Locator: 48683B.

Friday, July 25, 2025

Quick Connects -- Geoff Simon -- Alison Ritter -- Juy 25, 2025

Four New Permits; Fifteen Permits Canceled; Three DUCs Reported As Completed -- July 25, 2025

Locator: 48682B.

***************************

Back to the Bakken

WTI: $65.16.

Active rigs: 31

Four new permits, #42157 - #42160, inclusive.

- Operator: Formentera Operations

- Field: Larson oil field

- Comments:

- Formentera Operations has permits for four The Great wells, NENW 25-162-94,

- to be sited 400 FNL and 2279 / 2384 FWL.

Fifteen permits canceled:

- Burlington Resources (9):

- Abercrombie (3), McKenzie County

- Aberlid, McKenzie County

- Omlid (5), McKenzie County

- WPX Energy (5):

- five Syw wells

- Syw 22-27HE, Syw 22-27HY, Syw 22-27HA, Sy2 22-27HX, Syw 22-27HIL

- Kraken:

- a Cass permit, Williams County

Three DUCs reported as completed:

- 41178, 2,705, CLR, Helen 5-8H, Williams County;

- 41311, 2,164, CLR, Kenneth 6-17H, Williams County;

- 41312, 2,160, CLR, Helen 7-8H, Williams County;

Kelly Evans, CNBC Anchor, Starting COB Today -- Three-Months Maternity Leave -- Pregnant With Her Sixth Child -- July 26, 2025

Locator: 48682ARCHIVES.

Breaking: Anthropic (Claude) seeks to double its valuation to over 150 billion in talks with Mideast funds -- Financial Times -- this news broke after the information below was already posted.

- corroborates Tom Lee's statement -- see below: this is still the early states of AI;

- reminder: Anthropic was not part of the Trump-Musk Mideast Tour of The Mideast (TMMT) some months ago

- this tells me a number of things, to include:

- Anthropic wouldn't make this announcement if they didn't think the Mideast still has another $100 billion to invest in AI

- Anthropic is a very, very sophisticated chatbot; it's not a conversational chatbot like Gemini or ChatGPT

From CNBC, mid-afternoon, Friday, July 25, 2025.

Tom Lee -- speculative bubble:

- speculation that inflation is coming back;

- speculation that we are on the precipice of a recession.

Tom Lee -- PTSD, due to:

- fear of tariffs;

- fear of "the Fed."

Tom Lee "only" invests in the "35 best large cap publicly traded companies."

Tom Lee:

- early stages of AI

Other:

- risk of recession: lowest "recession probability" year to date

- anyone who says this is a bubble didn't live through or doesn't remember the 1990s

*********************************

The Book Page

So, I’m reading The Perfectionists: How Precision Engineers Created the Modern World, by Simon Winchester, c. 2019.

Chapter 8 on “GPS” was incredibly fascinating, but then I started reading Chapter 9 — and whoo-hoo!. It turned out to be the story of a machine that makes machines, a machine that was sent to Chandler, Arizona, in 2018.

The chapter begins:

Once every few weeks, beginning in the summer of 2018, a trio of large Boeing freight aircraft, most often converted and windowless 747s of the Dutch airline KLM, takes off from Schiphol airport outside Amsterdam, with a precious cargo bound eventually for the city of Chandler, a desert exurb of Phoenix, Arizona.

The cargo is always the same, consisting of nine white boxes in each aircraft, each box taller than a man. To get these profoundly heavy containers from the airport in Phoenix to their destination, twenty miles away, requires a convoy of rather more than a dozen eighteen-wheel trucks. On arrival and finally uncrated, the contents of all the boxes are bolted together to form one enormous 160-ton machine — a machine too, in fact, a direct descendant of the machine tools invented and used by men such as Joseph Bramah and Henry Maudslay and Henry Royce and Henry Ford a century and more before.

Just like its cast-iron predecessors, the Dutch-made behemoth of a tool (fifteen of which compose the total order due to be sent to Chandler, each delivered as it is made) is a machine that makes machines. Yet, rather than making technical devices by the precise cutting of metal from metal, this gigantic device is designed for the manufacture of the tiniest of machines imaginable, of which perform their work electronically, without any visible moving parts.

......

......

The particular device sent out to perform such tasks in Arizona, and which, when fully assembled, is as big as a modest apartment, is known formally as an NXE:3350B EUV scanner It is made by a generally unfamiliar but formidably important Dutch-registered company known simply by its initials, ASML.

