Biggest energy story today: WTI keeps "melting up."

Holy mackerel: WTI up 3% despite huge build.

Not only that, but "days of supply" for WTI surges:

- US crude oil inventories jumped by 19 million bbls -- but this is a one-off -- due to recent weather;

- but look at this: at 439.6 million bbls, US commercial crude oil inventories are 1% above the five-year average. Wow, wow, wow.

- imports: yawn

- refiners operating at 84.1% operating capacity;

- distillate fuel inventories decreased by 1.1 millions and are back to a whopping 18% below the five-year average as we go into the planting season;

- propane: look at this: despite a decrease of 2.1 million bbls, inventories are a whopping 18% above the five-year average;

- jet fuel product supplied was down 0.8% -- but again, this was a one-off; machts nichts.

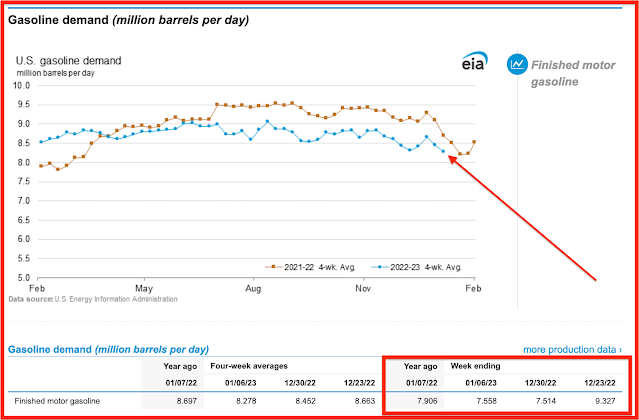

Gasoline demand, link here:

Despite that huge build, though it was telegraphed by the API data yesterday, WTI is up 3%: