This chart simply amazes me: link here. Story here by Charles Kennedy.

How can a country make such a huge mistake -- they could not have seen the global lockdown coming, but that much oil that fast, under any circumstances? What were they possibly thinking?

But look what else amazes me: Saudi Arabia is only exporting five million bbls/day. Five million bbls? Is that what the Permian and Bakken are producing each day?

And then this from earlier this month -- Saudi Arabia's foreign exchange reserves are plummeting.

Saudi Arabia foreign change reserves, link here. I think this is an all-time low in modern history.

I still think Saudi Arabia is in deep doo-doo.

Even though the new production quotas don't go into effect until next year, Saudi Arabia knew exactly what would happen if OPEC+ voted to increase production ... and Saudi Arabia was exactly correct.

Overnight, Brent went from $76 to $69. Perhaps a bit of hyperbole, but not much.

Saudi can't make it on $70-oil, much less Brent with a "6-handle."

Saudi is in panic mode.

One sign of panic mode is corroborated by evidence of flip-flopping overnight on long term strategy.

Some months ago, part of Vision 2030, Saudi Arabia made huge announcements about turning to value-added industries, like refining and petrochemical. At one time, Saudi was going to be the world's leader in solar energy; that plan was also scrapped years ago.

Now, again, Saudi Arabia flip-flops again, in panic mode.

An exclusive in today's WSJ: Saudi-owned Motiva suspends $6.6 billion petrochemical expansion. In other words, Saudi can't even manage a $7-billion expansion for the first/second biggest economy in the world, the US. What was Saudi's rationale?

Saudi Aramco is putting the expansion on hold as it shifts capital-spending focus to oil, natural gas fields.

And look what's mentioned in the lede at the article:

Saudi-owned Motiva Enterprises LLC suspended a $6.6 billion plan to

add petrochemical facilities to its refining operations in Port Arthur,

Texas, according to people familiar with the matter.

The decision to halt the project—which had envisioned the

creation of the biggest refining and petrochemical operation in the

U.S.—comes as Aramco dials back its diversification plans and refocuses on its core business of pumping oil and natural gas, according to the people.

The Wall Street Journal previously

reported that Aramco had slowed the petrochemical project amid a review

last year of investments at home and abroad. The review followed

financial pressure from lower oil prices and a heavy dividend burden

that Aramco took on when it went public in 2019.

Wow, how many times have we talked about that heavy dividend burden?

That dividend: $75 billion annually.

$6.6 billion / $75 billion = 8.8%.

The article continues:

The state-run company now plans to invest almost all of its $35

billion capital expenditure budget this year toward boosting oil and

natural-gas production, according to people familiar with those plans.

Aramco said last year it was working to increase its oil production capacity by one million barrels a day to 13 million barrels a day.

Five years ago, Saudi Crown Prince

Mohammed bin Salman

pledged to unshackle the economy from oil exports by 2020. But as

the world’s top crude exporter seeks to maintain growth and generate

jobs, the kingdom is redoubling its commitment to hydrocarbons.

Amid moves by governments, investors and other oil companies to

transition away from fossil fuels and the greenhouse gases they emit,

Saudi Arabia is betting that the world will need its crude for the

foreseeable future.

State-run Aramco took full ownership of Motiva and its Port

Arthur refinery in 2017 from joint-venture partner Royal Dutch Shell

PLC. Shell took some of the U.S. company’s other assets as part of the

deal. At the time, the company was pushing to expand its global refining

and petrochemical business as a way of locking in buyers of its crude

and controlling more of the value chain of its oil.

Under Saudi ownership, Motiva bought a separate Port Arthur

petrochemical plant in 2019. A few months earlier, it had filed for

approval to spend $6.6 billion to build two new petrochemical plants in

addition to its existing 630,000-barrels-a-day Port Arthur refinery.

That plan is now shelved, the people said.

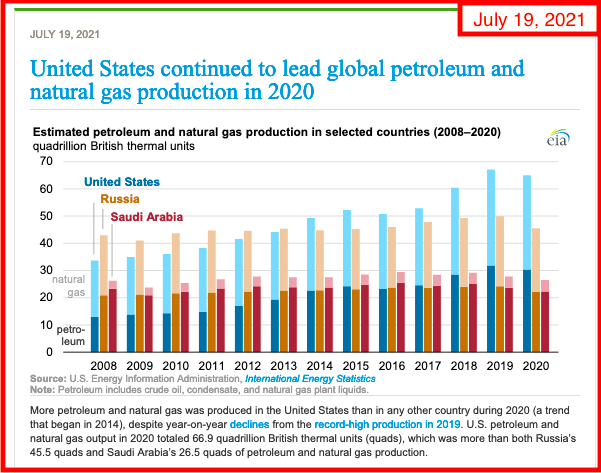

Now, back to this graphic posted earlier today:

So, the high point for Saudi Arabia is around 11.8 million boepd and now they are scrapping a $6.6 billion expansion project to try to move production from "12 million boepd" to 13 million boepd.

The state-run company now plans to invest almost all of its $35

billion capital expenditure budget this year toward boosting oil and

natural-gas production, according to people familiar with those plans.

Aramco said last year it was working to increase its oil production capacity by one million barrels a day to 13 million barrels a day.

Saudi Aramco's annual dividend is more than twice its annual CAPEX.

One more graphic from today's social media.

My hunch: China filled its SRP with inexpensive oil and will now quit buying new oil until prices come down again. We always talk about "swing producer." No one ever talks about "swing consumer."

China is in the driver's seat as far as "swing consumer" goes. They simply switch to coal when oil and natural gas become too expensive.