Monday, July 25, 2016

ExxonMobil, Saudi Arabia In Discussions To Develop A Petrochemical Complex Along The US Gulf Coast -- July 25, 2016

I normally don't post these stories this early in the "cycle" -- but this helps understand Prince Salman's strategic plan for Saudi Arabia. Oil & Gas Journal is reporting that ExxonMobil and SABIC (Saudi Arabian Basic Industries) are in discussions to develop a jointly-owned "grassroots" petrochemical complex to be built along the US Gulf Coast, either in Texas or Louisiana.

Labels:

SaudiPerspective

Update On CBR -- July 25, 2016

The Wall Street Journal has an update on declining CBR. It has a fair number of data points for the archives, and is probably a human interest story, certainly for many on the east coast, but regular readers probably won't find much new in the article.

But this data point is very interesting:

The changes are evident in North Dakota, once the epicenter of the crude-by-rail trend. Oil output from the state’s Bakken Shale formation has fallen by 180,000 barrels a day from its 2014 peak. Meanwhile, pipeline takeaway capacity has more than doubled since 2010.

EOG Resources Inc., one of the first oil companies to see the potential for trains to relieve pipelines, opened its first rail loading terminal in Stanley, N.D., in 2009. But that terminal hasn’t loaded a train in more than a year, according to Genscape, a data provider that tracks activity at U.S. rail terminals.

“New pipeline infrastructure has been put in place to move significant volumes of oil to market,” an EOG spokeswoman said.

Enough pipeline capacity is coming online to replace all of the current volume BNSF Railway Co. is shipping out of North Dakota, said David Garin, the railroad’s group vice president of industrial products.

BNSF used to transport as many as 12 trains daily filled with crude primarily from North Dakota’s Bakken Shale, carrying about 70% of all rail traffic out of the area. Now it is down to about five a day.And along with the decline in coal shipping volumes, this is probably not a good-news story for Warren Buffett who owns BNSF.

But this data point is very interesting:

Even at its height in 2014, crude-by-rail accounted for less than 2% of total rail volumes, according to Association of American Railroads data. But its decline threatens what was once viewed as a sizable driver of growth for the railroad industry, one that many rail companies, along with oil and gas producers, made investments to support.

Between 2010 and 2015, 89 terminals were built or expanded in the U.S. and Canada to load crude on trains, and nearly as many to offload it, according to consulting firm RBN Energy LLC.Back to the Bakken:

There could soon be more than enough space to carry away all Bakken oil through pipelines now in the works. Phillips 66 is partnering with pipeline company Energy Transfer Partners LP to develop a pair of pipelines that will bring North Dakota crude to Illinois and then down to Texas.

The endeavor, which will cost close to $5 billion, is expected to take a major bite out of oil train traffic, even though the pipelines will ultimately bring oil to the Midwest and the Gulf of Mexico, rather than to the East and West coasts, where trains have primarily taken it.

Phillips 66 said earlier this year it may still be cheaper to take that oil and put it on a barge for delivery by sea to the coasts than to send it directly there by train.Something tells me this rail and these loading terminals in North Dakota won't go unused.

Labels:

CBR,

CBR_Slowdown

Eight Permits Renewed; Only One New Permit -- July 25, 2016

Active rigs:

Wells coming off confidential list Tuesday:

| 7/25/2016 | 07/25/2015 | 07/25/2014 | 07/25/2012 | 07/25/2011 | |

|---|---|---|---|---|---|

| Active Rigs | 32 | 73 | 192 | 208 | 179 |

Wells coming off confidential list Tuesday:

- 32011, TASC, MRO, McMahon USA 14-34H, Reunion Bay, no production data,

- 32092, 1,503Three Forks B1, 32 swell packers proposed

- Operator: North Range Resources

- Field: Rough Rider (McKenzie)

- Comments:

- Whiting (2): two P Bibler permits in Williams County

- Hess (2): two EN-Jeffrey permits in Mountrail County

- Petro-Hunt (2): two Kostelnak permits in Dunn County

- BR: a Ranvan permit in McKenzie County

- Crescent Point Energy: a Legacy et al Berge permit in Bottineau County

Market Down 100+ Points On WTI Pullback -- July 25, 2016

The market is down because of the pullback in the price of WTI, now under $44/bbl. Even though the market is down 100+ points in mid-day trading, there are 225 new 52-week highs on the NYSE, including:

I used to think the Christian Science Monitor was a reputable publication. But it appears they, too, have gone a bit bonkers. It's bad enough the UN sponsored this research but it goes beyond the pale that the CSM would actually publish the results and the conclusions. The UN now blames "agriculture" for rising "emissions" that contribute to global warming. [Yes, I understand their "reasoning" -- the fact that forests are being cut down.]

But look at that conclusion again. Remember, this was written by really smart people:

But regardless, we're doing all this to prevent an average increase of only two degrees. Over the next century. Yesterday it was air conditioners; today, it's agriculture. Tomorrow it will be cattle farting. Oh, we already had that one.

As Queen says: "When the temperature outside rises ...

I'm Going Slightly Mad, Queen

- CenterPoint Energy

- El Paso Electric

- Exelon

- FirstEnergy

- Murphy USA

****************************

Going Bonkers

I used to think the Christian Science Monitor was a reputable publication. But it appears they, too, have gone a bit bonkers. It's bad enough the UN sponsored this research but it goes beyond the pale that the CSM would actually publish the results and the conclusions. The UN now blames "agriculture" for rising "emissions" that contribute to global warming. [Yes, I understand their "reasoning" -- the fact that forests are being cut down.]

Food production accounts for approximately 30 percent of global greenhouse gas emissions. Currently, 21 percent of these emissions come from deforestation and land use changes that are a result of agriculture.The report concludes:

The report concludes with words of caution: “If we depend on current yield trends alone to meet future demand for food, we will need the entire global emissions allowance for keeping global average temperatures below two degrees Celsius. That would leave virtually no emissions for all other sectors, including energy production, industry, and transport.”As Don has noted: we're all going to have to quit eating if we want to stop global warming.

But look at that conclusion again. Remember, this was written by really smart people:

"We will need the entire global emissions allowance for keeping global average temperatures below two degrees Celsius."Obviously they did not mean that, and this report would have been proofread a gazillion times before publication. If we get the average global temperature down to below two degrees Celsius it's going to be awfully cold. Unless things have changed, I believe water freezes at 0 degrees Celsius at one atmosphere pressure.

But regardless, we're doing all this to prevent an average increase of only two degrees. Over the next century. Yesterday it was air conditioners; today, it's agriculture. Tomorrow it will be cattle farting. Oh, we already had that one.

As Queen says: "When the temperature outside rises ...

Bakken DUCs Rise To Nearly 1,000 -- July 25, 2016

The Emergent Group is reporting today that Bakken DUCs rise to nearly 1,000. See graph and data at this link. A reminder: CLR said fracking operations would resume when oil returned to $50 to $55. Not only is oil back in the mid-$40s, oil is a) now below $43; b) trending down; and, c) talk on the street suggesting the price of oil could go significantly lower (again).

The tea leaves certainly suggest we won't see $60 oil by the end of the year, and there is even question whether we will get into "CLR's fracking range."

In the July, 2016, Director's Cut (May, 2016, data), the NDIC reported that after falling a bit earlier this year, DUCs in the Bakken did increase slightly, by 39 from last report, up to 931.

This story was a front page story over at the on-line edition of The New York Times.

The tea leaves certainly suggest we won't see $60 oil by the end of the year, and there is even question whether we will get into "CLR's fracking range."

In the July, 2016, Director's Cut (May, 2016, data), the NDIC reported that after falling a bit earlier this year, DUCs in the Bakken did increase slightly, by 39 from last report, up to 931.

**************************

LUCA: The Ancestor Of All Living Things

This story was a front page story over at the on-line edition of The New York Times.

