Locator: 10010SLAWSON.

Updates

November 4, 2012:

Slawson permits for five wells on a 640-acre spacing unit;

June 16, 2012:

Slawson Drilling the Upper Bakken; Slawson says it is drilling the "upper" Bakken, very interested in the area along the Montana-North Dakota border

Permits

2014

None

2013-

26111, 286, CLR, Major Federal 1-6H, t10/13; cum 117K 11/17; cum 169K 11/21; cum 198K 11/24;

Issued in 2012-

22638, PNC, SM Energy, Hatter Federal 16-29H, Squaw Gap (still on conf 2/14; PNC 4/14;)

The six wells below are on two pads: one 4-well pad; one 2-well pad

- 22763, PNC, Slawson, Battleax Federal 3-34H, Squaw Gap, as of 2/15;

- 22764, PNC, Slawson, Chariot Federal 3-27H, Squaw Gap, as of 2/15;

- 22765, PNC, Slawson, Chariot Federal 2-27H, Squaw Gap, as of 2/15;

- 22766, PNC, Slawson, Battleax Federal 2-34H, Squaw Gap, as of 2/15;

- 22767, PNC, Slawson, Battleax Federal 1-34H, Squaw Gap, as of 2/15;

- 22768, PNC, Slawson, Chariot Federal 1-27H, Squaw Gap, as of 2/15;

Original Post

Link here.

This is a great story/link sent to me by a reader. I have been so busy I was not able to post it earlier.

This is a huge story; a big "thank you" to a reader for sending it to me. Sorry it took so long to get posted. Way too busy.

The gist of the story concerns Slawson and Squaw Gap; and Bakken "tight oil" and "shale oil."

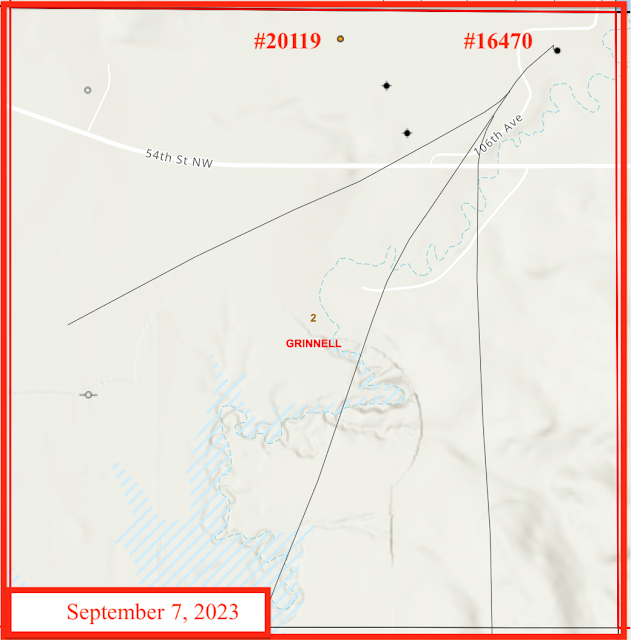

Squaw Gap oil field is in southwest McKenzie County, right on the Montana state line. It is just north of Bicentennial where Whiting's Lewis & Clark prospect begins, I believe. State highway 16 runs right through the middle of it, in the Little Missouri National Grassland.

Here are the wells and permits in Squaw Gap since 2009. As far as I can tell no permits were issued for Squaw Gap oil field in 2009, 2010, or 2011. So far in 2012:

- 22638, PNC, SM Energy, Hatter Federal 16-29H, 29-147-104, PNC as of 4/14;

- 22763, PNC, Slawson, Battleax Federal 3-34H, 34-147-105,

- 22764, PNC, Slawson, Chariot Federal 3-27H, 34-147-105,

- 22765, PNC, Slawson, Chariot Federal 2-27H, 27-147-105,

- 22766, PNC, Slawson, Battleax Federal 2-34H, 27-147-105,

- 22767, PNC, Slawson, Battleax Federal 1-34H, 27-147-105,

- 22768, PNC, Slawson, Chariot Federal 1-27H, 27-147-105

Four wells in section 27 (all on lot 4); and two in section 34. Slawson has another well sited in this field, but it will be running north into Mondak field.

- 22615, PNC, Slawson, Phalanx Federal 3-22-15H, conf as of 2/15;

Other older wells in Squaw Gap:

- 6622, PA, a Madison well; 651 bbls total;

- 7208, PNA, a Madison well; 1,657 bbls total; Red River dry;

- 7292, PNA, a Madison well; 6,710 bbls total;

- 7666, PNA, a Madison well; 13,065 bbls total;

- 7737, PNC,

- 8287, PNA, a Madison well; 20,893 bbls total;

- 8404, PNA, a Madison well; 13,767 bbls total;

- 8872, PNA, a Madison well; 3,395 bbls total;

- 12779, 110, Whiting, Beaver Valley Ranch 34-21H, t12/89; cum 181K 9/16; Bakken; cum 197K 11/21;

- 12835, 254, XTO, Silkworm 1-16, t6/90; cum 370K 9/16; Bakken; cum 409K 11/21; cum 429K 11/24;

- 13432, 73 (no typo), Rocky Top Energ, LLC/Whiting, MOI Squaw Gap 22-9H, t11/92; cum 91K 9/16; Bakken; cum 97K 4/21; off line 4/21; cum 102K 11/24;

- 16401, 479, Slawson, Stingray Federal 1032H, t4/07; cum 224K 9/16; Bakken (Red River: dry); "primarily to be a Silurian Red River "C" test with secondary potentials at the top of the Ratcliffe, two possible fractured intervals in the Upper Mission Canyon, the Bakken Upper Shale ...." The Bakken shale was 7 - 9 feet thick; after testing all sections, ended up drilling a horizontal Upper Bakken shale; cum 272K 11/21; cum 294K 11/24;;

