Tuesday, April 5, 2022

South Dakota Attorney General -- Update -- April 5, 2022

Updates

April 6, 2022: to say I'm disappointed in the Republican Party with regard to this issue would be an understatement. The Republicans aren't even showing up for presentations by the South Dakota Highway Patrol with their analysis.

This issue, along with a few others, has resulted in me turning in my Republican Party affiliation. I now self-identify as an independent and it won't take many more wedge issues to self-identify as a Democrat.

Original Post

KFYR-TV, yesterday, April 4, 2022:

South Dakota Attorney General Jason Ravnsborg twice caused police officers to hit their brakes to avoid his errant driving in the months before he struck and killed a pedestrian in 2020.

The Highway Patrol’s scrutiny of the attorney general’s driving record is coming to light ahead of the House meeting next week. Lawmakers will consider a majority report from a Republican-controlled impeachment investigation committee that recommended he not be impeached.

However, Gov. Kristi Noem is pushing for Ravnsborg’s ouster. The Highway Patrol is offering a public briefing for lawmakers on Wednesday, tomorrow, April 6, 2022.

Sioux Falls Argus Leader, today, April 5, 2022:

Republicans are lining up on opposite sides ahead of next week as they prepare to weigh whether Attorney General Jason Ravnsborg should be impeached for his role in the crash that killed 55-year-old Joseph Boever in 2020.

On one side, there's Republicans on the House Select Committee on Investigation, who reviewed the investigation and voted not to recommend impeachment.

This would be another wedge issue for me. From the linked article:

Ravsnborg was convicted of a pair of traffic violations after he struck and killed Boever on the night of Sept. 12, 2020, while traveling from a political function in Redfield to his home in Pierre. Ravnsborg initially reported to a 911 dispatcher that he did not know what he'd struck. He did not report the discovery of Boever's body until the following morning, when he had returned to Highmore in a vehicle he was loaned the night prior.

Two New Permits; Two DUCs Reported As Completed; Active Rigs Creeping Up In Number -- Now 36 -- April 5, 2022

Active rigs:

| $101.50 | 4/5/2022 | 04/05/2021 | 04/05/2020 | 04/05/2019 | 04/05/2018 |

|---|---|---|---|---|---|

| Active Rigs | 36 | 12 | 44 | 62 | 58 |

Two new permits, #38868 - #38869, inclusive:

- Operator: Lime Rock Resources

- Field: Murphy Creek (Dunn County)

- Comments:

- Lime Rock Resources has permits for two wells in NENW 4-143-95;

- to be sited 624 FNL and 1512 FWL; and, 612 FNL and 1550 FWL;

Two producing wells (DUCs) reported as completed:

- the two new DUCs reported today

- 35192, 2,920, XTO, Zane Federal 21X-6B, Siverston, 15 days of production, 30K

- 35190, 2,732, XTO, Zane Federal 21X-6AXD, Siverston, 15 days of production, 27K

- six sites on this pad; one location canceled; others:

- 35188, drl/NCW, XTO, Hoffman 21X-6BXC, Siverston, no production data,

- 35189,

- 35199,

- another six-well pad in same section, just to the east:

- 32619, IA/150, XTO, Johnson 31X-6FXG, Siverston, 10/16; cum 245K 10/21;

- 32151, 186, XTO, Johnson 31-6HXE, Siverston, 11/16; cum 292K 10/21;

- 31597, IA/122, XTO, Johnson 31X-6D, Siverston, 11/16; cum 267K 10/21;

- 19890, IA/884, XTO, Johnson 31-6SWH, Siverston, 5/11; cum 346K 10/21;

- 31609, IA/156, XTO, Johnson 31X-6G, Siverston, 5/11; cum 182K 10/21;

- 31596, IA/287, XTO, Johnson 31X-6CXD, Siverston, 11/6; cum 242K 10/21;

- other wells of interest:

- 19305, off line since 10/21; 2,640, XTO, Hoffman 149-98-1-12-1H, Sivderston, t4/11; cum 344K 10/21; typical Bakken well, but did demonstrate a moderate halo effect back in early 2015. Halo effect probably due to #28311 completed in early 2015, drilled from the south, in the opposite direction and parallel to #19305. Lateral distance between the two horizontals: 0.2 miles or 1,056 feet.

The Energy Transition Is Dead -- More Corroboration -- April 5, 2022

The energy transition is dead. Tracked here.

Europe's natural gas bridge to energy transition is [has] crumbled: S&P Global report.

By the way, when we did start calling it "energy transition"? The wiki entry. The wiki entry reads like an op-ed rather than "science."

