I was surprised to see Honeywell and Sempra Energy on this list.

Saturday, July 30, 2022

My Favorite Chart -- The US Money Market Fund Monitor -- July 30, 2022

My favorite chart, US money market fund monitor, link here. These folks are earning zero percent on their money. They are also ignoring the recent climate infrastructure and semiconductor / chip bills winding their ways through Congress.

Updated at the source on July 19, 2022.

Richard Zeits On Array Fracking — March 5, 2013

A reader asked about the definition of a drilling unit.

Link here: https://seekingalpha.com/article/1248431-bakken-the-downspacing-bounty-and-birth-of-array-fracking.

Bakken: The Downspacing Bounty And Birth Of 'Array Fracking'

"People are just starting, I think, to understand the true bounty of the Bakken and how long it's going to be there and how good it's going to be there."

James J. Volker, Chairman & CEO, Whiting Petroleum (WLL)

Year End 2012 Investor Conference Call

High Density Drilling May Re-Define The Play's Resource Potential

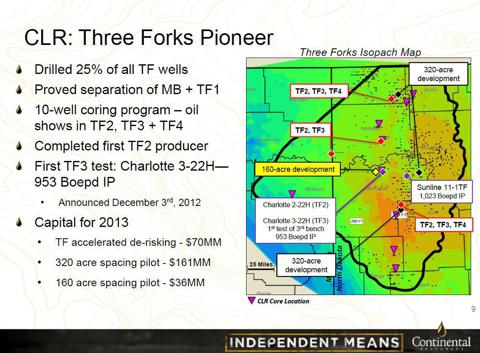

The Bakken is gearing up for a radical downspacing. High density testing will kick off this year with several large-scale pilots being simultaneously initiated across the play. Several operators - including Continental Resources (CLR), Whiting Petroleum, EOG Resources (EOG), Kodiak Oil & Gas (KOG) and Oasis Petroleum (OAS) - have announced extensive evaluation programs. Others are likely moving ahead in the same direction, without special announcement. Many of the pilots are comprehensive, geoscience-heavy and are based on very aggressive downspacing patterns. Several projects will test "vertical downspacing," with wells arrayed throughout a wide section of the Bakken/Three Forks (TF) interval, including the lower TF benches. Large amounts of capital are being committed to the effort: Continental plans to drill 47 wells in its program; Kodiak will be spending one third of its total budget this year on high density pilots; and Whiting is initiating six or seven multi-well projects.

Importantly, the downspacing in the Bakken may give broad acceptance to a new approach - which is showing signs of emerging - to managing fracture stimulation programs in thick shales. "Array Fracking" may be a good moniker to describe the concept of creating an integrated fracture systems in a thick, high oil content reservoir from multiple optimally positioned wellbores (similar approach seems to be gaining traction in the Niobrara).

The picture below from Continental's presentation provides the idea of how aggressive some of the downspacing pilots can get. In this specific case, "high density drilling" means up to 32 wells per single drilling unit in full development mode with laterals landed in four stacked intervals (possibly five if TF4 proved productive), a truly staggering density relative to the 7-8 well patterns that have been considered "dense" until recently.

(Source: Continental Resources October 9, 2012 Presentation)

The results of the evaluations, if positive, may become an important catalyst for the Bakken as a whole and could lead to yet another leap in the estimate for the play's recoverable reserves and economic value. Several highly reputed operators claim that they see minimal on-production communication between wellbores with short offset intervals (this is, for example, Continental's view based on their evaluation on over a hundred well pairs' performance, the view also shared by Kodiak). The feasibility of downspacing with dense arrays of wellbores is still an uncharted territory. It very much remains to be proven - for each specific area and set of geological intervals - that a meaningful downspacing can be achieved without big sacrifice in the EUR per well. The search process may also bring substantial modifications to the way wells are currently being completed and produced. If proven successful, the approach may mean quite a revolution for the Bakken development.

What is the motivation behind the effort to downspace? According to Whiting Petroleum's CEO Jim Volker:

What that really is all about is the recognition that when you go through - and do the oil in place calculations - through most of the properties and look at most of the operators in the basin, including ourselves, at the current density that we're drilling, we're getting about 10%, maybe as much as 11% or 12% recovery, of the oil in place. The question has always been -we've drilled at these wells based on essentially no interference - the question in our minds here over the last several months and last year or so, and not just ourselves but other operators, is: What happens? How do we increase that recovery efficiency?

