Updates

September 13, 2025: awhile back I was sharing thoughts with regard to the "Jeep" brand. After my cross-country from Dallas, Texas, to Rapid City, South Dakota, I saw a lot of Jeeps on the road, and said that the Jeep was the national vehicle of Texas. LOL. The WSJ must have been reading the blog. From The WSJ today:

From the linked article, the lede:

On a weeknight in mid-August, thousands of Jeep fans flocked to a waterfront park in Brooklyn, N.Y., where an ambitious turnaround campaign was underway.

Rapper LL Cool J performed, and Jeep, facing an unsettling sales slump, unveiled the return of its Cherokee sport-utility vehicle that it branded “America’s Original Influencer.”

The Cherokee is credited with inventing the modern SUV and accounted for one out of every six Jeeps sold in America just before the pandemic, the sort of precious branding power companies dream of. But in 2023, in what would be a major strategic mistake, Jeep stopped making the Cherokee as part of cost-cutting measures to support the automaker’s transition to making more electric vehicles. Sales fell and dealers revolted.

Now Jeep and its parent company Stellantis are trying to mount a comeback.

The “biggest piece of the puzzle” to fixing Jeep’s woes is simple: “You start with the Cherokee,” said Bob Broderdorf, a company lifer who was put in charge of Jeep earlier this year, in an interview.

Automakers are in the midst of big pivots. After they pushed to electrify their product portfolios for several years, goaded in part by stringent emissions regulations, consumer interest in EVs dramatically fell off. Now, recent policy changes have made American classics like the Cherokee more attractive for car companies to sell.

Midsize SUVs like the Cherokee are the most popular kind of vehicle in the U.S. Not having one factored heavily in the 36% slide in Jeep sales in 2024 from before the pandemic, according to data from industry-research firm Motor Intelligence.

Original Post

ChatBOTs: "everyone" is using ChatGPT.

Folks don't realize that ChatBOTs use 10x the resources that a simple Google search uses: 10x -- energy, blades, etc. 10x. Let that sink in. And unlike a simple Google search, ChatGPT is absolutely addictive. And they are clever: if you don't sign in, one gets limited time with ChatGPT; if you sign in, unlimited access. Again, 10x the resources.

Example: my nephew is using a "special" ChatBOT app to inventory his business. He gets inventory numbers done in seconds -- literally seconds -- compared to a dedicated employee working a week on the same project. And that's just one small example.

I think a lot of folks are underestimating ChatBOTS, particularly old-school analysts. Think a couple of analysts on Melissa's "Fast Money" show. From my perspective, horse-drawn buggies:the Ford Model T::simple Google search:ChatGPT.

For investors / traders: consider starting each trading / investing day with a ChatGPT prompt / query to provide a quick, sharp market snapshot for the week ahead—ingredients strong enough to out-CNBC the cable ticker.

College sports: TCU pummels North Carolina in opener, 48-14. The game was even "worse" than the score indicated. Wow.

Car trends:

- Tesla doing remarkably well. Particularly Model Y. Color me surprised.

- F-150s resting on laurels? See below.

- Jeep fading? How bad is it? It's bad. The Detroit Free Press.

F-150:

The Toyota RAV4 overtook the Ford F-150 as the best-selling vehicle in the United States in 2024, ending the F-150's 40-year streak at the top. The RAV4's sales rose 9% to 475,193 units, while the F-150's sales declined 5% to 460,915 units, a shift attributed to increased consumer preference for SUVs and the RAV4's popular hybrid powertrain.

But this may change again in 2025:

The F-150 Hybrid is selling exceptionally well, both within Ford’s lineup and against other hybrid models nationally. It’s not just a strong niche performer; it’s one of the leading hybrid vehicles in the U.S., especially dominant among trucks. Ford’s hybrid pickups not only outpaced expectations—they outperformed the entire U.S. battery-electric pickup market in 2024.

- Ford’s hybrid pickups (F-150 Hybrid + Maverick Hybrid) recorded a combined 142,597 sales in 2024

- In contrast, all U.S. battery-electric (BEV) pickups combined totaled around 130,000 units .