Each of of the machines in the order costs its customer about $100 million, making the total order worth about $1.5 billion.

Wow, wow, wow. I did not see that coming.

But it certainly connects a lot of dots.

***********************

Continuing

On page 291, more of the ASML story.

Enormous machines such as the fifteen that started to arrive at Intel's Chandler (Arizona) fab from Amsterdam in 2018 are employed to help secure this goal. The machines' maker, ASML -- the firm was originally called Advanced Semiconductor Materials International -- was founded in 1984, spun out from Philips, the Dutch company initially famous for its electric razors and lightbulbs (sic). The lighting connection was key, as the machie tools that the compay was established to make in those early days of the integrated circuit used intense beams of light to etch traces in photosensitive chemicals on the chips, and then when on to employ lasers and other intense sources as the dimensions of the transistors on the chips became ever more diminished.

Then the process is explained in great detail.

Then:

With the latest photolithographic equipment at hand, we are able to make chiops today that contain multitudes: seven bilion transistors on one circuit, a hudred million transistors corralled within one square millimeter of chip space. But with numbers like this comes a warning. Limits surely are being reached -- remember, this was being written in 2018. The train that left the railhead in 1971 may be about to arrive, after a journey almost half a century, at the majesty of the terminus. Such a reality seems increasingly probable, not least because as the space between transistors diminishes ever more, it fast approaches the diameter of individual atoms. And with spaces that small, leakage of some properties of one transistor (whether electric, electronic, atomic, photonic, or quantum-related properties) into the field of another will surely soon be experienced.

There will be, in short, a short circuit -- maybe a sparkless and unspectacular short circuit, but a misfire nonetheless, with consequences for the efficiency and utility of the chip and of the computer or other device at the heart of which it lies.

So, they need new machines to make chips even smaller.

An American company (which ASML subsequently bought) had already developed a unique means of producing this particular and pecuiar type of EUV radiation. Some said the company's method verged on the insane, and it is easy to see why.

If everything works properly -- and at the time of this writing, it seems to be -- then the first of these supercomplex chips, made in this bizarre manner, will be on offer from 2018 onward. And Moore's law, by then fifty-three years old, will prove to have kept itself on target, again.

But.

How much longer? The use of EUV machines may allow the law's continuance for a short while more, but then the buffers will surely be collided with, at full speed, and all will come to a shuddering halt. The jib, in other words, will soon be up.

A Skylake transistor is only about one hundred atoms thick -- and although the switching on and off that produces the ones and zeros that are the lifeblood of computing goes on as normal, the fact that such minute components contain so very few atoms makes the storage and usage of these digits increasingly difficult, steadily more elusive. See also this post.

There are plans for getting around the limits, for eking out a few more versions of what might be called "traditional" chips by, among other things, making the chips themselves increasingly three-dimensional -- by stacking chip on top of chip and connecting each for forests of ultraprecisely aligned and very tiny wires. This would allow the number of transistors in a chip to keep on increasing for a while without our having to reduce the size of individual transistors.

Other talk:

- the curious one-molecule-thick substance graphene;

- molybdenum disulfide, black phosphorus, and phosphorus-boron compunds as possible alternatives to silicon.

And then finally: quantum.

Light squeezing, for example, allows some actual measurement (rather than calculatioin, which is the basis of immensely small numbers -- see page 298 -- the Planck length -- 0.0000 (34 zeroes) 16229 meters, or about twenty decimal places smaller than the diameter of a hydrogen atom. The time it would take a photo to journey through a Planck length: 5.49 x 10^-44 seconds.

Back to Intel's 14A chip:

Intel -- Breaking Up -- ICYMI -- July 25, 2025

Locator: 48681INTC.

Breaking, 1:45 p.m. CT: it's being reported by CNBC that Intel will spin off its networking division (think "Oracle") as a stand-alone company. INTC was down about 7% before the announcement; after the announcement, down about 10%.

This suggests to me, Intel will have three divisions:

- Intel hardware: think Apple

- Intel inside: think AMD

- Intel networking: think Oracle.

Let's see what ChatGPT has to say about. This is exactly how best to use a conversational chatbot.

From ChatGPT:

*************************

18A

Tag: Intel 7 Intel 18A Panther Lake Fab 52 Fab 62 Arizona RibbonFET gate-all-around transistors and PowerVia backside power delivery.

