Locator: 48677B.

Breaking, jobs report: May ADP employment report -- jobs added in private sector -- 37K vs 110K estimate.

Certainly this will get the attention of the Fed's JPow, but JPow will stay the course; will not react politically; will make decisions based on data and generally ignore Trump just because he can. Tea leaves: both inflation and unemployment will trend higher over the summer. Before the jobs report, Dow futures were up almost 100 points; after the jobs report, Dow futures are up only 35 points. The Dow is likely to open in the red.

From April 22, 2025: North Dakota strengths --

- Fargo

- intersection of I-94 and I-29

- natural gas pipelines

- large data centers

- oil

- agriculture

- two top state universities

- aeronautics, particularly drone research

- two major USAF bases

Drones: the U.S. Air Force (USAF) has a significant presence in North Dakota, particularly at Grand Forks Air Force Base, which serves as a hub for unmanned aerial systems (UAS) research, development, and operations. North Dakota is also home to GrandSKY, the nation's first drone business park co-located on an active Air Force base, further solidifying its position as a drone innovation center.

Strategic: The USAF B-52 Stratofortress bomber is primarily stationed at Minot AFB, North Dakota and Barksdale AFB, Louisiana. These are the main bases where the B-52 is operated by the Air Force Global Strike Command and the Air Force Reserve Command. Additionally, a significant number of B-52s are stored in long-term storage at Davis-Monthan AFB's Boneyard.

Futures:

Let me guess: the #1 story on CNBC today -- talking about the Fed.

The blog: the only blog focusing on the Bakken that has no requirement for subscriptions, no ads, no passwords, or paywalls. Did I forget anything? The blog is posted for my own use and immediate family members. Others are welcome to read it but I don't recommend that anyone read it except perhaps for entertainment purposes.

Page views: since inception, we start the day, June 4, 2025, 5:23 a.m. with 21,447,091 page views. The blog has been up and running for 5,817 days. According to ChatGPT:

The Million Dollar Way blog, which focuses on the Bakken oil industry, has been active since at least June 2009. This is evidenced by discussions about the blog’s status on forums as early as June 2009. As of June 4, 2025, this indicates that the blog has been posting for approximately 5,817 days.

Before I forget: a reader writes me -- for mineral owners -- huge, huge advice -- take advantage of EnergyLink for tracking personal minerals.

No link although easy to find; maybe I'll post link later, but reader says most (if not all) operators in the Bakken provide a notice each month by mail to every mineral owner how to enroll with EnergyLink. I assume they do this for all US operators, not just those operating in the Bakken.

Two books I'm reading today:

- The Story of Semiconductors, John Orton, Oxford Press, c. 2004.

- The Perfectionists: How Precision Engineers Created The Modern World, Simo Winchester, c. 2018.

On order:

- The Innovators: How A Group of Hackers, Geniuses, and Geeks Created the Digital Revolution, Walter Isaacson, c. 2015.

***************************************

Disclaimer

Brief

Reminder

Briefly:

- I am

inappropriately exuberant about the Bakken and I am often well out front

of my headlights. I am often appropriately accused of hyperbole when it

comes to the Bakken.

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia. Nvidia is a metonym for AI and/or the sixth industrial revolution.

- I've now added Broadcom to the disclaimer. I am also inappropriately exuberant about all things Broadcom.

- I've now added Oracle to the disclaimer. I am also inappropriately exuberant about all things Oracle.

- Longer version here.

*********************************

Bullets

Quick notes. I may get back to some of these later today. But probably not. Going swimming, bike riding.

- I can't stress enough how invaluable X has been for the blog, for personal investing

- my feed gets "almost zero" political tweets

- one has to be very, very selective when it comes to whom one follows

- ChatGPT is incredible; I almost feel guilty relying on it as much as I do

- geo-politics, in no particular order; stream of consciousness.

