Locator: 48579B.

NYC: politics. Story yet to play out. Putting a marker here.

NBA: A-Rod becomes NBA team owner. Minnesota Timberwolves. Wow. Part owner. Deal: $1.5 billion. Four-year process. The art of the deal. Compare with $10 billion for LA Lakers, announced just seven days ago, to owner of LA Dodgers. Wow. Meanwhile, from San Antonio:

The San Antonio Spurs today announced a

new jersey patch partnership with Ledger (link here; ask to translate page), the world leader in digital

asset security for consumers and enterprises, that brings together

innovation, international connection and shared values. The multi-year

agreement was announced today and marks a defining moment in the Spurs

continued evolution from legacy franchise to formative global brand. See more here.

NYISO: link here. Indian Point Energy Center, a three-unit nuclear power station, ceased power operations in 2021; it is currently undergoing decommissioning.

LNG: Cheniere -- FID to build an expansion to its Corpus Christi LNG export plant. Link here.

Taxes, from perhaps one of the best on x -- link here:

********************************

Back to the Bakken

From Dan yesterday, link here:

WTI: $64.98.

New wells:

- Thursday, June 26, 025: 54 for the month, 207 for the quarter, 421 for the year,

- Wednesday, June 25, 2025: 54 for the month, 207 for the quarter, 421 for the year,

- 40896, conf, Hess, EN-McKenna-157-93-3328H-3,

RBN Energy: E&Ps, faced with a "final reckoning," helped save themselves with dividends. Archived.

The summer movie season opened with the latest — and reportedly last —

entry in the Tom Cruise-propelled “Mission: Impossible” franchise

called “The Final Reckoning.” That title reminded us that, to E&P

executives, the commodity price crash at the onset of the pandemic in

2020 must have seemed like the final blow in a series of financial

crises that brought many of their companies to the verge of bankruptcy.

But in a dramatic, “Mission: Impossible”-style recovery, producers

restored their battered balance sheets and won back investors by

radically shifting cash allocations. In today’s RBN blog, we’ll review

the rise of the new E&P hero — dividends — and analyze how producers

apportioned cash flows in Q1 2025.

A hair-raising 90% erosion in U.S. E&P share prices between 2014

and 2020, as measured by the S&P E&P index, resulted largely

from individual investors fleeing the oil and gas sector. Money had

surged to the sector on the promise of substantial long-term growth with

the Shale Revolution and the surge in crude oil prices to over $100/bbl

in 2014. But a long, subsequent decline in realizations and massive

overinvestment led to growing debt, massive losses and shrinking market

caps. With E&Ps paying paltry dividends — just over 1%, on average,

in 2019 compared with 4.6% for the integrated majors and 5.45% for

midstream companies — oil and gas producers were the worst performing

S&P group in five of seven years between 2014 and 2020.

No

wonder E&Ps pivoted from their failed growth-at-all-costs strategy

to target individuals and institutions who prioritized return on

investment. Producers prioritized boosting cash flows over capital

investment to wield a powerful tool to grow share prices: substantially higher dividends.

With a big assist from the post-pandemic surge in oil prices, the

average E&P dividend across the entire sector more than tripled to

3.28% in 2022 and 3.98% in 2023, with several major producers adding

special dividends that brought total yields to near or even above 10%.

These yields, which exceeded payouts by integrated majors like

ExxonMobil and Chevron, resulted in the E&P sector becoming the

top-performing S&P group in both years.

Although oil prices have slipped from their 2022-23 highs, the 39

large E&P companies we follow have managed to largely sustain their

higher-than-historical dividend payouts that restored investor support.

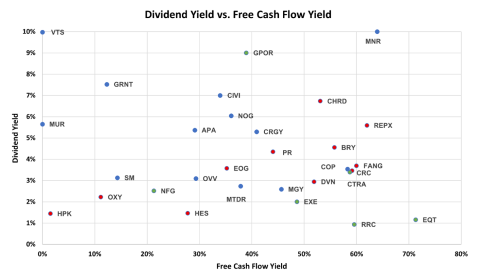

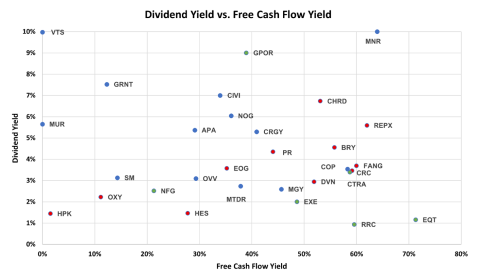

Figure 1 below shows the Q1 2025 yields (y axis) for the 28 of these

companies that pay dividends (colored dots with stock symbols) compared

with each company’s free cash flow yield (x axis). (For a list of stock

symbols and company names, click here.

Red dots are for companies in the Oil-Weighted group, blue dots are for

the Diversified group, and green dots are for the Gas-Weighted group.)

The free cash flow yield is the percentage of cash flow retained by an

E&P after funding its capital investment program. The median free

cash flow is 40% and the median dividend yield is 3.65%, still an

elevated return on a historical basis. The median free cash flow return

in the most recent quarter was up slightly from an average 37% in 2023.

Figure 1. E&Ps’ Free Cash Flow Yield vs. Dividend Yield, Q1 2025.

Source: Oil & Gas Financial Analytics, LLC