Locator: 48672MOVIE.

The Coen Brothers film rankings.

Ethan Coen (by himself) and Honey Don't -- opens in theaters August 22, 2025; trailer here:

************************************

Iran: From July, 2025 -- The Next Decade

We're going to be overwhelmed by YouTube videos on this subject for the next year. Right, wrong, indifferent. Whether one agrees or disagrees with Trump's policies, these videos are going to be ubiquitous over the next well months. Victor Davis Hanson will probably have the best analysis.

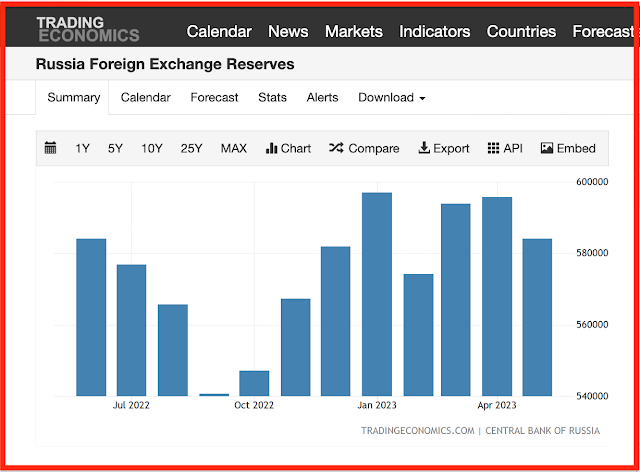

How "the" war in Iran will completely cripple Russia. Link here.

Reminder:

Seven US B-2 bombers were used to strike Iranian nuclear facilities as part of Operation Midnight Hammer.

These bombers were tasked with delivering GBU-57 MOP bunker-busting bombs. The operation targeted the Fordow and Natanz nuclear enrichment facilities.

The U.S. Air Force has 19 B-2 Spirit stealth bombers in service. Initially, the U.S. had 21, but one was lost in a 2008 crash and another in 2022.In the operation against Iranian nuclear facilities, US B-2 bombers dropped a total of 14 GBU-57 "bunker buster" bombs. These bombs were used to target the Fordow enrichment facility and a second nuclear site. The operation, named "Midnight Hammer," also involved other precision-guided weapons like Tomahawk cruise missiles launched from submarines.

The Russian void in Iran will be filled by ... not China ... but Turkey, the US, and Saudi Arabia.

We're going to get a lot of "propaganda" that China will step in to fill the void (they won't). We will also get a lot of "propaganda" that Turkey will step in to fill the void. That's partly true, but Saudi Arabia and the US will be watching closely. The economic potential in the Mideast following the 35-minute US war on Iran will be huge for those countries rushing to fill the void left by Russia, and each will want a piece of that economic pie. My hunch: Saudi Arabia is most "needful" of that potential and won't let China step on the Muslims.

The Hormuz Strait:

- I generally disregard any analyst who raises this canard: Iran can shut down the Hormuz Strait.Fact: the Hormuz Strait has never been shut down and never will be by Iran.

- If, if, if, if --- the Hormuz Strait is shut down, "we" have bigger problems than oil in the Mideast.

- any media outlet, particularly CNBC, that talks about the risk of the strait closing tells me that CNBC is not serious on this issue.