Locator: 48657B.

Disclaimer

Brief

Reminder

Briefly:

- I am

inappropriately exuberant about the Bakken and I am often well out front

of my headlights. I am often appropriately accused of hyperbole when it

comes to the Bakken.

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia. Nvidia is a metonym for AI and/or the sixth industrial revolution.

- I've now added Broadcom to the disclaimer. I am also inappropriately exuberant about all things Broadcom.

- I've now added Oracle to the disclaimer. I am also inappropriately exuberant about all things Oracle.

- Longer version here.

For traders, and perhaps, investors: what's more important -- the monthly "Consumer Confidence" numbers or Tom Lee's prognostications on CNBC?

- Bitcoin:

- in 2019, a CNBC host dismissed Tom Lee's advice to invest 1 - 2% of a portfolio in Bitcoin at $5,000 as "crazy"; was the host Becky Quick, taking her "advice" from Warren Buffett? It seems likely.

- today, Tom Lee says Bitcoin is going to $3,000,000 -- that's $3 million -- per coin.

- S&P 500:

- today, Tom Lee says he thinks a new bull market started on April 7th and he never changed his year-end price target for the S&P 500 of 6,600. Today, the S&P 500 is 5,900. At 6,600, that would be a 12% increase.

Like many investors, because of my fear of getting really, really wealthy, I'm missed:

- Bitcoin;

- Netflix;

- Palantir;

Fortunately, I did not miss:

- Nvidia;

- AVGO;

- ORCL;

But I'm still disappointed.

Living in a state with no income tax has softened that blow a bit (missing Netflix, Palantir).

Tom Lee is a regular guest on CNBC but has never wavered; he has always stood his ground.

- Benjamin Graham --> Peter Lynch --> Warren Buffett --> Tom Lee?

Beth, from over the weekend, tag AVGO, Boradcom:

Last night/yesterday:

- NASCAR: tonight, exclusively on Amazon Prime, Nashville. Blaney easily wins. Bigger story: Hocevar comes in second.

- PGA: Scottie Scheffler wins (again). Surprise comeback.

Canada: prime minister Mark Carney will fast-track Canadian energy projects. Link to Charles Kennedy so you know it's an important story and well written. Generative AI calls Mark Carney a pragmatic environmentalist.

Saudi Arabia: to review spending priorities after recent price slide. Link here.

Saudi Arabia needs oil prices at about $90 per barrel to balance its budget. The world’s top crude oil exporter is already running a higher-than-planned deficit, which is set to swell with the oil price dip in the second quarter. On the table: Neom, AI, military defense, oil-producing infrastructure CAPEX.

Oil prices are currently running at $65 at best for Saudi Arabia. Saudi Arabia sees the "price war" between Saudi Arabia and US shale. It's not that simple.

Dividends, Saudi Aramco: With oil prices having crashed into the $60 a barrel range, the Kingdom will look to avoid falling again into the “trap of booms and busts,” Al-Jadaan told FT.

Saudi Aramco's net income for 2024 was $106.2 billion, a decrease from $121.3 billion in 2023. This drop in profit was primarily attributed to lower oil prices and revenue, along with higher operating costs. Despite the earnings decline, the company raised its base dividend for the fourth quarter of 2024 by 4.2%, demonstrating its commitment to shareholder returns.

However, for 2025: Saudi Aramco announced a significant reduction in its dividend for 2025. They expect to pay out $85 billion, a decrease from $124 billion in 2024. This cut is attributed to a combination of lower oil prices and a shift in financial priorities, including increased capital investments. I guess that would be a 31% dividend cut for 2025.

Later, Saudi Aramco: just announced, Saudi Aramco completes $5 billion bond issuance. Link here. Look how little $5 billion is compared to all the other figures with regard to Saudi Arabia today. Compare to Warren Buffett:

Record levels: Berkshire Hathaway's cash holdings were over $334 billion at the end of 2024, almost double the $167.6 billion reported at the end of 2023. By March 31, 2025, this increased to $347 billion. Buffett holds $1 for every $20-bill held by the US Treasury IIRC.

*********************************

Back to the Bakken

With regard to the Enerplus wells that are coming off confidential list this week, initial production data has been posted.

