Locator: 48934LAW.

Friday, August 22, 2025

BRK/BNSF - CSX -- No Merger -- Some Kind Of Partnership -- August 22, 2025

Locator: 48933BNSF.

A day late, a dollar short. Not gonna cut it.

No guts, no glory.

A reader, earlier today, asked me my thoughts regarding the Intel issue. I think the Intel story is a fascinating story but I have never had any thoughts whatsoever about investing in Intel. It didn't fit my investing plan. I made that decision some time ago.

Then it dawned on me.

Years ago when talking, writing in the USAF, I came across a rule that I tried to live by. It has to do with filters. I didn't understand the concept of "filters" then but, nonetheless, I was instinctively using them. If I was questioning whether something I might say/write might offend somebody, I erred on the side of letting it slide. Didn't say it / didn't write it. There were a million other things to say; I didn't need to write / say something inappropriate. Often I did not know if something might be construed as inappropriate but there was generally no need to test it. That usually had to do with jokes or sarcasm.

That "rule" transfers to investing. I get a kick out of all the time some analysts take trying to decide whether to invest in something or not, or whether to sell or not. Most investors only have a handful of stocks in which they are interested. If after an appropriate amount of time one can't decide whether to buy or not, my advice, don't buy it. Move on. For heaven's sake, there are thousands of publicly traded companies from which to pick for investing. If after a reasonable time of studying, evaluating, if you can't decide what to do, skip it, move on. I would think that even mediocre investors should be able to tell relatively quickly whether to buy something or not. And in this age of investing, in which there are no commissions, let's say you have second thoughts after buying something. Sell it. At worst, you can share your loss with the IRS.

[See alpha-beta pruning as described by David Shenk in The Immortal Game: The History of Chess, p. 216.]

Jim Cramer's "lightning round" serves as a good example, I guess, regarding what I'm trying to say.

Rule #2. Once you've made your decision, don't look back. Keep moving forward. Study it if you want to see if you might learn something but I'm not sure in this age of "lightning rounds," if that's even necessary.

It seems a BNSF - CSX merger is a no-brainer but apparently one party or the other sees something they don't like. So, that's it. Move on. Speak in platitudes; talk about a partnership. But move on.

****************************

A Musical Interlude

****************************

A Musical Interlude

Foreign Exchange Reserves -- Russia, Saudi Arabia, China -- Posted August 22, 2025

Locator: 48932SAUDI.

Locator: 48932CHINA.

Locator: 48932RUSSIA.Foreign exchange reserves: Russia, Saudi Arabia, China.

Russia, link here:

Saudi, link here:

China, link here, posted August 22, 2025:

Four New Permits -- All In Brooklyn Oil Field; Twelve Permits Renewed -- August 22, 2025

Locator: 48931B.

WTI: $63.66.

Active rigs: 29.

Four new permits, #42245 - #42248, incluisve:

- Operator: CLR

- Field: Brooklyn oil field, Williams County

- Comments:

- CLR has permits for four wells (Addyson, Charleston, Richmond, and Olympia), SESE 22-155-98,

- to be sited 347 / 443 FSL and 358 / 411 FEL.

Twelve permits renewed:

- Zavanna (7): seven Hunter permits, Foreman Butte, McKenzie County;

- Oasis (5): five Cindy Blikre permits, Lindahl oil field, Williams County

****************************

Brooklyn Oil Field

The Brooklyn oil field is tracked here.

6 x 6

18 1280-acre spacing units

three x six standup spacing units

Alison Ritter's Quick Connects -- August 22, 2025

Locator: 48930B.

Quick connects:

Today's Market And BRK -- August 22, 2025

Locator: 48929BRK.

The more we parse Jpow's Jackson Hole speech given today, the more interesting it becomes.

The Dow at the close:

BRK-B:

My Close-Of-Day Query To ChatGPT -- Today -- 3:14 P.M. CT -- Friday, August 22, 2025

Locator: 48928BRK.

The Dow hit a record high and the S&P "balanced" also hit a record high.

My ChatGPT query is in the upper right hand corner below. In case it's too small to read:

On a day the Dow surges almost 1,000 points, Warren Buffett's BRK remained flat, with "B" shares almost closing "down." This has been quite a market -- some would say a bull market -- and yet BRK has not participated. When did Warren Buffett / BRK lose its MOJO?

Answer pending. Family commitments now. Actually, I'm going to go listen to some music.

Apple And TI -- A Marriage Made In Heaven -- August 22, 2025

Are folks paying attention?

Same time this story was making headlines, another headline: META will pay $10 billion to Google for search / AI.

