Locator: 48338ARCHIVES.

Market: wow, dividends and bonds that are already part of one's portfolio are looking really, really good.

Mideast: let's start the countdown --

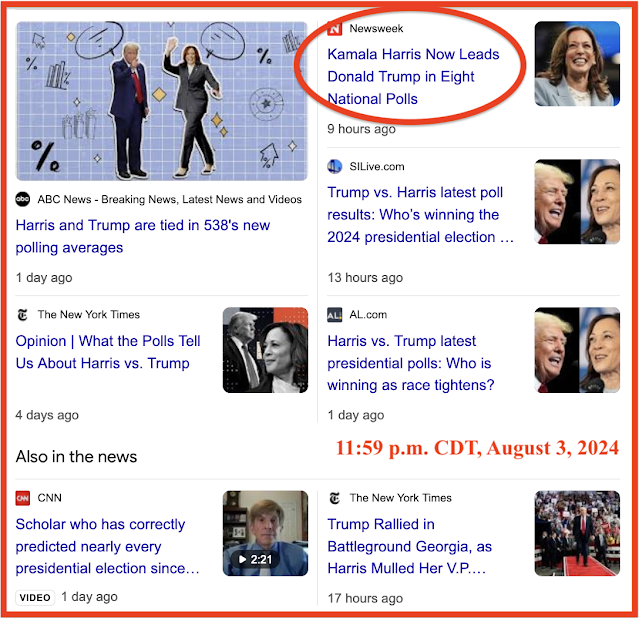

- Friday, August 2, 2024: nothing

- Saturday, August 3, 2024: nothing

- Sunday, August 4, 2204: folks said "tonight" would be the night; nothing

- Monday, August 5, 2024: Trump says "tonight" will be the night.

Mideast: the only thing I'm tracking today -- "Mideast" over at twitter.

Trump says Israel will attack Iran tonight. Remember the time difference. "Tonight" in the Mideast means prime time television in this time zone (US central daylight time).

What does Iran have to lose if it persists in a regional war? A loss of its nuclear "weapon" sites. Israel is looking at an excuse / reason to take them out. A small response to Hezbollah / Hamas will not suffice, but an attack by Iran itself opens the doors for bigger targets for Israel.

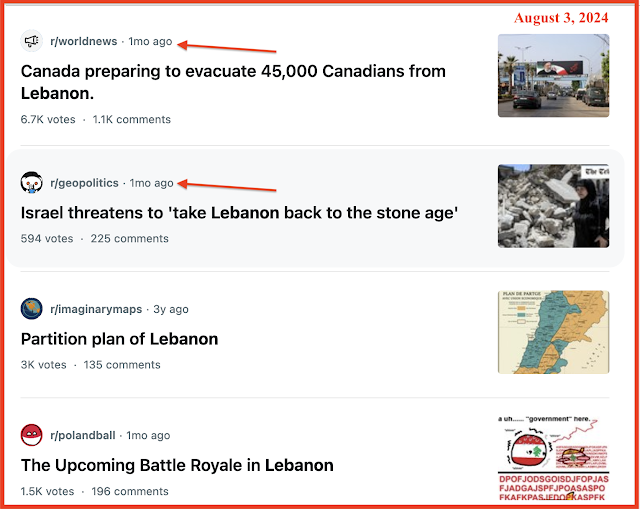

Mideast: link here. Since this is not even a "thing" -- if one looks at the map there is no way Iran would fly over Saudi Arabia to attack Israel.

Iran shares no border with Israel, nor does Saudi Arabia.

To attack Israel, Iran would have to fly over a) Turkey (unlikely); b) Syria; c) Jordan (unlikely); Iraq (unlikely).

So if Iran can't even entertain flying over Saudi Arabia to attack Israel, what is Prince MSB really saying?

The Prince is saying it loud and clear: Saudi Arabia is not going to get engaged in a regional war. Saudi is not about to risk its oil over an Iranian mis-step.

AI revolution: more evidence today that the folks who suggest "AI" is a "bubble" do not understand what's going on. One can start here. Or here.

MLB app: I'm not going to provide the specifics quite yet, but "the MLB" has just got a new subscriber. Me.

Someone sent me tickers for a Texas Rangers game this week, and to get them, I needed to download the MLB app. Which I did. Thirty seconds while visiting Chipotle with Sophia, see below.

Downloaded the app on a lousy internet connection: no problem. And the tickets showed up. Small miracle. All the person had to know to send me tickets was my e-mail address. And my e-mail address for that app is attached to the IP of my mobile device and the risk of nefarious activity trends toward zero.

The market: link to The WSJ.

No worries from me. I'm taking all available cash and buying as fast as I can. Well, methodically and according to rule. The best news. Monthly dividends for August have yet to flow. For example, Apple / AAPL will pay August 15th. Whoo-hoo. Hopefully market doesn't recover until October. September is the big month for dividends, plus other mailbox money.

The last big opportunity to buy AAPL: when it sunk to $160.