A surprisingly specific genetic portrait of the ancestor of all living things has been generated by scientists who say that the likeness sheds considerable light on the mystery of how life first emerged on Earth.

This venerable ancestor was a single-cell, bacterium-like organism. But it has a grand name, or at least an acronym. It is known as Luca, the Last Universal Common Ancestor, and is estimated to have lived some four billion years ago, when Earth was a mere 560 million years old.

Genes that do the same thing in a man and a mouse are generally related by common descent from an ancestral gene in the first mammal. So by comparing their sequence of DNA letters, genes can be arranged in evolutionary family trees, a property that enabled Dr. Martin and his colleagues to assign the six million genes to a much smaller number of gene families. Of these, only 355 met their criteria for having probably originated in Luca, the joint ancestor of bacteria and archaea.Genes are adapted to an organism’s environment. So Dr. Martin hoped that by pinpointing the genes likely to have been present in Luca, he would also get a glimpse of where and how Luca lived. “I was flabbergasted at the result, I couldn’t believe it,” he said.

The 355 genes pointed quite precisely to an organism that lived in the conditions found in deep sea vents, the gassy, metal-laden, intensely hot plumes caused by seawater interacting with magma erupting through the ocean floor.

Deep sea vents are surrounded by exotic life-forms and, with their extreme chemistry, have long seemed places where life might have originated. The 355 genes ascribable to Luca include some that metabolize hydrogen as a source of energy as well as a gene for an enzyme called reverse gyrase, found only in microbes that live at extremely high temperatures, Dr. Martin and colleagues reported in Monday’s issue of Nature Microbiology.

Until the book comes out (which I am sure will happen), this is a great book that will bring you up to speed regarding LUCA: The Vital Question: Energy, Evolution, and the Origins of Complex Life, Nick Lane, c. 2015. Bill Martin figures prominently in Nick Lane's book.

Labels:

DUCs,

FrackingBacklog

Update On CAFE Standards -- Forbes -- July 25, 2016

This is kind of cool. On July 19, 2016, I noted that meeting the US CAFE standard of 55 mpg by 2025 was "impossible." Today, from Forbes: a hard truth revealed from fuel efficiency upset: government can't predict consumer preferences.

Having said that, it will be hard to complain about 50 mpg if gasoline continues to cost less than $2.00/gallon.

Also from the linked article:

The biggest news in energy policy circles this week was the release by federal regulators of a mid-term report on U.S. fuel-economy standards. The report delivered a bit of bad news: Instead of achieving the original, headline-grabbing efficiency target of 54.5 miles per gallon (mpg), the fleet of new vehicles sold in 2025 is likely to clock-in at more like 50 mpg. And even that target depends on fuel prices over the next decade—with oil prices needing to approach $100 per barrel by 2025 to keep efficiency above 50 mpg.

The shortfall came as a shock to many analysts and observers who had long operated under the assumption that U.S. vehicle efficiency targets were effectively written in stone. But those watching recent trends closely were not surprised. In fact, I explained why vehicles might not meet their targets in an earlier post, citing a nearly 30% gap between the levels of efficiency achieved and the target in 2016.

Rightly so, administration officials underscored this week that the projected 54.5 mpg was just that, a projection. As one official said, “54.5 isn’t a standard, never was a standard, and isn’t a standard now. 54.5 is what we predicted, in 2012, the fleet-wide average could get to, based on assumptions that were live back then about the mix of the fleet.”

This underscores an important reason why the target won’t be met, and why achieving future emissions reductions in transportation could be exceedingly difficult: The standards are tied to consumer preferences. As preferences deviate from the forecasts, the target falls short. That’s what has happened over the last few years as consumers went out and bought more pick-ups and SUVs than predicted.Much, much more at the link.

Having said that, it will be hard to complain about 50 mpg if gasoline continues to cost less than $2.00/gallon.