When I compare Nvidia's 2-nm current chip and Intel's 18A chip, it seems the Intel chip is better but the Nvidia chip is already about to ship or shipping (and the company has the MOJO), where Intel's 18A is scheduled to ship in 2026 and is lacking MOJO. Having said that, my understanding is that Intel is competing with AMD.

A reminder:

- GPUs: Nvidia

- CPUs: Intel, AMD

Honda Mileage -- Personal Data -- July 25, 2025

Locator: 48680HONDA.

Technically, it's a 2012 model but it was bought in late 2011. Mileage, MPG, has remained remarkably "stable" for several years, ten cents / mile for gasoline, averaging about 30 mpg in city driving, of which maybe a fourth of that driving is on interstate or four-lane divided highways.

Intel CEO -- Brutally Honest -- We're Not Going To Make 14A Chips If We Don't Have Any Customers -- July 25, 2025

Locator: 48679INTEL.

Breaking, 1:45 p.m. CT: it's being reported by CNBC that Intel will spin off its networking division (think "Oracle") as a stand-alone company. INTC was down about 7% before the announcement; after the announcement, down about 10%.

This suggests to me, Intel will have three divisions:

- Intel hardware: think Apple

- Intel inside: think AMD

- Intel networking: think Oracle.

Let's see what ChatGPT has to say about. This is exactly how best to use a conversational chatbot.

From ChatGPT:

*****************************

Original Post

From the linked article;

Intel has cast doubt on the future of its chip-manufacturing operations. It’s more good news for Taiwan Semiconductor Manufacturing, but could be a problem for chipmaking machinery supplier ASML.

Intel has lost out in advanced chip manufacturing for external clients to Taiwan Semi, or TSMC, in recent years. It hoped to win back some market share with the coming launch of its 18A process, which is reportedly being tested by Nvidia and Broadcom.

However, Intel appeared to play down hopes of winning any major external customers: Executives said on the company’s earnings call Thursday that 18A will primarily be used for internal products, at least initially.

“There’ll be more opportunities for us to attract external customers after we do so much improvement in terms of performance and yield on our own products,” Intel CFO David Zinsner told analysts.

But that begs the question: will Intel be able to even manufacture the 14A chip at scale? It almost feels as if we're not hearing the whole story.

Electricity Rates -- By State -- May, 2025, Data -- July 25, 2025

Locator: 48678ELECTRICITY.

Note: in a blog like this with a lot of numbers / data points, there will be typographical and content errors.

This blog is being re-posted as originally posted back on June 4, 2025 (March, 2025, data) but the numbers are updated to reflect the most recent data, the May, 2025, data.

Link here to The New York Times.

Of course, Trump is being blamed.

Let's not mention New Yorkers refusing that natural gas pipeline.

From The New York Times:

The cost of electricity is rising across the country, forcing Americans to pay more on their monthly bills and squeezing manufacturers and small businesses that rely on cheap power.

And some of President Trump’s policies risk making things worse, despite his promises to slash energy prices, companies and researchers say.

This week, the Senate is taking up Mr. Trump’s sweeping domestic policy bill, which has already passed the House. In its current form, that bill would abruptly end most of the Biden-era federal tax credits for low-carbon sources of electricity like wind, solar, batteries and geothermal power.

Repealing those credits could increase the average family’s energy bill by as much as $400 per year within a decade, according to several studies published this year.

$400 / year at worst within a decade. Oh give me a break. Surging? As The New York Times says. At most, an increase of $400 / year within a decade.

So, on average, $40 / year increase.

Why didn't The New York Times say $4,000 over the next 100 years. Four-thousand dollars certainly sounds a lot worse than $400.

Average electricity bill in the US:

- 2023: average residential customer: $136.84, 855 kWh / month = 16.00 cents / kWh;

- 2024: average residential customer: $140.90, 855 kWh / month = 16.48 cents / kWh;

- 2025, April: average residential customer: $154.76, 855 kWh / month = 18.1 cents / kWh;

Texas, 2025: $170.63, higher than the national average due to increased consumption during extreme weather conditions.

Bottom line:

- $400 increase within a decade -- > increase an average of $40 / year = $40 / 12 = $3.33 / month

- $3.33 / $154.76 = 2% increase per year. And that generated the story in The New York Times? Oh, give me a break.

Whatever.

- $155 / 30 days = $5.17 / day.

- $3.33 / 30 days = 11 cents / day.

- 11 / 517 = 2%.

Probably consistent with inflation.

Americans have it so great. The rest of the world would like to have our energy costs.

