Locator: 48962B.

Playing chess: if the Federal Reserve fails to fire Lisa Cook, would this be grounds for Trump to fire JPow? JPow says he doesn't have the power to fire Lisa Cook. That may be true, but he certainly has the power to affect her pay, her access to the building. The Federal Reserve does not provide legal services for private matters involving the governors. Needs to be fact-checked.

GDPNow: next estimate later today, August 26, 2025.

Deep dive overnight:

- Intel: it's not over yet. Do not count Intel out. MOJO, FOMO vs reality.

- US-India relations sour: that's the meme -- don't believe it. Link here.

- Department of War. Odds of happening? 10% at best.

- Kevin Hassett. Wiki.

Electricity, New Jersey: op-ed, WSJ. Link here.

Despite flat electricity demand for the past two decades—and some of the lowest energy usage per capita among the 50 states—New Jersey residents pay some of the highest retail power prices in the country.

As of April 2025, the Garden State ranked No. 12 in the nation, with prices more than 15% above the U.S. average. This gap has widened further in the wake of the recent decision by the New Jersey Board of Public Utilities to approve an additional 17% to 20% rate increase for most utility customers starting in June. This is absolutely incorrect based on EIA data.

- EIA:

- Electricity rates by state: link here.

********************************

Back to the Bakken

WTI: $63.66. Oh-oh. Down almost 2%.

New wells:

- Wednesday, August 27, 2025: 53 for the month, 91 for the quarter, 531for the year,

- 40706, conf, Oasis, Lake Trenton Federal 5302 21-31 5B,

- 40730, conf, Oasis, Nordby 5793 13-12 3B,

- Tuesday, August 26, 2025: 51 for the month, 89 for the quarter, 529 for the year,

- 41640, conf, Neptune Operating, Foster 4-9-16 4H,

- 40948, conf, Hess, TI-H. Bakken-LN-157-94-0712H-1,

RBN Energy: Energy Transfer to take Permian gas west on transwestern expansion -- the Desert Southwest Project. Archived.

Midstreamers developing natural gas takeaway capacity out of the Permian have understandably focused on pipelines to the Gulf Coast — and along the coast to LNG export terminals and other big gas consumers.

But don’t forget the Desert Southwest, where demand for gas-fired power is soaring.

Energy Transfer recently committed to building a 516-mile, 1.5-Bcf/d expansion to its Transwestern Pipeline system from West Texas to the Phoenix area, and hinted that it might double the project’s capacity due to the high level of interest.

In today’s RBN blog, we discuss Energy Transfer’s aptly named Desert Southwest Project, what drove its quick progress to a final investment decision (FID), and what other westbound projects out of the Permian might still happen.

RBN’s Arrow Model shows seven gas-pipeline corridors out of the Permian, four of them toward the Gulf Coast and the others to the Midcontinent, Central Mexico and the West.

Of the roughly 19.3 Bcf/d of gas flowing out of the Permian this month, 67% (12.9 Bcf/d) is heading east toward the Gulf; only 13% (2.6 Bcf/d) is headed west toward Arizona and California.

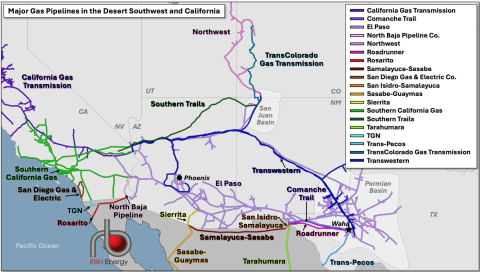

The vast majority of those westbound flows are on two pipeline systems: Energy Transfer’s Transwestern system (dark-blue lines in Figure 1 below), whose mainline takes a more northerly route through New Mexico and Arizona, and Kinder Morgan’s El Paso Natural Gas system (EPNG; light-purple lines), which has both northern and southern mainlines and more spurs and alternate pathways than you can shake a stick at.

Both systems also pick up gas volumes from the San Juan Basin in northwestern New Mexico. Both systems also feed gas into other pipeline systems in Southern California, and EPNG feeds gas into pipelines in northwestern Mexico.

Figure 1. Major Gas Pipelines in the Desert Southwest and California. Source: RBN

Historically, both pipelines were driven by the very large loads in California, to the point that, at least on EPNG, the Desert Southwest shippers were simply known as “East of California.” The Transwestern and EPNG systems have each undergone a number of expansions over the past quarter-century, mostly — as you might expect — to help accommodate rising gas demand in fast-growing Arizona and Mexico and, to lesser degrees, New Mexico and California. But as we’ll get to next, those expansions — a couple of MMcf/d here and there — are nothing compared to what Energy Transfer and Kinder Morgan have each been pursuing the past couple of years, and what Energy Transfer recently committed to building.