- Iran defies Trump; will continue enriching nuclear fuel

- the US will rue the day when "we" did not end once-and-for-all Russia's war with Ukraine, Iran's nuclear program when "we" had a once-in-a-lifetime opportunity to do in 2025

- Israel and the US are in a standoff with regard to whether to strike Iran's nuclear facilities

- Iran's latest defiance may bring the Israel - US standoff to an end

- the incredible Ukraine strike on Russia may influence the outcome of the Israel - US standoff

- Ukraine-Russia

- can you imagine the response in this country had a terrorist cell in Canada managed to do to America's B-52 bases what Ukraine did to Russia's strategic bomber fleet

- Russia no longer produces strategic bombers, has not done do for decades, and no longer has the capacity to build new strategic bombers or replace the ones they lost

- whoo-hoo! FANG subsidiary Viper Energy will buy the assets of STR (Sitio Resources); over at oilprice --

- one of my best investments ever; long story; but directly as a result of X

- difficult to find "full" story; ChatGPT was the solution (again)

- AVGO (Broadcom) is all over the news lately; links below; also one of my best investments ever; huge thanks to a reader who brought AVGO to my attention several years ago

- ONEOK buys remaining stake in Delaware Basisn JV for just one one billion dollars; breaking on Reuters (paywall);g ChatGPT provides "whole" story.

- Texas pension fund had boycott on Blackrock (ESG); Texas has lifted that boycott; now invests in BlackRock; link here.

- debate between Anas and Giovanni -- let's see what ChatGPT has to say about this. Simple question: why was BlackRock removed from Texas boycott? Giovanni is/was correct.

- Trump: like him or hate him, he knows what he's doing and he's not waiting around

- US non-fuel trade deficit soars; fuel trade turns to surplus. Amazing story. Wasn't even a story until Trump got involved; most activist president since FDR; finally some adulting in the room.

- Constellation - Meta: can one think of a bigger energy story; the day ESG died; link here. For someone who comes across as a bozo, he has really come a long, long way; is he a better CEO than Tim Cook? Over at X. SIR.

- Deportation / immigration: new "top cop" for Dallas, TX -- Dallas is no longer a sanctuary city. Let that sink in for a few minutes. Dallas is as blue as it gets when it comes to politics.

- Geiger Capital: link here.

- America's wealth and the multi-millionaires next door; link here.

- there are now 100 stocks from the US valued at more than $100 billion; long, long thread; the thread lists every US stock with more than $100 billion in market cap;

- the list is incredible; I wonder if ChatGPT has the same list? LOL.

- many of these $100-billion companies are relatively new companies.

- Nine of these companies have a market cap of over $1 trillion -- though one is likely to fall off that list at least sometime this year;

- Walmart at $800 is #10; long way to go to get to $1 trillion

- BRK losing its Warren Buffett patina; story at Barron's. Patina: a gloss or sheen on a surface resulting from age of polishing; Buffett "guilty" of both.

- three of the top 30 largest stocks (by market cap) in the world hit new all-time highs yesterday; link here; Broadcom (AVG); Netflix (NFLX); and Palantir (PLTR).

Screenshots from some of the links above.

Not to be forgotten:

Measles vaccination rates, US, link here. Thank you RFK, Jr.

California refineries:

California's oil refining sector is experiencing significant changes, including the potential closure of two major refineries, which is raising concerns about fuel supply and prices. The Phillips 66 Los Angeles refinery is scheduled to close in late 2025, and the Valero Benicia refinery is expected to shut down in April 2026. These closures could lead to a shortage in California's fuel supply and potentially increase gasoline prices. So, even if a source for additional heavy oil is found, it won't be particularly helpful to California if these refineries shut down as scheduled.

CVX: 5-day ticker, pays almost 5%; for long-term investors, pays a whole lot more than 5%.

P/E of 16; P/E similar to XOM and OXY. With the pay date of March 10, 2025, CVX increased its quarterly dividend from $1.63 to $1.71, a 4.9% increase.

Only three states where nightly hotel rates are not tracked: North Dakota, Alaska and Hawaii. Link here.

I can't make this stuff up. Posted one hour ago. Link here. Meanwhile, three weeks ago, Governor Newsom committed another "massive" amount of state funding for the bullet train. Link here.

***************************

Back to the Bakken

WTI: $63.63.

New wells:

- Thursday, June 5, 2025: 21 for the month, 174 for the quarter, 388 for the year,

- None.

- Wednesday, June 4, 2025: 21 for the month, 174 for the quarter, 388 for the year,

- 41312, conf, CLR, Helen 7-8H,

- 40795, conf, St Croix Operating, St Croix Antler 1,

RBN Energy: Chevron's diminished role in Venezuela complicates plans for US refiners seeking heavy crude. Archived.

