Opening comment: we're going to start seeing stories today and for the next ten days about how brilliant the Pelosi visit was and how brilliantly the Biden-Pelosi team played China

- good cop, bad cop

- Biden said he did not support Pelosi's visit; reiterated the "one China policy"

- Pelosi: said the US fully supports Taiwan's independence; the EU said they would defend Taiwan if attacked;

- China unable to "really" respond in any way

- the West saw how China was able to respond: pretty much no response whatsoever

- the "paper tiger" -- again

- Jim Cramer completely wrong on his Pelosi-China analysis

- I find it incredible that this was the first such trip in 25 years -- with one of our most steadfast allies in the region; and, one of our most important trading partners.

This is will show Taiwan what China can do, link here:

China will quietly reverse this ban next month.

MPC: earnings surge.

Chesapeake Energy: will exit Eagle Ford; link here.

- hard pivot to natural gas

- and Eagle Ford was gassy

Coal: demand setting records. EIA

- global coal demand will rise 8 billion tonnes in 2022 (that's this year)

- will match the 2013 all-time high;

- 2023: demand will increase again, albeit not by much

Markets: the train has left the station.

- despite all the hawkish comments coming from Fed members

********************************

Back to the Bakken

Far Side: link here.

WTI: $96.03.

- as predicted, price starts rising as soon as Pelosi's plane departs Taiwan

- is anyone paying attention? I predicted OPEC+ would raise their quota by 250,000 bbls crude oil per day (a drop in the bucket)

- in fact, it appears OPEC+ will raise the quote by 100,000 bbls crude oil per day

Natural gas: $7.741

Active rigs: 46 or thereabouts.

Friday, August 5, 2022: 4 for the month, 35 for the quarter, 374 for the year

- 37008, conf, CLR, LCU Reckitt Federal 4-22H,

Thursday, August 4, 2022: 3 for the month, 34 for the quarter, 373 for the year

- 38170, conf, CLR, LCU Foster Federal 7-28H,

Wednesday, August 3, 2022: 2 for the month, 33 for the quarter, 372 for the year

RBN Energy: will the US deliver what the world needs?

U.S. exports of crude oil, LNG, NGLs and refined products have moved

into the spotlight on the world stage. Within the past few years, global

markets have come to rely on U.S.-sourced hydrocarbons to meet critical

needs for energy supplies. But export volume growth has slowed. Demand

in the U.S. is ramping up, leaving less available for shipment overseas.

And some members of Congress are encouraging the Biden administration

to curtail or even ban some exports. What’s next for U.S. hydrocarbon

sales to international markets? Will U.S. exports be there to challenge

Russia’s use of oil and gas as political weapons? Or could market,

logistical and political forces disrupt the flows that are meeting

energy needs of the world? Today, we preview the deep dive into these

issues on the agenda at RBN’s upcoming xPortCon conference.

For the archives:

Over the past decade, the Shale Revolution vaulted the U.S. into the

role of a major exporter of crude oil, petroleum products, natural gas

and NGLs. And the world came to depend on those exports to balance the

global supply/demand equation. Then a combination of COVID, producer

discipline and infrastructure capacity constraints slowed the growth of

those supplies just as demand for U.S. exports was skyrocketing due to

the combined impact of Russia’s invasion of Ukraine, the West’s

sanctions on Russia and a steadily progressing pandemic recovery.

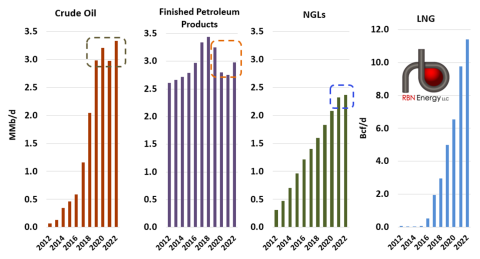

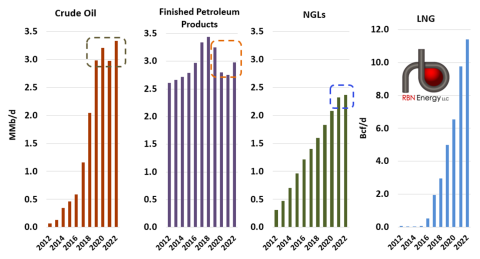

Figure 1 details what has happened to U.S. energy exports in recent

years. Crude oil exports (red bar chart to left) soared from 0.5 MMb/d

in 2015 (before the crude oil export ban to countries other than Canada

was lifted) to 3.0 MMb/d in 2019, but then growth ground to a halt. As

shown in the dashed gray box in that chart, crude exports have stayed

within a narrow range ever since, mostly due to the COVID-induced

production decline and ongoing producer discipline constraints.

Figure 1. Crude, Products, NGLs and LNG Exports (2022 year-to-date May). Source: EIA

Much more at the link.