The wells:

- 37977, conf-->drl/A,

Hess, EN-Joyce-LE-156-94-1721H-6, Manitou, from the permit, sections

16/17/20 & 21-156-94; 844 FSL 749 FWL; number of days of production

not reported; huge well; first production, 4/21; t--; cum 170K 11/21;

| Date | Oil Runs | MCF Sold |

|---|

| 4-2021 | 18287 | 25524 |

- 37978, conf-->drl/A,

Hess, EN-Joyce-LE-156-94-1721H-5, Manitou, from the permit, sections

16/17/20 & 21-156-94; 844 FSL 782 FWL; number of days of production

not reported; huge well; first production, 4/21; t--; cum 172K 11/21; see update here.

| Date | Oil Runs | MCF Sold |

|---|

| 4-2021 | 5259 | 776 |

- 37979, conf-->drl/A,

Hess, EN-Joyce-LE-156-94-1721H-4, Manitou, from the permit, sections

16/17/20 & 21-156-94; 844 FSL 815 FWL; no production data, yet; huge well, first production, 5/21; t--; cum 162K 11/21;

- 17887,165, the parent well, off-line; never did well; will be interesting to see if it comes back on line; came back on line, 6/21; off line again, 8/21; 165, Hess, EN-Joyce-156-94-1720H-1, Manitou, t6/09; cum 95K 11/21; intermittent production; struggling;

- 27313, 781, Hess, EN-Eva-156-94-1621H-1, Manitou, not an EN-Joyce well, but sited on same pad as the "original" EN-Joyce

pad; also drilled back in 2014; not a particularly good well; remains on

line; 781, Hess, EN-Eva=156-94-1621H-1, Manitou, t7/14; cum 202K 11/21;

- 27314, drilled back in 2014, not a particularly good well; remains on line; 349, Hess, EN-Joyce-LE-156-94-1721H-1, Manitou, t9/14; cum 125K 11/21;

- 27315, drilled back in 2014, not a particularly good well; remains on line; 142, Hess, EN-Joyce-LE-156-94-1721H-2, Manitou, , t8/14; cum 154K 9/21; cum 158K 11/21;

- 27316, drilled back in 2014, not a particularly good well; was taken off line 7/20 and remains off line, 4/21; back online 6/21; 490, Hess, EN-Joyce-LE-156-94-1721H-3, Manitou, t9/14; cum 135K 9/21; cum 138K 11/21;

Updates

January 17, 2022: #37978 updated; very, very nice well;

July 11, 2021: the three more recently completed EN-Joyce wells are starting to report "runs." See this post. These are huge wells and fracks seem to be "moderate" fracks.

Original Post

This is really, really cool. During the early years of the blog / the Bakken revolution, I was never impressed with the Hess wells, but either last year or the year before, I forget, I posted on the blog, that I was impressed with good the Hess wells have become.

The Manitou oil field is not a "big field" in the Bakken, but it looks much more promising all of a sudden. Look at how far "we've" come. The early EN-Joyce wells were not impressive. Drilled in 2014, they have produced less than 300,000 bbls crude oil cumulative. In general, these wells maxed out in the first full month of production with 6,000 to 12,000 bbls over thirty days and declined quickly.

Now, 2020 / 2021 -- it appears we may see 50,000 bbls in the first month of production for three new Hess EN-Joyce wells.

Results like this explain why operators in the Bakken do not need to add rigs to maintain the company's production in the Bakken. Any increase in the number of active rigs in the Bakken will be "new" operators bringing one rig on line, and a couple of the "older" operators maybe adding another rig.

Calendar year 2021 will be fascinating to watch. Six more months to go and we won't see final results of 2021 until February/March, 2022.

From a reader today:

The three new EN Joyce wells in 156-94-17/20 and 16/21 have massive

first month cums. We got our stubs yesterday and they did something like

61,000 bbls, 51k and 41k respectively. They are on confidential status

but suspect the production numbers will be out today.

See this post from November 18, 2020: three section line wells.

