Locator: 44513HYDROGEN.

Updates

December 29, 2024: Angelica.

Original Post

This is all happening before Trump takes office.

A reminder, the difference between green hydrogen and blue hydrogen, well covered by RBN Energy over the years.

From 2022, CNBC, link here:

Hydrogen, earlier today: link here.

Also from today, link here:

Hydrogen is now occasionally tracked here.

Nexus: blue hydrogen, Summit, pipelines across five midwestern states, CCS.

From the blog, first posted October 18, 2022, with updates.

************************

Background

Beulah, ND: the nation's Great Plains Hydrogen Hub.

RBN Energy: clean hydrogen hub plans taking shape in the Midwest and Great Plains.

PADD 2 — the 15-state region that includes both the Midwest and the Great Plains — is a major player in U.S. hydrocarbon production and refining, not to mention energy consumption, with its rich mix of industry and farming. It’s also bound to be a hot spot in the energy transition, given its vast wind resources, scores of ethanol plants, and extensive plans for carbon capture and sequestration (CCS). Not surprisingly, there also may be a clean hydrogen hub or two in PADD 2’s future — after all, it’s got natural gas in spades, plus lots of zero-carbon nuclear plants, countless wind farms, and more existing and potential hydrogen end-users than you can shake a stick at. In today’s RBN blog, we discuss the PADD 2 proposals now under development and why they may have a good shot at winning Department of Energy (DOE) support.

A provision in last year’s $1-trillion-plus Infrastructure Investment & Jobs Act provides a total of up to $8 billion in federal funding over five years to support the development of several clean hydrogen hubs around the U.S. Last month, the DOE announced that concept papers from hub proponents are due November 7; full applications are due April 7, 2023; winners will be notified in the fall of 2023; and award negotiations with the winners will be completed in the winter of 2023-24. DOE also said that most of the six to 10 selected proposals will each receive between $500 million and $1 billion in federal support, though it’s possible that a proposal could receive a little less or a little more, depending on its size and need.

Hydrogen, the "North Dakota story," link here.

Now, this update. From Rigzone, "Biden hydrogen hub plan sparks $8 billion race."

Many of the states in the race have decided to join efforts in regional partnerships rather than go it alone. Their approaches tend to be based on available resources.

New York, for example, formed an alliance with Massachusetts, New Jersey and Connecticut last month.

Another partnership that includes Arkansas, Louisiana and Oklahoma would use existing infrastructure to form the basis of its hub. Hydrogen is already produced in the region using natural gas. The hydrogen output is used there in some manufacturing processes, such as lowering sulfur content of fuels from refineries.

A third alliance involving Colorado, New Mexico, Utah and Wyoming also seems to be taking an “all-of-the-above” approach.

In February, a coalition of businesses that includes Equinor ASA, Mitsubishi Power, Marathon Petroleum Corp. and United States Steel Corp. said they would help work on a hub that would knit together Ohio, Pennsylvania and West Virginia.

North Dakota hydrogen is tracked here.

******************

North Dakota Hydrogen

North Dakota's hydrogen hub is among entities with its name in an $8 billion hat, seeking federal grant funds for regional hydrogen hubs. You may recall that hydrogen hubs were on the Department of Energy's list of "moonshot" ideas in the early days of the Biden Administration. Now the department has money to put toward that goal, and it has blown the starting whistle for those grants.

Over at National Law Review, March 17, 2022 -- like only two weeks ago -- this is how you apply for free money -- or "almost" free money -- from the US DOE.

If folks recall, North Dakota has one of the leading reputations for getting free money from the US government. Among everything else, I do believe North Dakota is #1 -- based on per capita spending -- for federal money for drone R&D. Now, it's time to be #1 -- again, based on per capita spending -- on hydrogen hubs.

The deadlines have already passed; hopefully "we" were ahead of the game. Here's how it worked:

The Department of Energy (DOE) has begun the process of establishing “Hydrogen Hubs” that are funded in the Infrastructure Investment and Jobs Act, aka the “infrastructure package.”

The infrastructure package provides $8 billion for hydrogen hubs, plus an additional $1 billion for hydrogen electrolysis research, development, deployment and commercial applications. Another $500 million was appropriated in the infrastructure package for a Clean Hydrogen Manufacturing, Recycling, Research, Development and Demonstration Program.

All of this funding is to be distributed over the next five years.

The Hydrogen Hub Program. Through the Regional Hydrogen Hub Program DOE will choose a minimum of four locations in the U.S. to locate hydrogen hubs — networks of clean hydrogen producers, potential clean hydrogen consumers, and connective infrastructure located in close proximity.

The law calls for diverse energy sources for hydrogen production at the hubs, requiring, to the maximum extent practicable, that one hub produce hydrogen from fossil fuels; one from renewables; and one from nuclear energy.

H2 Matchmaker. To help hydrogen players connect with others and create “hubs”, DOE has stood up the “H2 Matchmaker” tool, an interactive map which includes various hydrogen producers, infrastructure companies, consumers, and other stakeholders, along with their contact information.

You can find the H2 Matchmaker map here, where you will also find the H2 Matchmaker Self-Identification Form. You can use the H2 Matchmaker Self-Identification form to submit your own information for the H2 Matchmaker Map.

********************

RBN Energy

RBN Energy: making sense of the hydrogen buzz, production edition, part 2. Archived.