An example of transition toward sustainable energy is the shift by Germany (Energiewende) and Switzerland, to decentralized renewable energy, and energy efficiency. Although so far these shifts have been replacing nuclear energy, their declared goal was the coal phase-out, reducing non-renewable energy sources and the creation of an energy system based on 60% renewable energy by 2050.

Wiki is going to have update this entry now that Europe is return to coal and natural gas. But one things I've learned about wiki, once it becomes an "op-ed" it is never updated to reflect reality. Exhibit A: "Bakken revolution. By the way, if you do that google search, themilliondollarway shows up as the thrid hit. Whoo-hoo.

Of the gazillion sites talking about the "Bakken revolution," this blog shows up as the number 3 hit, although it is a sub-file for the #2 hit. Whoo-hoo!

Energiewende translates to "failed energy policies."

The pipeline: "They" keep talking about the Keystone XL. By the time they quit talking about the Keystone XL it would have been completed. Just an observation.

Investment Observations -- April 5, 2022

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

ATT: why the Warner Bros. Discovery merger is the "most exciting" story in streaming. Link here.

"This is going to be the most exciting story in the sector for the next few years," Jessica Reif, research analyst at Bank of America, confidently told Yahoo Finance.

The telecom giant revealed it will issue a special dividend to shareholders on April 5 when they can decide whether to own just AT&T, the soon-to-be Warner Bros. Discovery, or both.

AT&T's WarnerMedia will represent 71% of Warner Bros. Discover, and its shareholders will receive an estimated 0.24 shares of the new joint venture for each share of AT&T that they own once the transaction closes.

WarnerBros. Discovery, which is set to trade on the Nasdaq (^IXIC) under the ticker symbol "WBD," will be run by Discovery CEO David Zaslav, with Discovery CFO Gunnar Wiedenfels serving as the new company's CFO.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

JNJ. From thelegalexaminer -- "those suing JNJ... found themselves frustrated again. After separating into two companies, JNJ's subsidiary LTL Management can procced with its bankruptcy filing. -- March 15, 2022. That was just three weeks ago. The US Supreme Court won't take up this case. Judge Michael B. Kaplan is the US Bankruptcy Judge for the District of New Jersey. Wiki entry for US Bankruptcy Court. It looks like this is where the buck stops.

Under a Texas law, commonly known as the “Texas Two-Step,” Johnson & Johnson separated the company and created LTL Management. After its creation, Johnson & Johnson assigned legal liability for baby powder lawsuits to LTL Management. This business was then moved to North Carolina, where it declared bankruptcy. Filing for bankruptcy paused all lawsuits against LTL. Some of these baby powder lawsuits are sitting before the court in jury trials close to verdicts.

Bankruptcy pauses litigation. At NPR.Meanwhile, the other split-to-be remains on track, apparently. JNJ to become two companies: consumer health -- all the stuff you see at Target; and, biotech and medical technology -- all the stuff used and seen in health care facilities. No name for new company yet. Let's call them JNJConsumer an JNJBiotech.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

UNP: shares continue to fall. No specific news. Rails are going to move record amounts of "everything" except perhaps cars.

- US soybean 2022 - 2023 output expected at record-breaking 125 million metric tons.

- sizeable shift from corn

- fertilizer price spike playing a major role in transition

- 2021 - 2022 output ran about 120 million metric tons

- North Dakota, coming in at #9, makes the top 10;

RMDs: this may catch some folks off-guard.

All non-spouse inherited IRAs must be depleted within ten years after the death of the original owner (some very limited exceptions). This does not affect me but it does affect a member of the family. The family member was completely unaware of this new law and the original owner died nine years ago. The very small RMDs will still result in a huge IRA when the tenth anniversary is reached next year. Interestingly enough, this was missed by the individual's financial advisor. If you are taking RMDs from an IRA whose original owner died prior to 2020, check the year of the tenth anniversary. Note: I don't have any training or formal education in financial affairs or investment. The new law is very complicated. If this information is important to you go to the original source (the IRS) and/or your financial advisor and at least ask the question.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

Riddle Yourself This? Why Are Automobile Companies Partnering On EVs? April 5, 2022

Riddle yourself this: why are automobile companies partnering on EVs?

Covid lockdown and teenage girls: sad, sad, commentary.

WTI, futures: earlier I mentioned this would be the most interesting oil-related data point to follow for the next few weeks.

Today, 10:31 a.m. CT, April 5, 2022 -- note the "100 shares" traded today for guaranteed delivery in August, 2023 --> up $2.30 and trading at $87.96.