Also, it's now being reported that Apple may use Google Gemini to assist / front-load Siri.

Now, back to Apple, Texas Instruments, and Sherman, TX.

In the map below, at the very top:

For those that do not know, just north of Sherman, TX, WinStar World Casino and Resort is considered the biggest casino in America based on the size of its gaming floor. Located in Thackerville, Oklahoma, the casino offers over 600,000 square feet of gaming space.

WinStar is also the largest casino in the world, in terms of gambling area, by most accounts. It surpasses other major contenders with its vast floor space, over 10,000 electronic games, and 100 table games.

The map:

In case you missed it:

From the linked article:

When Texas Instruments announced a $60 billion manufacturing megaproject in July, it was a bold bet that companies would want to mass produce foundational microchips on U.S. soil. In August, Apple vowed to do just that.

During the same Oval Office press conference where President Donald Trump announced a 100% tariff on chips from companies not manufacturing in the U.S., Apple CEO Tim Cook upped his companies’ U.S. spending commitment to $600 billion over the next four years, up from an original $500 billion announcement in February.

Part of that spending, Cook said, will go toward making “critical foundation semiconductors” for iPhones and other devices at Texas Instruments’ new chip fabrication plants in Utah and Texas.

In July, CNBC became the first news organization to see the inside of TI’s newest fab in Sherman, Texas. There, full production is on schedule to start by the end of 2025. It’s one of seven new factories the chipmaker is building in the U.S. to provide chips to major customers like Nvidia, Ford Motor, Medtronic and SpaceX.

Although Texas Instruments doesn’t make the world’s most advanced chips, its essential components are found almost everywhere, from smartphones to the graphics processing units powering generative AI.

“If you have anything that plugs into the wall, or has a battery in it, or has a cord in it, you probably carry more than one TI chip in it,” said Mohammad Yunus, TI’s senior VP of technology and manufacturing.

But just one month after TI announced the $60 billion project, its shares plummeted 13% following weak guidance and tariff concerns raised in its July 23 earnings call.

“The worry is their end customers. Like in the wake of tariff uncertainty, they don’t know what to expect. Are they stockpiling?” said Stacy Rasgon, senior analyst at Bernstein Research.

It remains to be seen whether demand will remain high once tariff uncertainties calm. Still, shares did recover some ground in August.

TGIF -- Throwback Friday -- Starting With Charlie Crockett -- And Ending With the Market -- August 22, 2025

This page is pretty much complete. Still needs to be proofread / edited.

At the Ryman:

Charley Crockett performed his first show at the historic Ryman Auditorium in Nashville in November 2022, which was so successful it was released as a live album and concert film titled "Charley Crockett: Live from the Ryman" in 2023.

The performance is available to stream on PBS and its companion app, and the album and film can be purchased on his official store or from retailers like Amoeba Music and Amazon.com. Also, full set here.

Charlie Crockett: I don't think I've ever been so excited about a singer since first hearing Willie Nelson ("Red-Headed Stranger") and Linda Ronstadt. Link here. Link here.

Barred from life to trading on/in the stock market. When you end up on CBS Mornings you know you've made it. Just don't screw it up. Is Charlie Crockett the Lana Del Rey of country music? I asked ChatGPT and was surprised by the answer.

Best line in "Jamestown Ferry": A case of gone was all she carried as she got on the Jamestown ferry. And she said that gone was all she'd ever be. Link here. My hunch: Leonard Cohen wished he would have written those lines. LOL.

ChatGPT: if folks are using ChatGPT like I'm using ChatGPT, the 22nd century is going to arrive a lot sooner than folks imagine.

Moving on. This was the most important "life lesson" Charlie Crockett ever learned. Wow. How do these guys survive?

Charlie Crockett: is the real deal. Including time in jail. LOL. Born in the same town as Freddie Fender, San Benito, Texas, in the Rio Grande Valley, just across from Mexico.

God: if you don't believe in God, or believe in angels watching over some folks, you will, after watching the Charlie Crockett documentary. When watching these documentaries, it's always amazing how many folks journal and/or take notes the old-fashioned with -- with pencils/pens and spiral journals.

The music: Charlie Crockett is on the same continuum as Q. Tarantino but at the opposite end of that continuum.

Freddy Fender: Sir Douglas Quintet, "Mendocino." Link here.

C. H. Mitchell's Bar-B-Q: Valdosta, Georgia. Link here.

Canada: blinks.

It was just a matter of time. Link here. Canada trying to "make nice"? Nope, a sign of desperation.

