Locator: 48730B.

NASDAQ hits all-time high.

******************************

Back to the Bakken

WTI: $68.61.

New wells:

- Tuesday, July 15, 2025: 23 for the month, 23 for the quarter, 453 for the year,

- 41310, conf, Kraken, Bubba LE 14-11-2 1H,

- Monday, July 14, 2025: 22 for the month, 22 for the quarter, 452 for the year,

- 41448, conf, Kraken, Bear Butte 13-12-1 5H,

- Sunday, July 13, 2025: 21 for the month, 21 for the quarter, 451 for the year,

- 41449, conf, Kraken, Bubba 14-11-12 2H,

- Saturday, July 12, 2025: 20 for the month, 20 for the quarter, 450 for the year,

- 40864, conf, Grayson Mill, Martin 32-36 3H,

- 40547, conf, Hunt Oil, Clearwater 157-90-24-25H-3,

RBN Energy: XOM's strategy for Wink to Webster Pipeline enhances control of Permian crude. Archived.

The Wink to Webster Pipeline, operated by ExxonMobil, stands out as the largest crude oil pipeline by capacity exiting the prolific Permian Basin in West Texas.

What makes it even more of a midstream icon is the company’s hands-on management of the entire process, from the production well to the long-haul run to delivery to ExxonMobil’s refineries. In today’s RBN blog, we’ll examine Wink to Webster’s complicated ownership structure, how it connects directly to terminals run by its owners and its destination flexibility.

This is the latest in a series of blogs we’ve written highlighting crude oil pipelines serving the Permian. In Part 1 and Part 3 of this series, we looked at the Longhorn and BridgeTex pipelines, respectively, and what ONEOK has accomplished with these systems since it acquired Magellan Midstream in 2023 (see Tulsa Time). In Part 2 and Part 4, we discussed the EPIC Crude and Gray Oak pipelines, respectively, to the Corpus Christi area, which have both been operating at full capacity. In Part 5, we covered Enterprise Product Partners’ Midland to ECHO (M2E) pipelines. Today, we take a closer look at Wink to Webster (W2W).

As we detailed in Houston Bound, W2W (blue line in Figure 1 below) is operated by ExxonMobil and began commercial service at the end of 2020, transporting oil from Midland, TX — the heart of the Permian’s Midland Basin — to Webster, TX, just south of Houston, and from Webster to Baytown along the Houston Ship Channel. The pipeline’s ownership structure is a bit complicated, so let’s break it down. W2W is owned by Wink Webster Pipeline LLC, a joint venture (JV) initially formed by affiliates of ExxonMobil, Plains All American Pipeline and Lotus Midstream (which was purchased by Energy Transfer in 2023), with MPLX, Delek US and Rattler Midstream joining the JV in August 2019. (Delek controls a 15% stake in the pipeline system, while Diamondback Energy has a 4% interest after its 2022 acquisition of Rattler. Percentages for the other members of the JV have not been disclosed.) In addition, Enterprise announced in January 2020 that it would own a 29% undivided joint interest (UJI) in the pipeline system, represented by its Midland to ECHO 3 pipeline (M2E-3; red line). M2E-3 is often grouped with W2W for capacity and flow analysis — they use the same steel pipe — but is not part of the JV’s legal ownership.

Figure 1. Wink to Webster/Midland to ECHO 3 Pipeline Connectivity. Source: RBN

Together with Enterprise’s M2E-3, W2W can move up to 1.5 MMb/d of crude oil. At the time it came online, W2W doubled the total capacity from the Permian to Houston to 3 MMb/d. We should note that Enterprise converted its Midland to ECHO 2 (M2E-2) pipeline to NGL service (and temporarily renamed it the Seminole Pipeline) in early 2024, so Permian-to-Houston capacity is currently at 2.8 MMb/d. Enterprise is expected to convert the line back to crude service — and it’s M2E-2 name — in Q4 2025, which should push overall Houston-bound capacity back to 3 MMb/d.

RBN Energy: foreign firms step up investments i US production and infrastructure.

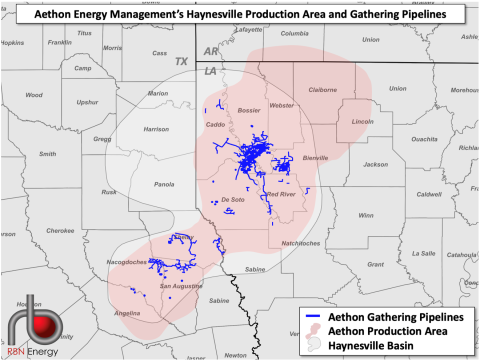

The uncertainty and angst spurred by the ongoing trade war doesn’t seem to have dampened foreign companies’ interest in acquiring upstream and midstream energy assets in the U.S. The recent rumor — still unconfirmed — that Mitsubishi Corp. is in talks to acquire Aethon Energy Management’s massive holdings in the Haynesville for a reported $8 billion is only the latest indication that overseas interest may be stronger than ever. In today’s RBN blog, we’ll discuss the latest round of foreign investments in U.S. energy and what’s driving those deals. We’ll also look at the Aethon assets on the block.

European, Asian and Middle Eastern companies investing in the U.S. energy space isn’t a new phenomenon — Canadian investment is common too, of course. But the pace of foreign interest in U.S. assets has been accelerating the past few years, much of it tied to the global LNG trade. Controlling gas production and promising acreage near existing and planned LNG export terminals can give LNG traders and overseas gas consumers greater control over their feedgas supply, help them manage their supply costs, and enable them to hedge against price volatility. Similarly, investors in LNG liquefaction and export assets gain a greater say on how those facilities are managed, as well as a deeper understanding of how that part of the market works.

A few months ago, in American Pie, we discussed the flurry of foreign investment in U.S. energy production and infrastructure in 2023-24. Today, we’ll follow that up with a look at more recent deals, beginning with the potential sale of Aethon Energy Management, one of U.S.’s largest privately held gas producers. Recent reports suggested that Mitsubishi is in “advanced negotiations,” to acquire Aethon, though the Japanese trading giant said in late June that it “has not made any decision that is consistent with the contents of those reports.” (Back in April, it was reported that Abu Dhabi National Oil Co., or ADNOC, was interested in Aethon.)

Figure 1. Aethon Energy Management’s Production Areas and Gas Gathering Lines in the Haynesville. Source: RBN