Link here: https://www.atlantafed.org/cqer/research/gdpnow.

Most recent 3Q23 estimate, yesterday, September 6, 2023, unchanged from one week earlier: 5.6.Thursday, September 7, 2023

3Q23 GDPNow Estimate Unchanged At 5.6 — September 7, 2023

Gasoline Demand -- September 7, 2023

Locator: 45564B.

I requested an Altima for our cross-country trip last weekend. I was not happy when they "gave" me a Toyota 4Runner:

The Honda Civic:

The Nissan Altima:

The Toyota 4Runner:

So, on the highway:

- the Civic: 40

- the Altima: 36

- the 4Runner: 19

Not happy.

We drove the 4Runner hard. It was a great road car, but we averaged 22 mpg. My Honda Civic would have gotten 36 mpg without a problem.

36 vs 22.

If gasoline in the 4Runner cost me $600 on the road trip, it would have been $367 in the Altima, even less in the Honda Civic. In the big scheme of things, $600 vs $400 was no big deal, but still ...

So, what did I see on our 3500-mile-five-day-round-trip-Dallas-to-Philadelphia-and-back?

- almost no Civics

- the highways were filled with 4Runners.

When Americans travel cross-country, what do they drive? Civics or 4Runners?

Answer: 4Runners.

4Runners: 19. Civics: 40.

All of that, to re-post this:

Gasoline demand, link here:

*******************

Norway

The Norway experience has been the same. Norway has the highest penetration of EVs in the world (fact-check me on that) and yet their gasoline demand is at all-time highs.

Apologists for EVs say that it takes awhile (apparently, ten years or more) for all those yearly EV sales to start to make a difference. It appears it will take a long, long time for EV penetration to make a diffference.

If Norway has led the western world in EV penetration and gasoline demand is still increasing, it's going to take a long, long time to see any impact in the US when it comes to EV penetration and gasoline demand.

I could write at length about that but our road trip to Philadelphia and back to Dallas explains it all. Americans would rather drive in road comfort in a 19-mpg 4Runner rather than be cramped in a 40-mph Honda Civic.

Best-selling vehicle in the US? A pickup truck.

In addition, vehicle registrations:

Right now, WFH (work-from-home) for white collar is a "thing." That's not going to change any time soon.

Whatever small change EVs may make with regard to gasoline demand, these small changes will be more than offset by what Americans actually drive.

The New Chord Energy Osprey Wells -- September 7, 2023

Locator: 45563B.

This might get a few Williston residents excited.

A

reader writes to tell me he/she received division orders for three

Chord Energy wells earlier in September, 2023, or late August, 2023:

- 39322, Osprey 5401 44-23 4B

- 39321, Osprey 5401 44-23 3B

- 39281, Osprey 5401 43-23 2B

What Happened To All That Goodwill? September 7, 2023

Locator: 45561POLITICS.

News item: NYC mayor is having challenges with 60 immigrants brought up from Texas maybe once or twice a month.

- Meanwhile, El Paso, TX, upwards of 3,000 "encounters" daily.

Population:

- NYC metropolitan area: 20,110,000

- "recent" immigrant population: 110,000

- out of every 200 "New Yorkers" -- 1 is a "recent" immigrant

- overall, as a percent: 0.5%

- a busload of 60: 0.0000029 = 0.000298% -- from Texas, maybe once a month?

- one planeload of passengers from Europe: 300

- my hunch: the public unions are very concerned; immigrants are taking their jobs

Flights from Europe into NYC on a daily basis:

Yesterday: the photo-op --

Today, the headlines:

NYC: sanctuary city --

******************

Ice Cream

Ice cream from Portland, OR, down here in Bluebell Ice Cream country.

Weekly EIA Petroleum Report -- Same Old Stuff -- Crude Oil In Storage At "Record Low" (?) -- September 7, 2023

Locator: 45560WTI.

Days of supply, crude oil: folks can fact check me at this site, but it appears we are at a "new record."

- US crude oil measured in terms of "days of supply" dropped to 25.0 days. We have not had a "24-handle" since 2019, before the Covid-19 lock down.

- $100-WTI? The trend needs to continue and approach 21 days.

- US pump prices -- gasoline -- hit highest seasonal level in a decade (see below)

WTI: despite this new data, WTI dropped in price today, now trading below $87 (1:20 p.m. CT, September 7, 2023).

Gasoline: link here.

Weekly EIA petroleum report: link here.

- US crude oil in storage decreased by a whopping 6.3 million bbls, and had literally no effect on price of WTI after the report came out; folks are obsessed with interest rates and the recession which has been predicted for the past two years;

- oil trading below $88, though some analysts predict spike in price of oil sooner or later;

- US crude oil in storage now stands at 416.6 million bbls, 4% below the five-year average -- which means there's still so much oil sloshing around ...

