, the U.S.

Geological Survey (USGS) estimated that the underexplored areas of the

Suriname-Guyana Basin held 13.6 billion barrels of oil and 32 trillion

cubic feet (Tcf) of gas. But Guyana isn’t the only country with plans to

develop those reserves.

Figure 1. The Guyana-Suriname Basin and the Stabroek Block. Source: RBN

The Guyana-Suriname Basin stretches across three countries on the

Atlantic coast of South America: Guyana, Suriname and French Guiana. The

oil-rich formation has an onshore segment but is predominantly an

offshore play. Suriname has been extracting minimal amounts of crude oil

from the onshore basin since the 1980s but the former Dutch colony

wants to raise its profile as a petroleum supplier with its offshore oil

bonanza, mirroring its neighbor’s success. (Suriname’s maritime border

indicated by dashed-pink line in Figure 1.)

*****************************************

Guyana, Suriname

Re-posting from August 19, 2021. Link here.

Locator: 10010GUYANA.

Locator: 10010SURINAME.

March 2, 2024: how much oil in Guyana? Now estimated to be one-half trillion dollars. Link here.

February 27, 2024: Chevron-Hess $53 billion merger at risk;

XOM and CNOOC claim right of first refusal to buy out Hess stake in

Guyana. If XOM and/or CNOOC "win" that argument, there's really no

reason for Chevron to pursue Hess, except for Bakken and DJ Basin.

September 8, 2023: update.

March 6, 2023: Guyana wants to bring in more majors.

November 29, 2022: update here.

August 19, 2021: Guyana, Suriname oil drilling activity to jump. Link to Irina Slav.

**************************

Background

Guyana-Suriname Basin: rise from obscurity to super potential, WorldOil, May, 2021.

- estimates of 10+ billion bbls of oil

- estimates of 30 tera cubic feet of natural gas

THE EARLY EXPLORATION

Onshore exploration. In both Suriname and Guyana,

oil seeps were known from the 1800s, into the 1900s. Exploration in

Suriname discovered oil at a 160 m depth while drilling for water in a

schoolyard in Calcutta Village.2 The onshore Tambaredjo oil field (15-17 oAPI

oil) was discovered in 1968. First oil began in 1982. Satellite oil

fields to Calcutta and Tambaredjo were added. These fields had an

original STOOIP of 1 Bbbl of oil. Currently, these fields are producing

around 16,000 bopd.2 Staatsolie’s crude is processed at Tout Lui Faut refinery, at 15,000 bpd, to produce diesel, gasoline, fuel oil, and bitumen.

Guyana did not have the same onshore success; since 1916, 13 wells have been drilled, but only two wells have shown oil.3

Onshore oil exploration in the 1940s produced geological studies in

Takatu basin. Three wells were drilled between 1981 and 1993, all either

dry or non-commercial. These wells confirmed the presence of thick

black shale, Cenomanian-Turonian age (known as Canje Fm), equivalent to

the La Luna formation in Venezuela.

Venezuela has a thriving oil exploration and production history.4 Drilling success dates back to 1908, first in the western part of the country with the Zumbaque 1 well,5

with production in Lake Maracaibo rising during WWI and into the 1920s

and 1930s. Of course, the tar sands in the Orinoco Belt, discovered in

1936,6 have significantly impacted the oil reserves and

resources, contributing to the 78 Bbbl of oil reserves; this reservoir

gives Venezuela the current first position on reserves. La Luna

formation (Cenomanian-Turonian) is a world-class source rock for much of

this oil. La Luna7 is responsible for most of the oil found

and produced from the Maracaibo basin and several others in Colombia,

Ecuador and Peru. The source rock found offshore Guyana and Suriname has

similar characteristics to those found in La Luna, and is the same age.

Offshore Guyana oil exploration: Shelf region. Exploration on the continental shelf began in earnest in 1967,7 with

the Guyana Offshore-1 and -2 wells. A 15-year gap ensued until the

Arapaima-1 was drilled, followed by Horseshoe-1 in 2000 and the 2012

wells, Eagle-1 and Jaguar-1. Six of these nine wells had either oil or

gas shows; only the Abary-1, drilled in 1975, flowed oil (37 oAPI).

Although the lack of any economic discovery was disappointing, these

wells were very important, because they confirmed a functioning

petroleum system was generating oil.

Offshore Suriname oil exploration: Shelf region. The

story of exploration on the continental shelf in Suriname mirrors that

of Guyana. Nine wells were drilled through 2011, three of which had oil

shows; the others were dry. Again, the lack of economic discoveries was

disappointing, but these wells confirmed a functioning petroleum system

was generating oil.

ODP Leg 207 drilled five sites in 2003 on the Demerara Rise, which

separates the Guyana-Suriname basin from offshore French Guiana. Very

importantly, all five wells encountered the same Cenomanian-Turonian

Canje Fm source rock found in Guyana and Suriname wells, which was a

confirmation of the presence of a source rock as La Luna.

Much more at this link.

Guyana success.

ExxonMobil/Hess

et al. announced in May 2015 the now-famous Liza-1 discovery well in

Stabroek license, offshore Guyana (Liza-1 well12).

Upper Cretaceous turbidite sands are the reservoir.

The follow-up Skipjack-1 well, drilled in 2016, found no commercial hydrocarbons.

Through

2020, the Stabroek partners have announced a total of 18 discoveries,

amounting to a gross recoverable resource over 8 Bbbl of oil (corporate

ExxonMobil)!

The Stabroek partners solved

the concerns about the seismic response to hydrocarbon-bearing versus

water-bearing reservoirs (Hess Investor, 2018 Investor Day 8).

A deeper Albian age source rock has been confirmed in some wells.

Interestingly,

ExxonMobil and partners found oil in a carbonate reservoir in the

Ranger-1 well, announced in 2018. Evidence suggests that this is a

carbonate bank that accumulated atop a subsiding volcano.

The

Haimara-18 discovery, announced in February 2019 as a gas condensate

discovery in 63 m of high-quality reservoir. Haimara-1 sits adjacent to

the border between Stabroek, Guyana, and Block 58, Suriname.

From March 6, 2023, link here:

Locator: 10011GUYANA.

Tag: Guyana, Antilles, Wear Indies.

Reminder:

Link here.

So, this is what we have:

- Trinidad and Tobago: Shell.

- Surinam: Apache and TTE.

- Guyana: XOM.

- Venezuela: CVX.

A reader alerted me to a Charles Kennedy article on Guyana today.

I had forgotten that Hess partnered with XOM on Guyana.

Now we watch for Shell and and CVX bidding for Guyana; both have experience in this geographic area.

Guyana is tracked here at the sidebar at the right. That site needs to be updated.