How arbitrage works: we talked about this in more general terms the day the release was announced -- how the SPR release is one big "play on the spread." Link here.

The Biden Surge: tracked here.

OPEC+ fracture: Asian buyers will look for cheaper oil than from Saudi Arabia after recent price hike. Only one other source: Russia? Link here.

Pop Quiz -- The Pipeline Edition -- April 5, 2022

Quick, what was this story published?

a) The Babylon Bee

b) The Onion

c) WSJ

d) nowhere, I made it up

At the same time, White House officials say Mr. Biden has no interest in reviving the Keystone XL pipeline project. They say that it couldn’t be completed in time to address today’s shortfall and that the president is still committed to reducing greenhouse gas emissions from fossil fuels over the long term.

Canada could export some more oil via rail, according to analysts and others familiar with the situation, and it could also pump more oil by increasing pressure on existing lines or by installing larger pipelines along permitted routes.

The Kraken Is Yet To Be Released -- The EU Is In Deep Trouble -- April 5, 2022

Updates

10:27 a.m. CT: yup, it's true. We don't know when and how, but the EU says it will ban coal imports from Russia. Link here.

Original Post

A reader sent this CNBC article: EU to propose ban on Russian coal imports.

My thoughts:

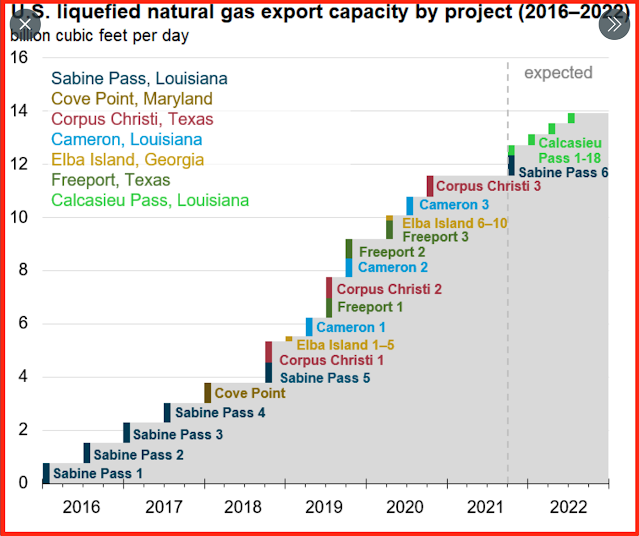

The EU is in deep trouble, but it's starting to make sense why the EU waited so long to announce sanctions on Russian energy.1. First of all, obviously, the EU cannog survive without Russian energy if they don't alternative energy supplies.2. Plan A: the EU was hoping for a short war so they could avoid sanctions altogether.3. Plan B: even while hoping Plan A would work, the EU was working on Plan B -- lining up LNG imports from the US and lining up dry cargo tankers to ship coal from Australia.4. They can now start to talk about sanctions on Russian energy now that they've lined up alternative energy sources.5. They would have liked to have had more time but the photos and videos coming out of Bucha and other cities in Ukraine made it politically and morally impossible not to announce sanctions.6. Expect to see articles next week on armadas of coal moving to Europe. Biden will do everything he can to keep the US from participating in coal exports to Europe. We will see yet more Greta memes.

By the way, this leads credence to the possibility that automobile manufacturing in Germany is due to parts shortages as well as prohibitively high electricity costs.

All of this put together pretty much points to a(n) European recession earlier than later, and that will quickly spread to the US. Generally defined as two consecutive quarters of negative growth in the GDP, a recession won't be official until well after the fact, though we will feel the effects much sooner. Monthly economic reports will allow analysts to "predict" GDP before official numbers come in.

Look for a recession, high energy costs, very expensive gasoline, hurricanes, a BA.4 Covid variant, and a southern surge at the border all hitting about mid-October, 2022, if not sooner.

By the way, isn't October, like, the worse month for stocks in the entire year? That's a rhetorical question.

The kraken is yet to be released.

One may want to start stockpiling non-perishable foods and paper products if one has not already started.

Zeihan Was Right -- RBN Energy; CLR Reports Two Nice Wells: Most Operators Not Able/Willing To Complete Wells At $105-Oil; And So Much More; No Paywall; No Subscription; Disfruta! -- April 5, 2022

First question of the day: how could UNC give up a 15-point lead in mere minutes?

- may have been the biggest comeback in NCAA men's championship basketball history;

Market:

- analyst says "bear market rally" is over; it's all gloom and doom from here;

- if you even bother to read this article, make sure you note the track record of the analyst.