And so the idea here is to drill a series of pilots - and we're going to be doing that in both Hidden Bench, Pronghorn, Sanish, possibly Missouri Breaks as well - to go in and drill on higher densities, essentially doubling the density in the better reservoirs in there, to demonstrate our ability to increase that recovery efficiency, get it up from 10% or 11% up to somewhere around 20%. And what that means is breaking up more rock. And we don't believe that with the current spacing that we are on, that we are getting all of the oil that's out there. So that's really what this is all about.

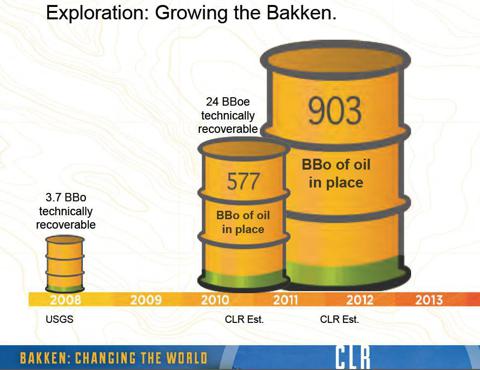

The amount of incremental oil that can be recovered if high density drilling proves viable is enormous. Continental Resources currently estimates total oil in place in the Bakken Petroleum System - including Deeper Three Forks - at 903 billion barrels.

(Source: Continental Resources October 9, 2012 Presentation)

Harold Hamm, Continental Resources' Chairman and CEO, commented during the company's earnings call last week:

Obviously, the initial recoveries are always low in these large fields. Historically, that's been the case. And as you go on and technology advances along with development, that number always tend to increase. So at 5% [oil recovery rate], you're looking at 45 billion barrels. So is that within reason? I think it is.

The 45 billion barrel estimate is almost a double from the 24 billion barrel figure established by Continental three years ago. In terms of oil reserves, the new estimate may put North Dakota, ahead of many oil-rich countries.

Continental Is Leading The Charge

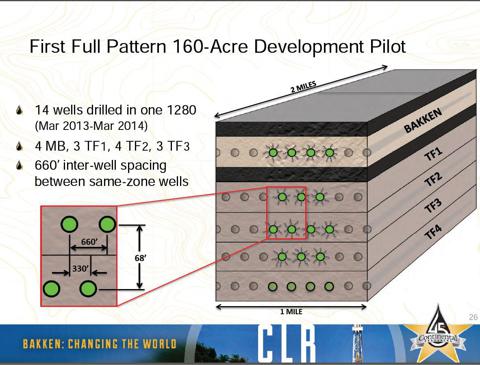

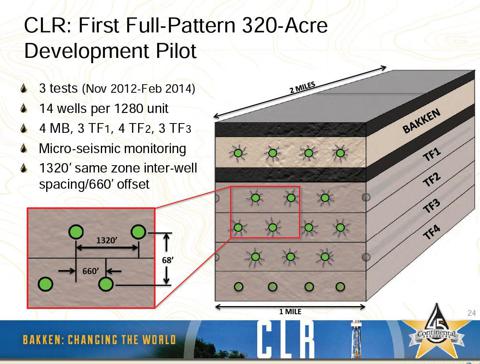

Continental is again at the forefront of the effort, having announced four comprehensive pilot density projects to test 320-acre and 160-acre spacing in the Middle Bakken and first three benches of the Three Forks. The program includes 47 gross wells.

(Source: Continental Resources October 9, 2012 Presentation)

Importantly, Continental has stated in the past that they are not seeing any reduction in initial production rates from wells drilled on tighter spacing, the view the company re-iterated during its earnings conference call last week:

… As far as the density is concerned - obviously, we've got a lot of wells - we've got numerous wells that have been drilled in pairs of wells that are 660 feet offset: the Middle Bakken and the first bench well, and they are 660-foot offsets. And we're not seeing any influence on IPs or even EUR. So I mean, there's just a constant building of data set out here that's saying that the pattern is not causing any kind of degradation in at least initial rates.

… It really is going to be about the quality of the rock in a given area and how it performs with the stimulation technologies that we're currently applying, leaving room, of course, for additional optimization, additional stimulation techniques that we might use in the future.

