The word for the day:

abatis.

I mentioned earlier I was in my US Civil War / US Grant phase. See this post. My notes on US Grant are in progress at this post.

It was in James Marshall-Cornall's biography that I came across the word abatis, along with glacis. The latter, glacis, has nothing in common with glassy as far as etymology is concerned, but there is a sort of family resemblance. LOL.

Whatever.

I wasn't going to post this except that it bothers me that it appears that Victor Davis Hanson has joined the "woke" crowd. I've haven't read any of his stuff in a long time -- perhaps the last time I paid much attention to him was pre-Covid when I would sit for hours at Starbucks. But since then, not much interest. It was pure serendipity that his article appeared in the most recent issue of The Claremont Review of Books when I was reading about US Grant and putting that story together.

It all began with my short -- very short -- visit to Shiloh, TN, last month, a truly life-altering event for me.

Internet sources suggest "the Shiloh battlefield" was 5.8 miles square and/or 9,324 acres. The numbers don't work; different sources, but be that as it may, prior to the battle Grant was anticipating as many as 100,000 Union soldiers (James Marshall-Cornall), although fewer than that actually fought. A smaller but similar number of Confederates were expected; about 45,000.

It is impossible to imagine that many men (and hangers on) in an area that would be about six sections in size. And then the logistics: the food required to feed this army; the liquor required; and, finally, the number of port-a-potties that would have been required. Many arrived by steamer coming down the Tennessee ... just the disembarking of tens of thousands of troops would have been mind-boggling.

************************************

Global Warming

I wouldn't have bothered with posting this story but I have such fond memories of Yorkshire, how could I not post this for the archives for my grandchildren.

If I had all the money in the world, I would have a house in Yorkshire.

Here's the headline: snowstorm strands 61 in pub in Yorkshire, England, for third night, plenty of beer available. You will have to google the story. Google blogger app blocks this site from being linked.

From the article:

- Tan Hill Inn

- Yorkshire Dales

- three feet of snow "overnight"

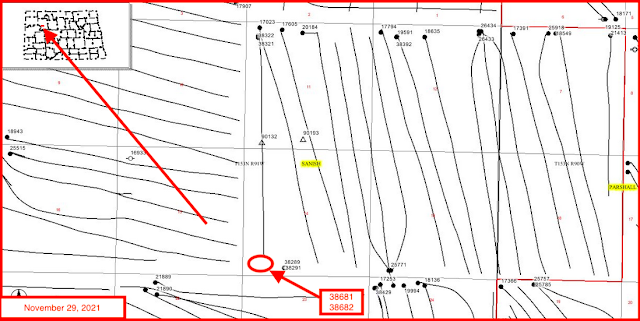

So, now, the map. I was stationed for many months at RAF Menwith Hill, northern Yorkshire, and I often spent weekends walking in the Yorkshire Dales.

The map, and there it is:

- Tan Hill Inn is 90 minutes northwest of Pateley Bridge

- some folks left their heart in San Francisco; I left mine in Pateley Bridge

The Tan Hill Inn website.

From wiki:

Tan Hill is a high point on the Pennine Way in the Richmondshire district of North Yorkshire, England. It lies north of Keld in the civil parish of Muker, near the borders of County Durham and Cumbria, and close to the northern boundary of the Yorkshire Dales National Park. It is in an isolated location, the nearest town of Kirkby Stephen being an 11-mile drive away.

The Tan Hill Inn is the highest inn in the British Isles at 1,732 feet above sea level.

********************************

The NFL Is Back!

LOL.

Several months (?) ago I mentioned on the blog how brilliant Amazon was to "steal" the rights to Thursday Night Football from Fox Sports. So, how did that work out. Here are the headlines, from The TV Ratings Guide:

- November 26, 2021: Thursday TV ratings 11/25/21: NFL dominates Thanksgiving; top shows in prime time:

- NFL Overrun, CBS

- Football Night In America: NBC

- NFL: Bills vs Saints: NBC

- November 18, 2021: Thursday Cable Rating 11/18/21: Rising NFL Leads

And then this, from SportsNaut:

- Week 12: November 29, 2021: Raiders, Cowboys Thanksgiving OT thriller draws historic NFL audience numbers -- this was a Thursday game. LOL. Historic NFL audience numbers.

- NFL TV rating: CBS draws 38.3 million for Thanksgiving broadcast

- A Thanksgiving matchup between the Dallas Cowboys and Las Vegas Raiders

delivered what will go down as one of the most-watched games in NFL

history. CBS estimates it averaged 38.53 million viewers for its

Thursday broadcast of the Raiders and Cowboys overtime thriller, the

largest audience for a regular-season game since 41.47 million watched

the New York Giants vs. San Francisco 49ers.

- Week 11: Dallas Cowboys vs Kansas City Chiefs had everyone watching;

- TNF: 13.52 million; 7.7 rating

- Fox Game of the week: 28.06 million; 14.4 rating

- Early Fox game: 17.28 million; 9.15 rating

- SNF: 14.55 million; 8.05 rating

- MNF: TBD, tonight

- Week 10:

- TNF: 12.92 million; 7.4 rating; third behind SNF (16.74 million) and Fox Game of the Week (17.58)

- Week 9: a 3% bump from the 2020 NFL season

- Week 8: TNF -- with 20.26 million viewers, only behind SNF with 21.29 million viewers; MNF far behind with 13.92 million viewers

- Week 7: TNF -- a weak matchup but "the TV ratings will leave the NFL and its broadcast partners very pleased." Viewership for TNF week 7 marked a 26% increase from 2020 week 7 TNF;

We'll quit there but that tells me everything I need to know.

**********************************

Special Crust Stuffing

From PowerLine, Saturday, November 27, 2021: