| $50.86↓ | 10/20/2017 | 10/20/2016 | 10/20/2015 | 10/20/2014 | 10/20/2013 |

|---|---|---|---|---|---|

| Active Rigs | 56 | 33 | 68 | 191 | 184 |

RBN Energy: Expanding storage supports booming exports.

U.S. crude exports continue to takeoff — increasing during the week ended September 29, to a new record just under 2 MMb/d, according to the Energy Information Administration (EIA), with 1.3 MMb/d in the first week of October followed by 1.8 MMb/d in EIA’s Wednesday report. The crude exodus is primarily occurring from port terminals along the Gulf Coast and is expected to continue as expanding Permian basin shale production is shipped directly to marine docks by pipeline. Recent and planned expansions to crude storage are largely linked to demand for new capacity at marine docks staging cargoes for export. In today’s blog, Morningstar’s Sandy Fielden details the rapid growth of commercial crude storage capacity at Gulf Coast terminals since 2011.

We’ve covered growing terminal and storage capacity on the Gulf Coast extensively since the start of the shale boom. By 2014, pipelines were built out to reach the Gulf Coast from Cushing in the Midwest and the Eagle Ford and Permian basins in Texas, bringing significant new flows to the Houston region.

All the new crude showing up in the Houston region needed new storage capacity to stage its redistribution to local refineries and plants further east in Louisiana. We detailed the growth of Houston storage in a 2015 blog series.

More recently, we covered expanding storage capacity in Texas City and storage at the Louisiana Offshore Oil Port, as well as the potential for crude exports from that port.

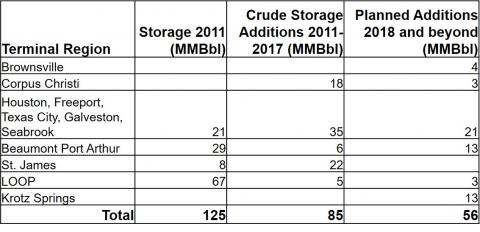

Our estimate of expansions in commercial crude storage capacity along the Gulf Coast by terminal region is summarized in Figure 3 below. We list existing capacity circa 2011, as well as estimated additions between 2011 and 2017 and planned additions next year and beyond. The terminals included are those at Gulf Coast ports or with waterborne access (including the Mississippi River), not inland terminals at pipeline intersections or in producing regions such as the Permian Basin. The data shows crude storage capacity at these terminals increased by 68% from 125 MMBbl in 2011 to 210 MMBbl in 2017 with plans in the works to add another 56 MMBbl or so. Below the table we provide a brief overview and rationale behind new additions in each terminal region.

Source: Company Presentations, Morningstar