Feedjit is unfortunately no longer available. The service was run as a hobby site for many years. Due to emerging cyber risks and regulatory requirements, it is not possible to continue to operate Feedjit as a not-for-profit fun service without incurring significant costs.Thank you Mark Zuckerberg, et al.

For this reason we are regrettably shutting down the service.

Both Kerry and I hope you enjoyed Feedjit for the many years that it was running. If you are looking for a way to view your website traffic in real-time, I recommend you install Google Analytics and check out the real-time view.

Regards,

Mark Maunder.

**********************************

Meanwhile, Over At Camelot 2.0

President Trump's first state dinner. Guest of honor: French President Macron. One of a very select group of guests: Tim Cook.

From Macrumors:

************************************

Wow

If the GOP has a bucket of #1 enemies, certainly Ms Lisa Perez Jackson would be in that bucket.

Guess what! That's her in the picture above; she accompanied Tim Cook to President Trump and Melania's first state dinner -- wow, wow, wow. There are so many story lines.

Ms Lisa Jackson was the director of the EPA under the Obama administration and probably did as much -- or tried to do as much -- as she could to destroy / derail / slow the US shale revolution. Wow.

When she left the Obama administration, she went to work for Tim Cook at Apple. Tim Cook could have brought another "date," but he chose to have Ms Lisa Jackson join him. That's really something.

One-hundred-fifty people, apparently, attended President Trump's first state dinner. That means seventy-five primaries were invited; the other 75 were friends, dates, significant others, spouses. That was a very, very small state dinner .... and Tim Cook was invited. That speaks volumes.

On top of all that, Tim Cook was seated next to Mrs Macron. Someone needs to fact check that.

Reading The Opium Wars, Hanes, c. 2002, puts so much of this into perspective.

*******************************

As Long As We Are Talking Apple ...

I remember the skeptics who said the Apple Watch would not move the needle for Apple. I don't know whether that's accurate or not, but I sure see a lot of movers and shakers wearing Apple Watches.

But apparently, Apple Watches have moved the needle for Verizon. From Macrumors:

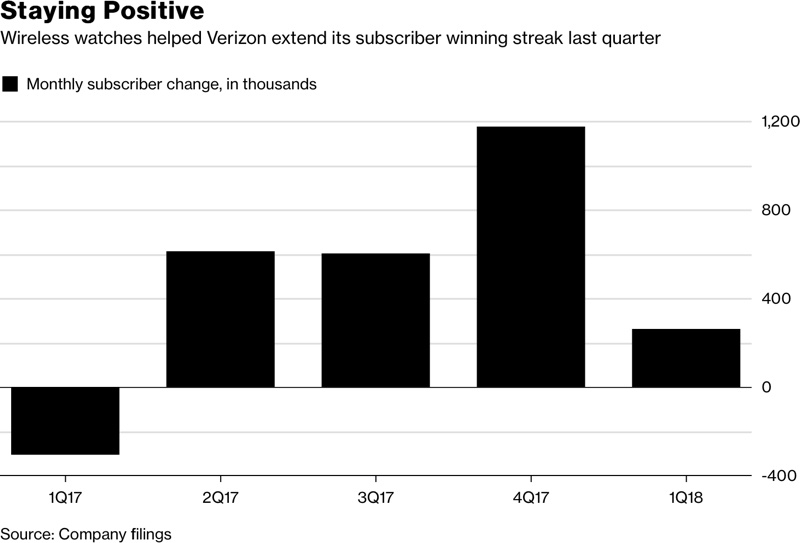

Verizon, the largest carrier in the United States by subscriber count, saw a monthly subscriber increase of 260,000 during the first quarter of 2018, reports Bloomberg, largely due to an increased number of smart watch activations.

The company actually lost phone and tablet subscribers last quarter, but the dip in subscribers did not hurt its bottom line because of smart watches, wearables, and other connected devices like vehicles.

Image via Bloomberg

Verizon says it added a total of 359,000 subscribers who are using smart watches and other devices during the quarter, making up for the loss of 24,000 phone customers and 75,000 tablet customers.

There was no breakdown in the number of activations by specific device, but Verizon's jump in smart watch subscribers comes following the September release of the Apple Watch Series 3, the first Apple Watch with LTE connectivity.

I had forgotten the Series 3 Apple Watch had LTE connectivity. Aewsome.