Also from the linked article:

Instead of representing 43% of the U.S. market, SUVs and pick-up trucks have accounted for nearly 60% of auto sales this model year. Meanwhile, sales of hybrid electric vehicles in the first half of this year hit their lowest levels in five years, implying that in addition to a shift toward trucks, consumers may be purchasing less efficient vehicles within each given class.

Labels:

CAFE_Standards,

EVs

The Big Energy Picture: 2015 Data Starting To Trickle Out -- July 25, 2016

Note: this is for my own use. The data comes from EIA but there will be typographical and factual errors in my data. This just helps me get the "big picture" with regard to the energy sector in the US. Do not quote me on any of this. If this information is important to you, go to the source.

The US Energy Flow for 2015 at this link: http://www.eia.gov/totalenergy/data/monthly/pdf/flow/total_energy.pdf.

Domestic production and imports (in quadrillion BTUs):

Total US consumption (in quadrillion BTUs): 97.65

US production + imports - exports (in quadrillion BTUs):

1.84 / 97.65 = 1.9% (wind) [in 2014: 1.77%]

0.58 / 97.65 = 0.6% (solar) [in 2014: 0.4%]

Note: in the US, a quadrillion is a thousand-trillion.

Comments:

I think over time, one will see a "drag" on the energy sector as more and more solar / wind is added to the mix. "Drag" will be seen in the following:

The Midcontinent fossil fuel industry is going to thrive in a non-dispatchable energy environment. Think about it. All things being equal, electricity supply/demand has been fairly stable / flat over the past few years, I assume. Coal and natural gas "growth" might have flat-lined over the past decade -- I don't know -- but with the addition of non-dispatchable energy, albeit very, very, very little, the US will require additional natural gas plants for "back-up." That "back-up" is not going to come from nuclear power or coal. In fact, hydroelectricity could also be impacted negatively. I don't think there is any energy less expensive than existing hydroelectric power but with political mandates, some states like California will displace hydroelectricity for solar energy (see RBN Energy).

The US Energy Flow for 2015 at this link: http://www.eia.gov/totalenergy/data/monthly/pdf/flow/total_energy.pdf.

Domestic production and imports (in quadrillion BTUs):

- the US produces: 88.63

- the US imports: 23.61

- Sub-total: 112.24

Total US consumption (in quadrillion BTUs): 97.65

US production + imports - exports (in quadrillion BTUs):

- coal: 15.73 (in 2014: 17.92)

- natural gas: 28.32 (in 2014: 27.51)

- petroleum: 35.38 (in 2014: 34.78)

- nuclear: 8.34 (in 2014: 8.33)

- renewable: 9.68 (in 2014: 9.63)

- hydroelectric: 25% of 9.68 = 2.42

- wood: 21% of 9.68 = 2.03

- biofuels: 22% of 9.68 = 2.13

- biomass waste: 5% of 9.68 = 0.48

- wind: 19% of 9.68 = 1.84

- solar: 6% of 9.68 = 0.58

- geothermal: 2% of 9.68 = 0.19

1.84 / 97.65 = 1.9% (wind) [in 2014: 1.77%]

0.58 / 97.65 = 0.6% (solar) [in 2014: 0.4%]

Note: in the US, a quadrillion is a thousand-trillion.

Comments:

I think over time, one will see a "drag" on the energy sector as more and more solar / wind is added to the mix. "Drag" will be seen in the following:

- increased utility expenses for all consumers

- increased non-dispatchable energy requiring increased / redundant / otherwise unnecessary natural gas plants

The Midcontinent fossil fuel industry is going to thrive in a non-dispatchable energy environment. Think about it. All things being equal, electricity supply/demand has been fairly stable / flat over the past few years, I assume. Coal and natural gas "growth" might have flat-lined over the past decade -- I don't know -- but with the addition of non-dispatchable energy, albeit very, very, very little, the US will require additional natural gas plants for "back-up." That "back-up" is not going to come from nuclear power or coal. In fact, hydroelectricity could also be impacted negatively. I don't think there is any energy less expensive than existing hydroelectric power but with political mandates, some states like California will displace hydroelectricity for solar energy (see RBN Energy).

