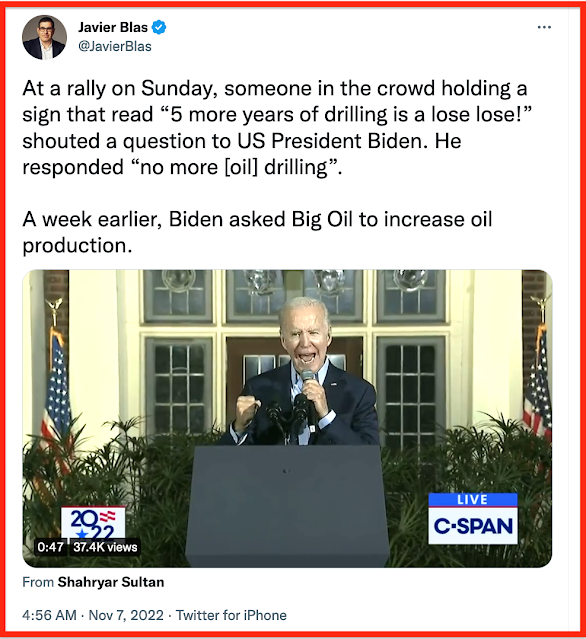

This is one Peter Zeihan got wrong. Link here.

Also, here:

Energy giant ExxonMobil Corporation is set to sell its troubled California offshore oil and gas property while incurring a loss of about $2 billion.

Sable Offshore, a blank check company, has agreed to buy the Santa Ynez oilfield. Sable proposes resuming production at the idled oilfield by 2026, failing which, Exxon will buy back the entire business.

The Santa Ynez oilfield is located about 9 miles (14 km) off the California coast. The property includes three oil and gas platforms, a pipeline, and processing facilities.

Sable seeks approvals to produce 28,100 barrels of oil and gas daily from the current 112 wells, with the possible exploration of 100 more wells. Sable will finance about 97% of the $643 million purchase price through a five-year loan. According to Reuters, Sable is under pressure to reach an agreement by March 1 or to return investor funds.

A pipeline burst caused a major oil spill into the Pacific Ocean in 2015. Following this, the property shut down operations. Since then, Exxon has failed to successfully restart operations at the oilfield. In March 2022, Exxon’s last attempt to restart production at Santa Ynez was rejected by Santa Barbara officials. The authorities cited the excessive use of trucks to transport oil to refineries as a cause for worry.

Sable must not have gotten the "Biden memo."