Continental has already initiated its first 320-acre pilot density project, with three wells currently being completed and two more being drilled. The 160-acre pilot and the next 320-acre pilot are scheduled to spud by mid-2013, with the third 320-acre pilot planned to spud in the third quarter of 2013.

(Source: Continental Resources February 2013 Presentation)

Continental's evaluation program is remarkably comprehensive and integrates four intervals, the Middle Bakken, TF1, TF2 and TF3. In each pilot, the wells are arrayed to help determine the optimum well spacing and pattern to maximize the ultimate recovery of oil from the multiple Bakken and Three Forks reservoirs.

According to Continental's press release, these "aggressive pilot projects over a wide area in the field" will be drilled and completed over the next 18 months, with production coming on line starting in late 2013. All wells in the program should be producing in the first quarter of 2014. These exploration and appraisal programs should help determine the ultimate recovery of the field and drive valuations higher by accelerated de-risking and down-spacing.

The rest of the article is archived.For Investors -- CLR, DVN, EOG -- July 30, 2022

|

Company |

EPS |

Production |

Mkt Cap |

P/E |

Div Yld |

|

EOG |

7.50 |

0.450 |

65 |

15 |

2.7 |

|

CLR |

5.60 |

0.198 |

25 |

12 |

1.6 |

|

DVN |

5.35 |

0.250 |

41 |

12 |

8.4 |

CLR: 2Q22 -- Earnings Presentation

Pay attention to debt and how fast CLR is paying off debt.

Also note: a dividend payer. I'm laser-focused on dividends. I'm absolutely convinced that companies that don't pay a dividend will be at a disadvantage with those that do in the current investing environment. There are some exceptions, though I'm hard-pressed to come up with any.

Dividends don't have to be huge, but most mom-and-pop, like Warren Buffett, like receiving dividends.

Hulu -- July 30, 2022

At this post, I compared the most recent earnings quarters for XOM and AAPL. It was a very, very superficial comparison, but even so, some interesting data points fall out.

From that post:

- Apple has a record 813 million pad subscribers to its various streaming and music services;

- compare this to Hulu with 39 million subscribers

- Disney valued Hulu at $16 billion in 2019 when it agreed to acquire the rest of it from Comcast

- Hulu revenue, 2021: $10 billion; a 33% increase on the previous year.

And, of course, that led me to Hulu's most recent revenue and usage statistics (2022), posted June 27, 2022.

Before going there, note something else: this information is being hosted by something called "business of apps," home page here; and "about us" here. This is just incredible what folks are doing, this one based outside of London.

Back to Hulu at that link. It begins:

Video streaming service Hulu started its life with major backing from new and old media, receiving investment and content from NBC Universal, MSN, MySpace and Yahoo in 2007 before launching early in 2008.

Hulu entanglement with the media conglomerates of America placed it in stark contrast to Netflix, which while subservient to the licensing demands of the industry, is considered an independent operator. For most of its existence, the majority of Hulu was owned by one or several media companies, ending with Disney acquiring a majority share in 2019.

This perception of Hulu as a place film and TV studios dump content is a misconception, created during the era when several media companies had stakes in the company but did not want to launch any new titles on it. Before that period it was competitive with Netflix, attempting to break new ground with innovative online partnerships.

What's interesting about this, this platform will out-wiki Wikipedia over time for those interested in investing.

Sadly for Hulu, it was always in the shadow of Netflix, as its rival added millions of customers every year in North America, Europe and South America. Netflix and Amazon Prime Video both launched original TV series in 2015, another move that pushed the video streaming services away from old media’s control.

It would take Hulu two years to copy Netflix and Prime Video’s model, launching The Handmaid’s Tale in 2017. It became an instant hit for the streaming service, and provided Hulu with a way to rebrand as a content producer in its own right, instead of an aggregator of old television shows and movies.

As Hulu started to gain traction through its original series, Disney began to acquire more of it from other media conglomerates. First came the acquisition of 30 percent of Hulu from 21st Century Fox, then a month later AT&T sold 10 percent of the company to Disney. A month after that, Comcast announced it would sell its 33 percent share to Disney by 2024, ceding full control.

And then, everything from there.

At the "investors" tab at the top of the blog

- Streaming: link here. Streaming wars.