Labels:

SolarEnergy,

Wind

Tesla Races To Finish Giga-Battery-Factory -- July 25, 2016

Updates

July 25, 2016: from today's print edition of The Wall Street Journal:

But Tesla’s lofty market valuation depends in large part on a successful Model 3 launch, set for late next year. And the factory’s readiness for mass production is unclear. Tesla had spent less than one-fifth of a planned $2 billion on Gigafactory capital outlays through March 31.

Original Post

SPARKS, Nev.— Tesla Motors Inc. is scrambling to finish building its massive $5 billion battery factory here years ahead of schedule to meet demand for its coming cheaper sedan and provide power for new types of vehicles Chief Executive Elon Musk says are under development.

Tesla has doubled the amount of people constructing the “gigafactory,” which sits on more than 3,000 acres near Reno. Now, 1,000 workers build seven days a week on two shifts in an effort to start churning out lithium-ion cells by early 2017.

The goal is to have the factory operational before the launch next year of the $35,000 Model 3 sedan, which is about half the base price of the Model S. Tesla opened reservations for the Model 3 earlier this year, and strong demand led Mr. Musk to pull a 500,000 sales target ahead two years to 2018. He also raised $1.7 billion through a stock offering in hopes of speeding up battery production expected to lower the cost of the batteries for electric vehicles.

As of now, the gigafactory’s structure is less than one-sixth the size of what the final building is expected to occupy. Most exterior walls are temporary and can be relocated. Already finished is a four-story rectangular portion of the facility, housing 1.9 million square feet of floor space.

Once completed, Mr. Musk anticipates the new plant could be capable of producing a total of 105 gigawatt hours of battery cells by 2020, or enough to power 1.2 million Model S sedans—though up to one-third of those batteries are slated for stationary battery storage. About 50,000 Model S sedans were built in 2015.Close association with SolarCity:

Mr. Musk in recent weeks has laid out aggressive expansion plans for Tesla, including heavier vehicles and an energy-storage business that marries Tesla’s battery business with SolarCity Corp. ’s solar panels. Mr. Musk, chairman and largest shareholder of both companies, has proposed a $2.8 billion merger of Tesla and SolarCity.

The roof of the new factory will be covered in SolarCity’s panels. A solar-panel field will be constructed nearby to provide additional power to the factory.I sincerely hope Tesla meets its goal. If they can, again it will show what American workers can accomplish, all the way up and down the line, from the engineers who designed this to the welders in the trenches.

Labels:

Tesla,

TeslaBattery

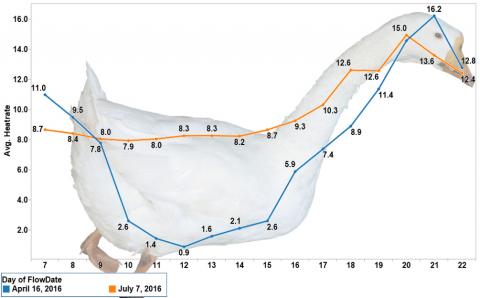

What A California Duck Looks Like -- RBN Energy -- July 25, 2016

From RBN Energy:

This spring, as Californians enjoyed their famously pleasant sunny weather, implied heat rates averaged below 4.0. With heat rates that low, the Pacific Northwest and Desert Southwest reduced the power being sent to California. During the summer months, however, the load profile is high enough during the middle of the day that both imports and less expensive natural gas units within California are needed to balance the grid. That means that the impact on gas demand can really swing widely during the day, depending on the season.

There are so many story lines here. I see them as great news for natural gas; the Midcontinent fuel fossil story; and, investors if they pay attention.

I see really, really bad news for utilities if they don't get a handle on this, and hydroelectricity. Nuclear energy in California is already dead.