WTI: $62.89. a $2-bump following Ukraine's drone attack on four Russian airfields deep into Russia.

New wells:

- Tuesday, June 3, 2025: 19 for the month, 172 for the quarter, 386 for the year,

- 41090, conf, Silver Hill Operating, Rooster W Federal 159-94-2-26-1MBHX,

- Monday, June 2, 2025: 18 for the month, 171 for the quarter, 385 for the year,

- 40687, conf, Hess, GO-Jimmy W Hill-157-98--214H-3,

- 41233, conf, BR, Keene 14-35 TFH,

- 40909, conf, Rockpoert Energy, Merritt 18-19-30 4H,

- 40832, conf, Hess, EN-Horst-LE-154-93-03H-1,

- 40518, conf, BR, Franklin 14-36 TFH,

- Sunday, June 1, 2025: 13 for the month, 166 for the quarter, 380 for the year,

- 41201, conf, Silver Hill Operating, Rooster W Federal 159-94-2-26-2TFHX,

- 40915, conf, Rockport Energy, Annie 7-6-31 4H,

- 40823, conf, Rockport Energy, Mary Carson 8-5 1H,

- 40686, conf, Hess, GO-Jimmy W Will-157-98-3526H-2,

- 40531, conf, Enerplus, Deuce 149-92-19D-18H,

- 40530, conf, Enerplus, Lumber 149-92-19D-18H,

- 40529, conf, Enerplus, Curve 149-92-19D-18H,

- 40528, conf, Enerplus, Dinger 149-92-19C018H,

- 40527, conf, Enerplus, Juiced 149-92-19C-18H,

- 40526, conf, Enerplus, Bullpen 149-92-19C-18H,

- 40525, conf, Enerplus, Southpaw 149-92-19C-18H,

- 40524, conf, Enerplus, Closer 149-92-19C-18H-LL,

- Saturday, May 31, 2025: 54 for the month, 154 for the quarter, 368 for the year,

- None.

RBN Energy: "unacceptable risk" label could disrupt US ethane, butane exports.

After dodging the huge tariffs on exports of U.S. LPG and ethane to China — at least until August 12 — a new wrinkle has emerged. Enterprise Products Partners said in a filing May 29 that the U.S. Bureau of Industry and Security (BIS) has flagged its exports of butane and ethane to China as a security risk; specifically, that they pose an “unacceptable risk of use in or diversion to a military end use.” Details about the licenses and how they will apply are limited at this point, but it appears they will be required for these exports to continue. In today’s RBN blog, we examine the potential impact on the ethane and butane markets.

In its 8-K filing to the Securities and Exchange Commission (SEC), Enterprise indicated that it is unable to determine, as yet, whether it will be able to acquire such licenses for its exports in a reasonable amount of time, if at all. (An 8-K filing is a mandatory disclosure that public companies must file with the SEC to inform their shareholders and the public about major, unscheduled material events or corporate changes.) There has been no direct word from the other ethane exporter, Energy Transfer, nor exporters of butane, including Targa Resources and Phillips 66 (P66). However, it is reasonable to assume that they received similar letters from the BIS regarding their exports. The location of LPG (propane and butane) and ethane export terminals and the products they export are shown in Figure 1 below. (For more on U.S. LPG and ethane exports, see Hot To Go!)

Figure 1. North American NGL Marine Terminals. Source: RBN

The BIS decision has the potential to ruin the U.S. ethane market and disrupt global flows. The U.S. is the sole source of long-distance ethane exports to China. In the short term, there are no markets that could replace China’s ethane imports nor are there markets that can take most of the U.S. ethane previously destined for China. The impact on the butane market is less severe, as only 5% of U.S. butane exports head to China and the smaller volume can easily be diverted to other countries. For example, butane that would typically head to China from the U.S. could instead be sent to India, and the volume destined for India from, say, the Middle East would then go to China.

A reminder, the full story below has been released and will be available for a short period of time. This story has much more than the subject heading would indicate. An important read:

RBN Energy: the short- and long-term outlooks for Uinta waxy crude production. Archived.

