A reader asked about the definition of a drilling unit.

Link here: https://seekingalpha.com/article/1248431-bakken-the-downspacing-bounty-and-birth-of-array-fracking.

Bakken: The Downspacing Bounty And Birth Of 'Array Fracking'

"People are just starting, I think, to understand the true bounty of the Bakken and how long it's going to be there and how good it's going to be there."

James J. Volker, Chairman & CEO, Whiting Petroleum (WLL)

Year End 2012 Investor Conference Call

High Density Drilling May Re-Define The Play's Resource Potential

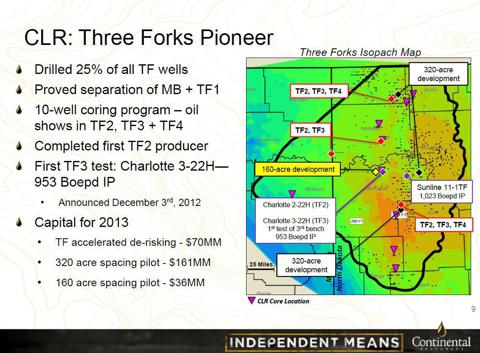

The Bakken is gearing up for a radical downspacing. High density testing will kick off this year with several large-scale pilots being simultaneously initiated across the play. Several operators - including Continental Resources (CLR), Whiting Petroleum, EOG Resources (EOG), Kodiak Oil & Gas (KOG) and Oasis Petroleum (OAS) - have announced extensive evaluation programs. Others are likely moving ahead in the same direction, without special announcement. Many of the pilots are comprehensive, geoscience-heavy and are based on very aggressive downspacing patterns. Several projects will test "vertical downspacing," with wells arrayed throughout a wide section of the Bakken/Three Forks (TF) interval, including the lower TF benches. Large amounts of capital are being committed to the effort: Continental plans to drill 47 wells in its program; Kodiak will be spending one third of its total budget this year on high density pilots; and Whiting is initiating six or seven multi-well projects.

Importantly, the downspacing in the Bakken may give broad acceptance to a new approach - which is showing signs of emerging - to managing fracture stimulation programs in thick shales. "Array Fracking" may be a good moniker to describe the concept of creating an integrated fracture systems in a thick, high oil content reservoir from multiple optimally positioned wellbores (similar approach seems to be gaining traction in the Niobrara).

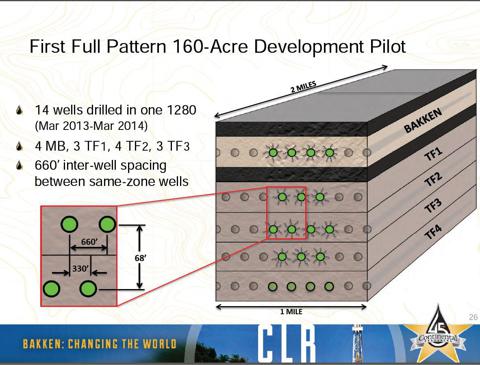

The picture below from Continental's presentation provides the idea of how aggressive some of the downspacing pilots can get. In this specific case, "high density drilling" means up to 32 wells per single drilling unit in full development mode with laterals landed in four stacked intervals (possibly five if TF4 proved productive), a truly staggering density relative to the 7-8 well patterns that have been considered "dense" until recently.

(Source: Continental Resources October 9, 2012 Presentation)

The results of the evaluations, if positive, may become an important catalyst for the Bakken as a whole and could lead to yet another leap in the estimate for the play's recoverable reserves and economic value. Several highly reputed operators claim that they see minimal on-production communication between wellbores with short offset intervals (this is, for example, Continental's view based on their evaluation on over a hundred well pairs' performance, the view also shared by Kodiak). The feasibility of downspacing with dense arrays of wellbores is still an uncharted territory. It very much remains to be proven - for each specific area and set of geological intervals - that a meaningful downspacing can be achieved without big sacrifice in the EUR per well. The search process may also bring substantial modifications to the way wells are currently being completed and produced. If proven successful, the approach may mean quite a revolution for the Bakken development.

What is the motivation behind the effort to downspace? According to Whiting Petroleum's CEO Jim Volker:

What that really is all about is the recognition that when you go through - and do the oil in place calculations - through most of the properties and look at most of the operators in the basin, including ourselves, at the current density that we're drilling, we're getting about 10%, maybe as much as 11% or 12% recovery, of the oil in place. The question has always been -we've drilled at these wells based on essentially no interference - the question in our minds here over the last several months and last year or so, and not just ourselves but other operators, is: What happens? How do we increase that recovery efficiency?