- in pre-market trading, it looks like some profit-taking after a couple of great days on Wall Street -- at least for oil and tech.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

US blocks Russian bond payment:

- complicated;

- $4 billion due April 4, 2022

- 30-daygrace period

- money being blocked: frozen assets in US banks

- also, JPMorgan told to halt activity as go-between

- if US markets (equities) fall today, a major reason will be the US-Russian bond story.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

XOM:

- many questions

- when might it take $4 billion write-off in Russian losses due to sanctions?

- record profit likely to be reported 1Q22; why does stock not reflect that? or does it?

- when will Congress step in? windfall profits tax or something else?

- estimates here:

- EPS: $2.03, up over 200% from prior-year quarter

- revenue: $83 billion; up over 40% from prior-year quarter

- XOM has history of slightly beating estimates

- probably same here unless it writes down Russia losses, although that's really too early

Disclaimer: this is not an

investment site. Do not make any investment, financial, job, career,

travel, or relationship decisions based on what you read here or think

you may have read here.

UNP:

- notable stock price drop over last couple of days

- can't find any specific reason; I assume some analyst downgraded the stock

- buying opportunity?

- three transportation stocks covered by analyst here: Delta, UNP, Ryder;

Disclaimer: this is not an

investment site. Do not make any investment, financial, job, career,

travel, or relationship decisions based on what you read here or think

you may have read here.

JNJ:

- interesting play, but there should be time for investors;

- the split / spin-off shouldn't close for 18 to 24 months;

- liability issues seem to be behind them (?): NPR had story

AMD: huge sell-off over last few days; recovering a bit?

- to buy Pensando -- a Milpitas startup led b Cisco "vets"

- $2 billion; link here.

Biden and the truckers:

- don't even click on this article; all fluff

- incredible that business reporters would write this story as they did

- amazing that Teamsters agreed to the photo-op

- I expected more of Buttigieg; sorely disappointed;

- one hour ago: Barron's -- article on diesel;

- US diesel up 63% in 1Q22 -- would that be unprecedented? Let's take a look:

- at $5.25 / gallon, it appears that diesel set an all-time high

- it's hard to believe but the previous high, June 30, 2008, only had a 4-handle: $4.72

- as low as $2.50 during the Trump years of "drill, baby, drill" -- not that long ago

Airfares:

- expect "spectacularly" higher airfares;

- only question for airlines:

- keep prices "as is" at the front end, but when "checking out" add a fuel surcharge; or,

- simply keep it simple, no surprises, high price at front end when searching for flight?

- northeast is going to be a debacle for those wishing to fly;

- jet fuel for delivery to NYC-area airports hits $6.43 / gallon or $270 / barrel -- a likely spot market record. Link here. When you see it in print, doesn't look like much, but graphically, oh-oh.

ISO NE:

- a paltry 12000 MW demand but still prices in the 5th decile, though still "a shade of green"

- link here;

- wind not helping out much yet this morning (5:01 a.m. April 5, 2022)

Putin's War:

- the atrocities are unbelievable; photos / videos now starting to emerge as Russia pulls back:

- Biden refrains from using the word "genocide"

- unbelievable that the EU continues to fund Putin's War; hasn't put sanctions on Russian energy:

- links everywhere including oilprice;

- the fact that Putin is not being compared to Hitler, at least by many, still boggles the mind;

Renewables can't solve Europe's energy crisis: link here;

- a reader of the Bakken wrote me regularly three to four years ago the same thing that is now being said by "everyone"

- renewables can't even begin to "save" Europe

- and that's why EU has difficulty placing sanctions on Russian energy -- difficulty, perhaps "impossible"

- Greta, take note:

- most recent energy plan for Europe:

- Another 20 billion cubic meters, according to the plan, could be replaced by using more coal, per Industry and Internal Market Commissioner Thierry Breton.

Speaking of coal: great observation by Twain's Mustache --

- 23% of electricity in the US comes from burning coal:

- US GDP per capita last year: $70,000

- meanwhile, there's more than 3 billion people in the world earning $5.50 per day or less

- and Greta is lecturing them for using coal?

- meanwhile, US coal prices top $100 / ton for the first time since 2008

- but 23% of US electricity comes from coal? Wow, that's a quarter of all our electricity -- dependable, dispatchable, predictable

Gasoline demand: interesting phenomenon --

- anecdotal: stations running out of gasoline more frequently, especially in high-density urban areas like New York City:

- the stations are getting the same amount of gasoline but more customers are doing more frequent purchases; trying to avoid sticker shock

- interestingly enough, EIA data still doesn't show the increase in gasoline demand that GasBuddy says is happening;

- we'll get new numbers tomorrow;

More and more taxing jurisdictions cutting fuel taxes:

- stimulating demand? LOL.