- Saudi Arabia knows that (excess oil sloshing around) and will extend their production cuts through the rest of the year;

- the US imported 9.7% more oil than usual, suggesting the refiners have too much US light shale oil and need heavier oil from other sources;

- speaking of which, refiners are operating at 93.1% of their refining capacity

- jet fuel supplied was up 3.2% but other than that the rest of the numbers were pretty much n line with previous reports and expectations;

News: Biden administration cancels several Alaskan oil permits that former president had approved.

Gasoline demand, link here:

Update On CLR / XTO Permits / Old Well In Grinnell Oil Field -- December 13, 2024

Locator: 45558B.

Old XTO permits, now CLR permits, still on confidential list.

Update

The well:

- 19257, 1,027, XTO, Michael State 31X-16, t4/11; cum 326K 7/23; recent production, note halo effect; cum 384K 10/24; note recent production and jump in production 3/23; a workover?

| Pool | Date | Days | BBLS Oil | Runs | BBLS Water | MCF Prod | MCF Sold | Vent/Flare |

|---|---|---|---|---|---|---|---|---|

| BAKKEN | 10-2024 | 31 | 1290 | 1377 | 1033 | 5533 | 5338 | 195 |

| BAKKEN | 9-2024 | 30 | 1199 | 1159 | 1067 | 5537 | 5477 | 60 |

| BAKKEN | 8-2024 | 31 | 1334 | 1341 | 1122 | 4775 | 4713 | 62 |

| BAKKEN | 7-2024 | 31 | 1402 | 1367 | 1187 | 5939 | 5925 | 14 |

| BAKKEN | 6-2024 | 30 | 1365 | 1588 | 1134 | 5643 | 5643 | 0 |

| BAKKEN | 5-2024 | 31 | 1487 | 1554 | 1244 | 6072 | 5881 | 0 |

| BAKKEN | 4-2024 | 30 | 1542 | 1182 | 1296 | 6275 | 6090 | 0 |

| BAKKEN | 3-2024 | 31 | 1723 | 2085 | 1438 | 6728 | 6440 | 0 |

| BAKKEN | 2-2024 | 29 | 2175 | 1799 | 1608 | 6725 | 6454 | 0 |

| BAKKEN | 1-2024 | 20 | 924 | 914 | 712 | 3033 | 2885 | 0 |

| BAKKEN | 12-2023 | 31 | 1757 | 1827 | 1505 | 6344 | 6055 | 0 |

| BAKKEN | 11-2023 | 30 | 2080 | 2462 | 1793 | 6983 | 6703 | 0 |

| BAKKEN | 10-2023 | 31 | 1881 | 1599 | 1420 | 5249 | 4960 | 0 |

| BAKKEN | 9-2023 | 30 | 1636 | 1341 | 1830 | 3896 | 3711 | 0 |

| BAKKEN | 8-2023 | 18 | 854 | 1093 | 647 | 2910 | 2817 | 0 |

| BAKKEN | 7-2023 | 31 | 2017 | 2023 | 1607 | 6803 | 6612 | 0 |

| BAKKEN | 6-2023 | 30 | 2112 | 2023 | 1723 | 6989 | 6806 | 0 |

| BAKKEN | 5-2023 | 31 | 2401 | 2515 | 1913 | 7723 | 7549 | 0 |

| BAKKEN | 4-2023 | 30 | 2671 | 2611 | 2327 | 9841 | 9659 | 0 |

| BAKKEN | 3-2023 | 31 | 3439 | 3399 | 2865 | 9337 | 9048 | 0 |

| BAKKEN | 2-2023 | 2 | 90 | 0 | 337 | 160 | 141 | 0 |

| BAKKEN | 1-2023 | 11 | 197 | 227 | 0 | 429 | 337 | 0 |

| BAKKEN | 12-2022 | 5 | 64 | 216 | 0 | 126 | 97 | 0 |

| BAKKEN | 11-2022 | 30 | 552 | 438 | 53 | 1219 | 939 | 0 |

Original Note

The well:

