Locator: 48486B.

The dip: we've seen this story reported several places, so it must be accurate.

Investors bought the dip: Retail investors conditioned by the "buy the dip" mantra have put their money to use once again during the recent stock market woes, with the FOMO trade rearing its head amid the panic selling as investors poured $50 billion into the stock market — the largest amount this year. And while the stock market is still bruised by both results and expectations from the tariffs, as Deutsche Bank's Bankim Chadha told us, "risk appetite is still alive."

See "my favorite chart," posted last night. I find that data simply amazing.

Big tech, US pledge, link here.

China, first quarter growth -- 1Q25 -- tops expectations. Remember: economic growth is an energy story.

************************************

Back to the Bakken

WTI: $61.83.

New wells:

- Thursday, April 17, 2025: 68 for the month, 68 for the quarter, 275 for the year,

- 41172, conf, CLR, Helen 3-8H1,

- 41171, conf, CLR, Kenneth 2-17H1,

- 40959, conf, CLR, Rutledge 5-11H,

- 40741, conf, Kraken Operating, Triangle South 12-1 10H,

- 39037, conf, Grayson Mill, Orville 4-9 5H,

- Wednesday, April 16, 2025: 63 for the month, 63 for the quarter, 270 for the year,

- 41170, conf, CLR, Helen 2-8HSL,

- 40977, conf, CLR, Entzel5-14H,

- 40740, conf, Kraken, Triangle South LE 11-1 11H,

- 40735, conf, Kraken, Steen 13-24 5H,

- 40700, conf, Hess, EN-Keisel-155-94-1918-10,

- 40666, conf, Grayson Mill, Scott 13-24 XW 1HR,

RBN Energy: gas prices at Permian's Waha hub roar higher, devastating shorts. Archived.

What happens when almost everybody is on the same side of a trade and

the fundamentals flip? Yup, max pain. Everyone races for the exits at

the same time, sending the market into speculative liquidation mode and

causing cascading losses. It can get frantic and ugly — tens or even

hundreds of millions of dollars are at stake, and no one’s sure how bad

things might get. As we discuss in today’s RBN blog, frantic and ugly is

precisely what happened over the last few days at the Waha natural gas

trading hub in West Texas.

Just two weeks ago, we posted Already Gone,

where we discussed the implications of Waha prices going negative

again, months before the market expected that to happen. Many factors

were to blame, including faster-than-expected growth in Permian crude

oil and associated gas production, pipeline maintenance, and constrained

flows on the new Matterhorn Express pipeline, each putting downward

pressure on Waha prices.

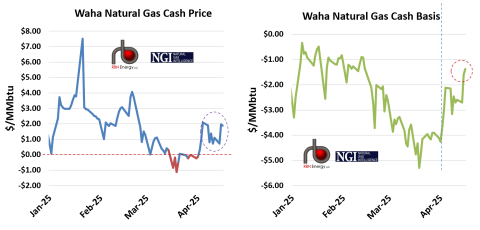

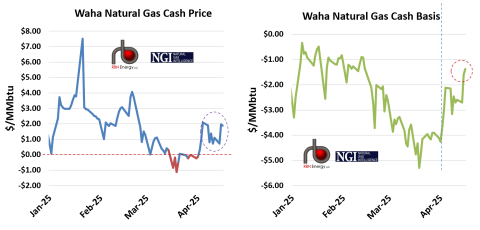

But no sooner than the pixels had dried on that blog, gas prices made

a U-turn, went positive and ramped higher during the first half of

April. And it wasn’t just spot (aka cash) prices (left graph in Figure 1

below) and cash basis (right graph) that increased — the forward curve

for all of 2025 shifted markedly higher too, as did the curve for 2026.

(More on that in a moment.) The move has turned into what some have

described as a market rout in financial basis futures, severely

punishing hedgers and traders caught on the wrong side of the market.

Figure 1. Waha Natural Gas Cash Price and Cash Basis. Sources: RBN, NGI

Note: Vertical dashed line in right graph indicates April 1.

Before talking about why it happened, let’s consider what happened. Permian producers use Waha basis futures to hedge

their production — the basis being simply the difference between the

price at Waha and the price at Henry Hub. They sell basis futures on the

forward curve to protect their bottom line against adverse price moves,

which, as we know, are common at Waha. Traders, in turn, speculate

on Waha futures to bet on how prices will move. Put simply, they buy

(go long) when they think the price is going up, and sell (go short)

when they think the price is going down. Trader strategies are usually

much more sophisticated than that, with deals more common across the

calendar and against other hub prices. But the main point is that

traders’ futures trades are bets on price direction.