Exports of Venezuelan crude to the U.S. have moved lower in recent months, a trend that seems likely to continue with the May 27 expiration of Chevron’s permit to operate there. But while a limited extension of that permit appears likely, if not yet official, the development adds new challenges for Gulf Coast refiners that process heavy crude. In today’s RBN blog, we’ll update the situation in Venezuela, assess what it means for Chevron, and discuss the outlook for the heavy crude-capable Gulf Coast refiners.

Let’s start with some background on Chevron’s long history in Venezuela, which dates back more than 100 years. Chevron’s legacy company, Venezuelan Gulf Oil, began drilling in 1924, spurring commercial oil production there, and followed that up with operations at Lake Maracaibo and the Boscan Field (tiny, pink-shaded area in Figure 1 below) in northwestern Venezuela. Then-President Carlos Andrés Pérez nationalized Venezuela’s oil industry in 1976 and established Petróleos de Venezuela S.A. (PDVSA) as the state-owned oil company, but despite the nationalization, Chevron remained, and it was asked to form joint ventures (JVs) with PDVSA. In 2006-07, then-President Hugo Chávez’s regime increased royalties and taxes on foreign oil companies and made other changes that prompted some companies — including ExxonMobil and ConocoPhillips — to leave Venezuela.

Figure 1. Venezuela’s Orinoco Belt and Boscan Field. Source: RBN

But Chevron hung on, attracted by Venezuela’s vast reserves and the ability to profitably produce oil at relatively low costs. By staying put, Chevron agreed to give up majority control of its operations to PDVSA. Still, it retained 40% interests and continued to be involved in several onshore and offshore projects, including Petroboscán in western Venezuela, while focusing on extra-heavy oil production in three blocks within the Carabobo area of the Orinoco Belt (blue-shaded area in Figure 1 above).

There have been other ups and downs for Chevron along the way, resulting in a mostly downward trend for Venezuelan crude exports to the U.S. in recent years (see Figure 2 below). The first Trump administration imposed economic sanctions on Venezuela in August 2017, which resulted in lower oil production and reduced exports to the U.S. The Trump administration followed that up with an April 2020 order for Chevron to wind down production in Venezuela, although exports to the U.S. had reached zero by that time. The Biden administration later reversed that order and eased sanctions further in October 2022, allowing Chevron to increase production for sales to the U.S. Imports began again in January 2023.

*****************************

Uinta -- Re-Posting

RBN Energy: Supreme Court's ruling on Uinta Basin railway is a big win for energy infrastructure projects. Archived.

Midstream developers have complained for decades that federal courts reviewing agency approvals for their infrastructure projects have cast too wide a net — that is, instead of requiring agencies to simply analyze the specific environmental impacts of the project in question, the courts have been insisting regulators also examine the effects of the upstream and downstream activities the project would enable. As we discuss in today’s RBN blog, the U.S. Supreme Court ruled last week that under the all-important National Environmental Policy Act (NEPA) of 1969, it’s up to regulators to set the boundaries of their environmental review and that courts should defer to their judgment as long as they fall within a “broad zone of reasonableness.”

Also, two other related posts.

First, earlier on the blog:

Uinta Basin Railway: finally, some adulting in the room. And it was unanimous. Link here. Also, reported in The New York Times. This has to be a big story if it's being reported by TNYT.

The U.S. Supreme Court has given the green light to Utah’s Uinta Basin Railway project, backing a narrower interpretation of environmental review laws and potentially clearing the path for a major expansion in oil transport capacity.

In a unanimous decision Thursday, the justices reversed a lower court ruling, slamming it for what they described as an overly expansive and intrusive interpretation of environmental law. The line would link the Uinta Basin’s oil fields—tucked deep in northeastern Utah’s sagebrush terrain—to the national rail network, unlocking access to Gulf Coast and West Coast refineries.

At the heart of the case was how far federal agencies must go under the National Environmental Policy Act (NEPA) to evaluate ripple effects—like emissions from oil refining or increased drilling—when considering infrastructure projects.

Writing for the court, Justice Brett Kavanaugh affirmed that federal agencies have discretion to weigh environmental impacts as they see fit, pushing back on calls for broader reviews that include downstream effects like refining emissions or increased oil consumption.

“Simply stated, NEPA is a procedural cross-check, not a substantive roadblock. The goal of the law is to inform agency decision-making, not to paralyze it,” Justice Kavanaugh said in the ruling.

Second, another RBN Energy blog, posted a few days ago:

A reminder, the full story below has been released and will be available for a short period of time. This story has much more than the subject heading would indicate. An important read:

RBN Energy: the short- and long-term outlooks for Uinta waxy crude production. Archived.