Re-posting the November 18, 2020 post:

I assume this is fairly common and I've simply missed other examples,

but it's my experience that there is generally just one well along a

section line but today I noted that Hess has permits for three wells

along the same section line. When I get caught up I will take a closer

look, but for now:

- 37977, loc, Hess, EN-Joyce-LE-156-94-1721H-6, Manitou, from the permit, sections 16/17/20 & 21-156-94; 844 FSL 749 FWL;

- 37978, loc, Hess, EN-Joyce-LE-156-94-1721H-5, Manitou, from the permit, sections 16/17/20 & 21-156-94; 844 FSL 782 FWL;

- 37979, loc, Hess, EN-Joyce-LE-156-94-1721H-4, Manitou, from the permit, sections 16/17/20 & 21-156-94; 844 FSL 815 FWL

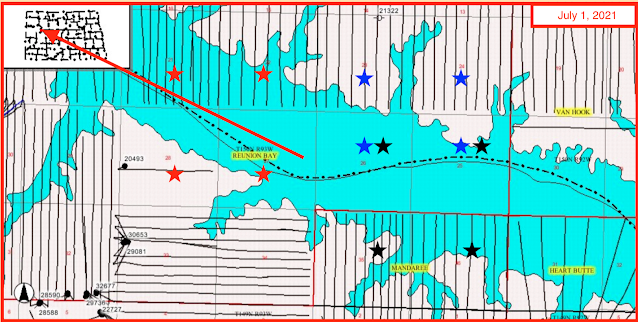

Graphic:

When the going gets tough, the tough get going. Hess, CLR, BR.

********************************

More Of The Bakken

Active rigs:

$75.91

| 7/1/2021 | 07/01/2020 | 07/01/2019 | 07/01/2018 | 07/01/2017 |

|---|

| Active Rigs | 23 | 11 | 60 | 67 | 58 |

One well coming off the confidential list -- Thursday, July 1, 2021: 1 for the month, 1 for the quarter, 181 for the year:

- 37481, drl/NC, BR, F Jorgenson 1C TFH, Elidah, no production data

RBN Energy: Alaska oil production continues to decline on stronger headwinds.

It’s been a challenging few years — some would say decades — for

producers in northern Alaska. Crude oil production in the remote, frigid

region peaked at just over 2 MMb/d in 1988 and has been falling ever

since, dropping to about 450 Mb/d in 2020 and the first few months of

2021. It’s not that Alaska is running out of oil; far from it. Instead,

the state’s energy industry has been battered by competition from shale

producers in the Lower 48, thwarted by federal policies, and, more

recently, ESG-related concerns and the Biden administration’s efforts to

put the kibosh on new federal leases. Despite it all, the few producers

still active in Alaska hold out hope for a revival. Today, we discuss

the many hurdles that northern Alaska producers face.

As we said in our 2016 blog series about Alaska, the 49th

state was seen as the next big thing for U.S. crude oil production in

the 1970s –– and that promise soon became reality. With the completion

of the 800-mile Trans-Alaska Pipeline System (TAPS) from Prudhoe Bay to

Valdez, AK, in 1977, Alaska North Slope production took off, and by

1988, the state not only accounted for one-quarter of total U.S. crude

oil output (blue layer in Figure 1), it briefly knocked Texas off its

perch as the #1 oil-producing state. Alaskan oil didn’t give the U.S.

“energy independence” -– a rallying cry in the Ford, Carter and Reagan

years –– but it sure helped. The physical characteristics of the North

Slope’s medium sour crude, with a 31.5 API gravity and about 1% sulfur,

were (and are) a plus. West Coast refineries were configured to run it,

and the crude is marketable in Asia too. Still, Alaska’s production has

experienced a long, slow decline that continued in 2020, when it

averaged 448 Mb/d, only 4% of the U.S. total and the lowest level since

TAPS came online 44 years ago, according to the Energy Information

Administration (EIA).

Figure 1. Alaska Crude Oil Production. Source: EIA

Perhaps reporting soon:

- 37977, loc, Hess, EN-Joyce-LE-156-94-1721H-6, Manitou, from the permit, sections 16/17/20 & 21-156-94; 844 FSL 749 FWL; number of days of production not reported:

| Date | Oil Runs | MCF Sold |

|---|

| 4-2021 | 18287 | 25524 |

- 37978, loc, Hess, EN-Joyce-LE-156-94-1721H-5, Manitou, from the permit, sections 16/17/20 & 21-156-94; 844 FSL 782 FWL; number of days of production not reported:

| Date | Oil Runs | MCF Sold |

|---|

| 4-2021 | 5259 | 776 |

- 37979, loc, Hess, EN-Joyce-LE-156-94-1721H-4, Manitou, from the permit, sections 16/17/20 & 21-156-94; 844 FSL 815 FWL; no production data, yet;

The other EN-Joyce wells:

- 17887, the parent well, off-line; never did well; will be interesting to see if it comes back on line;

- 27313, not an EN-Joyce well, but sited on same pad as the "original" EN-Joyce pad; also drilled back in 2014; not a particularly good well; remains on line;

- 27314, drilled back in 2014, not a particularly good well; remains on line;

- 27315, drilled back in 2014, not a particularly good well; remains on line;

- 27316, drilled back in 2014, not a particularly good well; was taken off line 7/20 and remains off line, 4/21;