Locator: 48671B.

Dow on track for best quarter since 3Q24. NASDAQ on track for best quarter since 4Q23.

Jim Cramer: starts off his early-moring half-hour show with a reference to RBN Energy's recent blog on propane, butane.

Current dividend declaration: link here.

Increased divided to be paid: October, 31, 2025, link here.

Record, solving Rubik's Cube: Purdue ECE students recently shattered the Guinness World Record for the fastest robot to solve a Rubik's Cube, solving it in just 0.103 seconds.

This is faster than the blink of an eye and significantly faster than the previous record of 0.305 seconds, set by Mitsubishi Electric engineers. The record-breaking robot, dubbed "Purdubik's Cube," was built by a team of four undergraduate students as part of their senior design project.

EREVs, link here. Fake EVs. For the archives. Back to the Chevy Volt and Fisker Karma.

Earlier examples of this type of vehicle – the Chevy Volt and Fisker Karma – were introduced to the U.S market in 2011.

These were followed by the BMW i3 and Cadillac ELR in 2014. But EREVs (also known as Range Extended Electric Vehicles, or REEVs), never attracted much interest from American consumers.

The Volt was the most popular EREV by far, with GM selling 157,000 over nine years, until it ended production in 2019. That may seem impressive, but it’s a blip in the overall U.S. new vehicle market, which saw about 16 million sales each year in that timeframe, versus an average of 17,000 Chevy Volts sold each year for nine years (0.1%).

EVs, why voltage matters. Another incredibly confusing article. We talked about this many times. Best blog.

***********************************

Back to the Bakken

WTI: $62.84.

New wells:

- Wednesday, June 4, 2025: 21 for the month, 174 for the quarter, 388 for the year,

- 41312, conf, CLR, Helen 7-8H,

- 40795, conf, St Croix Operating, St Croix Antler 1,

- Tuesday, June 3, 2025: 19 for the month, 172 for the quarter, 386 for the year,

- 41090, conf, Silver Hill Operating, Rooster W Federal 159-94-2-26-1MBHX,

RBN Energy: Supreme Court's ruling on Uinta Basin railway is a big win for energy infrastructure projects. Archived.

Midstream developers have complained for decades that federal courts reviewing agency approvals for their infrastructure projects have cast too wide a net — that is, instead of requiring agencies to simply analyze the specific environmental impacts of the project in question, the courts have been insisting regulators also examine the effects of the upstream and downstream activities the project would enable. As we discuss in today’s RBN blog, the U.S. Supreme Court ruled last week that under the all-important National Environmental Policy Act (NEPA) of 1969, it’s up to regulators to set the boundaries of their environmental review and that courts should defer to their judgment as long as they fall within a “broad zone of reasonableness.”

Also, two other related posts.

First, earlier on the blog:

Uinta Basin Railway: finally, some adulting in the room. And it was unanimous. Link here. Also, reported in The New York Times. This has to be a big story if it's being reported by TNYT.

The U.S. Supreme Court has given the green light to Utah’s Uinta Basin Railway project, backing a narrower interpretation of environmental review laws and potentially clearing the path for a major expansion in oil transport capacity.

In a unanimous decision Thursday, the justices reversed a lower court ruling, slamming it for what they described as an overly expansive and intrusive interpretation of environmental law. The line would link the Uinta Basin’s oil fields—tucked deep in northeastern Utah’s sagebrush terrain—to the national rail network, unlocking access to Gulf Coast and West Coast refineries.

At the heart of the case was how far federal agencies must go under the National Environmental Policy Act (NEPA) to evaluate ripple effects—like emissions from oil refining or increased drilling—when considering infrastructure projects.

Writing for the court, Justice Brett Kavanaugh affirmed that federal agencies have discretion to weigh environmental impacts as they see fit, pushing back on calls for broader reviews that include downstream effects like refining emissions or increased oil consumption.

“Simply stated, NEPA is a procedural cross-check, not a substantive roadblock. The goal of the law is to inform agency decision-making, not to paralyze it,” Justice Kavanaugh said in the ruling.

Second, another RBN Energy blog, posted a few days ago:

A reminder, the full story below has been released and will be available for a short period of time. This story has much more than the subject heading would indicate. An important read:

RBN Energy: the short- and long-term outlooks for Uinta waxy crude production. Archived.

