Locator: 48764B.

Equity markets are closed tomorrow, Thursday, but open again on Friday.

Iran: says it's ready to negotiate. As long as Tehran continues to target downtown Tel Aviv (non-military targets) and not targeting strictly military targets, Iran doesn't impress folks as being serious about negotiating.

Trump's opening gambit: no, we're not negotiating. It's an "unconditional surrender." Which I'm sure will go nowhere, but it will delay things long enough to let Israel take out a few more targets. I'm sure negotiations will include unfettered movement and access to all facilities for international inspectors.

Massive draw: of course this is a non-story, but it sure got a huge headline. Link here.

Air India 171 air crash: preliminary -- identical to what CaptainSteeeve (sic) first noticed a few days ago -- simultaneously all (two) engines shut down without explanation; RAT deployed; only three ways all engines shut down simultaneously:

- fuel flow switch shut off: CaptainSteeve (sic) won't even consider this as a possibility.

- contaminated fuel: all those planes flying in India that day receiving the same fuel had no problems. But, having said that, this remains the most likely explanation. I don't buy it.

- vapor lock: theoretical possibility but most aviation experts agree -- has never occurred in modern jet plans.

******************************

Back to the Bakken

WTI: after being slightly in the red all night, WTI is now up half a percent overnight.

Lots of speculation that the US will use a bunker buster. Can penetrate maybe 300 feet; more likely 200 feet. Iran's key nuclear facility, Fordow, is probably 1,000 inside a mountain. Apparently the only bomber that can carry the MOP (bunker buster) -- the B-2 -- has departed Diego Garcia and has returned to its home base, Whiteman AFB, Missouri, leaving only B-52s in Diego Garcia. The B-2s can "easily" return but it wouldn't be unreported.

New wells:

- Thursday, June 19, 2025: 47 for the month, 200 for the quarter, 414 for the year,

- None.

- Wednesday, June 18, 2025: 47 for the month, 200 for the quarter, 414 for the year,

- 41287, conf, CLR, Peterson 9-29H,

RBN Energy: Sunoco's acquisition of Parkland will give it fueling stations, termials and a refinery.

U.S. fuel supplier Sunoco announced in May that it has inked a US$9.1-billion agreement to buy Canada-based Parkland Corp., a move that would create the Americas’ largest independent fuel distributor. Sunoco would gain control of Parkland’s fleet of fueling stations and its valuable Burnaby refinery near Vancouver, BC. The deal is supported by Parkland’s largest shareholder and is slated to be voted on June 24. In today’s RBN blog, we’ll discuss this deal and what it means for Canada’s only West Coast refiner.

Under terms of the proposed transaction, whose total value includes debt, Parkland shareholders will receive C$19.80 in cash and 0.295 shares in a new, publicly traded entity called SUNCorp. Parkland shareholders can also choose to receive C$44.00 in cash or 0.536 Sunoco units per share. The deal includes a C$2.65 billion bridge loan for Sunoco.

The planned acquisition was approved unanimously by Parkland’s board of directors in early May and is supported by Parkland’s largest shareholder, Simpson Oil, which believes it provides the potential for enhanced operations and opportunities under Sunoco’s experienced management. Dallas-based Sunoco, a master limited partnership (MLP) whose general partner is controlled by Energy Transfer, first expressed interest in Parkland in 2023 and made an offer, but it was turned down, according to published reports.

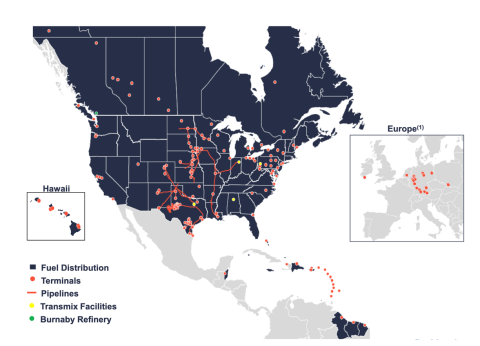

Combined Assets of Sunoco and Parkland

Figure 1. Combined Assets of Sunoco and Parkland. Source: Sunoco