What's killing Americans when it comes to inflation:

- health care costs

- college tuition

- McMansions as the only option for starter homes

- automobile insurance rates

- EVs

Residential electricity is not on that list.

Now, the most recent rates by state.

North Dakota, once again, the lowest among all 57 states, last column, all sectors.

North Dakota: 8.34 cents.

Iowa, poster child for wind: 8.99 cents.

Texas: 10.22 cents.

California: holy mackerel -- 26.03 cents! Is anyone paying attention?

Those numbers are in the final column, "all sectors."

For commercial which is much, much more expensive:

California, commercial:

- May, 2025: 22.91 cents

- May, 2024: 23.71 cents

North Dakota, commercial:

- May, 2025: 7.49 cents

- May, 2024: 7.22 cents

Residential costs: North Dakota is among the lowest, but not the lowest. For May, 2025:

- Idaho: 11.88 cents

- Utah: 12.63 cents

- Montana: 12.90 cents

- Oklahoma: 12.94 cents

- Missouri: 12.97 cents

- North Dakota: 13.07 cents

- Washington State with all that hydroelectric power: 13.67 cents

- California: 35.03 cents

Commercial costs: North Dakota is the lowest. For May, 2025:

- North Dakota: 7.49 cents

- California: 22.91 cents

Industrial costs: North Dakota is among the lowest but not the lowest, mostly because North Dakota does not have a large industrial base.

Serendipity, Serendipitous, Fortuitous, And Lucky -- July 25, 2025

Locator: 48832CHIPS.

This blog needs to be completed to include links and background; right now, it's for my benefit as I continue to read John Orton's book.

Development of the transistor from John Orton's book, c. 2004.

So many advances were serendipitous, fortuitous, or lucky.

Tag: serendipity.

Examples:

First: early on, Brattain attacked a condensation problem by substituting an alcohol for water ….pure serendipity … p. 52

Second: in washing the sample before attempting to make measurements, Brattain inadvertently dissolved the oxide film and ended up with not one but two metal contact directly on the Ge surface. Again, pure serendipity. That was even more bizarre than Brattain's first serendipitous breakthrough .. again, the result was favourable -- by applying a positive voltage to the Au dot and negative to the point contact the observed voltage amplification at frequencies up to 10kHz! From p. 52.

Third: selecting Ge early on in the process was entirely fortuitous. Begins bottom of page 53 and top of page 54.

Fourth: The Metal Oxide Silicon (MOS) transistor was yet another product of the fertile ground cultivated by Bell Telephone Laboratories and, once again, it involved just a small element of good fortune. The critical step in its invention was the (accidental!) discovery that the Si surface can be oxidized to from a highly stable insulating film which possesses excellent interface qualities (i.e. the interface between the oxide layer and the underlying silicon).

Serendipity, Serendipitous, Fortuitous, And Accidental -- The Story of Semiconductors -- John Orton -- July 25, 2025

Locator: 48831CHIPS.

I continue to enjoy John Orton's book on semiconductors.

I am finding is so fascinating that I am transcribing significant amounts to be placed on the blog.

The first example was section 3.1 transcribed here.

Do a word search, "serendipity" at this post. No less than three events in the early invention of the transistor were due to serendipity, were serendipitous, or were fortuitous.

Now, transcribing section 4.2 we have yet another serendipitous / fortuitous / accidental discovery which was critical for development of the microchip / transistor / semiconductor. Link here. To wit:

4.2 The metal oxide silicon transistor. It begins:

The Metal Oxide Silicon (MOS) transistor was yet another product of the fertile ground cultivated by Bell Telephone Laboratories and, once again, it involved just a small element of good fortune. The critical step in its evnention was the (accidental!) discovery that the Si surface can be oxidized to form a highly stable insulating film which possesses excellent interface qualities (i.e. the interface between the oxide layer and the underlying silicon). We have already commented on the importance of this interface in passivating Si planar transistors which, in turn, led to the practical realization of integrated circuits. The further application in the metal oxide silicon field effect transistor (MOSFET) turned out to be a singularly important bonus.[Comment: so, now in the very beginning of the transistor story four discoveries that were serendipitous (serendipity), fortuitous, or accidental. Absolutely amazing.]

Continuing:

We saw in the previous chapter that the quest for a FET (which would function in a manner closely parallel to that of the thermionic valve) had already acquired something of a history.