OPEC+:

- Russia offering record discounts (~ $32 under Brent); link here;

- Saudi Arabia: raised its selling price for its key Arab Light to the Far East to a premium of $9.35 over Dubai

- I assume Dubai is a proxy for Brent in that part of the world

EV batteries:

- I didn't care for this article one way or the other; would not have posted it but it has a summary of those companies that "provide" EV charging stations;

- look at the list and tell me who's going to win this game; that's a rhetorical question; don't reply;

- one can also see where money can be made in mergers;

- winners will be those with deep pockets; here is the list provided at the linked article:

- ABB (ABB)

- Blink Charging (BLNK)

- BP (BP)

- ChargePoint (CHPT)

- Chevron (CVX)

- COP

- EVBox (TPGY)

- XOM

- Phillips 66 (PSX)

- Royal Dutch Shell (SHEL)

- Sunoco (SUN)

- Total Energies (TTE)

- Valero (VLO)

***********************************

Back to the Bakken

Active rigs:

| $104.30 | 4/5/2022 | 04/05/2021 | 04/05/2020 | 04/05/2019 | 04/05/2018 |

|---|---|---|---|---|---|

| Active Rigs | 35 | 12 | 44 | 62 | 58 |

Tuesday, April 5, 2022: 10 for the month, 10 for the quarter, 169 for the year

- 38517, conf, CLR, Thorp Federal 7-28H1, Little Knife, no production data,

- 36102, conf, CLR, Gordon Federal 6-5H1, Haystack Butte, nice well;

- 36101, conf, CLR, Gordon Federal 7-5H, Haystack Butte, nice well;

Monday, April 4, 2022: 7 for the month, 7 for the quarter, 166 for the year

- 38518, conf, CLR, Thorp Federal 8-28H, Little Knife, no production data,

- 37015, conf, CLR, LCU Ralph 2-27H, Long Creek, no production datal

Sunday, April 3, 2022: 5 for the month, 5 for the quarter, 164 for the year

- 38548, conf, Ovintiv, Wisness State 152-96-16-21-6H, Westberg, no production data,

- 38526, conf, CLR, Thorp Federal 9-28HSL1, Little Knife, no production data,

- 38545, conf, Ovintiv, Wisness State 152-96-16-21-14H, Westberg, no production data,

RBN Energy: energy transition slams into energy reality slams into war in Europe.

The battle lines were drawn. The drive toward decarbonization was rushing headlong into the reality of energy markets. Things were going to get messy, but at least it was becoming more evident how the energy transition would impact key market developments, from the chaos in European natural gas, to producer capital restraint in the oil patch, to the rising impact of renewable fuels and, of course, the escalating roadblocks to pipeline construction. Then, a monkey wrench was thrown into the works.

The world was confronted with the madness of war in Europe, with all sorts of consequences for energy markets: sanctions, boycotts, cutbacks, strategic releases, price spikes and, here in the U.S., what looks to be a softening of the Biden administration’s view against hydrocarbons — at least natural gas and LNG. So now the markets for crude oil, natural gas and NGLs aren’t only inextricably tied to renewables, decarbonization and sustainability, they must navigate the transition turmoil under the cloud of wartime disruptions. It’s simply impossible to understand energy market behavior without having a solid grasp of how these factors are linked together. That is what School of Energy Spring 2022 is all about! In today’s RBN blog — a blatant advertorial — we’ll highlight how our upcoming conference integrates existing, war-impacted market dynamics with prospects for the energy transition.

The war did not end "energy transition" -- the new euphemism for "renewable energy" -- it only made obvious what most of us already knew. See how RBN Energy analyzes this and compare to Peter Zeihan.

************************************

Wells Coming Off Confidential List Actually Reporting Production

The wells:

- 36102, conf, CLR, Gordon Federal 6-5H1, Haystack Butte, nice well;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 2-2022 | 19349 | 29880 |

| 1-2022 | 26665 | 40192 |

| 12-2021 | 26548 | 38584 |

| 11-2021 | 34840 | 47151 |

| 10-2021 | 4668 | 6810 |

- 36101, conf, CLR, Gordon Federal 7-5H, Haystack Butte, nice well;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 2-2022 | 20192 | 35630 |

| 1-2022 | 26471 | 44242 |

| 12-2021 | 25723 | 39804 |

| 11-2021 | 32812 | 45361 |

| 10-2021 | 6337 | 9098 |