Locator: 49886B.

SpaceX + xAI = biggest deal ever in history. That seems to be important. Launching data centers in low earth orbit.

- valuations:

- SpaceX: $859 billion to $1.26 trillion

- xAI: $219 billion to $294 billion

- $1.554 trillion

- is this all about energy to power data centers and cooling these space centers?

India: deal with Trump is biggest story today; so many story lines.

Oracle: ???

****************************

Back to the Bakken

WTI: $62.65.

New wells reporting:

- Wednesday, February 4, 2026: 11 for the month, 64 for the quarter, 64 for the year,

- 42153, conf, Neptune Operating, Gullickson 36-25 4H,

- 41237, conf, Hunt Oil, Clearwater 157-90-14-12H-1,

- 41236, conf, Hunt Oil, Clearwater 157-9-14-11H-3,

- 41234, conf, Hunt Oil, Clearwater 157-90-14-11H-1,

- 41461, conf, CLR, Garfield FIU 2-5HSL,

- Tuesday, February 3, 2026: 6 for the month, 59 for the quarter, 59 for the year,

- 41959, conf, Petro-Hunt, State 162-100-16B-21-2H,

- 41352, conf, Hess, GO-Beck Living TR-156-98-2017H-3,

- 39807, conf, BR, Mazama 1C,

RBN Energy: for Devon and Coterra, a Permian match made in hydrocarbon heaven. Link here. Archived.

The February 2 announcement that Devon Energy and Coterra Energy have agreed to merge didn’t come as a huge surprise — it had been rumored for weeks. The two large oil and gas producers have highly complementary assets in two major basins (the Permian’s Delaware and the Anadarko) and, as they see it, their combination will likely provide $1 billion in synergy-related savings by the end of next year. Finally — and this is important — a Devon/Coterra combination had been urged on by activist investor Kimmeridge Energy Management, with Coterra in particular, for falling short of its potential. In today’s RBN blog, we’ll discuss the deal and its implications.

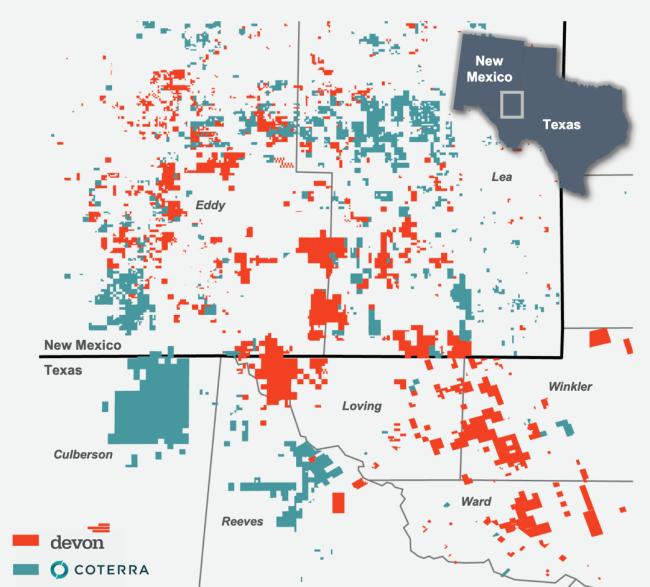

Devon Energy and Coterra Energy’s Acreage in the Delaware Basin

For Devon and Coterra (like ConocoPhillips/Marathon), the Permian — or, more specifically, the Delaware Basin in West Texas and southeastern New Mexico — is key. As shown in Figure 1 above, Devon has about 400,000 net acres (orange-shaded areas) and 496 Mboe/d of production in the play (as of Q3 2025), 45% of it crude oil, while Coterra has 346,000 net acres (teal-shaded areas) and 367 Mboe/d of production (44% oil).

Devon and Coterra are also active in the Anadarko (left-most map in Figure 2 below), where significant portions of their combined 520,000 net acres in Oklahoma are complementary and their pro forma production is expected to average 173 Mboe/d.