It was a patent awarded in 1930 to a Polish physicist, Julius Lilienfield (who emigrated to America in 1926), that thwarted William Shockley in his original attempt to patent such a device but, even more frustratingly, the existence of high densities of surface states on Ge and Si which prevented the Bell scientists from actually making one.

Even though the application of a voltage to a "gate" electrode may have been successful in inducing a high density of electrons in the semiconductor region beneath it, these electrons were not free to influence the semiconductor's conductivity because they were trapped in surface (or interface) states.

What was needed was a surface (or, more probably, an interface) characterized by a low density of these trapping states (of order 10^15 m^-2 or less) but, at the time, no one knew how to produce it.

Brattain and Bardeen had continued to study the problem of surface states until 1955, eight (8) years after their invention of the point contact transistor, but it was not until 1958 that another Bell Group under "John" Atalla discovered the low density of states associated with a suitably oxidized SI surface. It was necessary ...

... and... and then a long paragraph explaining the next process ... ending ...

... However, the key result was that their densities were below the above limit of 10^15 m^-2, thus making possible the development of a practice FET. This was finally achieved at Murray Hill in 1960. Within a few years RCA pioneered the introduction of MOS devices into integrated circuits and this technology rapidly came to dominate that of bipolar (e.g. n-p-n) devices in many applications.

Then a long paragraph of technical details, describing a process which is known as "inversion," the channel itself often being refrerred to as a "inversion layer."

Another short technical paragraph.

Then, another long technical paragraph, bottom of page 102, which begins:

A virtue of these curves ...As already explained in Box 4.1, digital signal processing (which is fundamental to present-day-computing and information transfer) depends on the use of short voltage (or current) pulses which are generated and moved around an array of electronic circuits in incredibly complicated fashion but the basis is, nevertheless, simple. At any point in the circuit, "information" is represented by the presence (digital "1") or absence (digital "0") of a pulse voltage. Typically its amplitude is about 5 V but the exact value is less important than the ability of monitoring circuitry to determine, with a high degree of certainty, that the pulse is either present or absent......

Now, skip ahead to the end of section 4.2:

In summary, then, we see that, by the early 1960s, the two principal active devices, bipolar and MOS transistors had become available to the electronic engineer and the story from this point is one of continuing miniaturization to improve speed and packing density in IC design and on the other hand, the development of large-scale devices with large voltage-handling capacity for use i high power applications.

Which device to use in which application depended, of course, on the specification required.

In general, MOSFETs have an advantage in IC design on account of their lower power dissipation and modest demand on silicon area, though bipolar devices are capable of faster switching speeds at the expense of more power dissipation and greater demand on space.

The dissipation advantage inherent in the use of MOS devices was further enhanced in the late 1960s by the development of Complementary MOS (CMOS) circuity in which each switching element takes the form of a pair of transistors, one NMOS and one PMOS, the important feature being that power is dissipated only when the switch operates -- in the quiescent state (whether storing a digital 0 or 1). no current flows.

Section 43. Semicoductor technology. Oh, no. This section starts at the bottom of page 107 and doesn't end until page 120, and it begins:

In one sense (the commercial sense), this section is the most important in the book!

The reader should already be persuaded of the important part played by well controlled semiconductor materials in the development of transistors and integrated circuits. Without high-quality germanium the transistor could never have been discovered and without high-quality silicon the integrated circuit would still be a mere concept.

However, even greater importance attaches to the role played by technology.

Without the amazing skills built up by semiconductor technologists we might still be trying to wire together crude individual transistors on printed circuit boards, rather than linking powerful integrated circuit chips to build fast computers with almost unimaginable amount of memory.

A long, long paragraph. Then:

...but this still leaves unanswered the question of how to define their precise positions [the precise position of transistors on a chip]. This step, known as "photolithography," probably representing the most important single contribution to the technology, originated in the printing industry and was adapted for microelectronic applications by a number of American companies such as Bell, TI,and Fairchild at the beginning of the 1960s. As an aid to understading it, we refer to the earlier process of making mesa transistors, depeding on selective etching to form the local bumps on the semiconductor surface which defined the active device area.

Interestingly, this process is wll described in Simon Winchester's book.

Really Hot -- PSX Reports Earnings -- Beat Estimates -- Huge Beat -- Shares Up In Pre-Market -- July 25, 2025

Locator: 48830PSX.

Tag: PSX, INTC

$2.38 vs $1.71.

