Regular readers of the blog, and particularly those that follow "Focus on Fracking" every Sunday/Monday night, are familiar with this weekly data point:

And always the most fun:

So, based on that reported & estimated data, the crude oil figures from the EIA for the week ending December 16th appears to indicate that our total working supply of oil from net imports, from oilfield production, and from storage was 1,054,000 barrels per day less than what our oil refineries reported they used during the week.

To account for that obvious disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (+1,054,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been an omission or error of that magnitude in this week’s oil supply & demand figures that we have just transcribed.

Moreover, since last week’s “unaccounted for crude oil” was at a record (+2,259,000) barrels per day, that means there was a 1,204,000 barrel per day difference between this week's balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the changes to supply and demand from that week to this one that are indicated by this week's report are off by that much, thus rendering those comparisons virtually meaningless....

However, since most everyone treats these weekly EIA reports as gospel, and since these weekly figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer) ...

Every week for as long as I can remember, the author of that website discusses the "missing oil" and how the EIA simply inserts "a figure" to compensate for it.

Hold that thought.

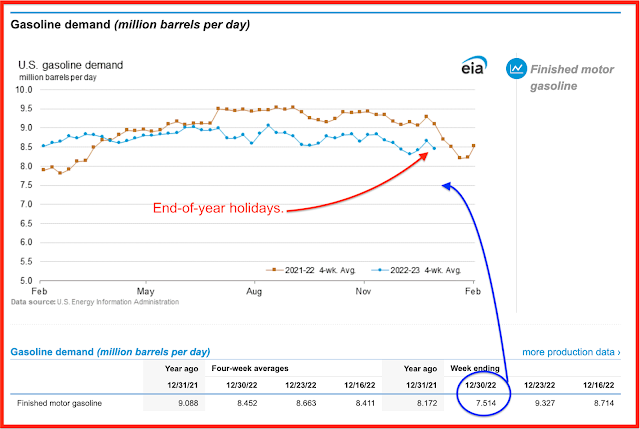

With that in mind, this, without question, is the most interesting item to pop up on my twitter feed earlier this evening:

Reading the thread will provide a few more details