Apple has a long, long way to go to meet / beat Hulu but like everything about Apple, whatever it does becomes part of the Apple eco-system where everything connects seamlessly.

But look at that:

- Hulu: 40 million paid subscribers

- Apple: trending toward a billion paid subscribers

And, yes, I know, that's comparing apples to oranges, but don't get me started. LOL.

Placed Under "Things To Follow Up" -- Parcel: 8-153-93 -- July 30, 2022

Disclaimer: in a note such as this, there will be typographical and content errors. If this is important to you, go to the source.

Note: no other public source, ad-free, subscription-free, tracking-free provides data like this with regard to the Bakken.

Updates

October 5, 2024: the NDIC map suggests there have been no changes in this location since the original post.

Original Post

If I was asked which one section I was most interested in right now, it would be this section.

The parcel: 8-153-93.

At the sidebar to the right: things to follow up.

https://themilliondollarway.blogspot.com/2022/07/a-closer-look-at-70-acre-parcel-whiting.html. A closer look at the 70-acre parcel for which Whiting paid $2.346 million in 2022.

https://themilliondollarway.blogspot.com/2022/07/70-acre-parcel-in-mountrial-county-goes.html.

https://themilliondollarway.blogspot.com/2022/07/blm-sale-july-11-2022.html.

The parcel: 8-153-93.

Going forward, with re: to monthly hearing dockets, watch for this triangular (triangle) under-the-water parcel:

- Chord Energy, Whiting

- Alkali Creek oil field

- section 31-154-93

- section 32-154-93

The wells above are the CLR Jersey / Jersey Federal / Jersey FIU wells. These are very good wells. Some have hit / other approaching 500K bbls crude oil cumulative after just six years. These wells are tracked here and production has been updated. At least one well that was PNC'd is now a producing well. Note the rig on #27896, Jersey FIU 13-6H.

AAPL And XOM Profits -- July 30, 2022

From Reuters: record-breaking second-quarter profit.

... biggest quarterly profit ever on the back of soaring energy prices and as it kept a tight rein on spending.The top U.S. oil producer reported second-quarter net income of $17.9 billion, or $4.21 per share, an almost four-fold increase over the $4.69 billion, or $1.10 per share, it earned in the same period last year.

From The WSJ: Apple reports 11% decline in profit.

... reported an almost 11% decline in profit after weathering supply constraints and shutdowns in China.

... reported that profit fell to $19.4 billion, the worst quarter since the July-through-September period in 2020 ahead of the 5G-capable iPhone launch.

On a per share basis, the Cupertino, Calif., company’s profit fell to $1.20 from $1.30 a year earlier. Analysts surveyed by FactSet, on average, predicted earnings per share of $1.16.

XOM going forward: much is out of their control. Geopolitics and politics in Washington (DC), it seems, will be the driver.

AAPL going forward:

- despite an 11% drop in profit, Apple still reported a profit of $19.4 billion compared to Exxon's $17.9 billion

- COVID-19 lockdowns are behind us

- supply constraints becoming less of an issue

- APPL making huge strides in diversifying out of China

- partnerships with leading chip manufacturer: TSM; about to open another stateside chip facility;

- despite all those headwinds, Apple actually increased margins, in round numbers, from 42% to 44%

- has a record 813 million pad subscribers;

- compare this to Hulu with 39 million subscribers

- Disney valued Hulu at $16 billion in 2019 when it agreed to acquire the rest of it from Comcast

- Hulu revenue, 2021: $10 billion; a 33% increase on the previous year.

- absolute dominance in automotive entertainment systems (Car Play);

- Tim Cook does not give guidance; usually very conservative in comments; this time, sounded very enthusiastic about Apple's September, 2022-ending quarter

- the September, 2022-ending quarter is the "back-to-school" quarter

- most / all new products for the year will have been released

- both the new iPhone and new M2 MacBook Air open to rave reviews

- Gene Munster who knows Apple best said AAPL will be a $250-stock in two years

Income: back of envelope calculations on income:

- 89% of ? = $19.4 billion

- = $21.80 billion

- checking: eleven percent of $21.8 billion = $2.398 billion

- $21.8 billion - $2.398 billion = $19.4 billion; so checks

- in other words, if not an eleven percent decline, but same income year/year would have reported $21.80 billion income vs the $19.8 billion it reported and the $17.9 billion Exxon reported

Paid subscribers, link here:

- added more than 30 million paid subscriptions in 2022

- paid subscriptions reached a record 813 million in 3Q22 (June, 2022-ending quarter)

Incredible logistics and decision-making:

look at this headline from the linked WSJ article

With supply chain issues, semiconductor issues, with capricious Covid closings in China, Apple had too make a decision: where to focus; where to cut back.