******************************

INTC

Mid-day trading: why did it drop so much more as the day went on? Simply because folks are now hearing the whole story and that story is now getting the headline -- if Intel cannot find a customer for it's newest planned 14A chip, Intel says it won't produce it. Wow --

Pre-market;

Hot And Hotter -- July 24, 2025

Locator: 48829FIRED.

Hot -- today's forecast, north Texas, DFW:

Hotter:

Really hot! Link here.

Ice cream break in Peru, granddaughter Olivia far right in shorts. This was a day off from work; Olivia is working this summer in Peru involving satellite technology. Later this summer to the Galápagos Islands before returning to Stanford.

Sophia -- Jiu-Jitsu -- Awarded the top grey belt, July 25, 2025:TGIF -- No New Bakken Wells Being Reported Today -- July 25, 2025

Locator: 48830B.

Tech: two biggest takeaways from yesterday -

- the huge head fake immediately following release of Intel's earnings

- headline story: "Intel beat estimates"

- thirty minutes later: "oh-oh"

- the three-month break-out of the Magnificent 7

- exhibit A: AMD

WTI: $66.20.

New wells:

- Sunday, July 27, 2025: 38 for the month, 38 for the quarter, 468 for the year,

- 41347, conf, CLR, Syverson 6-12H,

- 40680, conf, Oasis, Ongstad 5795 13-15 2B,

- 40580, conf, Oasis, Ongstad 5795 13-15 3B,

- Saturday, July 26, 2025: 35 for the month, 35 for the quarter, 465 for the year,

- 41133, conf, Petro-Hunt, Klevmoen Trust 153-95-20A-32-1HS,

- Friday, July 25, 2025: 34 for the month, 34 for the quarter, 464 for the year,

- None.

RBN Energy: new budget bill aims to throttle pace of EV adoption, with long-term consequences.

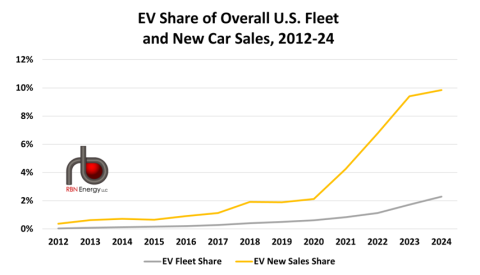

Expectations for electric vehicle (EV) adoption in the U.S. took a sharp detour into uncharted territory earlier this month when President Trump signed the landmark budget reconciliation bill into law. Known as the One Big Beautiful Bill Act (OBBBA), the law dramatically scales back EV subsidies, eliminates penalties for automakers that don’t meet fuel-efficiency standards, and significantly restricts state-level zero-emission vehicle (ZEV) programs. In today’s RBN blog, we look at why the law is likely to slow the pace of EV adoption and impact forecasts for vehicle sales and gasoline demand — a key topic in the just-published Future of Fuels report from our Refined Fuels Analytics (RFA) practice.

We’ll start with one of the most significant changes in the OBBBA, or at least one that is very noticeable to consumers: the early termination of the New EV Tax Credit (30D), which has helped EVs move closer to price parity with internal combustion engine (ICE) vehicles. Under changes made to the tax credit in 2022’s Inflation Reduction Act (IRA), EVs complying with either critical mineral or battery component requirements are eligible for tax credits of $3,750 each, or $7,500 if a vehicle meets both. In addition, a tax credit of up to $4,000 was for the first time extended to used EVs. The IRA also gave buyers the option of using the credit as part of their down payment or as cash-back from the dealer. (Under earlier legislation, buyers had to wait until they filed their taxes in the following calendar year to receive the value of the credit.)

Those tax credits are ending as of September 30 — seven years earlier than under the IRA — but the OBBBA makes a couple other key changes as well. Leased EVs will no longer be classified as commercial vehicles, a loophole that has allowed leasing companies to claim the full tax credit, then pass it on to the consumer. (About half of new EVs are now leased, according to market reports, up from 15% in 2022. The industrywide lease rate for all new vehicles is about 25%.) In addition, the Commercial Clean Vehicle Tax Credit (45W) is also being discontinued. Businesses and tax-exempt organizations that purchase qualified clean vehicles — battery-electric, fuel cell and plug-in hybrid vehicles — for commercial use qualify for the credit. The credit can be up to $40,000 for larger vehicles (14,000 pounds or more, such as heavy-duty trucks, school buses and semis) and up to $7,500 for smaller vehicles.

Figure 1. EV Share of Overall U.S. Fleet and New Car Sales, 2012-24. Source: RBN Refined Fuels Analytics