We’ve discussed the qualities of the Uinta Basin’s unusual waxy crude, the challenges inherent in moving it to market, and the use of machine-learning AI to optimize its extraction from two key geologic layers or “benches” deep below the rugged hills of northeastern Utah. Now, in today’s RBN blog, it’s finally time to reveal what all this tells us regarding the prospects for continued Uinta production growth; the need for new takeaway capacity, blending and refining infrastructure to handle it; and — very important — the estimated duration of economically recoverable waxy crude under various price scenarios.

This is the third blog in our series on how artificial intelligence (AI) is being used to assess and optimize the development potential of the Uinta Basin, which is now the fastest-growing crude-oil-focused production area in the U.S. on a percentage basis. In Part 1, we discussed the two flavors of Uinta waxy crude (black wax and yellow wax); their positive attributes (great for making high-value lubricants, low levels of sulfur and other impurities, and desirable yields of gasoil, kerosene, naphtha and other essential refined products); and initial production (IP) rates that match — and in some cases exceed — those in the best parts of the Permian.

We also described the challenges of storing and transporting waxy crude, the fast rise in Uinta production (now averaging more than 170 Mb/d), the demand from distant refineries and blenders, and the strain being put on existing midstream and downstream infrastructure. That’s all spurred talk of expansion projects, but E&Ps, rail terminal developers, refiners and blenders are wary of making big up-front investments without having a clear understanding of the Uinta’s long-term prospects and, with that, a high degree of confidence that the basin will remain economically productive long enough for their investments to pay off.

In Part 2, we examined the AI-based analytics our friends at Novi Labs use to (1) understand the individual contributions of a wide range of geologic and operational variables to production levels in the Uinta’s two most extensively drilled benches (Uteland Butte and Castle Peak), (2) employ that understanding to predict the performance of future wells in the two benches, and (3) forecast the volumes of waxy crude that could ultimately be extracted from these benches at various price points. Put simply — well, as simply as we can — Novi Labs’ machine-learning approach begins by gathering and incorporating a broad range of well-specific inputs (geologic, operational and spatial) on hundreds of drilled wells from public and proprietary sources. Novi then leverages the algorithms in the models it developed for each of the two benches, using reams of available data to gain a much deeper understanding of the relationships among and between these many variables and their impact on production outcomes.

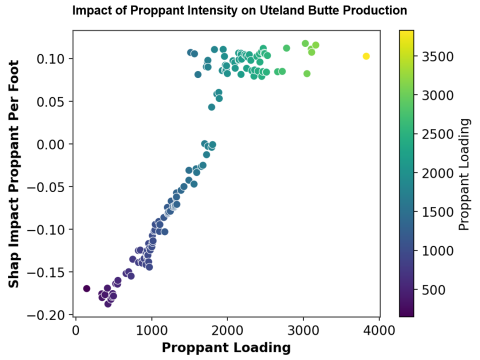

In essence, machine learning integrates the wide range of data collected to recognize patterns and identify the primary drivers of well performance. It does this through the development and use of “Shapley values,” a game-theory concept that quantifies the contribution of individual input categories — more on that in a moment — to production from a given well compared to the average of the wells in the area. Machine learning then enables operators to assess how changing specific variables (such as drilling in a higher-pressure area, tightening well spacing, or increasing proppant intensity) would affect production outcomes in wells yet to be drilled. It also provides operators with guidance on how best to lay out, space, and sequence the development of the benches.

Today, we’ll build on the discussion about machine learning and Shapley values, compare the Uinta’s forecast productivity per well to the Permian and Bakken, and look at how much crude the wells in the Uinta’s key benches are likely to produce over time at various price points.

Novi Labs selected about 20 data points or variables (out of a broad set available to it) on hundreds of drilled wells in the Uteland Butte and Castle Peak benches that meet its criteria (at least 90 days of production and values for proppant, completion fluid and lateral length). The geologic data includes things like porosity, total organic carbon (TOC), lithology (the physical and chemical characteristics of the rock) and pressure, plus depth, structural position within the basin and proximity to faults. The operational data, in turn, includes factors such as proppant intensity, fluid volume per foot, stage spacing, lateral length, and the precise placement of the lateral within the bench.

Impact of Proppant Intensity on Uteland Butte Production

Figure 1. Impact of Proppant Intensity on Uteland Butte Production. Source: Novi Labs