- This means Ford’s hybrid offerings outsold the entire battery-electric pickup segment in the U.S. that year.

Bragging rights: important for marketing but in big scheme of things, we're starting to see major trends shifting.

Next up: BYD not doing as well as folks might think. CNBC "Fast Money" panelists got this one wrong.

NYTimes: China EV debacle. Link here.

*****************************

Back to the Bakken

WTI: $65.78. Up almost 3% overnight.

New wells:

- Tuesday, September 2, 2025: 3 for the month, 96 for the quarter, 536 for the year,

- 40946, conf, Hess, TI-H. Bakken-157-94-0712H-3,

- Monday, September 1, 2025: 2 for the month, 95 for the quarter, 535 for the year,

- 40705, conf, Oasis, Lake Trenton Federal 5302 21-31 4B,

- 37544, conf, Hess, AN-Lone Tree-152-95-1207H-8,

- Sunday, August 31, 2025: 55 for the month, 93 for the quarter, 533 for the year,

- None. Six months ago -- 28-day February.

- Saturday, August 30, 2025: 55 for the month, 93 for the quarter, 533 for the year,

- None. Six months ago -- 28-day February.

RBN Energy: the push to enable higher Appalachian gas flows into North Carolina.

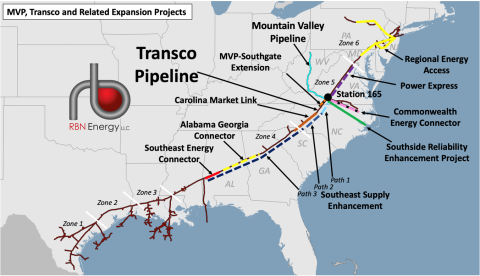

After a decade of regulatory and legal challenges, Mountain Valley Pipeline (MVP) finally came into service in the middle of last year. The 2-Bcf/d pipeline — soon to be expanded to 2.5 Bcf/d via additional compression — was designed to ease natural gas takeaway constraints out of the Marcellus/Utica and help production there break past its current plateau near 36 Bcf/d, but bottlenecks on the massive Transco Pipeline have complicated matters. In today’s RBN blog, we look at efforts to unleash more Appalachian gas in the domestic market, focusing on the Southside Reliability Enhancement Project (SREP), which has enabled more gas to reach North Carolina.

This is the fourth blog in our series about upstream and midstream developments in the Marcellu/Utica shale play. In Part 1, we discussed how the enormous production growth in the basin during the early years of the Shale Era stalled in the 2020s, averaging about 35 Bcf/d for the past five years. Appalachian production has been stymied not by challenges on the upstream side but by the lack of takeaway capacity in the region. Part 2 discussed the various projects — proposed, under construction and already in service — to expand pipeline takeaway capacity through new lines and expansions of existing lines. Part 3 turned to the individual upstream companies and their near-term production plans as communicated to investors.

Today, we are going to dive more deeply into what was discussed in Part 1, focusing on what has been accomplished since SREP (area of improvements indicated by green line in Figure 1 below) came into service in September 2024, including how much incremental gas is flowing out of Appalachia and where it is heading. Let’s start with a look at how flows on MVP have developed now that it has been online for more than a year. MVP (aqua line) started flowing gas in June 2024 and ramped up its outflows into Transco to 1 Bcf/d within its first month of service. Some of that gas was finding new egress to markets to the south while some of it was displacing natural gas that previously flowed in from farther north (more on that below). After plateauing for a time last summer, MVP’s ramp-up resumed in the fall and early winter. By the beginning of 2025, MVP had reached its full potential, pouring an average of 1.9 Bcf/d into Transco, according to data from Wood Mackenzie. While those volumes sagged in subsequent months, the cause was related to natural gas prices rather than a constraint on MVP’s ability to find supply or flow its molecules to Transco. Next, let’s look at why it happens that way.

Figure 1. MVP, Transco and Related Expansion Projects. Source: RBN