- revenuee focus: iPhones

- cutback on other hardware, revenue:

- iPhone: $40.67 billion vs $38.33 billion estimated (huge)

- Mac: $7.38 billion vs $8.70 billion estimated (took the hit to focus on phones)

- iPad: $7.22 billion vs $6.94 billion estimated

- other hardware product (watches, headphone, ear pods, cables): $8.08 billion vs $8.86 billion estimated

- services: $19.60 billion vs $19.70 billion

Most interesting: analysts already looking at next quarter. Tim Cook looking five years down the road.

Five years down the road: big decision has to be made. Which direction to go with regard to Apple Car.

- hiring ex-Lamborghini engineer this past quarter is not trivial but still hard to interpret

Whiting, Smokey Update -- November 27, 2022

From a previous post:

- April 13, 2020: AB, #21513, offline 2/20; wells on same pad being drilled; remains off line 11/20; Whiting, Smokey 3-6-7-14HS; see this post.

Update: November 27, 2022, back on line:

- 21513, 23, Whiting, Smokey 3-6-7-14HS, Bully, t2/12; ccum 232K 9/22, recent production --

| Pool | Date | Days | BBLS Oil | Runs | BBLS Water | MCF Prod | MCF Sold | Vent/Flare |

|---|---|---|---|---|---|---|---|---|

| BAKKEN | 9-2022 | 26 | 2596 | 2682 | 6140 | 5782 | 5780 | 2 |

| BAKKEN | 8-2022 | 21 | 2620 | 2686 | 5488 | 5289 | 5289 | 0 |

| BAKKEN | 7-2022 | 31 | 3861 | 3828 | 7321 | 5922 | 5914 | 8 |

| BAKKEN | 6-2022 | 30 | 4867 | 4924 | 8362 | 9428 | 9243 | 185 |

| BAKKEN | 5-2022 | 31 | 4755 | 4882 | 11638 | 11640 | 11593 | 47 |

| BAKKEN | 4-2022 | 27 | 3625 | 3361 | 12169 | 4249 | 4236 | 13 |

| BAKKEN | 3-2022 | 31 | 4112 | 4162 | 13958 | 5356 | 5347 | 9 |

| BAKKEN | 2-2022 | 28 | 5902 | 5806 | 13585 | 7997 | 7986 | 11 |

| BAKKEN | 1-2022 | 8 | 1160 | 1148 | 505 | 1622 | 1611 | 11 |

| BAKKEN | 12-2021 | 9 | 1037 | 1033 | 2351 | 1637 | 1620 | 17 |

| BAKKEN | 11-2021 | 30 | 1168 | 1163 | 2534 | 1773 | 1752 | 21 |

| BAKKEN | 10-2021 | 8 | 310 | 310 | 751 | 1097 | 1088 | 9 |

| BAKKEN | 9-2021 | 8 | 319 | 316 | 753 | 993 | 989 | 4 |

| BAKKEN | 8-2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 7-2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 6-2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 5-2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 4-2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 3-2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 2-2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 1-2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 12-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 11-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 10-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 9-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 8-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 7-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 6-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 5-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 4-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 3-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 2-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 1-2020 | 24 | 812 | 937 | 1285 | 2566 | 2487 | 10 |

| BAKKEN | 12-2019 | 31 | 1124 | 1121 | 2108 | 3957 | 3305 | 559 |

| BAKKEN | 11-2019 | 30 | 1137 | 1102 | 2062 | 4295 | 0 | 4205 |

| BAKKEN | 10-2019 | 31 | 1171 | 1286 | 2258 | 5546 | 0 | 5453 |

| BAKKEN | 9-2019 | 24 | 1067 | 957 | 2061 | 4515 | 4293 | 150 |

| BAKKEN | 8-2019 | 31 | 1467 | 1543 | 2587 | 6769 | 6663 | 13 |