- 19257, 1,027, XTO, Michael State 31X-16, t4/11; cum 326K 7/23; recent production, note halo effect; cum 384K 10/24;

| Pool | Date | Days | BBLS Oil | Runs | BBLS Water | MCF Prod | MCF Sold | Vent/Flare |

|---|---|---|---|---|---|---|---|---|

| BAKKEN | 7-2023 | 31 | 2017 | 2023 | 1607 | 6803 | 6612 | 0 |

| BAKKEN | 6-2023 | 30 | 2112 | 2023 | 1723 | 6989 | 6806 | 0 |

| BAKKEN | 5-2023 | 31 | 2401 | 2515 | 1913 | 7723 | 7549 | 0 |

| BAKKEN | 4-2023 | 30 | 2671 | 2611 | 2327 | 9841 | 9659 | 0 |

| BAKKEN | 3-2023 | 31 | 3439 | 3399 | 2865 | 9337 | 9048 | 0 |

| BAKKEN | 2-2023 | 2 | 90 | 0 | 337 | 160 | 141 | 0 |

| BAKKEN | 1-2023 | 11 | 197 | 227 | 0 | 429 | 337 | 0 |

| BAKKEN | 12-2022 | 5 | 64 | 216 | 0 | 126 | 97 | 0 |

| BAKKEN | 11-2022 | 30 | 552 | 438 | 53 | 1219 | 939 | 0 |

| BAKKEN | 10-2022 | 31 | 608 | 666 | 30 | 1302 | 1013 | 0 |

| BAKKEN | 9-2022 | 30 | 582 | 442 | 32 | 1159 | 974 | 0 |

| BAKKEN | 8-2022 | 31 | 594 | 661 | 33 | 1231 | 1040 | 0 |

Wells of interest, note legal name (16G, 16C, 16D)

- 35237, conf, CLR/XTO, Michael State Federal 31X-16G, Grinnell, t--; cum --; API: 33-105-04896;

- 35236, conf, CLR/XTO, Michael State Federal 31X-16C, Grinnell, t--; cum --; API: 33-105-04895;

- 35233, conf, CLR/XTO, Michael State Federal 31X-16D, Grinnell, t--; cum --; API: 33-105-04892;

The map:

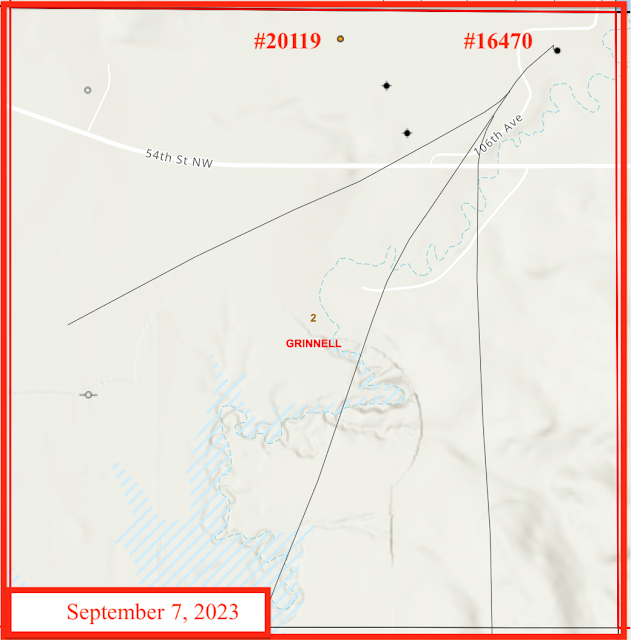

Wells Of Interest -- XTO Wells In The Grinnell -- September 7, 2023

Locator: 45557B.

Updates

January 21, 2025: production data updated; only one of two wells updated; map unchanged after all these years.

Original Post

Wells of interest:

- 16470, 191, XTO, GBU Harney 41X-2, Grinnell, t4/07; cum 103K 7/23; cum 106K 10/24; off line;

- 20119, conf, XTO, GBU Janice 31X-2F, Grinnell, t--; cum --; after all these years, still shown as conf;

The maps:

Hess EN-Hegland -- #16720 Off-Line -- Suggesting Area Activity -- September 7, 2023

Locator: 45556B.

The well:

- 16720, IA/223, Hess, EN-Hegland-155-94-0508H-1, Manitou, t1/09; cum 131K 4/23, recent production:

| Pool | Date | Days | BBLS Oil | Runs | BBLS Water | MCF Prod | MCF Sold | Vent/Flare |

|---|---|---|---|---|---|---|---|---|

| BAKKEN | 7-2023 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 6-2023 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 5-2023 | 0 | 0 | 5 | 0 | 0 | 0 | 0 |

| BAKKEN | 4-2023 | 30 | 337 | 338 | 288 | 810 | 798 | 12 |

| BAKKEN | 3-2023 | 31 | 349 | 351 | 329 | 832 | 822 | 10 |

| BAKKEN | 2-2023 | 27 | 344 | 344 | 183 | 669 | 658 | 11 |

| BAKKEN | 1-2023 | 31 | 373 | 372 | 287 | 846 | 834 | 12 |

| BAKKEN | 12-2022 | 28 | 281 | 284 | 222 | 780 | 773 | 7 |

| BAKKEN | 11-2022 | 30 | 409 | 406 | 297 | 886 | 877 | 9 |

| BAKKEN | 10-2022 | 31 | 405 | 404 | 352 | 961 | 952 | 9 |

| BAKKEN | 9-2022 | 30 | 348 | 345 | 392 | 961 | 952 | 9 |

Wells of interest:

