Locator: 48912B.

Mortgage fraud: by a Fed governor? CNBC talking heads not concerned. At worst, "it's a problem that has to be dealt with." But other than that, let's just move on.

Economic numbers: look incredibly good.

- S&P Global Flash US MFG PI: 53.3 vs 49.5.

- S&P Global Flash US SERVICES PI: 55.5 vs 55.0.

Economic numbers: not good. It's hard to believe the Fed will dither another month.

- released this morning

- continuing claims: increased 30K to 1.97 million

- Philadelphia federal manufacturing survey: -0.3% vs 7.0% estimate

- that seems like a pretty big miss -- but I don't follow these numbers

- initial jobless claims: 235k vs 225K estimate -- in big scheme of things, pretty much in line

Walmart: big miss on EPS but beat on top line. Shares drop 3% pre-market in line with what the rest of the market has been doing this week -- falling. Although share price dropped, CNBC talking heads not particularly concerned. Walmart talks about it, but tariffs really not a big deal for Walmart, again, in the big scheme of things.

*********************************

Back to the Bakken

WTI: $62.99.

New wells:

- Friday, August 22, 2025: 40 for the month, 88 for the quarter, 518 for the year,

- 41132, conf, Petro-Hunt, USA 153-96-24C-13-1HS,

- Thursday, August 21, 2025: 39 for the month, 87 for the quarter, 517 for the year,

- 40899, conf, Hess, BL-Blanchard-LW-155-96-2215H-1,

- 35237, conf, CLR, Michael State Federal 7-16H,

RBN Energy: Canada's pitch on data centers focuses on hydropower, natural gas resources.

As demand for data centers accelerates, developers continue to search for locations that offer the best combination of several factors, starting with the availability of uninterrupted (and affordable) power. Those variables have led to a data-center buildout in several parts of the U.S., such as Northern Virginia, Texas and California’s Silicon Valley, but Canada has its own set of positives to lure developers. In today’s RBN blog, we look at the state of data-center development in Canada, how the factors that affect site selection differ from the U.S., and how Canada is working to become a bigger player in the global market.

Demand for data centers (see Storm Front), which are home to thousands or even tens of thousands of networked computers that process, store and share data, has grown significantly with the expansion of artificial intelligence (AI) tools like ChatGPT and Perplexity, which demand far more computational power (and energy) than conventional Google searches. The prospect of a massive buildout of data centers has utilities just about everywhere preparing for a surge in power demand (see Where You Lead I Will Follow). And while access to uninterrupted power is a critical factor for companies deciding where to build a data center, it’s not the only variable — power prices, access to fiber-optic networks and climate also play a major role, and there are some significant differences between the Canadian and U.S. markets.

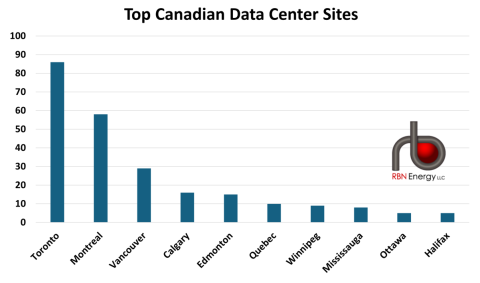

North America is the global leader in data center development, with about a 40% market share, with virtually all of that in the U.S., which has nearly 4,000 sites in operation, according to DataCenterMap.com. Canada has 283 data centers in operation, and while that’s less than 1% of the U.S. total, it still makes Canada a Top 10 market globally. The majority of Canadian data centers are located in major population centers near the country’s U.S. border (see Figure 1 below), including Toronto (86), Montreal (58) and Vancouver (29), although some are located in more remote areas, and Alberta has big plans to ramp up investment there (more on that in a bit).

Figure 1. Data Center Locations in Canada. Source: DataCenterMap.com