If you read Shenk's book on chess you will better understand Trump's mindset when it comes to life / business. For Trump, business is life / life is business. It is said sharks will die if they don't keep moving. [Are sharks the most successful chordate group ever? Nope, that distinction falls to other chordate groups, especially ray-finned fishes, when considering diversity, population size, and colonization of habitats. I might disagree. Between sharks and ray-finned fishes, which commands more respect? LOL.

The blog: best thing I ever did. Well almost. There were a few women along the way.

Intel: most misread story this past month. Link here.

Europe: is losing / has lost its way. The WSJ. It began with Angela Merkel.

Germany's response: link here. Three words: "it's too late."

Lucid: looking for love in all the wrong places. But it might just work out. Stranger things have happened. The WSJ.

Apple! Holy mackerel! Is anyone paying attention? Is Apple making a stealth move to Texas? Link to CNBC. Also at the blog. Link pending.

Shark Tank! Confirmed: Trump taking a 10% interest in Intel. Not Trump specifically, but the US government, with the deal "negotiated" by Trump. Think about that: the US government got 10% of Intel and didn't have to spend an additional dime. Trump's a pretty good negotiator. Later: it's unlikely anyone will ever really understand what happened, but at the end of the day, the US owns 10% of Intel as of today -- I assume 10% of outstanding shares of Intel. The value of this investment will now change on a daily basis, as with all publicly traded companies.

*****************************

The Art Page

Caillebotte.

I bought this book years ago after seeing a Caillebotte exhibit in Fort Worth, Texas. The book is still in its shrink wrap; I have no plans to ever open it up. At least not for awhile.

From The WSJ today:

We saw this at the Ft Worth exhibition, at the Kimbell Fine Arts Museum, some years ago.

Hangs at the J. Paul Getty Museum in Los Angeles, a museum we have visited often.

Not On My Radar Scope -- But The Imporance Of Being Fully Invested -- August 22, 2025

Locator: 48925INVESTING.

This reversal tells me all I need to know about the market. MOJO and FOMO remain the governing / guiding principle in the market today. The "YOLO-train" left the station two years ago.

The market surges 700 points and BRK-B? Barely moves and could finish in the red today. Tells me all I need to know about the market.

MMF, link here. Already at record highs, investors were still putting money into MMFs -- albeit at a slower rate than during the past few months.

********************************

The Book Page

I should finish this book this weekend.

Then I will go back through it again.

- The Immortal Game: A History of Chess or How 32 Carved Pieces On A Board Illuminated Our Understanding of War, Art, Science, and the Human Brain; David Shenk, c. 2006.

This book sneaks up on you. After the first chapter, I wasn't sure I would read any more of the book, much less finish it. Now, it's a top shelf book for; highly recommend.

ChatGPT agrees. LOL.

The 10,000-hour rule:

The 10,000-Hour Rule, popularized by Malcolm Gladwell in his book Outliers, suggests that achieving mastery in any skill requires approximately 10,000 hours of deliberate practice. This concept is based on research by Anders Ericsson on the practice habits of elite performers, though Gladwell's interpretation is often cited as an overly simplistic, generalized "magic number". The rule highlights the significance of consistent, focused practice in developing expertise, though it doesn't fully account for individual differences, the quality of the practice, or the role of other factors like luck.

Then, out of nowhere on page 132 of Shenk's book -- the 10,000-hour rule. Amazing.

Was the human brain pre-wired for sixty-minute "segments"? ChatGPT provided a nice discussion when asked. LOL. ChaptGPT: "ask me anything."

TGIF -- August 22, 2025

Locator: 48924B.

TGIF: thank goodness for the PGA tour championship.

TGIF: Charlie Crockett. Link here.

Misreading Intel: link here. [Later: most misread story this past month. Link here.]

*******************************

Back to the Bakken

WTI: $63.69.

New wells:

- Sunday, August 24, 2025: 45 for the month, 93 for the quarter, 523 for the year,

- 40856, conf, Oasis, Van Berkom 5793 13-11 4B,

- 40303, conf, Neptune Operating, Foster 4-9-16 2H,

- Saturday, August 23, 2025: 43 for the month, 91 for the quarter, 521 for the year,

- 40947, conf, Hess, TI-H. Bakken-157-94-0712H-4,

- 40513, conf, Neptune Operating, Foster 4-9-16 1H,

- 40452, conf, Hess, TI-H. Bakken-157-94-0712H-2,

- Friday, August 22, 2025: 40 for the month, 88 for the quarter, 518 for the year,

- 41132, conf, Petro-Hunt, USA 153-96-24C-13-1HS,

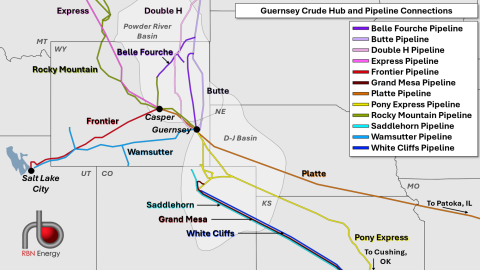

RBN Energy: crude differentials tighten as Guernsey as demand rises, production ebbs.