We’ve discussed the qualities of the Uinta Basin’s unusual waxy crude, the challenges inherent in moving it to market, and the use of machine-learning AI to optimize its extraction from two key geologic layers or “benches” deep below the rugged hills of northeastern Utah. Now, in today’s RBN blog, it’s finally time to reveal what all this tells us regarding the prospects for continued Uinta production growth; the need for new takeaway capacity, blending and refining infrastructure to handle it; and — very important — the estimated duration of economically recoverable waxy crude under various price scenarios.

This is the third blog in our series on how artificial intelligence (AI) is being used to assess and optimize the development potential of the Uinta Basin, which is now the fastest-growing crude-oil-focused production area in the U.S. on a percentage basis. In Part 1, we discussed the two flavors of Uinta waxy crude (black wax and yellow wax); their positive attributes (great for making high-value lubricants, low levels of sulfur and other impurities, and desirable yields of gasoil, kerosene, naphtha and other essential refined products); and initial production (IP) rates that match — and in some cases exceed — those in the best parts of the Permian.

We also described the challenges of storing and transporting waxy crude, the fast rise in Uinta production (now averaging more than 170 Mb/d), the demand from distant refineries and blenders, and the strain being put on existing midstream and downstream infrastructure. That’s all spurred talk of expansion projects, but E&Ps, rail terminal developers, refiners and blenders are wary of making big up-front investments without having a clear understanding of the Uinta’s long-term prospects and, with that, a high degree of confidence that the basin will remain economically productive long enough for their investments to pay off.

In Part 2, we examined the AI-based analytics our friends at Novi Labs use to (1) understand the individual contributions of a wide range of geologic and operational variables to production levels in the Uinta’s two most extensively drilled benches (Uteland Butte and Castle Peak), (2) employ that understanding to predict the performance of future wells in the two benches, and (3) forecast the volumes of waxy crude that could ultimately be extracted from these benches at various price points. Put simply — well, as simply as we can — Novi Labs’ machine-learning approach begins by gathering and incorporating a broad range of well-specific inputs (geologic, operational and spatial) on hundreds of drilled wells from public and proprietary sources. Novi then leverages the algorithms in the models it developed for each of the two benches, using reams of available data to gain a much deeper understanding of the relationships among and between these many variables and their impact on production outcomes.

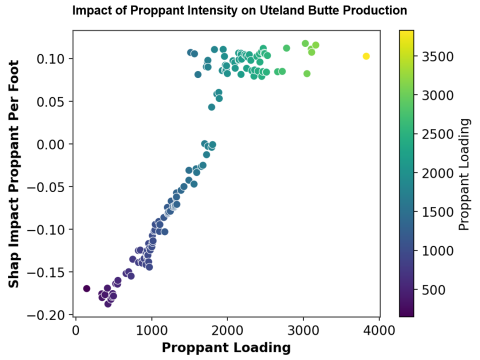

In essence, machine learning integrates the wide range of data collected to recognize patterns and identify the primary drivers of well performance. It does this through the development and use of “Shapley values,” a game-theory concept that quantifies the contribution of individual input categories — more on that in a moment — to production from a given well compared to the average of the wells in the area. Machine learning then enables operators to assess how changing specific variables (such as drilling in a higher-pressure area, tightening well spacing, or increasing proppant intensity) would affect production outcomes in wells yet to be drilled. It also provides operators with guidance on how best to lay out, space, and sequence the development of the benches.

Today, we’ll build on the discussion about machine learning and Shapley values, compare the Uinta’s forecast productivity per well to the Permian and Bakken, and look at how much crude the wells in the Uinta’s key benches are likely to produce over time at various price points.

Novi Labs selected about 20 data points or variables (out of a broad set available to it) on hundreds of drilled wells in the Uteland Butte and Castle Peak benches that meet its criteria (at least 90 days of production and values for proppant, completion fluid and lateral length). The geologic data includes things like porosity, total organic carbon (TOC), lithology (the physical and chemical characteristics of the rock) and pressure, plus depth, structural position within the basin and proximity to faults. The operational data, in turn, includes factors such as proppant intensity, fluid volume per foot, stage spacing, lateral length, and the precise placement of the lateral within the bench.

Impact of Proppant Intensity on Uteland Butte Production

Figure 1. Impact of Proppant Intensity on Uteland Butte Production. Source: Novi Labs