Locator: 48744B.

Ticker CVX: up 3% in market futures; last trading day before the weekend.

- travel, airline, and leisure stocks are down, surprise, surprise;

- oil, defense stocks are up, surprise, surprise

CNBC this morning: business as usual. Truly amazing. Already looking forward to end of conflict. A lot of "don't knows."

Global response: most interesting: almost mute response from world leaders demanding that Israel quit. Instead: almost minimal "noise" this morning.

Israel: it's interesting that unlike terrorists (Hezbollah, Houthis, Hamas, Hiran) Israel's military response was 100% military -- did not hit non-military targets. Targets: nuclear sites, ballistic missile sites, and military leaders. Civilian leadership not targeted. Hiran's oil infrastructure not hit yet.

Hiran: the only military response it was able to muster -- drones, all of which have been shot down by Israel.

Iraq: absolutely no talk about the amount of time Israeli aircraft spend flying over Iraq.

Trump: really, really, really wants a Nobel Peace Prize. Doing all he can to keep diplomatic options on the table. Trump not pouring gasoline on this fire.

**************************

Back to the Bakken

WTI: $73.66. Up $5.62; up 8.3% overnight after Israel attacks Iran.

New wells:

Sunday, June 15, 2025: 45 for the month, 198 for the quarter, 412 for the year,

- 40603, conf, Enerplus Resources, Danielle 145-97-12-1-8H,

Saturday, June 14, 2025: 44 for the month, 197 for the quarter, 411 for the year,

- None.

Friday, June 13, 2025: 44 for the month, 197 for the quarter, 411 for the year,

- 40604, conf, Enerplus, Danielle 145-97-12-1-7H,

- 40555, conf, Enerplus, Danielle 145-97-12-1-6H,

- 40347, conf, Neset Consulting Service, Vision 1,

RBN Energy: Corpus Christi dredging projects create new opportunities for crude oil exporters.

The 35-year dream of widening the Corpus Christi Ship Channel and deepening it to 54 feet from the old 47 feet is at long last a reality. The $625 million project also has spurred marine-terminal owners in Corpus Christi and Ingleside to undertake — or at least consider — major dock and dredging projects that would enable them to make full use of the deeper 30-mile channel. In today’s RBN blog, we discuss the newly completed channel-dredging project, related terminal improvements, and what they all mean for crude oil exporting economics in Corpus Christi.

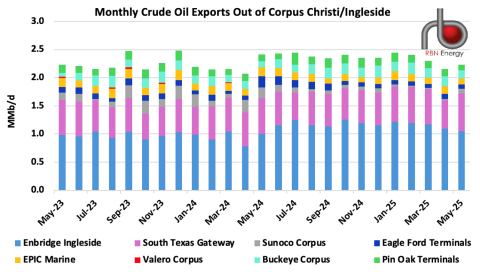

U.S. crude oil exports have been sliding the past few months, in part due to tariff-related upheavals in U.S. and international energy markets. According to RBN’s weekly Crude Voyager report, an average of 3.45 MMb/d were exported from Texas and Louisiana terminals in May, down from 3.87 MMb/d in January and the lowest monthly average since January 2023. Corpus Christi, the #1 port for sending out crude since 2020, has experienced a smaller (but still noteworthy) decline in crude export volumes; its May exports averaged 2.23 MMb/d (stacked bar to far right in Figure 1 below), down from 2.45 MMb/d in January and an average of 2.31 MMb/d in full-year 2024.

Figure 1. Monthly Crude Oil Exports Out of Corpus Christi/Ingleside. Source: Crude Voyager

As we’ve discussed in several blogs, there are at least a couple of reasons why Corpus Christi/Ingleside, with a 61% share of Gulf Coast crude oil exports in the first five months of 2025, has maintained a strong lead over the Houston area (with a 31% share), Beaumont/Nederland (6%) and Louisiana (2%). One is the ability of two Ingleside marine terminals — Enbridge Ingleside Energy Center (EIEC; light-blue bar sections in Figure 1 above) and Gibson Energy’s South Texas Gateway (STG; purple bar sections) — to partially load 2-MMbbl Very Large Crude Carriers (VLCCs) at their docks before sending them out to the deeper waters of the Gulf for topping off via reverse lightering. (VLCCs are the transporters of choice for many shippers moving crude from the Gulf Coast to Asia and Europe because of the lower per-barrel cost.)