We’ve discussed the qualities of the Uinta Basin’s unusual waxy crude, the challenges inherent in moving it to market, and the use of machine-learning AI to optimize its extraction from two key geologic layers or “benches” deep below the rugged hills of northeastern Utah. Now, in today’s RBN blog, it’s finally time to reveal what all this tells us regarding the prospects for continued Uinta production growth; the need for new takeaway capacity, blending and refining infrastructure to handle it; and — very important — the estimated duration of economically recoverable waxy crude under various price scenarios.

This is the third blog in our series on how artificial intelligence (AI) is being used to assess and optimize the development potential of the Uinta Basin, which is now the fastest-growing crude-oil-focused production area in the U.S. on a percentage basis. In Part 1, we discussed the two flavors of Uinta waxy crude (black wax and yellow wax); their positive attributes (great for making high-value lubricants, low levels of sulfur and other impurities, and desirable yields of gasoil, kerosene, naphtha and other essential refined products); and initial production (IP) rates that match — and in some cases exceed — those in the best parts of the Permian.

We also described the challenges of storing and transporting waxy crude, the fast rise in Uinta production (now averaging more than 170 Mb/d), the demand from distant refineries and blenders, and the strain being put on existing midstream and downstream infrastructure. That’s all spurred talk of expansion projects, but E&Ps, rail terminal developers, refiners and blenders are wary of making big up-front investments without having a clear understanding of the Uinta’s long-term prospects and, with that, a high degree of confidence that the basin will remain economically productive long enough for their investments to pay off.

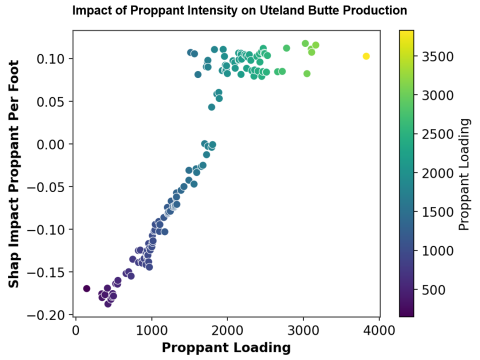

In Part 2, we examined the AI-based analytics our friends at Novi Labs use to (1) understand the individual contributions of a wide range of geologic and operational variables to production levels in the Uinta’s two most extensively drilled benches (Uteland Butte and Castle Peak), (2) employ that understanding to predict the performance of future wells in the two benches, and (3) forecast the volumes of waxy crude that could ultimately be extracted from these benches at various price points. Put simply — well, as simply as we can — Novi Labs’ machine-learning approach begins by gathering and incorporating a broad range of well-specific inputs (geologic, operational and spatial) on hundreds of drilled wells from public and proprietary sources. Novi then leverages the algorithms in the models it developed for each of the two benches, using reams of available data to gain a much deeper understanding of the relationships among and between these many variables and their impact on production outcomes.

In essence, machine learning integrates the wide range of data collected to recognize patterns and identify the primary drivers of well performance. It does this through the development and use of “Shapley values,” a game-theory concept that quantifies the contribution of individual input categories — more on that in a moment — to production from a given well compared to the average of the wells in the area. Machine learning then enables operators to assess how changing specific variables (such as drilling in a higher-pressure area, tightening well spacing, or increasing proppant intensity) would affect production outcomes in wells yet to be drilled. It also provides operators with guidance on how best to lay out, space, and sequence the development of the benches.

Today, we’ll build on the discussion about machine learning and Shapley values, compare the Uinta’s forecast productivity per well to the Permian and Bakken, and look at how much crude the wells in the Uinta’s key benches are likely to produce over time at various price points.

Novi Labs selected about 20 data points or variables (out of a broad set available to it) on hundreds of drilled wells in the Uteland Butte and Castle Peak benches that meet its criteria (at least 90 days of production and values for proppant, completion fluid and lateral length). The geologic data includes things like porosity, total organic carbon (TOC), lithology (the physical and chemical characteristics of the rock) and pressure, plus depth, structural position within the basin and proximity to faults. The operational data, in turn, includes factors such as proppant intensity, fluid volume per foot, stage spacing, lateral length, and the precise placement of the lateral within the bench.

Impact of Proppant Intensity on Uteland Butte Production

Figure 1. Impact of Proppant Intensity on Uteland Butte Production. Source: Novi Labs