Locator: 48722B.

Costco: surges. Up 2.875; up $28.96; trading at $1,037.70. Still sells their hot dog combo for $1.50. Hasn't changed the price in decades. Decades. Later: up 3.75%; up $37.55; trading at $1,046.32.

Largest company by market cap: MSFT just surpassed Nvidia this morning. It was Nvidia yesterday. A "3.4-handle"? Just checked: $3.41 vs $3.36. Trillion. P/E: 44 vs 35. Remember when "Fast Money" panel said Nvidia (NVDA) couldn't "grow into their P/E"? Wow.

Trump tween this morning: China violated trade agreement. Stocks fall. Another opportunity for traders, investors,

Netflix: new target -- $1,350. Wow.

Whoo-hoo! All of a sudden two basins are back in the news -- the Utica and the Uinta.

US military spending: I'm not sure this guy knows what he's talking about. Link here to The New York Times. The best example: amphibious landing craft. LOL.

Tariffs setting record collections for US Treasury. Link here. Liz Ann Sonders.

The Times and Amazon ink a marketing deal. Link here to The New York Times.

Palantir: Trump will clean up the Signal mess. Link here to The New York Times. Last month: link to The New York Times.

Trump: Over and over and over: examples of Trump not messing around. Addresses problems immediately. Before the press multiple times per day. Biden: "We're monitoring the situation." Appears before the press multiple times each decade.

Monthly crude oil field production data: scheduled to be released today. Link here.

BRK-B: month-to-date -- down almost 5.55.

********************************

Back to the Bakken

WTI: $60.08.

New wells:

- Monday, June 2, 2025: 18 for the month, 171 for the quarter, 385 for the year,

- 40687, conf, Hess, GO-Jimmy W Hill-157-98--214H-3,

- 41233, conf, BR, Keene 14-35 TFH,

- 40909, conf, Rockport Energy, Merritt 18-19-30 4H,

- 40832, conf, Hess, EN-Horst-LE-154-93-03H-1,

- 40518, conf, BR, Franklin 14-36 TFH,

- Sunday, June 1, 2025: 13 for the month, 166 for the quarter, 380 for the year,

- 41201, conf, Silver Hill Operating, Rooster W Federal 159-94-2-26-2TFHX,

- 40915, conf, Rockport Energy, Annie 7-6-31 4H,

- 40823, conf, Rockport Energy, Mary Carson 8-5 1H,

- 40686, conf, Hess, GO-Jimmy W Will-157-98-3526H-2,

- 40531, conf, Enerplus, Deuce 149-92-19D-18H,

- 40530, conf, Enerplus, Lumber 149-92-19D-18H,

- 40529, conf, Enerplus, Curve 149-92-19D-18H,

- 40528, conf, Enerplus, Dinger 149-92-19C018H,

- 40527, conf, Enerplus, Juiced 149-92-19C-18H,

- 40526, conf, Enerplus, Bullpen 149-92-19C-18H,

- 40525, conf, Enerplus, Southpaw 149-92-19C-18H,

- 40524, conf, Enerplus, Closer 149-92-19C-18H-LL,

- Saturday, May 31, 2025: 54 for the month, 154 for the quarter, 368 for the year,

- None.

- Friday, May 30, 2025: 54 for the month, 154 for the quarter, 368 for the year,

- 41202, conf, Silver Hill Energy Operating, Rooster W Federal 159-94-2-26-3MBHX,

- 37577, conf, BR, Keene 21-2 TFH,

RBN Energy: the short- and long-term outlooks for Uinta waxy crude production. Archived.

We’ve discussed the qualities of the Uinta Basin’s unusual waxy crude, the challenges inherent in moving it to market, and the use of machine-learning AI to optimize its extraction from two key geologic layers or “benches” deep below the rugged hills of northeastern Utah. Now, in today’s RBN blog, it’s finally time to reveal what all this tells us regarding the prospects for continued Uinta production growth; the need for new takeaway capacity, blending and refining infrastructure to handle it; and — very important — the estimated duration of economically recoverable waxy crude under various price scenarios.