This spring, as Californians enjoyed their famously pleasant sunny weather, implied heat rates averaged below 4.0. With heat rates that low, the Pacific Northwest and Desert Southwest reduced the power being sent to California. During the summer months, however, the load profile is high enough during the middle of the day that both imports and less expensive natural gas units within California are needed to balance the grid. That means that the impact on gas demand can really swing widely during the day, depending on the season.

There are so many story lines here. I see them as great news for natural gas; the Midcontinent fuel fossil story; and, investors if they pay attention.

I see really, really bad news for utilities if they don't get a handle on this, and hydroelectricity. Nuclear energy in California is already dead.

Labels:

Ducks_California,

Ducks_NG,

Ducks_Solar

Update On Radical Shifts In California's Power And Gas Markets -- RBN Energy -- July 25, 2016

Active rigs:

RBN Energy: great read. Part 2 in this series -- radical shifts in California's power and gas markets.

Llama, Lama Red Pajama

| 7/25/2016 | 07/25/2015 | 07/25/2014 | 07/25/2012 | 07/25/2011 | |

|---|---|---|---|---|---|

| Active Rigs | 32 | 73 | 192 | 208 | 179 |

RBN Energy: great read. Part 2 in this series -- radical shifts in California's power and gas markets.

After averaging more than a nickel below Henry Hub all this year, the California Border natural gas price spiked to 66 cents/MMbtu above Henry on Friday.

This kind of price volatility is no surprise to anyone following the radical shifts in California energy markets, starting five years ago when the state legislature enacted its 33%-by-2020 renewable portfolio standard (RPS) law.

By mid-2015, more than 14,000 MW of new solar and wind power had pulled down gas demand in California to the point that natural gas prices at the SoCal Border were averaging a negative basis to Henry Hub.

Still not satisfied, last year California legislators voted to establish a 50% renewables target for 2030. On top of it all, the West Coast was coming up on a La Niña year that would bring more rain –– and hydroelectric generation –– to the Pacific Northwest and eventually into California. With all that renewable power (solar, wind and hydro),

California seemed headed for an unprecedented period of low gas prices, but it did not turn out to be so simple. In today’s blog, we continue our look at California’s power and gas markets with the events and drivers that shaped late 2015 and the first six-plus months of 2016, and consider what’s to come.

In the first episode of California Sunset we discussed the events that transpired between 2011 and mid-2015 that reshaped the Golden State’s energy markets. Not long after the RPS law was passed, California shut down the nuclear generating plants at San Onofre, regulators expedited the build-out of new transmission lines to move more solar and wind power to market, and the state implemented a carbon cap-and-trade program. The market responded by building new solar projects and wind farms, which displaced the need for gas generation, especially through the middle of most days.It's an incredibly good read; I've archived it. This episode ends with this:

Looking at the longer term, there are a lot of moving parts that will impact the displacement of natural gas in the West, specifically California.

To comply with the updated RPS goals of 50% renewable-sourced generation by 2030 mentioned above, solar capacity will need to continue to grow by roughly 2,000 MW/y, with behind-the-meter rooftop solar growing by roughly 500 MW/y.

The rule of thumb for solar output across the heavy load hours is to use a 50% capacity factor (heavy load average output/capacity), which would imply a year-on-year increase of 1,250 MWa (2,000+500)/2). Using the same conversion mentioned above of 0.15 Bcf per 1,000 MW, that is an incremental annual decline of 0.187 Bcf/d.

So over the next 10 years, at that rate the California market will reduce its need for gas by almost 2.0 Bcf/d.

Consequently, by 2026 environmentally minded Californians should achieve some of the goals of the state’s aggressive RPS. What’s more, their ambitious renewables program has shifted the entire landscape for West Coast gas as all of that displaced gas will likely be backed up into the Desert Southwest/West Texas, Midcontinent and the Pacific Northwest/Canada. As RBN regulars are familiar, such profound changes in one energy market can cascade through others like falling dominoes, leading to unintended consequences.

