Before we get to the subject at hand, a little "word play."

A couple of new EVs are capturing the interests of myriad automobile buffs. Tesla is so yesterday. The new kids on the block: the new Ford Mustang Mach-E and the new Porsche Taycan.

Quick: using one word, one word only, what does "Taycan" mean?

Now, back to the subject at hand.

One of my favorite pages on the blog is "the next big thing," linked at the sidebar at the right.

I apologize. It is very difficult to track "the next big think" on the blog. It's become so disjointed. Be that as it may, we will press on.

The very, very first post on "the next big thing" was dated March 21, 2013. My very first "the next big thing" was Netflix. That was back in 2013. It may have been my defining moment with regard to prognostications.

So, now we have another "next big thing."

Let's run through the process of how this developed.

For those watching cable television like Spectrum and watching mostly networks focused on entertainment, business, and sports, what company jumps out at you as appearing to do much more advertising that it use to?

I limit this to networks focused on entertainment, business, and sports because I don't follow any news networks. I had to add business: even though I watch no business-networks on a regular basis, I occasionally watch CNBC and the company I am thinking of heavily advertises on CNBC.

So, again, what company jumps out at you as appearing to do much more advertising that it use to?

This is like Family Feud, isn't it?

There is no wrong answer. Everyone will think of something different.

For me, it is/was obvious.

USAA.

Second, what sector seems to have the most advertising on the networks focused on entertainment, sports, and business?

Car insurance.

So, I was curious.

Google: dollars spent on television advertising by industry.

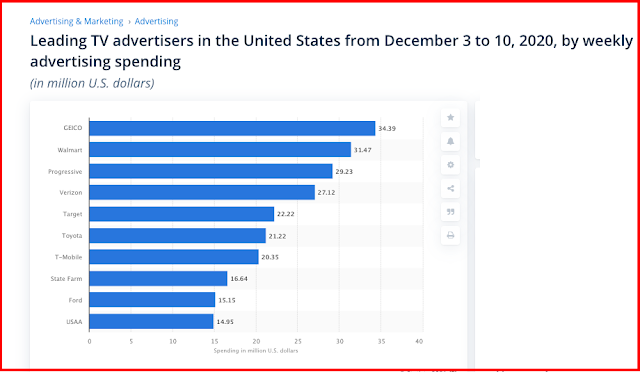

Results: from statista.com, "leading TV advertisers in the US from December 3 to December 10, 2020, by weekly advertising spending."

Wow, wow, wow.

Was I rigtht or was I wrong? USAA #10 on the top ten list. Whoo-hoo!

Now, take a second look at that list. What industry is #1 as represented by the companies that make the top ten list? Let's see: Geico (#1); Progressive (#3); State Farm (#8); and USAA (#10).

Retail, #2 overall: Walmart and Target.

Auto and telecommunications, tied for #3 / #4: Verizon, T-Mobile, Toyota, Ford.

But clearly, the #1 sector is automobile insurance. Yes, home and rental insurance can be bundled with automobile insurance but the home/rental segment of this bundle is inconsequential compared to the automobile segment.

[Another digression: name five "A" companies not on the chart above.]

With AI-enhanced algorithms there cannot possibly be anything simpler than the automobile insurance industry.

Has anyone else noticed this low-hanging fruit?

Yup.

Elon Musk.

Link here.

When competition starts to get really, really tough, look for Ford to announce that they will bundle automobile insurance with every EV they sell. In fact, my hunch if that Ford will offer casualty insurance for free to "qualifying" buyers.

There will be some strings attached, of course, but this is, too, will be fascinating to watch.

Financing a $100,000 car over three years would run about $3,000 / month. Link here. Casualty insurance alone (not liability) and with certain strings attached would be a trivial price for Ford to subsidize.

Can you imagine the consumer's response to "insurance included" when one buys an EV?

Now, back to that "word play" question at the top of the blog:

A

couple of new EVs are capturing the interests of myriad automobile

buffs. Tesla is so yesterday. The new kids on the block: the new Ford

Mustang Mach-E and the new Porsche Taycan.

Taycan translates to "mustang."

Imitation is the sincerest form of flattery.

And finally, on another note:

Oh, one more thing. Which company now has the "real" mustang?

Finally, the five "A" companies not on the chart at the top of the page:

- Apple

- Amazon

- Alphabet (Google)

- AARP

- AAA