- 16551, AB/27 (no typo), Legacy Reserves/Summit Resources, Gap Federal 1-27H, t7/10; cum 50K 9/16; Bakken; middle Bakken, but upper Bakken interesting; off line 5/21; cum 70K 5/21;

- 16566, IA/50, Legacy Reserves/Summit Resources, Gap Federal 3-8H, t11/08; cum 22K 9/16; Bakken very few days of production; very little production;

- 16920, PA/216, Slawson, Piranha 1-4H, t3/08; cum 115K 9/16;; Bakken; target: "Bakken," hard to say, but with hindsight, this may have been in the "upper Bakken,"

*******************

A note to the granddaughters

[After posting the note below, I got a few comments from others including Arne C. who directed me to his blog:

http://miscbaseball.wordpress.com/2010/06/11/a-very-brief-historical-tour-of-fenway-park/]

Now I know why you love this art museum, Boston's Isabella Steward Gardner Museum.

You have visited at least once, but that was before the new "wing." I visited it for the first time yesterday, and I was simply overwhelmed. I had never seen anything like it before, and my first impression was this is the best art museum I had ever seen.

Now, 24 hours later, reflecting on it, maybe it's a bit much to say this is the best art museum in the world, but it may be the best art museum experience in the world. It certainly is a museum no one should miss. If you visit Boston and have time for only one museum, I think this would be it. And that's a tough call. Competing for your time: the Museum of Fine Arts in Boston; the JFK Library and Museum south of Boston; and, the Peabody Essex Museum, north of Boston in Salem/Essex. But whereas the MFA is a "typical" big city fine arts museum, the ISG is unique. The ISG Italian palace is part of the experience; for some (including me) the palace may be THE experience.

I was overwhelmed. Even though the new wing has been open now for several weeks, the line to purchase tickets still exceeded my expectations. We walked through a long glass corridor to get to the palace. Immediately upon entering, one realizes one is in a different kind of museum. The three-story structure is built around a classic Italian courtyard. I was immediately reminded of the Roman baths in Bath, England. Absolutely spectacular. I explored three or four rooms/corridors/hallways in the immediate area after emerging from the glass corridor -- the rooms around the courtyard on the ground floor, and I realized I was overwhelmed. It was a unique experience. I did not have the same experience in the Louvre. I assume I had some idea of what to expect when visiting the Louvre for the first time, but I had no idea what to expect when visiting the ISG for the first time.

I went back to the new wing to collect my thoughts. In the opposite quadrant from the restaurant, is the "living room." Isabella Gardner loved books; in fact, I believe she started collecting books before she started collecting art, and throughout the museum -- I hate to call it a museum -- it's a palace -- are shelves of her books. I could spend hours in the "living room." With comfortable sofas and individual chairs, surrounded by books to be read by visitors, it is a most relaxing room. It is "outside" the palace proper and thus no admission charge. There were several books I spent some time with, but my two favorites: the 2012 anniversary edition celebrating the Boston Red Sox and Fenway Park; and the collected letters of Isabella Gardner and her co-conspirator in art collecting, Bernard Berenson.

This is my snapshot of the ISG Museum story. Isabella loved life. She married a New York City man who created his own wealth through smart investments; they moved to Boston where they settled in the newly filled in Back Bay. She was not well educated but she more than made up for that by self-education for the rest of her life. She was devastated by the death of her 2-year old son. To get her out of her depression, her husband took her to Europe. That began her love for travel, Europe, particularly Italy, and an eye for collecting. She had taken some "adult courses" under a history professor at Harvard which was probably the life-altering event in her life with regard to art and history.

Through serendipity, she met a young (incredibly handsome) Harvard undergraduate Bernard Berenson who wanted to be the intermediary identifying, buying, and collecting art for a rich patron. He began scouring the continent for art work for Ms Gardner who had just inherited $1.6 million from her father upon his death.

She and Berenson collected art at the turn of the century and became a very, very close and successful team. The stories coming out of the museum suggest they had had a "come-to-Jesus" moment when she discovered he was being paid a handsome commission by European dealers from whom he bought art, as well as a five percent commission from Ms Gardner. Obviously it was to his advantage for the dealer to increase his prices. Berenson must have been extremely persuasive (and very, very good looking); Ms Gardner stuck with him. The relationship appears to have grown stronger and closer.

Unexpectedly her husband died about this time; I believe she was in her late 40's or 50's. (Let's see: she was born in 1840; the palace opened in 1903 -- so late 50's I guess.) Knowing she had little time left in her life, she began immediately designing and building an Italian palace to house her art collection. She chose an empty lot near where Fenway Park came to be. Fenway Court, as she called her palace, opened in 1903; Fenway Park in 1912. The ISG Museum is now just a few blocks (within walking distance of the Boston Museum of Fine Arts) on the Green Line.

For more, visit the

ISG Museum website.

Incidentally, there's a little nook, a little corner on the first floor with two chairs, a table with a dozen books, and a lamp. I don't know if Ms Gardner placed that ensemble there herself but it has "her" feeling. I don't think many visitors realize it provides an opportunity for folks like me, who become overwhelmed, to simply sit and reflect on this most personal of personal museums, as some have described this palace.

Oh, and by the way, the lunch menu was very unique and the food excellent, including affordable wines. I had a Samuel Adams -- you know, I was just reminded that Paul Revere was captured before he completed his midnight ride. Walt Whitman admitted he used artistic license to write his poem. But, Paul Revere was able to warn his close friends Sam Adams and John Hancock before he was captured. But I digress.