*********************************

Too Good Not To Post

Reading To Georgie

True Love

I'm not sure what book Sophia is reading to Georgie, but I do see that Sophia has her favorite book to her right: Llama, Lama Red Pajama.

Labels:

Bakken101,

NotesToTheGranddaughters

CLR Reports Its Record Well In The Meramec, STACK -- July 25, 2016

Updates

Later, 6:49 a.m. Central Time: I misread the CLR press release. A reader noted it (see first comment). The original post has been updated to reflect my mistake. I hope I got it right this time. A big "thank you" to the reader for catching this. I highlighted the pertinent changes in bold.

Original Post

On July 19, 2016, Devon reported its record Meramec well in STACK:

In the overpressured oil window in southwest Kingfisher County, the Pony Express 27-1H well, drilled with a 5,000-ft lateral, recorded a 30-day average rate of 2,100 boe/d, 70% oil.I suppose, 0.7 x 2,100 = 44,000 bbls of oil / over the first month (30 days). EOG, others have reported similar wells in the Bakken but generally it seems the better Bakken wells are running 12,000 to 20,000 bbls oil / month in the first two or three months of production.

Now CLR is reporting its record Meramec well in STACK (I assume the story / link will disappear over time). On May 17, 2016, CLR announced

.... the completion of an industry record well in the over-pressured oil window of Oklahoma's STACK play. The Verona 1-23-14XH flowed at an initial 24-hour test rate of 3,339 barrels of oil equivalent per day, comprised of 2,345 barrels of oil, or 70% of production, and 6.0 million cubic feet of 1,370-Btu natural gas (British thermal units). The Verona is producing from the Meramec reservoir through a 9,700-foot lateral at a flowing casing pressure of approximately 2,400 psi, on a 34/64-inch choke.Note:

- the Devon well was a short lateral, a 5,000-ft lateral: 2,100 boepd over 30 days, first month

- the CLR well was a long lateral, a 9,700-ft lateral: 3,339 boepd -- 24-hour IP rate

Interestingly enough, going back to the press release, it turns out CLR actually reports the cost of this well:

"The Verona is another example of the exceptional results we are getting from wells drilled in the over-pressured oil window of STACK," said Harold Hamm, Chairman and Chief Executive Officer. "We couldn't be more pleased with the performance of our wells in STACK and the addition of this outstanding asset to our portfolio. Our STACK team also completed the Verona at a cost of approximately $9.0 million, which is $500,000 less than our year-end 2016 target cost for two-mile lateral wells in the over-pressured oil window. This is the Company's lowest cost completion in STACK to date."

The Verona is the Company's ninth well completed in the over-pressured oil window of STACK, and all have been strong producers. The Company is in the process of completing four additional Meramec wells. Continental currently has 11 operated rigs drilling in STACK, with six targeting the Meramec zone and five targeting the Woodford zone.

Located in Blaine County, Oklahoma, the Verona is immediately east of the Company's Ludwig unit, where Continental is currently drilling an eight-well density pilot, its first in the STACK play. The density pilot consists of seven new wells in the Upper and Middle Meramec reservoirs, as well as an additional well in the Woodford reservoir underlying the Meramec. Results from the Ludwig density pilot are expected to be announced by the Company's third quarter 2016 earnings release.

As announced earlier in the month, at March 31, 2016 Continental had approximately 171,000 net acres of leasehold in the STACK play, 95% of which is in the over-pressured window.The "thing" that might be most surprising regarding this story. I follow the "Bakken revolution" pretty closely. I follow CLR pretty closely. I follow Filloon pretty closely. I get a lot of input from readers. And here it is, July 25, 2016, and this press release is dated May 17, 2016, and I didn't see it until now. And I just stumbled upon it.

This tells me one thing: folks have become so "numb" or so accustomed to record wells in tight US plays they no longer get headlines. Unfortunately, one wonders if Wall Street analysts / experts are missing these stories, also. Whatever.

Labels:

Records,

Staggering

Subscribe to:

Comments (Atom)