This is the third blog in our series on how artificial intelligence (AI) is being used to assess and optimize the development potential of the Uinta Basin, which is now the fastest-growing crude-oil-focused production area in the U.S. on a percentage basis. In Part 1, we discussed the two flavors of Uinta waxy crude (black wax and yellow wax); their positive attributes (great for making high-value lubricants, low levels of sulfur and other impurities, and desirable yields of gasoil, kerosene, naphtha and other essential refined products); and initial production (IP) rates that match — and in some cases exceed — those in the best parts of the Permian.

We also described the challenges of storing and transporting waxy crude, the fast rise in Uinta production (now averaging more than 170 Mb/d), the demand from distant refineries and blenders, and the strain being put on existing midstream and downstream infrastructure. That’s all spurred talk of expansion projects, but E&Ps, rail terminal developers, refiners and blenders are wary of making big up-front investments without having a clear understanding of the Uinta’s long-term prospects and, with that, a high degree of confidence that the basin will remain economically productive long enough for their investments to pay off.

In Part 2, we examined the AI-based analytics our friends at Novi Labs use to (1) understand the individual contributions of a wide range of geologic and operational variables to production levels in the Uinta’s two most extensively drilled benches (Uteland Butte and Castle Peak), (2) employ that understanding to predict the performance of future wells in the two benches, and (3) forecast the volumes of waxy crude that could ultimately be extracted from these benches at various price points. Put simply — well, as simply as we can — Novi Labs’ machine-learning approach begins by gathering and incorporating a broad range of well-specific inputs (geologic, operational and spatial) on hundreds of drilled wells from public and proprietary sources. Novi then leverages the algorithms in the models it developed for each of the two benches, using reams of available data to gain a much deeper understanding of the relationships among and between these many variables and their impact on production outcomes.

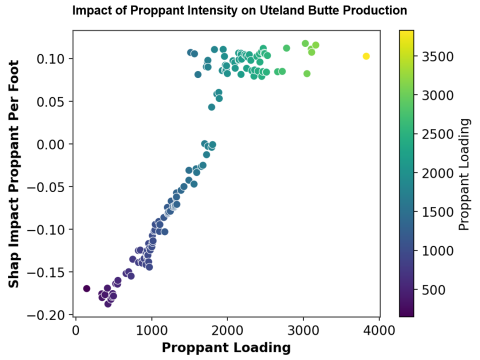

In essence, machine learning integrates the wide range of data collected to recognize patterns and identify the primary drivers of well performance. It does this through the development and use of “Shapley values,” a game-theory concept that quantifies the contribution of individual input categories — more on that in a moment — to production from a given well compared to the average of the wells in the area. Machine learning then enables operators to assess how changing specific variables (such as drilling in a higher-pressure area, tightening well spacing, or increasing proppant intensity) would affect production outcomes in wells yet to be drilled. It also provides operators with guidance on how best to lay out, space, and sequence the development of the benches.

Today, we’ll build on the discussion about machine learning and Shapley values, compare the Uinta’s forecast productivity per well to the Permian and Bakken, and look at how much crude the wells in the Uinta’s key benches are likely to produce over time at various price points.

Novi Labs selected about 20 data points or variables (out of a broad set available to it) on hundreds of drilled wells in the Uteland Butte and Castle Peak benches that meet its criteria (at least 90 days of production and values for proppant, completion fluid and lateral length). The geologic data includes things like porosity, total organic carbon (TOC), lithology (the physical and chemical characteristics of the rock) and pressure, plus depth, structural position within the basin and proximity to faults. The operational data, in turn, includes factors such as proppant intensity, fluid volume per foot, stage spacing, lateral length, and the precise placement of the lateral within the bench.

Impact of Proppant Intensity on Uteland Butte Production

Figure 1. Impact of Proppant Intensity on Uteland Butte Production. Source: Novi Labs