And so the idea here is to drill a series of pilots - and we're going to be doing that in both Hidden Bench, Pronghorn, Sanish, possibly Missouri Breaks as well - to go in and drill on higher densities, essentially doubling the density in the better reservoirs in there, to demonstrate our ability to increase that recovery efficiency, get it up from 10% or 11% up to somewhere around 20%. And what that means is breaking up more rock. And we don't believe that with the current spacing that we are on, that we are getting all of the oil that's out there. So that's really what this is all about.

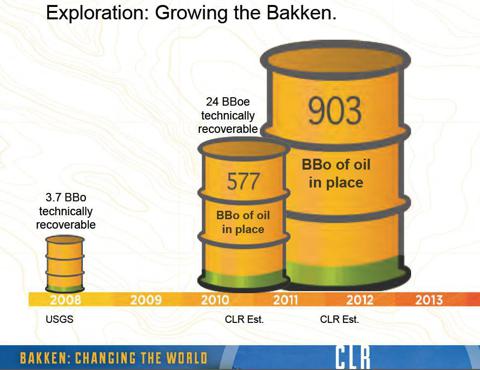

The amount of incremental oil that can be recovered if high density drilling proves viable is enormous. Continental Resources currently estimates total oil in place in the Bakken Petroleum System - including Deeper Three Forks - at 903 billion barrels.

(Source: Continental Resources October 9, 2012 Presentation)

Harold Hamm, Continental Resources' Chairman and CEO, commented during the company's earnings call last week:

Obviously, the initial recoveries are always low in these large fields. Historically, that's been the case. And as you go on and technology advances along with development, that number always tend to increase. So at 5% [oil recovery rate], you're looking at 45 billion barrels. So is that within reason? I think it is.

The 45 billion barrel estimate is almost a double from the 24 billion barrel figure established by Continental three years ago. In terms of oil reserves, the new estimate may put North Dakota, ahead of many oil-rich countries.

Continental Is Leading The Charge

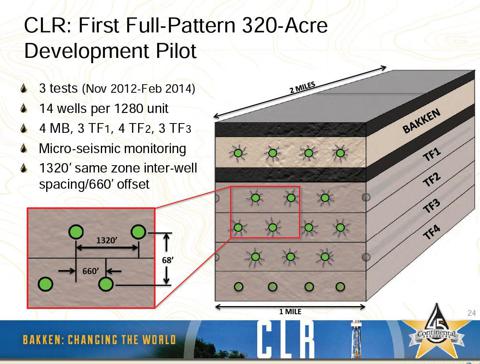

Continental is again at the forefront of the effort, having announced four comprehensive pilot density projects to test 320-acre and 160-acre spacing in the Middle Bakken and first three benches of the Three Forks. The program includes 47 gross wells.

(Source: Continental Resources October 9, 2012 Presentation)

Importantly, Continental has stated in the past that they are not seeing any reduction in initial production rates from wells drilled on tighter spacing, the view the company re-iterated during its earnings conference call last week:

… As far as the density is concerned - obviously, we've got a lot of wells - we've got numerous wells that have been drilled in pairs of wells that are 660 feet offset: the Middle Bakken and the first bench well, and they are 660-foot offsets. And we're not seeing any influence on IPs or even EUR. So I mean, there's just a constant building of data set out here that's saying that the pattern is not causing any kind of degradation in at least initial rates.

… It really is going to be about the quality of the rock in a given area and how it performs with the stimulation technologies that we're currently applying, leaving room, of course, for additional optimization, additional stimulation techniques that we might use in the future.

Continental has already initiated its first 320-acre pilot density project, with three wells currently being completed and two more being drilled. The 160-acre pilot and the next 320-acre pilot are scheduled to spud by mid-2013, with the third 320-acre pilot planned to spud in the third quarter of 2013.

(Source: Continental Resources February 2013 Presentation)

Continental's evaluation program is remarkably comprehensive and integrates four intervals, the Middle Bakken, TF1, TF2 and TF3. In each pilot, the wells are arrayed to help determine the optimum well spacing and pattern to maximize the ultimate recovery of oil from the multiple Bakken and Three Forks reservoirs.

According to Continental's press release, these "aggressive pilot projects over a wide area in the field" will be drilled and completed over the next 18 months, with production coming on line starting in late 2013. All wells in the program should be producing in the first quarter of 2014. These exploration and appraisal programs should help determine the ultimate recovery of the field and drive valuations higher by accelerated de-risking and down-spacing.

The rest of the article is archived.