Call it "Trumpicillin": need to fact-check. When do the trials begin?

Never forget! "Polarized" cap? What the heck is that?

CDC: announces study on gun violence and how it affects Americans health. Does this tell me all I need to know about how serious the Center takes Covid? Until results are in, Dr Fauci recommends --

- wearing a mask when using a gun to commit a crime;

- put a mask over the gun when taken inside a bank;

- double-mask AR-15's

Vaccinating: apparently the push to vaccinate kids didn't pan out. CDC now has huge push to vaccinate pregnant women.

- with 3.75 million women giving birth each year, that works out to about 1% of the US population. Anything to scare folks. Keep the narrative going.

Merck: to buy Acceleron for $180 / share in cash. Rare drug research. $12 billion deal.

Bed, Bath, And Beyond: down 28% pre-market. Warnings. Company and analysts blame problems on:

- supply chain woes;

- Covid;

- rates headed higher;

- worker shortage;

- cost of raw materials;

- surging oil prices;

- Evergrande;

- China;

- Vietnam;

- Afghanistan;

- daylight savings time will end

- but, apparently not management

Carmax: down 8%, pre-market.

S&P, NASDAQ: higher for 3Q21

- could post 6th quarterly gain

Jobs (yawn):

- up 11,000 to 362,000 vs 330,000 expected

- GDP, revised, 2Q: 6.7% vs prior 6.6%

- 2Q21: pce price index: core inflation, 2Q: 6.1% vs prior estimate, 6.1%

- ten year treasury: 1.538%

California bacon:

- across the state, newspapers are reporting skyrocketing prices for bacon; none mention the new California law, Proposition 12, that will come into effect January 1, 2022; one link here;

- pork producers appeal to US Supreme Court; link here;

- how severe is the bill?

- Prop. 12 requires each sow whose piglets are raised for uncooked cuts of

pork sold in California – about 9% of North American sows – to have a

minimum of 24 square feet of space. Because Prop. 12 applies only to

sows, not to their offspring who are raised for meat, it will apply to

well less than 1% of the 90 million North American hogs.

Hit and run: South Dakota attorney general reaches confidential settlement with widow. Link here.

- deer wearing glasses; carrying flashlight;

- hooves in passenger seat

European energy:

- Sweden recently shut down two nuclear reactors, giving in to faux environmentalist;

- country now firing up oil power plant to provide electricity: one bbl/hour; link here;

- this is going on around the globe; helps explain the surge in price of oil;

Mu? all that hand-wringing earlier this year about the "mu variant"? Eradicated.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

Investors, shale, link here, the usual suspects:

Starbucks: increases dividend by about 10%; from 45 cents to 49 cents/share.

Disclaimer: this is not

an investment site. Do not make any investment, financial, job, career,

travel, or relationship decisions based on what you read here or think

you may have read here.

Chamath: I happened to see this interview live;

- CNBC anchor dumbfounded;

- "February, 2021: the Whale, Chamath went on CNBC to urge people to never bet against Tesla, or sell t their shares." HODL.

- In the interview yesterday, he admitted he sold off his entire position in Tesla.

- said he needed the cash to buy something better

- creep.

Word for the day: forecourt. That's what they call them in Britain.

Poster for the day: link here. NSFW.

Costs: the other day a reader asked why we were not seeing more drilling in the Bakken.

one of many reasons: link here; but I don't think this is the big reason for the Bakken

Covid-19: vaccinations provide stronger protection than natural immunity. Hmmm. Link here.

China: further restricts power use amid widening energy crisis. Link to Tsvetana Paraskova.

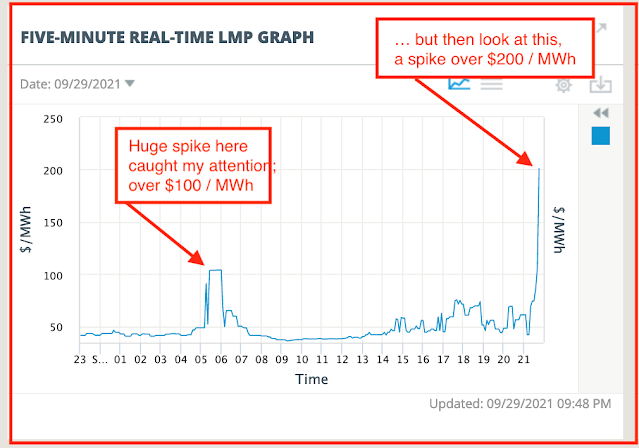

Asian LNG: spot price rises to $200+ boe. Countries will now start burning oil at 1/3rd the cost. Transitory. This, too, shall pass.

Peak demand? LOL:

Remember the name: Port of Fujairah. Link to Simon Watkins.

Dividends: paying dividend today.

- UNP: $1.07

- DVN: 38 cents

- Hess: 25 cents

- Ovintiv: 14 cents

Stagflation: link here, back to the "70's Show."

- read the comments, give me a break: interest rates, today: 0%; interest rates in the 70s: 14%;

****************************

Back to the Bakken

Active rigs, updated data at COB:

$74.06

| 9/29/2021 | 09/29/2020 | 09/29/2019 | 09/29/2018 | 09/29/2017 |

|---|

| Active Rigs | 25 | 11 | 57 | 67 | 58 |

Two wells coming off confidential list:

Thursday, September 30, 2021: 33 for the month, 44 for the quarter, 224 for the year:

- 37027, conf, Enerplus, Cello 149-94-02C-01H-TF, Mandaree, scout ticket not updated; huge well;

- 30202, conf, Whiting, Klose Federal 21-27-1H, Glass Bluff, scout ticket not updated; nice well;

RBN Energy: renewable diesel buildout driven by low carbon fuels standards.

With the UN’s Climate Change Conference (COP 26) in Glasgow just over a

month away, it’s natural to reflect on the progress achieved since the

Paris Agreement (signed at COP 21), which is approaching its sixth

anniversary. In the past half decade, the world has taken tremendous

strides toward decarbonization – not only in rhetoric, but in real and

substantial investment.

Green hydrogen and carbon capture are among the

notable solutions many are pursuing to that end. But perhaps no green

business has been in the spotlight as much recently as renewable diesel.

Low-carbon fuel standards have spurred a lucrative renewable diesel

market that refiners are lining up to access, with units being built and

planned across North America. The nationwide buildout is being

underwritten by the states that have enacted policies to induce

low-carbon solutions, and while the Golden State is paramount among

them, Californians are not alone.

The largess being generated by those

policies is so substantial that it will have an impact on and may

incubate other low-carbon technologies that can be paired with renewable

diesel to create even lower-carbon fuel sources and capture more of the

credits that are ultimately driving the economics of the energy

transition. In today’s RBN blog, we identify key manufacturing centers

for low-carbon fuel supply growth, the at-times lengthy route the fuels

may take to LCFS markets, and the economic incentive structure that

justifies all those costs.