See disclaimers for the blog.

This is not 1987. Or 2000. Link to The WSJ.

****************************

On Inflation And Fast Food Restaurants

Counter-intuitive: my nephew and I went out for Texas BBQ yesterday, Sunday. He mentioned he had been listening to a personal finance/investing podcast last week in which the analyst suggested that McDonald's low sales were due to the "Ozempic effect."

I doubted that Ozempic has anything to do with McDonald's low sales. First of all, Ozempic has not yet entered the mainstream to even begin to effect McDonald's. That may happen, but it will take awhile. Second, I'm not even convinced that the demographic group that is currently taking Ozempic is even going to McDonald's in the first place.

McDonald's sales, if they are down, are down because of the (perceived) high price for their entrees. Folks are cutting back on their visits to McDonald's because of their high prices. My nephew mentioned that McDonald's is now costing him upwards of $12 / meal for each of his eight-year-old twins.

Today, after "Tubular Camp," Sophia wanted to go to Chipotle, her favorite restaurant, by far. Nothing else comes close. I seldom go to Chipotle -- the servings are way too big for me. But if Sophia asks, I will take her to Chipotle. Today we invited her grandmother, May. I did not order anything but had a couple bites of the Chipotle salad that my wife ordered. Wow, it was incredible.

Sophia's burrito was too big -- as usual -- to finish in one setting. So, she had half of it there, and then took the other half home to enjoy later.

The Chipotle entre -- a burrito, a bowl, a salad -- all run about $9. My nephew mentioned that a McDonald's meal was trending toward $12 in the Minneapolis area. The most expensive item at McDonald's on a per serving basis? French fries. Chipotle: doesn't have French fries.

So, first observation with regard to McDonald's low sales. If you are a single, young, working adult going out to lunch, do you choose McDonald's where the perceived price for a meal is trending toward $12 or to Chipotle where an entree is about $9. Even if the prices for the lunch are about the same, where is that single, young, working adult likely to go?

The real question is this: if prices are really high, because of inflation, if you are going to pay "up," that is pay more because of inflation, are you going to pay "up" for mediocre fare or pay "up" for great fare? Are you willing to pay the same inflated price for McDonald's as you would for Chipotle?

Now, the second observation. Prices are high or "inflated" mostly due to what? It's my understanding the main reason for "inflated" fast food prices is due to wages. Wage inflation.

Wages aren't going to come down, and fast-food prices aren't going to come down. What could a fast food restaurant do to encourage customers: offer a "better" product for the same price! What a concept. Domino's can improve their product so many ways without adding anything (or at least not much) to the cost. After all, the "inflated" price of the pizza is due to wages. A 13"-pizza will cost the Domino's franchise almost nothing more than a 12"-pizza (or whatever the the current size is).

Across the board, Chili's, McDonald's, Wendy's, Domino's need to improve their products and advertise that improvement -- it's the wages that are said to be driving the inflated prices, not the ingredients.

My hunch:

- a) people will "pay up" for a Chipotle's; they won't "pay up" for a McDonald's.

- b) we should see "better" choices across the board at fast food restaurants, and "better" can come in many, many different ways.

McDonald's big problem: they really can't do much to change the perception of the quality of their product. The only way they can improve their product: lower the price.

Domino's: advertise a slightly "better" product than what the competition is serving, and keep the price the same. Because it's all about wage inflation, a slightly "better" product is not the problem.

************************

On Reading

I'm having a blast this summer getting back into my reading routine.

Currently reading:

- Jackie Kennedy (second book on Jackie K in past few months)

- Camera Girl: The Coming of Age of Jackie Bouvier Kennedy, Carl Sferrazza Anthony, c. 2023. Amazon.

- Jackie: Public, Private, Secret, J. Randy Taraborrelli, c. 2023.

- The Naked and the Dead, Norman Mailer

- A Walk on the Wild Side -- Nelson Algren

- Homer: Iliad (now that I'm older, I think the Iliad is a "better" book than the Odyssey

- The Greek playwrights: ASE (Aeschylus, Sophocles, and Euripides)

- native American history (two books)

I'm absolutely convinced that reading age-appropriate books on the following for the grandsons, age five to twelve, would be superb:

- the Bible (already being accomplished by the parents)

- Homer

- Shakespeare

By high school, I would add:

- Memoirs of US Grant

- Socrates, Plato, and, Aristotle (SPA)

- the Greek playwrights (ASE)

Literature:

- Catcher in the Rye

- The Great Gatsby

Fine art:

Architecture:

I'm struggling with coming up with a good book of the American Revolution. The ones I have are too detailed, don't have quite the flavor I'm looking for.

I'm also looking for a good book on chess. Not one about all the moves, per se, but more of history and philosophy of the game. Hard to articulate. Possibly this one.

****************************

Teaching Reading

Three most important things when teaching children almost any subject:

- consistently and continually put things in context;

- the art of scaffolding; and,

- the techniques of speed reading.

Spaceholder