- 39111, conf, Hess, EN-Hegland-155-94-0508H-4, Manitou,

- 39112, conf, Hess, EN-Hegland-155-94-0508H-5, Manitou,

- 39113, conf, Hess, EN-Hegland-155-94-0508H-6, Manitou,

- 39114, conf, Hess, EN-Hegland-155-94-0508H-7, Manitou,

- 39115, conf, Hess, EN-Hegland-155-94-0508H-1, Manitou,

The maps:

Greetings From Buc-ee's -- Labor Day Weekend -- 2023

Locator: 45555RETAIL.

From Buc-ee's in Nashville, or maybe Knoxville -- I forget which. Plus a third one, Royse City, northeast of Dallas. Over Labor Day weekend, September, 2023.

***************************

Storing Photos On-Line

Best idea ever. As soon as I get home from a trip, I download all my photos at Walgreens.

Saves huge amount of room on my own storage sites.

Can get re-prints any time.

Will provide user id and password to heirs so they have access to all these photos.

Many other options, of course, but Walgreen's is right down the street from us and I can pick up photos ten minutes after I submit electronic order.

Same thing with regard to movies, but for movies, I use YouTube.

MEW Or MEG -- September 7, 2023

Locator: 45554RETAIL.

Most successful ticker for over 25 years: Monster Energy.

The Monster Energy Girls (MEG) or Monster Energy Women (MEW) -- Nashville, near Vanderbilt, September 4, 2023, Labor Day.

Distributing free sample for years in Nashville.

******************************

Museum Notes

On our five-day trip Dallas-to-Philadelphia we accomplished a lot. Many, many highlights.

One of the highlights: the Philadelphia Art Museum. We had limited time there, but May saw "Whistler's Mother" and a companion piece.

"Whistler's Mother" is permanently hung at the Museé d'Orsay, Paris, but for the first time in 147 years it's on display in the US, at the Philadelphia Art Museum.

May has the photo! I'll post it later.

For the back story, see this link, posted just a couple of weeks ago!

Yes, we are definitely going back.

Three Wells Coming Off Confidential List Today -- September 7, 2023

Locator: 45552B.

Weekly EIA petroleum report: pending.

DIS / Hulu / CMCSA: deal in the news.

SLB: on a roll. To grow revenue by $5 billion this year (2023) and next (2024); link here.

Alaska: Biden cancels seven Alaskan oil and gas leases that Trump had approved. Link here.

- message sent: Biden administration not all that worried about price of gasoline

- Rystad Energy analysis of current state of affairs.

****************************

Back to the Bakken

WTI: $87.00.

Friday, September 8, 2023: 71 for the month; 273 for the quarter, 518 for the year

39613, conf, Kraken, Gladys 29-20-17-3H,

37472, conf, SOGC (Sinclair), Saetz Federal 3-36H,

39380, conf, Eagle Operating, Cutbank 18-13,

39031, conf, Liberty Resources, Temple 159-96-36-25-4MBH,

37928, conf, BR, Boxer 2B MBH,

RBN Energy: unveiling the full list of survivors of the DOE's hydrogen hub cutdown, part 4. Archived.

Considerable time and effort has been spent tracking the federal government’s plan to spend billions of dollars to create a number of regional hydrogen hubs. News about the Department of Energy’s (DOE) hub-selection process has been hard to come by, especially since the potential applicants weren’t publicly disclosed at the time of the agency’s informal cutdown in late 2022 and many potential developers, for competitive reasons, have elected to play their cards very close to the vest. In today’s RBN blog, we’ll publish the DOE’s full list of 33 encouraged proposals for the first time, examine some of the plans that were combined in an effort to produce a stronger joint application, and share a little about the concept papers that didn’t make the DOE’s informal cut.

The U.S. has made clean hydrogen a priority, with the federal government’s Regional Clean Hydrogen Hubs (H2Hubs) initiative intended to accelerate the process. As we noted in Part 1 of this series, the DOE opened up $7 billion in funding in September 2022 for the development of several hubs. For the first stage of the hub-selection process, the DOE’s Office of Clean Energy Demonstration (OCED), which will administer the hydrogen-hub funding, required interested parties to submit concept papers about their planned projects. Of the 79 papers that were submitted, 33 were encouraged at the end of 2022 to submit a full application by the April 7 deadline. (Also note that projects that were encouraged to submit a full application were not required to do so, and projects on the discouraged list were still eligible to submit a full application.)