Based on the response we received to our first-ever hydrogen blog last fall, it’s fair to say we didn’t waste this space on a fringe subject. To be honest, the level of interest in hydrogen far exceeded our expectations, and suggested that we might have even been a little bit late to the party — but fashionably so, if you ask us. In the weeks since then, we’ve spent a fair amount of time distilling the tremendous amount of news flow and reading material that was either sent our way or popped up in the daily news feeds.

You could go a lot of different directions with hydrogen and it’s still very easy, in our view, to get lost in the forest of green energy technology. So, as we are wont to do, we have stuck to our simple approach of tackling this fuel just like we do with hydrocarbons, and we are first turning our attention upstream. Today, we continue our series on hydrogen with a look at the top production methods for the fuel.

So, what is "blue hydrogen" about which The Williston Herald is talking?

From the RBN Energy blog regarding blue hydrogen, the stuff Mitsubishi was talking about in Bismarck this past week:

The existing hydrogen market is huge. It also emits significant amounts of carbon. That’s because, according to the International Energy Agency (IEA), around 75% of the hydrogen produced in the world is synthesized using natural gas, mostly through a process called steam methane reforming (SMR).

Note that another 20+% of global hydrogen is produced using coal, thanks mostly to China. In the U.S., about 95% of the hydrogen produced comes from natural gas, according to the Department of Energy (DOE).

Similar to the rest of the world, most of the natural gas is turned into hydrogen via SMR, although there are a few partial oxidation (POX) plants that make up a small sliver of the supply side of the market.

We won’t cover POX today, or another technology for producing hydrogen from natural gas called autothermal reforming (ATR), but the processes are not very different than SMR.

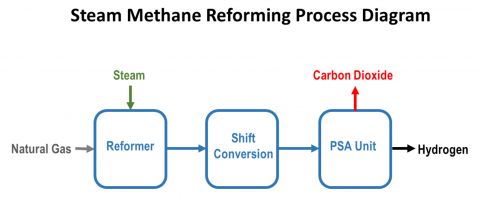

To that end, Figure 1 below shows a simplified process flow diagram for a typical SMR unit.

Figure 1. Simplified SMR Flow Diagram. Source: RBN

To create hydrogen via SMR, natural gas is first fed into a processing unit called a reformer. There it reacts with high-temperature steam and a catalyst, usually one that is nickel-based, to form hydrogen and carbon monoxide. The resulting gas mix is then fed to the shift conversion unit, where the carbon monoxide reacts with the steam to produce even more hydrogen, plus carbon dioxide (CO2). The hydrogen and carbon dioxide are then sent to a pressure swing adsorption (PSA) unit, where the CO2 is removed from the hydrogen.

Naturally, our Figure 1 is simplified, and there are a bunch of other pieces of equipment such as heat exchangers and dryers that we left off, but you get the general idea.

According to data published by the Argonne National Laboratory, the SMR process is about 70%-80% efficient. Using the low end of that range and an assumed $3 per million British thermal units (MMBtu) natural gas price, we estimate the natural gas costs of SMR equate to about $0.50 per kilogram (kg), a number supported by a recent IEA study.

The IEA also assumes another $0.17/kg in other variable costs for SMR, along with $0.34/kg to cover capital costs. That math brings SMR hydrogen production costs to just about $1/kg, assuming you do nothing to contain the produced carbon dioxide.

The IEA estimates that installing a carbon capture, utilization, and storage (CCUS) technology brings total costs up to $1.50/kg of hydrogen.

Even with the added cost of containing the CO2, SMR is cheap when compared to just about any other method of production. Also, while some SMR units feature CCUS, most do not. Remember from Part 1 of this series that hydrogen produced from natural gas via SMR is called “gray” hydrogen. If you combine CCUS with the SMR, your turn the hydrogen from gray to “blue”.

It's okay to ignore this next paragraph:

How much do SMR units produce each year? That’s a good question, and answering it isn’t as easy as you might like. To our knowledge, there is no requirement to report hydrogen production in the U.S., so there’s nothing in the way of historical data from the Energy Information Administration (EIA) like there is for most of the hydrocarbon world. The most recent information we could find from the DOE estimated U.S. hydrogen production at about 10 million metric tons per year (Mtpa). On a daily basis, that’s roughly 11 billion cubic feet per day (Bcf/d) of hydrogen containing approximately 3 million MMBtu. That translates to about 3 Bcf/d of natural gas equivalent energy. Further, if we assume almost all of that produced hydrogen was generated with natural gas-based SMR — the DOE estimates appear to exclude by-product hydrogen relinquished by refinery and chemical plant processing units — the amount of natural gas used to produce it would come out to roughly 4.3 Bcf/d. Note that math (4.3 Bcf/d of natural gas used to make the hydrogen energy equivalent of 3 Bcf/d) uses the low-end of our previously stated 70%-80% efficiency range.

But don't ignore this paragraph:

All of which is to say that gas demand from the hydrogen industry is already a huge component of the existing energy balance within the U.S., a fact not lost on most natural gas analysts. Note also that the DOE estimates about 25% of that hydrogen is consumed in the ammonia industry, with most of the rest in the refining and petrochemical sector.

For what it’s worth, we could find no production data for the “green” methods of producing hydrogen, which we discuss next.

So, blue hydrogen: Remember from Part 1 of this series that hydrogen produced from natural gas via SMR is called “gray” hydrogen. If you combine CCUS with the SMR, your turn the hydrogen from gray to “blue”.

Quick! Who combines CCUS with CO2 EOR? Full circle. We're back to Denbury.

Some folks suggest Denbury is about the only operator of note involved with CO2 EOR and CCUS.

I think I've said enough.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.