In the U.S., crude oil trading hubs like Houston, Midland and Cushing get the lion’s share of the market’s attention. But travel a bit further north and you can find one of the more unusual and liquid crude markets in the country — Guernsey, WY — a focal point for producers in Western Canada, North Dakota, Wyoming, Utah and Colorado.

Over the last few months, Guernsey differentials have tightened significantly, finally flipping to a premium to Cushing. We have seen this phenomenon occur before, most notably seven years ago after the startup of the Dakota Access Pipeline (DAPL). In today’s RBN blog, we discuss the recent movement in Guernsey differentials and what the future could hold for the often-overlooked sales point.

Guernsey doesn’t often get the publicity that some other trading areas receive, but as the primary Rockies crude oil trading hub it deserves more attention. Guernsey has a plethora of pipeline connectivity and oil tankage that allows it to receive crude from Canada and the Bakken, as well as local Powder River Basin (PRB) production.

All told, more than 300 Mb/d of Bakken production can reach the hub via Bridger Pipeline’s Belle Fourche (dark-purple line in Figure 1 below) and Butte systems (light-purple line), with another 280 Mb/d of Canadian production via Enbridge’s Express Pipeline (bright-pink line). Express dovetails with the Platte Pipeline (orange line) at Casper, WY, and then continues on through Guernsey.

Figure 1. Guernsey Crude Hub and Pipeline Connections. Source. RBN

Outbound, Guernsey can deliver directly to the benchmark hub and storage facilities at Cushing, OK; refining markets, including Patoka and Wood River in Illinois (the key hubs for PADD 2 refineries); and the not-so-distant refineries in Salt Lake City. Platte Pipeline can deliver 145 Mb/d to Patoka and Wood River. Pony Express (yellow line), the largest system out of Guernsey, can send 230 Mb/d of light, sweet crude and other grades to Cushing. Guernsey also has indirect connections to the Saddlehorn Pipeline (aqua line), which like Pony can move barrels to Cushing.

Thursday Night -- August 21, 2025

Locator: 48923ARCHIVES.

Taking guns off DC's streets: who has been the most impactful? President Trump. Drives his opponents nuts. They say they want guns taken off the streets ... but not by him. What a bunch of hypocrites.

Puts me a bad mood. I may just enjoy YouTube tonight.

Merry Way. I'll start here. Perhaps one of the best compositions ever and only 15,000 views in six years.

And that takes me here. Takes me back to my favorite class in my junior year of high school.

I may have to watch a classic movie on TCM.

1942: Crossroads.

News story that caught my eye tonight. The X-37B. A search of the blog suggests I've mentioned the spy plane on at least four occasions.

X-37B: launched back in late 2023. Still orbiting. Hasn't set any records, yet.

But today, from The WSJ:

From the linked article:

A Pentagon spaceplane called X-37B is slated to zoom into orbit this week for its eighth mission. When it will come back is a secret.

The uncrewed vehicle can spend months or years in space before it re-enters the atmosphere and glides down to a runway. That combination of flexibility and endurance has made it a favorite tool for military officials looking to quickly deploy new technologies on the final frontier.

A SpaceX rocket is scheduled to launch X-37B late Thursday from Florida’s Kennedy Space Center. While in space, X-37B has a range of objectives that include testing laser communications and a quantum inertial sensor, the Space Force said.

Government and commercial engineers have spent years experimenting with lasers that allow satellites to share large amounts of data in space. The Pentagon is also testing tools like the inertial sensor, which could help improve navigation in situations where Global Positioning System signals aren’t available.

Boeing developed an earlier spaceplane for the National Aeronautics and Space Administration. It transferred the program to the military in 2004. The aerospace giant has built two X-37Bs for the Pentagon, which has tasked the Space Force to operate them.

The spacecraft has spent the last five months on Earth after a 434-day mission that included tests of orbital maneuvers known as “aerobraking.” The move helps the vehicle use the drag from the planet’s atmosphere to change its orbit without using much fuel.

X-37B’s frequent trips reflect the U.S. military’s desire for space superiority. U.S. officials have in recent years revealed new details about the threats they say Chinese and Russian operations pose to Western commercial and military satellites.

Sports: Thursday Night Football. Re-airing of the PGA FedEx tournament championship.